Executive summary

BMW is one of the largest and successful cars and motorcycle producer in the world. The company has remained to be among the largest firms in the German motor industry. BMW, MINI as well as Rolls-Royce are amongst the three BMW strongest and finest sorts in the auto business. The group manufactures vehicles that have the greatest degree of standards in terms of quality, technology, dynamic and aesthetics. These qualitative features are as a result of the company’s origin and the German country strong leading position in engineering and innovation. Furthermore, the company has strong leading motorcycle market position. As a market leader in cars and motorcycles production, the company also offers a variety of successful financial services.

By 2007, the company came up with new strategic management practices that defined the future success course. The premeditated course emphasized on the productivity and the long-standing cost development. In addition, the corporation focused its actions on the first-class marketplace divisions within the worldwide car marketplace. The BMW Group is at present the primary global supplier of quality goods as well as services for personage mobility. The success of the BMW Group in the global market has been determined by the long-term strategies together with responsible actions.

BMW Company has been striving for social and ecological sustainability along its entire value-added chain. In fact, the company has been taking responsibility for its products and providing an equivocal commitment to the preservation of resources. These reasons are responsible for the sustainability of BMW Group within the automotive industry. This paper will be analyzing the company strengths, weaknesses opportunities and weaknesses in order to come up with long-term strategies that would lead BMW Group to sustainable growth.

Introduction

Starting position and objectives

Few individuals who are privileged to drive BMW cars actually understands the comfort and luxury that this auto offer. In fact, with such a significant reputation and huge market share, BMW autos cannot be considered as the most luxurious, or the most reliable or most powerful cars in the global markets. Despite this, the BMW cars still score well in each of these categories. For instance, nobody has ever mentioned that BMW cars are inexpensive regardless of the high specialty levels that most BMW models provide. Even though BMW justly underlines the advanced nature and quality of the adopted technology, the BMW products are not very original (Jeffs, 2008). The BMW auto designs are conservative while the model styling is definitely customary.

The BMW Group furthermore realizes high engineering quality than expected in cars production. Whereas most auto assemblies have at this time been presumed by low waged workforces or automatons, the BMW has imperatively conserved a pool of experienced German workers in its distribution schemes (“Datamonitor: Bayerische Motoren Werke AG (BMW Group)”, 2011). The group benefits from its high reputation, and from the substantial achievements this company has realized, BMW emerges as the topmost German auto-manufacturing industry representative. Indeed, the success of BMW series was not perceived to be certain or easy (Burgelman, 2008).

This paper basically analyses the distribution SWOT for BMW Group by identifying factors which made the company to be a global car manufacturer and distribution leader. It also provides the strategies that the BMW Group could use to maintain its market dominance in the automobile industry (“Industry Update”, 2007). The entire SWOT analysis for BMW is a group work with four members and entails operations and production, distribution, finance and marketing.

The suggested strategies objectively aim at establishing the BMW as the dominant player alongside Mercedes-Benz and Audi in the automobile industry market by the fiscal 2016.

Who is BMW Group?

Bayerische Motoren Werke Group abbreviated as BMW, has emerged to be amongst the prominent global luxury carmakers. The company was established and grounded in Bavaria State in Germany during World War I. BMW specialized in manufacturing engines but the company later on diversified to produce two of its most key products namely motorcycles and automobiles. BMW similarly offers financial services. In the fiscal 1959, BMW was bought by Herbert Quandt in 1959 when the corporation faced the drawbacks of the financial turmoil (Coulter, 2002). The family retained a controlling share equivalent to 47% of the total company’s shares.

At present, BMW is in the midst of the most prosperous and prime corporations in Germany. The BMW Corporation is reported to employ over one hundred thousand people who make and distribute a succession of triumphant, premium priced motorcycles and passenger cars (Kodama, 2011). Besides the BMW manufacturing operations, the company equally offers financial services that support its universal distribution and sales of motorcycles and cars. However, there has been saturation in the European market since the old automobiles are constantly being replaced with new cars. Although the BMW Group has significantly grown, the production in Western Europe has not increased (“Bayerische Motoren Werke AG SWOT Analysis”, 2008). The BMW Group production capacity has nevertheless increased indicating that the automobile industry in the European nations can manufacture over six million cars (“Research and markets: BMW Group- Key strategies, plans, SWOT, trends & outlook for 2012” 2012).

