Executive Summary

The Concept

Café Coffee Day (CCD) is structured as a specialty beverage retailer to be located in Charlottenburg – a part of Berlin in Germany. CCD will implement a system which is new to the beverage and food industry to provide both hot and cold beverages in a convenient manner. CCD will enable the customers to drive up and order coffee or other drink of their choice from the staff employed to make coffee. The drink may be anything from a freshly brewed coffee, custom blended espresso coffee or other beverage. CCD is expected to offer a valuable option to the coffee being served in a fast-food restaurant, gas station or other institutional coffee.

CCD will offer the patrons the choicest hot or cold beverages, usually comprising of specialty coffees, blended teas, and other custom drinks. Apart from beverages like coffee or tea CCD will offer soft drinks, cakes, Hungarian pastries, and wines.

CCD will cater to five different customer segments:

- The Youngsters from the affluent local community of Charlottenburg

- Tourists visiting the city

- Student population

- Local businessmen and office goers and

- The commuters passing by the location of the coffee house

CCD through its pleasing ambience will penetrate into the young generation market by locating the coffee shop at convenient and easily accessible locations. The interior of the coffee shop will be made to suit the younger generation with proper lighting and channel music. The inner ambience will be made youthful to attract the young customers.

Founders

Café coffee Day is the brain child of two young enterprising entrepreneurs who will participate in the day to day business of the coffee house establishment. One of the founders has completed technical education in Hungarian pastry making which is an added advantage to the business. The other founder is a business administration graduate.

Financials

The financial forecast of CCD is quite optimistic, since the business will be operated entirely on a cash basis. The initial start up cost has been kept as low as possible at € 112,000 to enable an early start. CCE believes that the investment in its staff is the greatest differentiating factor between it and its competitors. For the purpose of making this business plan, it is assumed that the entire capital expenditures for the equipments and furnishings are financed. The business will keep inventory as minimum as possible so that the products offered to the customers are always fresh. This will also help the company to take advantage of reduction in prices, if at all it happens.

Online Store

CCD has also plans to offer its products through an online store, where the customers can place order for the whole coffee beans, different varieties of tea, gift articles like coffee mug, ball caps, and T-shirts with the brand name of Café Coffee Day and gift baskets with chocolates and toys.

Highlights

The sales turnover, Gross margin, and net margin of the project are as follows:

Business Objectives

Café Coffee Day has identified and adopted three important business objectives which it wishes to accomplish in the next three years of operation:

- To establish at least ten fully furnished coffee shop locations in the districts of Berlin

- To offer the products through an online shop

- To achieve a gross margin of 45 percent or more on the sales

- To achieve a net after-tax earning of above 18 percent on sales

Mission

Café Coffee Day has adopted an organizational mission with two distinct elements which are considered as integral to the success of the business of the company:

- Product Mission – Provide the patrons the chicest and finest quality of coffee and other beverages at convenient locations under pleasing ambience

- Economic Mission – Operate and achieve profitable growth with sound and efficient economic decisions

Success Factors

Five success factors have been identified as keys to the success of the business of Café

Coffee Day. Out of these five factors three are quite common to any coffee shop kiosks. The fourth one is exclusive to Café Coffee Day – youthful ambience – which will give the extra competitive edge over the competitors.

- Greatest Locations – The selected locations with high visibility, easy accessibility and convenient interiors

- Best Products – Use of the choicest and finest coffee beans, clean and up to date equipments, extravagant serving containers and consistent flavor

- Courteous Service – Employment of professional and skilled servers and baristas who will render courteous and cheerful service

- Youthful Ambience – Equipping the interior of the coffee shop with an ambience quite different from other usual coffee shops

- Internet Shop – Offering to sell the products of the company through an online store and delivering them to the customer location

Core Competence of the Founder Team

The founder team consists of two youngsters; one having a diploma in Hungarian Pastry making and other having a degree in business administration. Together these young minds will make a great team for the promotion of Café Coffee Day as a super specialty stores that excels through its quality of the product offerings. Because of his background in the Hungarian pastry making one of the founders can personally supervise the making of quality pastries on the basis of the orders of the customers. The business administration background of the other founder member will help him conduct the business efficiently. With a perfect combination between these individuals the business of Café Coffee Day is sure to be a successful venture.

Market Potential and Market Contention

Since the proposed venture will be located in the southern part of Charlottenburg which is one of the wealthiest areas of Berlin, where the affordability of the youngsters is more, CCD is sure to make its presence felt among the younger customers of the region. Charlottenburg is a part of the city borough Charlottenburg-Wilmersdorf. It is situated towards the eastern side of the city of Berlin. The city is surrounded by rivers Havel and Spree. The population of Charlottenburg is about 315,100 (2004). The area of the city is around 64.7 km². (Deutschland – Germany).

