Introduction

Mergers and acquisitions should be effectively financed to guarantee value creation as the major outcome. In many cases, the focus is on leveraged transactions or leveraged buyouts (LBOs). Researchers accentuate the problem that the value creation associated with LBOs is dependent on various factors, and the success of LBO transactions depends on the club formation. Malenko and Malenko (2015) presented a newly developed theory of the LBO activity that is based on private equity-owned firms’ capacity to borrow with reference to sponsors’ reputation and on external factors influencing the club formation. The purpose of this paper is to describe the process of deconstructing Malenko and Malenko’s (2015) article to conclude about the effectiveness of its framework to demonstrate the validity of this theory and address the identified problem. Despite the fact that the authors formulated an alternative theory of the LBO activity to address the problem of the value creation and the role of private equity firms in mergers and acquisitions, their theory cannot be viewed as valid because it lacks empirical evidence to support assumptions, and these limitations, among other ones, are not mentioned by the authors while affecting the credibility of the framework.

Appropriateness and Utility of a Deconstruction Process to Find Solutions to Problems

In view of the fact that research articles are usually oriented to presenting the results of studies and experiments conducted to find a solution to a certain problem, it is important to make sure that researchers’ arguments and used frameworks are reasonable and effective to support the proposed solution. From this point, the process of deconstruction allows for analyzing research articles critically and with reference to each component of the applied framework in order to determine any weak, contradictory, or controversial arguments and statements (Fook, 2016). The article by Malenko and Malenko (2015) is important to be deconstructed because the authors present a new theory of the LBO activity with a focus on the merger and acquisition market that differs significantly from other existing theories in the field. As a result, the deconstruction of an article’s framework allows for identifying any possible weaknesses in a paper’s structure and argumentation (Fook, 2016). If there are weaknesses in articles’ frameworks, such papers cannot provide the information or evidence to be used in order to solve a certain problem. If deconstruction follows the process of analyzing a framework’s components as a system, it is possible to receive reliable conclusions regarding the appropriateness of the proposed arguments and their contribution to solving the determined problem.

The Framework’s Components in a Constructed System and Its Effectiveness to Solve the Problem

The major purpose of this section is to analyze the framework of Malenko and Malenko’s (2015) article with a focus on its components in order to present them as a system and discuss their interactions. One more purpose of this section is to provide arguments on how the framework of the reviewed article can contribute to solving the discussed problem associated with value creation in the context of LBOs. These aspects need to be analyzed in detail.

The Article’s Framework as a Constructed System

There are nine sections in the article written by Malenko and Malenko (2015). It is possible to state that the sections are logically organized to discuss the theory’s development and present the explanation. Before analyzing the framework of Malenko and Malenko’s (2015) article as a constructed system, it is necessary to focus on the problem that is formulated by the authors as requiring its solution with the help of the proposed theory. The problem and associated purpose of the study is presented in the introductory section of the article, where the background of the issue and its details are discussed.

Thus, the problem is that mergers and acquisitions are oriented to active value creation, but the real role of private equity firms and LBO transactions in these processes can be questioned. According to Malenko and Malenko (2015), the value creation related to LBOs is usually based on “operational improvements and the benefits of higher leverage involving tax shields and improved management incentives,” but “private equity (PE) firms are sometimes accused of doing nothing but leveling up their portfolio companies” (p. 607). From this perspective, it is important to understand the role of private equity firms, the aspects of club deals and club formation, and the factors that promote the LBO activity to guarantee value creation (DePamphilis, 2014). Therefore, it is possible to state that the authors of the article formulate their theory to address the mentioned problem while using an alternative approach and referring to the relationships between private equity firms, sponsors’ reputations, and specific externalities.

In addition to the background, problem, and purpose of the study and the theory development, the introductory section of the article also includes the description of the study results and the analysis of the theoretical contribution of their research. The authors discuss three categories of results in the article. They are the following ones: two factors that affect the LBO activity should be viewed as complements, the club formation process can have both positive and negative effects on LBO transactions, and determinants of the LBO activity can be various (Malenko & Malenko, 2015). The authors also mention the previous research in the area that influenced the development of their theoretical model. The authors’ logic of representing the results of the study before discussing the model can be based on the necessity of explaining the rationale for the research with the focus on its potential contribution to theory.