There is a considerable trade in automobile between other nations and the EU. This was well depicted by a surplus growth in exports of 20.1 billion euros in the financial year 1998. The automobile industry further entails high costs of investment implying that the BMW auto manufacturers must run the production facilities devoid of over capacity productions so as to generate profits (Johnson et al., 2005). Most European car manufacturers as a result maintain their profit levels by joining the merger and acquisitions. Irrespective of the nature of the fierce competition that European automobile industry faces from the giant manufactures like the Japanese and Americans, the largest market share of the total produced autos within the European market is dominated by Italy, Spain, France and Germany. The strongest market competitors for BMW are the Audi and Mercedes Benz.

The BMW organization

BMW Group is segmented into three major divisions namely the Automobiles division, motorcycles and the financial services division. The automobile as well as motorcycles divisions concentrate mainly in the manufacture of the company motorcars and motorcycles that are distributed all over the world through the company subsidiaries, dealers, retailers and independent importers along with the company own outlets that are situated in the universal prime markets.

The automotive segment develops, assembles, produces and sells passenger motorcars and off-road vehicles that include the BMW, MINI and Rolls-Royce brands. The company also sells automotive spare parts together with accessories. The company brand cars are distributed through dealers, distributors and retails located in more than 140 countries around the world. In the last financial year, the automotive segment distributed and sold more than 1.5 million motor car brand vehicles. This was a record of 14.2 % growth in sales volume from the previous year (BMW Group 2011, p.24). The sales volume increased in most of the segment markets such as Europe and North America. BMW still remains to be the leader in the premium market for motorcars.

Overview of BMW Market segment

Sales volume contribution per market segment

Picture 1: Sales volume contribution per market segment

The motorcycle segment manufactures and sells brands such as BMW Motorrad and Husqvarna motorcycles. Besides the intricate market environment, the sales of motorcycles experienced an increased growth especially the BMW brand. The sales volume increased by 3.2% in the last financial year. The total units sold by the segment in the last financial year totaled 104,286 units with the highest volume recorded on BMW Motorrad (BMW Group 2011, p.26). The sales of motorcycles increased in all the market segments especially in Germany, Italy, USA and France. The increased sales have enabled the company to continue expanding on its range of models in this segment.

Sales contribution per market segment

Picture 2: BMW sales contribution per market segment

The financial services segment provides individual financial solution needed for mobility by both the business and private clients. The segment possesses attractive variety products that make it to be one of the most reliable partners to many sales organizations in various countries around the world (BMW Group 2011, p.29). The segmented line of business comprises of; credit and lease financing for BMW Group vehicles to the retail clients, credit and lease financing for fleet management or customers, multi brand financing, dealers financing insurance and banking. The sector has been successful given that it boasts of running a portfolio of roughly 3,592,093 units in contract and credit funding bonds. Besides the segment total volume has been constantly improving at an average rate of 13.6% that is approximately €9010 per annum (BMW Group 2011, p.32).

The worldwide workforce for the BMW Group is approximated to 100306 employees. The group has been targeting the skilled workforce so as to keep with increased demand for vehicles as well as to help in the development of new technologies such as electro mobility. BMW constant vocational training ensures that the company is resupplied with skilled staff both in Germany and internationally. Moreover, the company is constantly promoting young talents through the provision of available opportunities (BMW Group 2012, n.p).

BMW Group employees

Picture 3: BMW Group global employees

SWOT Analysis

The formulation of the strategic distribution is amongst the critical management processes that a company like BMW must take into consideration. The strategic planning for the BMW distribution system usually integrates various external and internal factors that impacts on the company’s performance. Nonetheless, in the ever evolving business world, most of the strategic planning distribution factors are hardly captured. Thus, to critically assess the distribution factors, the SWOT analysis tool is often employed to efficiently extract factors from the corporation’s operational environment (McGee, 2009). The SWOT which denotes the strengths, weaknesses, opportunities and threats entails most of the vital factors which ought to be considered to allow a company like the BMW Group to successfully strategize.

SWOT analysis is perceived as a tool that has been very critical in evaluating corporate performances. The analysis extends to incorporate each module of a business unit and therefore offers a far-reaching outlook. The conceptual framework developed by Phillip Kotler forms the basic outline of this paper given that the antiquity of BMW surely displays strengths, weaknesses, opportunities and threats. Generally, the group SWOT analysis focused on four major areas namely finance and marketing, distribution, production and operations.

List analysis for BMW strengths and weaknesses

According to Kotler (2012), determining a company’s or an organization’s internal strengths and weaknesses forms the preliminary phase of conducting a SWOT analysis.

Strengths

- BMW has a well-established and closely controlled distribution network that operationally benefits its communications and brand management.

- The close proximity amid BMW and most of its product consumers has permitted the company to segment the market effectively.