The place has a historical background that extends to the year as back as 1239. Charlottenburg was made the 7th city borough of Grater Berlin in the year 1920. The year 2001 witnessed the amalgamation of the borough of Charlottenburg with the borough of Wilmersdorf (Deutschland – Germany).

There are a number of nice restaurants and cafes on the Wilmersdorf side of the district, whereas such posh restaurants and coffee shops are comparatively less in number in the Charlottenburg area. This offers a wide opportunity for the CCD to develop its business.

The café will serve as a meeting place for the young people within the age group of 15 to 29 years of both genders who are served the choicest coffee by friendly and cheerful young staff in an uplifting and invigorating ambience. In fact these young people constitute the majority of the customers for CCD. According to estimates the teen-agers will constitute 25 percent of the customers of CCD while 38 percent of the customers are expected to be between 20 and 24years of age with another 23 percent belonging to the age group of 25 years to 29 years. Around 72 percent of the customers will comprise of students and young professionals (Café Coffee Day).

Capital Requirement and Profitability

The project requires an initial start up expenditure of € 112,000 which will be met with the bank loan of € 120,000 obtained from the bank. The project is expected to achieve a sales turnover of The project assumes that the product cost will remain almost same during the first three years and hence the gross margin percentage is almost the same for all the three years. Because of the increased market share and establishing its reputation the net margin of the company is expected to rise in the second and third year.

Company Summary

Café Coffee Day is a specialty coffee shop which offers the customers in the young generation segment a convenient place with a youthful ambience where the younger people can meet and have their chats. With a lighting and music that will meet with the preferences of the youngsters CCD focuses on the market segment consisting of younger generation people who are students are newly employed youngsters. The company will be considered special with the quality of coffee and other beverages it is offering along with cakes. CCD will also offer a limited variety of wines to the patrons subject to availability. Thus CCD will aim to offer a valuable alternative to the traditional coffee shops, fast-food chains, and other institutional coffee houses.

The company will be formed as a partnership business between the two founder members. The profits and losses of the business will be shared between the partners in equal ratio since they will be contributing the initial capital required by the company apart from the loan funds equally.

Company Location

The first coffee shop of CCD will be located in Charlottenburg business district which is the center of West Berlin and is really has come a long way after the war. By any standard this area is mostly an up-market shopping and living area for all those who want a living away from the city. The city also has a historical palace and several museums to attract the tourists all though the year. There are several schools and colleges with their students as potential customers to the coffee house business.

Company Ownership

The company will be formed as a partnership between the two founders sharing the profits and losses equally among them.

Start – up Summary

The expenses for start-up of the venture are in line with that of other coffee house chains. For example the start up expenses for Starbucks is in the region of $ 380,000 (approximately € 270,000) for each store location. Comparing the start up expenses of Starbucks what Café Coffee Day is incurring as start up expense is perfectly in order. The costs for opening the first store of Café Coffee Day are estimated at € 112,000. Apart from this the business may need the working capital which is provided by the bank in the form of loan. The future stores of CCD may not cost more than € 75,000 since many of the costs incurred in the first instance may not be repeated like the trade mark registration and founding expenses.

Start up Costs

Products

Café Coffee Day will offer its patrons the choicest hot and cold beverages along with finely made Hungarian Pastries and cakes. The coffee shop will also serve certain varieties of wines as and when required by the customers. The coffee shop will offer 16 different types of cakes, 20 different types of coffees and 10 different types of wines to meet the demands of the customers. Apart from these products CCD will add other items of beverages and snacks at the appropriate times to meet the increased needs of the customers. The company has plans to offer all these products through the online store on the internet. The company has also plans to market premium items like coffee mugs, T-shirts and sweatshirts, ball caps and other items with the brand logo of Café Coffee Day through the online store in the near future once the business is established.

Product Description

The customers of CCD will be provided the luxury of ordering a coffee beverage that will be blended to their exact specifications. Every barista of the CCD who is entrusted with the responsible of making coffee will be trained in the fine art of brewing, blending, and serving the highest quality hot and cold beverages with exceptional attention to the minutest details.

Besides different varieties of coffees, the CCD will offer teas, frozen coffee beverages, seasonal specialty drinks, Hungarian pastries, and cakes, few varieties of wines. Through the website CCD will market premium items with CCD brand and logo like T-shirts and sweatshirts, coffee mugs, ball caps and other consumer items.

Competitive Comparison

Though CCD is operating in the retail coffee house industry the competition may emanate from even products like soft drinks, milk shakes and other adult beverages. The competition for the company should be expected from the following three sources.