The second section of the article describes the proposed theoretical model of the LBO activity in detail. The authors propose assumptions, examine targets as independent firms referring to non-private equity-owned firms and firms owned by private equity sponsors, and analyze commitment and non-commitment cases formulating lemmas. The third and fourth sections of the article describe the model modifications with reference to situations when private equity firms are characterized by identical and different skills (Malenko & Malenko, 2015). Additional lemmas and propositions are formulated with a focus on these aspects. The extensions of the model allow for testing it against various factors and in different contexts in order to support its credibility. The same principle is followed in the articles by Alperovych, Amess and Wright (2013) and Amess, Stiebale and Wright (2016). This approach allows for testing any changes in financing transactions and measuring possible effects on value creation.

In the fifth section, the authors represent the results of studying the club formation process that is an important factor associated with the LBO activity. According to Malenko and Malenko (2015), their main finding regarding clubbing is that “even though club formation is always beneficial in the context of a single deal, it can nevertheless destroy value in the take-over market overall by lowering PE firms’ ex-ante incentives to invest in reputation for no diversion” (p. 618). From this point, the authors propose an alternative view regarding the role of club formation in the value creation process. The sixth section demonstrates how the model developed by Malenko and Malenko (2015) can also be applied to the common-value setting. The seventh section is focused on describing implications of the theoretical model for certain determinants of the LBO activity related to the existing evidence.

Furthermore, the eighth section indicates new empirical predictions or implications of the proposed theoretical model for the context of the merger and acquisition market. Five predictions are formulated as a result of developing the model, and they explain how the value creation associated with the LBO activity can be dependent on a range of factors (Malenko & Malenko, 2015). General concluding remarks regarding the study are provided in the ninth section, and important formulas and calculations for the study are presented in appendices.

Effectiveness of the Framework to Facilitate the Problem Solution

The value creation in mergers and acquisitions is an important issue, and different abilities of private equity firms and the club formation process to add value require their further analysis. From this point, it is possible to claim that the framework of Malenko and Malenko’s (2015) article is effective to facilitate the solution to the problem of value creation in the acquisition market as the authors propose the logically developed theory of the LBO activity that can be applied to different settings in order to test possible results. The predictions and implications formulated by Malenko and Malenko (2015) are based on the results of developing an alternative model of the LBO activity and applying it to various contexts. Furthermore, these implications are explained with reference to the previous research in the field. In their articles, Axelson, Jenkinson, Strömberg and Weisbach (2013) and Haddad, Loualiche and Plosser (2017) also made similar conclusions and presented frameworks that can be viewed as being in line with the analyzed paper. Therefore, the provided findings and predictions seem to be logically developed from the model.

While perceiving the proposed framework as constructed of accurately connected components that are presented as a system, it is possible to focus on the credibility of the authors’ results and implications. From this point, the article’s framework can contribute to solving the problem of value creation in the merger and acquisition market as the authors present an alternative theoretical model that explains what factors influence the process of adding value. Malenko and Malenko (2015) theorize that club deals are able to create value ex-post because of allowing low-reputation bidders to borrow reputation from other bidders depending on the aspect of high and low valuations. As a result, private equity firms can have lower incentives to focus on their reputation in relation to sponsors, and such an ex-ante effect can influence the LBO activity significantly while reducing it and decreasing the possible value. From this point, the focus on the abilities of private equity firms to borrow against such factors as reputation and externalities are not typical for the previous research based on examining the trade-off aspect in this context (DePamphilis, 2014). Thus, such an alternative theoretical approach supported by the framework can potentially contribute to solving the problem.

Deconstruction of the Framework and Its Weakness

The purpose of this section is to describe the process of deconstructing the article by Malenko and Malenko (2015) with a focus on the weakness in the framework. In this case, deconstruction is important to conclude about the framework’s appropriateness to provide the solution to the problem of value creation in relation to LBOs. The weakness that was identified in the framework of the article written by Malenko and Malenko (2015) will be discussed in detail.

Deconstruction of the Framework

The process of deconstruction involves critical thinking and analysis with the focus on the framework of the selected article to state whether it is appropriate to address the determined problem. While analyzing the introductory section of Malenko and Malenko’s (2015) article, it is possible to notice that the authors formulate the problem, provide the background, and develop questions to address while creating a new theoretical model regarding the LBO activity based on the ideas about private equity-owned firms’ borrowings and club formation. In addition, the authors provide a review of literature in order to explain their selection of factors that can influence the LBO activity and value creation (Malenko & Malenko, 2015). Still, the number of the mentioned studies is limited, and the authors refer to the gap in the existing literature on this topic.