- BMW via using the internet was capable of considerably reducing the lead-time for the automobile manufacturers (Coulter, 2002).

- BMW has strong manufacturing capabilities and partnering growth with its dealers (Ostle, 2001a).

Weaknesses

- The raw materials used in manufacturing BMW are very costly as a result of German based heavy costs (Hill & Jones, 2012)

- The assembly of BMW parts is only done by plants abroad

- Numerous electronic products are needed to manufacture a BMW but very few electronic accessories are available (Ostle, 2001b)

List analysis for BMW opportunities and threats

The opportunities and threats structure that has been adopted in this paper also follows the four key areas.

Opportunities

- The BMW has strong sales potential both in the developing and developed countries such as the European nations and Asian countries (Henry, 2008)

- The technological developments and design of fuel injection systems and air bags coupled with the availability raw materials to develop the same products provides an opportunity for BMW to grow and develop.

Threats

- Fierce competitions in the BMW dominant markets threaten to slump down the demand for BMW auto products (Burgelman, 2008).

- The global market for automobiles has also been saturated with cheap, common and cost effective cars

Consolidation and new strategic directions

The SWOT analysis that has conducted clearly shows the BMW market situation. The prospective strategy anchors on the gathered information. These could be used to develop strategic actions which might make BMW to continue being a market leader in the automobile industry (Martin 2010, p.203).

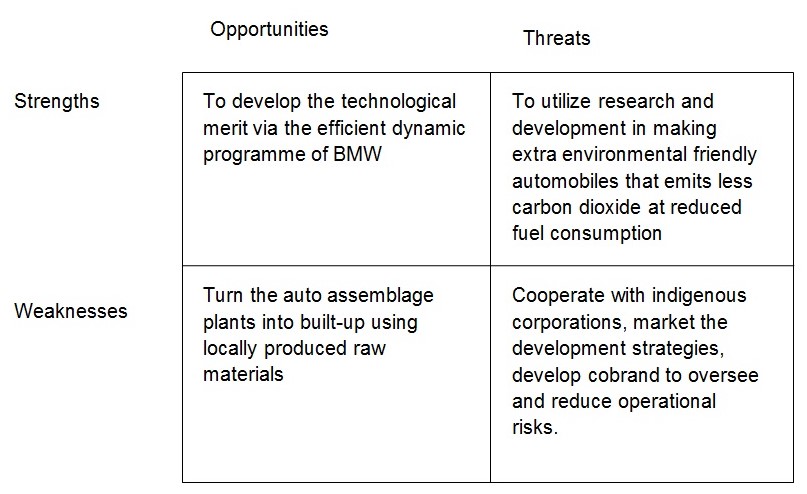

Linking the two SWOT lists

When the SWO matrix information is linked, new strategies for BMW could developed as indicated in the table below. The table indicates that four strategies have been proposed to suit both the developing and developed market segments.

Cost-Benefit analysis

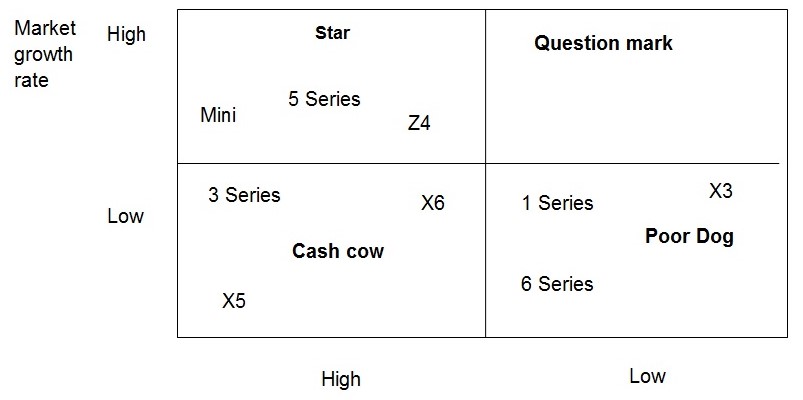

Boston Matrix

The overall UK market for the BMW

Relative market share

As mentioned above in the company SWOT analysis, BMW still continues to be the leader in the premium market. The future strategy of the company will be based on those factors that will enable the company accomplish its goal of being the premium leader in the auto industry. In fact, the company long term strategies are founded on the need to conserve resources, reduce carbon emission and remain competitive at the prime market (Ireland, Hoskisson & Hitt, 2008). Hence, the company long term strategies revolve around technologies that will ensure continued social and economic responsibility as well as sustainability.