- National Coffee houses like Starbucks

- Locally owned players of the coffee house industry

- Fast food Chains and convenience stores

CCD will stand out from all these kinds of competitors due to:

- the exceptional quality of coffee and other items being provided by it to the customers and

- the artistically done interior which will provide a youthful ambience to the young age customers visiting the coffee shop

Opportunities and Strengths

Despite the availability of a number of restaurants in the city of Charlottenburg, since there is no exclusive and youthful outlet to provide quality coffee, the venture of CCD will be successful. The south side of the city is filled with wealthy and affluent families, the youngsters of which would be willing to spend time in exclusive outlets other than restaurants and bars. The coffee shop proposed to be promoted by CCD will provide an appropriate outlet for spending time in an exclusive atmosphere. An additional strength which CCD possesses is its ability to change the nature of its product offering with the changes in customer preferences. The coffeehouse will be located in a spacious building that is more than adequate for a coffee house and also enough for converting it to a full pledged restaurant in case of necessity. The kitchen will be designed flexibly to meet any exigencies. In case the fad of the coffee fades away the CCD will be able to change itself into a full course restaurant or will turn to any eating place as the situation may warrant. This provides an additional strength to CCD.

Critical Risks and Problems

Any business has its own inherent risks which the owners of the business have to mitigate by adopting suitable measures. However the risks that are being faced by restaurants like coffee house are unique. The most critical issue that a coffee house faces is the change in the preferences of the customers. The next one is the changes in the economic conditions. Both of these factors affect the coffee house business badly. Coffee houses rely largely on the persons who have expendable income. For any reason when the economy takes a downturn it affects the expendable income of the people and the people then tend to change their spending priorities. This reduces the number of times the people visit the coffee houses.

Another problem that is continuously present in the coffee house industry is to find dependable employees who will stay with the business. It so happens that many restaurant employees tend to be young people who want to move up in their careers. At the end of their schooling or if they find another suitable job they move on. Quite often the positions of servers are filled with people who are unskilled and used to be single mothers or lower educated persons. The management should always consider the specific circumstances under which these people take up the employment. A single mother may be confronted with the problem of child care and a bus person may find it difficult to read and write. It is the job of the owner to tackle these problems in a manner that is most beneficial to the business as well as to the employees.

Market Analysis

Café Coffee Day launches with an exciting new coffee house concept in a highly receptive and steadily growing market segment in Germany.

German Coffee Shop Industry

While the overall picture of coffee consumption in Germany is sluggish the trends in consumption pattern with respect to non-household consumption in the form of coffee house outlets is showing an increasing trend. The consumption in this sector has reached 55,000 tons from a meager figure of 1000 tons within a span of 3 years. The main reason for its growth is the upcoming of coffee shops and espresso bars. “They are especially focused on younger consumers in the big cities or in cities with a university. It started in the early 1990s with the Italian roasters Lavazza and Segafredo, both of which operate today some 100 espresso bars. Coffee shops and other espresso bars followed, many of them were operated by small private roasters. Today there are some 215 of these outlets all over Germany. Experts believe that there is a potential of around 1,500 to 2,000 of these coffee places” (Manfred Komer, 2001).

According to market research studies the outdoor consumption of coffee is showing an increasing trend as more and more young people regard coffee drinking as trendy and not old fashioned.

Though the coffeehouse concept has started only in Berlin around 1700s when the coffeehouses were the hangouts of aristocrats who loved to play a popular card game called ‘ombre’. While they were playing the card game they also sipped their coffees in handless coffee cups similar to the Turkish cups but larger in size. It is interesting to note that it has taken around 1000 years for coffee to take its present shape to be offered in coffee houses.

Despite the historical role the coffee house industry has the specialty retail coffee business has began only after 1982 with the introduction of Starbucks and the coffee shop chain with no much progress made in the coffeehouse business globally prior to that period. In Germany the business had only a sluggish growth and the Starbucks started its operation only in the year 2002 with the opening of two outlets on a joint venture with KarstdtQuelle AG. While the overall coffee sales have not grown any significantly in the recent years, the specialty coffee house segment has shown a steady growth at a constant pace every year. The coffee house industry proved to be having high margins in view of the low food cost of the coffee drinks, a very modest initial capital investment, and very low overhead cost.

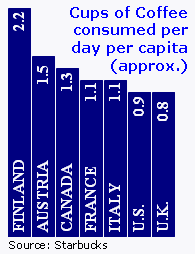

As shown by the graph showing the per capita consumption of coffee for the year 2000 for various countries worldwide, Germany is not one which has higher rate of coffee drinkers and hence offered good scope for the development of coffee consumption over the years. Quite recently the concept of coffee house concept has picked up recently.