Furthermore, the introductory section also includes the information regarding the received results with their detailed analysis. However, there is little evidence to support the credibility of these findings because they are rather innovative, and there is no research in the field where similar factors or variables are used. In addition, this section also includes details regarding the study’s contribution to the theory and existing literature. In this section, the authors identify how their model differs from other theoretical models on the topic. As a result, all the main conclusions and discussions are presented in the introductory section, and the following sections include the factual information and results of experiments in order to demonstrate how the model was developed. A similar framework is also used in other articles on the problem, but the majority of researchers, including Ang, Hutton and Majadillas (2014), Ayash, Bartlett and Poulsen (2017), and Hung and Tsai (2017), are inclined to follow a traditional pattern while presenting the background, problem, purpose, rationale, questions, and literature review in the introductory or separate sections and the discussion of results and contribution in the final sections of the article.

In this research article, the important information regarding findings and the theoretical contribution is provided in the first sections, the discussion of the results with the focus on literature is limited, and the final section presents concluding remarks that summarize the results and propose the extension for the further research. As a consequence, while using a reverse structure for an article, the risks of omitting the information critical for the formulation of the model and its explanation are high. From this point, it is possible to state that one of the weaknesses of this framework is in omitting the discussion of the model’s or framework’s limitations. In spite of the fact that Malenko and Malenko (2015) propose a unique theory of the LBO activity based on factors that were not previously studied by researchers in this context, they do not mention expected limitations, and this feature of the framework needs to be discussed further in the following sub-section.

Weakness in the Framework

The major weakness of the framework used in the article by Malenko and Malenko (2015) is the absence of limitations in the final sections of the paper. The authors formulate a novel alternative theory regarding the LBO activity that contradicts the previously formulated theoretical models related to the merger and acquisition market and the role of private equity firms and club deals in creating value. However, there are no acknowledged limitations that can support the credibility of the framework and guide further research in the field. The authors only provide the note that the proposed model is not associated with debt covenants, and the further extension of the model is required in order to test the LBO activity under new economic conditions and with the focus on debt covenants (Malenko & Malenko, 2015). Still, there are no statements that this aspect can be associated with the model’s limitations.

The focus on limitations in addition to the study implications and recommendations for further research is important to ensure that all possible restrictions in developing a new theory are addressed, and there are no risks or biases to influence the quality of the proposed theoretical model that seems to lack the empirical support at the current stage of its development (DePamphilis, 2014; Murray, 2014). Thus, Malenko and Malenko (2015) draw readers’ attention to the idea that their approach to formulating this theory is rather innovative, and they apply other concepts and factors than those ones that were used by other researchers, but the authors of the article do not assume any barriers to the process of developing the model, and they do not accept any limitations of their study. This aspect influences the validity of the model and proposed framework to address the problem of value creation in the merger and acquisition market in relation to LBOs.

While referring to a reverse structure of Malenko and Malenko’s (2015) article, it is possible to expect that the limitations are mentioned in the introductory section of the paper. Still, this section, similarly to the concluding section, also does not include limitations. Therefore, if limitations of Malenko and Malenko’s (2015) study are not mentioned by the authors, the risks of presenting faulty assumptions are high. In this context, predictions formulated according to the theoretical model can also be ineffective to contribute to solving the problem of value creation. For instance, the authors of the article note that club deals lead to creating value ex-post, and the resulting ex-ante effect contributes to decreasing the LBO activity (Malenko & Malenko, 2015). However, other articles in the field do not provide direct support for these assumptions and findings, and the absence of discussed limitations proves the idea that these conclusions require further research and evidence (Reddy, Xie, & Huang, 2016; Wright, Cressy, Wilson, & Farag, 2014). In this context, the absence of limitations and the presence of only a few sources to support predictions allow for concluding that the authors’ assumptions were not checked appropriately to avoid making incorrect assumptions, and this aspect can lessen the ability of the framework to facilitate the solution to the problem.