Product development strategy

The company recognizes the importance of technology in improving the internal capabilities that result in sustainable competitiveness in the world market arena (Hill & Jones 2012, p.108). The company long term strategies lie on its leadership in innovation and application of new technologies. The company believes that by 2020 vehicles will still be powered by the conventional combustion engines thereby putting a lot of emphasis on the development of more efficient in-house combustion engines (Hill & Jones 2011, p.108). In addition to improving the combustion engines, the company should double the effort in developing technologies in electro-mobility which will result in vehicles powered by electric means. The achievements in the technological strategies will lead to the considerable reductions in the CO2 emissions (Hitt, Ireland & Hoskisson, 2010). Moreover, through research and development the company should continue to effectively approach economy fuel engine technologies that will make it possess most efficient products in automotive industry.

The company should commit it long term objective of adopting efficient dynamic concepts in all its models so as to reduce the consumption of fuel and emissions (BMW Group 2011, p.32). That is the company has to continuously integrate innovative and efficient technologies in almost all the models that are being manufactured by BMW. Technologies that are based on the efficient dynamics will ensure sustained competitive products. Moreover, the company should apply hybrid solutions with electric power to reduce fuel consumption and improve on the efficiency (Dess, Lumpkin & Eisner, 2009). The company future portfolio will be expanded through the use of electric drive systems used in the products of the BMWi sub-brand.

Differentiation strategies

The differentiation strategy should apply to all area of BMW enterprise as well as its world subsidiaries. Differentiation encompasses the core corporate objective of the BMW. The corporation has several characteristics which distinguish it from the global market contenders. The company has modern equipment, leadership in the improved technology in the motor manufacturing and focusing in the development of innovative oriented products (Conklin & Sorrell, 2009). The BMW Group operates under greater quality control procedures which is essential in the production of high quality products. Moreover the company wide sale networks that are found throughout the world can be used to distribute its newly developed products. The company is also enjoying greater reputation together with increased customer royalty. Foss and Robertson (2000) claim that all these attributes will differentiate the company products from the competitors.

References

“Bayerische Motoren Werke AG SWOT Analysis”, 2008, Bayerische Motoren Werke AG SWOT Analysis, pp.1-10.

“Datamonitor: Bayerische Motoren Werke AG (BMW Group)” 2011, Bayerische Motoren Werke AG SWOT Analysis, p1-11.

“Industry Update” 2007, Market Watch: Automotive, vol. 6 no. 11, pp.2.

“Research and markets: BMW Group – Key strategies, plans, SWOT, trends & outlook for 2012” 2012, Research and Markets. Business Wire (English).

BMW Group, Annual report 2011, Web.

BMW Group 2012, Employees; diversity management, Web.

Burgelman, RA 2008, Strategic management of technology and innovation, McGraw-Hill Irwin, London, UK.

Conklin, W & Sorrell, C 2009, Applying differentiation strategies, Shell Education, Southern California

Coulter, MK 2002, Strategic management in action, Prentice Hall, Upper Saddle River, NJ.

Dess, G Lumpkin,T & Eisner, A 2009, Strategic management: Creating competitive advantages, McGraw-Hill Irwin, New York, NY.

Foss, N & Robertson, P 2000, Resources, technology and strategy, Routledge, London

Henry, A 2008, Understanding strategic management, Oxford University Press, London, UK.

Hill, CW & Jones, G 2011, Essentials of strategic management, Cengage Learning, Mason. OH

Hill, CW & Jones, GR 2012, Strategic management theory: An integrated approach, Cengage Learning, Florence, KY.

Hitt, M, Ireland, D & Hoskisson, R 2010, Strategic management: Competitiveness and globalization, concepts, Cengage Learning, Mason. OH

Ireland, D, Hoskisson, R & Hitt, M 2008, Understanding business Strategy: Concepts and Cases, Cengage Learning, Mason, OH

Jeffs, C 2008, Strategic management, SAGE Publications Ltd, Thousands Oak, CA.

Johnson, G. et al. 2005, BMW automobiles case study in exploring corporate strategy, text and cases, FT Prentice Hall, Essex.

Kodama, M. 2011, Interactive business communities: Accelerating corporate innovation through boundary networks, Gower Publishing, Farnham, UK

Martin, TF 2010, Strategic management, Cengage Learning EMEA, Florence, KY.

McGee, S 2009, “Succession planning at dealerships learning from BMW’s strategic approach”, Irish Motor Management, p47-51.

Ostle, D 2001a, “A tale of two disastrous deals”, Automotive News Europe, vol. 6 no.5, pp.4.

Ostle, D 2001b, “DCX, BMW-Rover: Parallels abound”, Automotive News, vol. 75 no. 5921, pp.40.