Coffee Drinking Per Capita by Country

Traditionally Germany is a coffee drinking nation and has offered good scope for new ventures in the line of coffee house business. The people of Germany drank 74 billion cups of coffee in the year 2002. This is equivalent to an annual per capita consumption of 160 liters of coffee in Germany. Germany now is placed third in a worldwide ranking of the coffee drinking nations as against the position shown in the year 2000 by the graph depicted above.

While the industry found only 50 and odd coffee shops in the year 1991, when the concept of coffee shop virtually did not exist, the industry sources estimate an increase of thirty fold in the number of coffee shops in the year 2005. Some of the franchises stores existing in the market are Starbucks, Tchibo, Segafredo, Testa Rossa, Café Nescafe, and Wieners. There are Chain stores players like Lavazza, World Coffee, Woyton Coffee, and Costa Coffee which operate in the market. These stores and shops have a significant role to play in the development of the coffee house industry in Germany. The number of coffee bars was estimated to be 350 in the year 2002. in the form of both franchise and chain stores in Germany. It was also estimated that the industry is capable of accommodating about 3000 coffee shop outlets more.

The German coffee shop industry is dominated by a couple of international brands. The most important among them is Segafredo with 96 franchises. Another one is Lavazza having 81 outlets which are company owned. Closely following these businesses are Starbucks with 13 franchises, World Coffee with 12 stores, Wieners Kaffeebar and Nescafe each having 11 franchises stores. In addition there are several local and regional coffee houses operating along with the international firms

The total turnover for the German market for the franchised coffee bars and bistros recorded US $ 29.3 million for the year 2002 which is an increase of 71.4 percent as compared to that of US $ 17.1 million in the year 2001. The growth was expected to be approximately at 86 percent at US $ 54.6 million for the year 2003 and the industry is expected to register an average growth of 40 to 50 percent every year thereafter. Germany had 19 successful players in the coffee house industry with the addition of BB’s Coffee and Muffins, Jacob J-cups and Starbucks in the year 2002. The annual average growth rate was 25 percent. This rate was overtaken by a stunning 48 percent in the subsequent period. The number of franchised outlets has increased to 176 stores during this period. Aggressive marketing efforts by existing companies like Segafredo, Café Nescafe, and Cup & Cino as well as the newcomers like Starbucks have contributed to rapid expansion of the industry.

“Although significant growth is expected for all franchised coffee shop concepts, industry sources expect best prospects to exist for those able to exploit market niches, to ride current trends, to offer high quality products, and/or to present new products and services (e.g., coffee-to-go, wraps, sandwiches, muffins, etc., concepts). To summarize, the German franchised coffee bars and bistros market is moving fast. The difficulty lies in finding the proper sites and facilities at a reasonable cost, as well as attracting the prospective customers” (Dagmar Winkler-Helmdach, 2003).

Market Profile

There were 20 German and International franchises that have entered the German coffee house industry which signified a tremendous boom for the industry. This trend is expected to continue, as there is a good scope for the business to grow further. There is space for a number of other domestic and international players who would like to venture in the coffee house market within the next years. Apart from a unique cultural influence these coffee shops encompass different perspectives on the food and drinks service. The nature of their franchising system

offers a wide range of cultural diversification for the food service industry an atmosphere quite away from the regular restaurants. It must be noted that the success of these coffee chain shops was ensured not only by their global brand image but also by a significant shift in the German consumer preferences. This venture is placing its confidence for its success exactly on the changed preferences of the German Consumers.

Statistical Data

The following table presents the German Market for the annual growth in the coffee shop industry.

Table I: The German Market for Franchising (USD/Million)

Source: German Franchise Association; individual research

According to this research conducted by German Franchise Association the receptivity of the industry is estimated at a score of 5 in the scale of 1 to 5 which means that the industry is highly receptive.

The development of coffee shop industry is more than indicated by the following table.

Table II: Franchised Coffee Bar and Bistro Development in Germany

Sources: Franchise Chancen 2001/02 and 2002/2003, VNR Verlag f. d. Deutsche Wirtschaft AG (publisher); German Franchise Association; www.franchise-net.de, www.franchiseportal.de (both Internet platforms for the franchising industry); www.café-future.net, www.kaffeeverband.de, www.scae.de (three Internet platforms for coffee and related industries); individual research

Despite the presence of well established international brands in the coffee shop industry in the form of both franchised and company owned which are already operating in Germany the market is still considered to be wide open for other entrepreneurs who would like to enter coffee house business.

“Those who are able to take advantage of existing market niches and/or present new, attractive product and service combinations at attractive locations will be able to get a head start in this market segment” (Dagmar Winkler-Helmdach, 2003).

Best Sales Prospects

On the basis of the experience of the existing players in the industry the following styles of coffee house establishments would do well in the industry segment.