The Role of the Framework and Weakness in Amplifying the Problem

In their article, Malenko and Malenko (2015) provide several important conclusions based on the development of the LBO activity theory that can be used in order to address the problem of value creation in the merger and acquisition market. The authors demonstrate “that PE sponsors’ ability to add value through operational improvements enhances value creation through financing, and hence differences in PE firms’ skills are amplified through access to credit markets,” and moreover, “if PE firms never added any operational value, no buyouts would take place” (Malenko & Malenko, 2015, pp. 622-623). Furthermore, club deals have a specific effect on the value creation process, and they add value while allowing bidders to borrow creditors’ reputations (Malenko & Malenko, 2015). However, these conclusions lack the focus on possible limitations, and they need support from the existing literature.

The proposed conclusions are not in line with the findings of other researchers. Thus, the studies by Axelson et al. (2013), Butt (2013), Jenkinson and Sousa (2015), and Haddad et al. (2017) do not provide the support for Malenko and Malenko’s (2015) findings. From this perspective, the authors’ impossibility to list any limitations for the study influences the credibility of assumptions and formulated predictions, and the whole framework seems to be structured ineffectively because of lacking some important components. As a result, the proposed framework seems to amplify the problem of value creation as practitioners cannot effectively apply the theoretical model of the LBO activity to add value to mergers and acquisitions because some possible weaknesses of this theory are not accepted by the authors of the article. In order to provide an effective conceptual framework that can contribute to resolving the discussion problem, the authors should demonstrate their acknowledgment of possible limitations associated with the development of their theory. Instead of this, the framework has a complicated reverse structure and lacks limitations, and these facts decrease its credibility while leading to amplifying the problem.

Moreover, it is important to note that, in other articles on the topic, the issue of the structure and presence of limitations is addressed. Thus, articles by Ang et al. (2014), Reddy et al. (2016), Ayash et al. (2017), and Hung and Tsai (2017) also describe or propose specific theoretical models and patterns to resolve the problem of value creation in the context of LBOs, but they demonstrate both advantages and limitations of their studies. The reason is that it is important to avoid such weaknesses in order to guarantee the extension or application of the model to different contexts that the authors list in the reviewed and deconstructed article. From this point, deconstruction is important to identify such issues and avoid enabling the problem.

Recommendations to Address the Identified Weakness and Modify the Framework

The single modification that should be made to improve the framework of the article by Malenko and Malenko (2015) and address the weakness is associated with adding a sub-section, in which limitations of the study and proposed theoretical model are described in order to accentuate the credibility of the article. The authors of the article seem to omit the description of the study’s limitations to argue why the proposed predictions are valid and what further research is required. It is possible to note that the authors’ framework needs a series of modifications in order to improve the article’s reverse structure. However, while applying only a single modification, it is important to concentrate on the concluding section of the article and its structure.

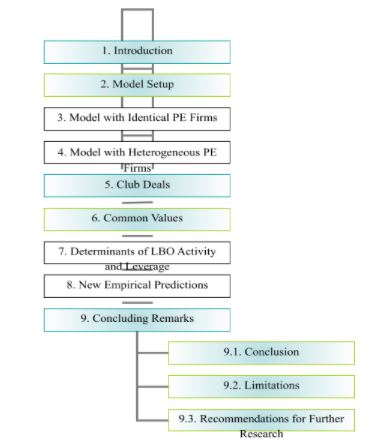

It is often stated in other articles on the value creation and LBOs in the merger and acquisition market that proposed theoretical models lack support as one of their limitations, or they are focused only on certain factors and aspects while ignoring others. Many researchers mention the limitations of their studies in order to guarantee that their assumptions and hypotheses are valid or credible (Hung & Tsai, 2017; Reddy et al., 2016). These limitations are usually included in the discussion or conclusion sections of research articles and reports where the results of experiments are provided. Therefore, the concluding section of Malenko and Malenko’s (2015) article should be modified to include several sub-sections with the focus on the part where limitations are described. If the authors of the article modify their framework, it can become more valid, reliable, and applicable, as well as effective to address the discussed problem. Figure 1 below represents the initial framework for the article by Malenko and Malenko (2015). Figure 2 below proposes the revised framework.

Reflection on the Deconstruction Process

Practicing skills in deconstructing such papers and study reports as Malenko and Malenko’s (2015) article is important for me in order to become able to improve critical thinking and analytical skills. When I was reviewing the selected article, I focused on constructing it as a system of components, and its reverse structure was perceived as normal because many other articles use such frameworks. As a result, I focused only on the logic of the arguments, the development of the model, predictions, implications, and the provided academic support. I could not concentrate on such weakness as the acknowledgment of any possible limitations that could influence the authors’ development of the theoretical model or its application. Therefore, I understand that I also needed to deconstruct the article in order to conclude about its real effectiveness to facilitate the problem solution. This experience was required to make my analysis of the article stronger.