- Vienna-style coffee house concepts

- Espresso bars (Italian style)

- Coffee bars (Anglo-American style)

- Coffee bars (Italian-American style)

According to the surveys conducted on the industries, the success of the coffee house depends on largely on the following two factors that are considered crucial:

- The company should offer a consistently high quality of products as well as the services accompanying the products – for example catering, coffee – to – go, coffee machine vending.

- The product lines should be different which may include different types of coffee, convenient style of food like sandwiches, bagels, wraps and muffins or supply of other related merchandise with the company brand like T-Shirts, Coffee mugs etc

The proposed venture of Café Coffee Day would include both the above concepts to make it a successful venture.

Competitive Comparison

Pilot projects to test the ability of the coffee house industry to substantiate success and growth have been used by the most of the companies that have been operating successfully in the German market. These coffee house ventures have introduced new concepts, ideas, services, and products to the German market and had also helped the companies to acquaint them with the diverse consumer habits. Some of the constraints that the companies had to overcome included are unfamiliar market conditions, high start-up costs, weak brand recognitions, and new or unusual training requirements in Germany. It is observed on the basis of the operation of these stores, that any new firm entering the market in order to be successful should offer quality products and exceptional services at competitive prices. Availability of appropriate site, size of the site and the location as well as the movement of people around the proposed location determines the success of the coffee shop.

Business Practices

Any new venture into the coffee shop industry in Germany should consider the differences in market structure and diverse operating conditions. The strategic planning stage should take into account factors like well-entrenched competition, challenges relating to the recognition of brand name against the international players operating like Starbucks, the stringent labor regulations, higher salary costs and the mandatory testing procedures. These are all some of the financial risks that the proposed venture should consider at the initial stages. The coffee shop industry has shown a tremendous growth during the year 2002 which trend is expected to be followed in the next 5 to 7 years to come. Based on the dollar value the domestic based outlets have registered a growth of 55.5 percent to USD 12.9 million as compared to the previous year. The gross revenue for the industry is expected to grow to the extent of 130 percent in the year 2003 which in dollar value is approximately equal to US $ 2.9 million. An average annual growth rate of 40 to 50 percent in the next three to five years is expected in the market.

Coffee Shop Concepts Working in Germany

The following are some of the successful coffee shop concepts working in Germany:

- Wiener’s Kaffeebar

Originally Wiener’s started operating coffee bars operate coffee bars that are the modified modern version of the Classic Vienna-type coffee houses. Subsequently Wiener’s have distanced them from the other styles of operations like Italian and American styles by adopting a typical Austrian food and coffee product offerings.

- Black Bean

Coffee shop, coffee bar, and shop-in-shop model are the three kinds of coffee shop outlets. being offered by Black Bean in an American style. The concept of Black Bean focuses on the offer of different varieties of flavored coffee and pastry and baked products. While take away and coffee retailing plays an insignificant part, the 40 seat capacity terrace equipped with mobile order terminals boost the summer sale per outlet.

- Cup & Cino

Shop-in-shop system is the kind of retail outlet which is operated by Cup & Cino. The following are some of the principles that are being followed by the company for its successful operation both domestically and internationally:

- The company adopts a change in the product lines on a daily basis to meet the changing customer preferences.

- The extended business hours of ‘Coffee-House’ of Cup & Cino operates with a modular design system, product line, and exquisite furnishings.

- While most of the coffee shops close early in the evenings, the design of the Cup & Cino allows it to transform into a cocktail bar just within 15 minutes to function in the extended evening working hours.

- The extended working hours contribute to the increased sales per day and per square meter of operation.

- Café Nescafe

Café Nescafe owned by Nestle Foodservice Deutschland started its first shop on the coffee house concept in the year 2001 with take-out comprising of more than 30 percent of the sale, the company is emphasizing other promotional activities allied with coffee like sandwiches, muffins etc and other non-food items. The company has aggressive expansion plans to open more franchised outlets within Germany.

Competitor Analysis

The proposed venture will face competition from the above domestic firms and also from other international brands and coffee house operators. The major competitors in the coffee house industry in Germany include:

- Tchibo

Tchibo was found in the year 1949 in Hamburg. The coffee house chain is famous for its changing coffee range every week. Apart from serving coffee the chain also markets clothing, household articles, electronics, and electrical appliances. The company started off with a mail order distribution business of coffee beans and in the year 1955 established its first coffee shop to offer the customers the taste of coffee they wanted to buy and the concept developed into an international coffee house chain over the years (Tchibo – Corporate Website). Although the company was not active in the coffee house retail business in the year 2003 Tchibo changed its business policy to involve itself more in the coffee shop business and with 850 outlets Tchibo operates as the oldest and strongest coffee chain in Germany. Though a significant portion of their turnover is contributed by non-food articles like clothing and household accessories, its stronghold in the coffee shop business is maintained because of the well positioned market presence of Tchibo based on the locations, consumer acceptance, and large market cap. There are are more than 1000 outlets integrated with the bakeries. Tchibo is to be considered as one of the strongest competitor for the proposed venture.

- Starbucks Germany and Other US Companies

In the year 2001 United States was represented in the German Coffee Shop industry by the lone firm of New World Coffee & Bagel. With the opening of 13 outlets by Seattle based Starbucks a coffee house giant changed the scenario with respect to the presence of the US based coffee house firms in the German market. The opening of the Starbucks stores raised the market share of the US companies to an impressive 17.3 percent in the year 2002 with an aggregate sale of USD 5.1 million. In the year 2003 the sales was increased to USD 11.2 million. With the planned opening of additional outlets by Starbucks on its own the volume of sales by the US companies is bound to increase doubly annually. This growth target when achieved by Starbucks would change the ranking of the market position of the leading names in the German coffee house industry replacing the current first position holder of Segafredo to second, closely followed by Café Nescafe, Wiener’s and Cup & Cino to the third, fourth and fifth positions respectively.

- Other Competitors

The foreign owned coffee houses including the US based firms play a dominant role in the coffee house industry of Germany by accounting for 56 percent of the market share of the total market. In the year 2002 the total revenue of the non-German firms accounted for US $ 16.4 million which constituted an increase of 86.4 percent as compared to the figure in the year 2001. In the year 2003 the revenue increased by 52.4 percent taking the total revenue figure to US $ 25 million. The total number of non-German coffee houses was nearly 160 as of the year 2002. It was estimated that there will be a growth of about 40 to 50 percent in the number and volume of sales of these firms in the next three to five years. The German Federal Coffee Association expects the contribution of firms like Segafredo, Starbucks, Testa Rossa to lead this growth.

- Segafredo

The first global coffee house player in the German coffee house industry was the Italian based Segafredo with a market share of 52.4 percent of the franchised coffee house segment in Germany for the year 2002. The company also claimed a 29.4 percent of the total coffee house market in the country. Since the year 1990 the company having international operations has been opening at least eight outlets on an average per year in Germany.

- Testa Rossa

This Austrian based company expanded into the German market from the year 1997. This company with its own coffee bean roasting company in Italy offers the customers an Italianesque life style providing different types of coffee, wine, and other food specialties. However the company concentrates on the sale of beverages constituting 75 percent of the sales.

SWOT Analysis of Competitors

An analysis of the operations of the competitor firms reveals the following:

Strengths

- Strong Brand Image

- Advantage of early start

- Strong Financial Backing

- Expertise due to multinational operations

- Varieties of High quality Product Offering

- Expertise in expert customer service

- Effective supply chain management

- High employee motivation

- Strategic Expansion plans

Weaknesses

- Higher overhead costs

- Lack of knowledge of local customer preferences

- Difficulties in training local managers

- Tackling local employee groups and demands

- Enhanced Legal compliance

Opportunities

- Ever expanding markets

- Bright economic climate with increased spending

- Changing consumer preferences towards more coffee consumption

Threats

- Resistance to foreign firms especially American Corporate

- Change in style – European style involves small café and established coffee houses

- Critical factors in Expansion – finding a reliable local partner and difficulties in quantitative market assessment (Starbucks Case Analysis)

Charlottenburg – A Perfect Launch Market

Charlottenburg has been identified to be the perfect launch market for Café Coffee Day where the efforts of the company can be maximized towards success to factors like:

- The high affluence level of the local population as the inhabitants of the locality belong to higher income earning groups

- There is a year round tourist activity because of the presence of the Palace

- There is an ever increasing student population in the location which will ensure a good business for the coffee house

- There is an extensive auto and pedestrian traffic through the location where the coffee house is located

- The media costs are considerably lower

- There are a number of special events being conducted locally and

- The location of the site for the coffee house is a prime one

CCD will be located in a site which is considered to be one of the best locations for the coffee house in Charlottenburg, which is in the heart of the tourist and business district, which is adjacent to the fine dining and shopping, just steps away from the business intersection in town.

Market Segmentation

The customer base of CCD in Charlottenburg will consist of the following five target segments:

- Youngsters from the affluent local residents

- Tourists visiting the palace

- Local businessmen and office goers

- Students of the locality and

- Travelers who pass through the location of the coffee house

These segments of customers constitute a potentially strong customer base for CCD. The advantage of having a diverse customer segments as above will enable the company to maintain consistent business throughout the year. For example although there will be tourists coming along all through the year there will be peak of the tourist season during summer. Alternatively the students will be strong during September to the next June of the year rather than in summer.