When I was reviewing Malenko and Malenko’s (2015) article for the second time, I found several weaknesses related to the article’s framework and content that were not noticed previously. Some statements made by the authors seemed to be questionable and provocative because they were not supported by the literature on the problem. Therefore, I paid attention to the fact that the assumptions made by the authors are not discussed in the context of possible limitations of the study and developed theoretical model. The further analysis of other articles on the topic proves that authors should mention limitations to avoid biased findings and conclusions. From this point, the process of deconstructing the research article helped me improve my skills in analyzing and interpreting research results from a critical perspective. This skill is important to conduct similar studies or select evidence that can be applied to practice to address the discussed problem of value creation in the merger and acquisition market.

Conclusion

The purpose of this paper was to describe the process of deconstructing the selected research article on the topic of the LBO activity in the context of the merger and acquisition market. The first step was to discuss the article’s framework with the focus on its components and advantages for promoting the problem solution. The second step was to present a deconstruction process with the focus on identifying one important weakness that can prevent the framework from facilitating the solution to the problem. The weakness identified during the process of deconstructing the article is the lack of limitations in the context of a reverse framework that can affect the quality of assumptions and contribute to amplifying the problem. The next step was to propose the possible modification of the framework in order to address the weakness. The revised relevant framework is presented in this paper in the form of a scheme that includes the required modification. The final step was to reflect on the deconstruction process and provide certain thoughts regarding this assignment. All these steps are completed and described in separate sections of the paper.

References

Alperovych, Y., Amess, K., & Wright, M. (2013). Private equity firm experience and buyout vendor source: What is their impact on efficiency? European Journal of Operational Research, 228(3), 601-611.

Amess, K., Stiebale, J., & Wright, M. (2016). The impact of private equity on firms׳ patenting activity. European Economic Review, 86(1), 147-160.

Ang, J., Hutton, I., & Majadillas, M. A. (2014). Manager divestment in leveraged buyouts. European Financial Management, 20(3), 462-493.

Axelson, U., Jenkinson, T., Strömberg, P., & Weisbach, M. S. (2013). Borrow cheap, buy high? The determinants of leverage and pricing in buyouts. The Journal of Finance, 68(6), 2223-2267.

Ayash, B., Bartlett, R. P., & Poulsen, A. B. (2017). The determinants of buyout returns: Does transaction strategy matter? Journal of Corporate Finance, 46(1), 342-360.

Butt, I. T. (2013). Comparative analysis: The 1960s & 1980s merger waves. New Horizons, 7(2), 95-97.

DePamphilis, D. (2014). Mergers, acquisitions, and other restructuring activities: An integrated approach to process, tools, cases, and solutions (7th ed.). San Diego, CA: Elsevier Science.

Fook, J. (2016). Social work: A critical approach to practice (3rd ed.). Thousand Oaks, CA: SAGE Publications.

Haddad, V., Loualiche, E., & Plosser, M. (2017). Buyout activity: The impact of aggregate discount rates. The Journal of Finance, 72(1), 371-414.

Hung, Y. D., & Tsai, M. H. (2017). Value creation and value transfer of leveraged buyouts: A review of recent developments and challenges for emerging markets. Emerging Markets Finance and Trade, 53(4), 877-917.

Jenkinson, T., & Sousa, M. (2015). What determines the exit decision for leveraged buyouts? Journal of Banking & Finance, 59(1), 399-408.

Malenko, A., & Malenko, N. (2015). A theory of LBO activity based on repeated debt-equity conflicts. Journal of Financial Economics, 117(3), 607-627.

Murray, A. (2014). Acquisition finance: Alternative thinking. Unquote Analysis, 21(1), 10-11.

Reddy, K. S., Xie, E., & Huang, Y. (2016). Contractual buyout-a legitimate growth model in the enterprise development: Foundations and implications. International Journal of Management and Enterprise Development, 15(1), 1-23.

Wright, M., Cressy, R., Wilson, N., & Farag, H. (2014). Financial restructuring and recovery in private equity buyouts: The UK evidence. Venture Capital, 16(2), 109-129.