The other customer segments of young local residents belonging to the affluent families, local businessmen, and office goers and pass through traffic provides the foundation for a consistent business throughout the year.

By approaching several customers CCD makes it a point that it doesn’t depend on any single customer segment. For example some of the coffee houses which focus on the student population will do poorly during non-school months. It is important for them to market to the new incoming students. CCD will be able to avoid these differences in the levels of business by adopting the strategy of serving mixed customer base.

CCD will use the 8,000 addresses collected by the company for marketing purposes and also the internet home page containing the 500 addresses of the potential customers.

Target Market Segment Strategy

The overall strategy of CCD is to maintain a constant high customer count by approaching the five segments of potential customers in the Charlottenburg Region. The reasons for choosing Charlottenburg in preference to other choices of Schoneberg and Mitte are as follows:

- Charlottenburg is inhabited by relatively affluent families with more spending capacity than the other two districts

- There will be an added customer segment of tourists visiting the Palace and adjacent museums which are having historical background. This will ensure an year round business

- Being a business district there is a possibility of increased business from local businessmen and other office goers

- Charlottenburg is known for its foreign residents who have moved to this place for regrouping after they have left their home countries.

The analysis of the customer segments is detailed below:

Local Residents

Approximately 357,000 residents live within a radius of seven kilometers from the proposed location of CCD. The most affluent of the residents even live closer to the coffee shop within three kilometer radius. It is a drive of less than 5 minutes to the CCD location for most of the potential customers. There is an excellent public parking facility within 100 yards of the location.

The local residents form the core customer group for CCD. It is proposed to reach out to them through local marketing and through the involvement of the local chamber of commerce. The company also proposes to support events of local charitable organizations and sports teams of youth of the locality. Since the target customers belong to the age group of 18 to 28, it is imperative that CCD sponsors more of sports and cultural events for the youth so that the coffee shop will become popular in the district.

Tourists

Charlottenburg is having an excellent tourist activity round the year. It is estimated that about 1 to 1.5 million people will visit the place during the next year. While the hotels remain fully booked during the summer months, tourism all through the year is strong. This is due to the fact that the palace offers a historic monument and the museums around the place also offer interesting sight to the tourists. There are other events like film festivals, concerts, operas and art shows also take place in the city district throughout the year which offers excellent scope for the coffee shop business. The tourists will be attracted with advertisements in the local tour guides.

Local Businessmen

Since Charlottenburg represents a combined borough there are a lot of business activities going on in the district. Many local businesses both private sector and government are located within three to four blocks of the proposed location of CCD. There is the district court house which is nearby two blocks away. Thus CCD is proposed to be located in the heart of shopping and dining area. Because of much of the parking for employees is out of the immediate area with the different modes of commuting to downtown, most of the employed people stay near their place of employment during the breakfast, lunch and after office hours. CCD is targeting a significant number of these local businessmen and office goers. CCD proposes to reach business customers through the local chamber of commerce and also by visiting the business houses and offices personally to distribute the menu and inauguration discount offer coupons.

Students

With the number of schools and colleges in and around the district the student population that can be counted as target customers are expected to be in the range of 20,000 to 25,000 students. These students most of them being under the age of public drinking have only a very few places in Charlottenburg where they can meet their friends for a chat. Coffee houses especially ones with the right kind of ambience have proved to be the popular place among the students. In order to attract the students as a potential customer segment, CCD will print and distribute student discount cards and will also distribute free coffee coupons at various student events and offer different kinds of entertainments during the weekends.

“Students represent an excellent customer segment for several reasons:

- Students bring an energy and youth to the coffeehouse

- By attracting students we generate excellent word-of-mouth

- Students represent a large base of potential part-time employees

- Often under the drinking age, students need an affordable place to hang out with their friends”

Local Commuters

There is an estimated traffic of 15 million auto traffic through Charlottenburg district passing through the proposed location of the CCD. Since the coffee shop is located on the main business street of Charlottenburg all the vehicular traffic will pass through the CCD. With a convenient parking lot nearby CCD will be able to attract most of these commuters by advertising heavily on both sides of the road.

CCD will conduct as much PR activities as is necessary to ensure to get a maximum exposure to the local market.

Strategy and Implementation Process

Café Coffee Day will use a strategy of offering the best quality of products and service to the customers. The following are some of the strategic assumptions on which the project is based for execution:

- People are on the lookout for a better and different tasting coffee drink

- Coffee drinkers want a more pleasing ambience and environment

- Coffee drinks have become more trendy and are affordable luxury

- The coffee house industry in Germany is ever growing unaffected by economic events or shocks and

- Café Coffee Day will offer unique advantages and special features over other competing players in the industry

Competitive Edge

The competitive edge as compared to other coffee houses in Charlottenburg area includes the following features:

- The quality of coffee and other products CCD offers will be of significantly higher quality than the products offered by others

- The proposed location of the coffee house is arguably the best fit strategically for the development of the coffee house business as it is located in the heart of downtown right in the middle of the shopping, dining and entertainment and cultural area

- An ambiance superior to all other coffeehouses in the area with upscale “Côte d’Azur” look. It features stained glass decorations, art glasswork, Mediterranean Riviera style furnishings, and outdoor dining.

- CCD is the only coffeehouse in the district that will offer entertainments over the weekend evenings

- With the expertise of one of the partners CCD can offer excellent varieties of Hungarian Pastries along with other products including limited varieties of wine

- CCD will have an exclusive website to undertake the selling of whole coffee beans, tea, chocolates, branded gift items and gift baskets at affordable price ranges.

Marketing Strategy

While there are different marketing strategies being adopted by the various coffee houses CCD will engage in an ongoing aggressive marketing program which will enable CCD to establish its market standing and continuous growth. The marketing strategy of CCD is to place the coffee house as the ‘Lexus’ of all the locally available coffee houses that offers high quality products, with a superb service in a superior environment.

Launch Marketing

Most coffee house chains do very little spending on marketing and advertising. For example Starbucks believe that their presence in the market alone will enable them to sustain and improve their customer base. If at all Starbucks advertise it will be for introducing a new product. The coffee house industry is historically a sales oriented business with very little exposure to advertising and marketing. The impact of advertising and marketing can be seen from the impact of them on the sales of companies like PepsiCo which is totally absent even in the case of leading multinational players in the coffee house industry. CCD will have a different orientation in developing the customer base by resorting to advertising and marketing to propagate customer awareness, build customer traffic, and improve the customer base through effective marketing communication. The aggressive launch market plan of CCD includes:

- Effective public relations and enhanced publicity

- Sending direct mails to the potential customers

- Using the local print and broadcast media extensively

- Using attractive design and packaging

- Involvement in the community functions and youth events

- An apt location of the coffee shop and

- A pleasing and desirable store ambience

Media Advertising

CCD will use all the available media for promoting the promotion of its sales as a part of the marketing efforts. This will include advertising in the local, regional, and national news papers. The company will also use the national broadcast media like television and radio and will advertise through these media for a wide exposure.

Website

The website created by CCD will be made fully into an ecommerce functional one and can also be made a potential source of revenue at a later date. The company will eventually sell the following items through the website:

- Wholesale coffee beans and various kinds of tea

- Gift baskets filled with chocolates and toys

- Other gift items like branded t-shirts, coffee mugs and ball caps and

- Household furnishing items

As the first of its kind to any other coffee houses, CCD will undertake to sell articles of glass artwork which will be a representative of the interior décor of CCD. The company will act as the sales agency for different kinds of stained glass and art glass artworks.

The website created by the company will also market Café Coffee Day with

- A periodic newsletter

- Some interesting information about the coffee industry

- A site map describing the location of CCD

- The working hours of the CCD stores

- News on any special events in the locality and

- Coffee recipes for preparation at home

Sales Strategy

The sales strategy of Café Coffee Day includes:

- Cash Coffee Day will pay salaries to staff at 10 percent above the industry standards to attract the best available talents

- Installation of state of the art inventory system and sales system which will enable the company to reduce the customer waiting time and result in an efficient product ordering

- Creating a mobile kiosk to take Café Coffee Day to the community to serve in special events, farmers’ markets and cultural and outdoor sports events

- Undertaking an aggressive ongoing marketing program

- Solicit and analyze the customer feedbacks for improvement and streamlining of the operations.

Management Summary

The launching and operations of the coffee house venture of Café Coffee Day will be managed by both the partners of the firm with the assistance of an able sales and administrative team

First Partner

One of the founders has completed a vocational education in Hungarian pastry making which is a distinct advantage for the project as he will be able to supervise the planning and execution of the making of the pastry items with the assistance of a team. With his background and experience he can be made responsible for the staffing, menu development, training, product ordering, and supervision over customer service. He can also look after the construction of the site and the interior of the store in the initial stages.

Second Partner

The second partner has completed a university degree in Business Administration. He may be made responsible for marketing, Public relations, website design, and development, legal and regulatory issues, financial issues, and accounting supervision.

However in order to successfully run the business there is the need for good baristas who can make different kinds of coffee with exotic flavors.

Personnel Plan

The personnel plan is shown in the following table. The table includes the salaries to the partners (founders), two full time employees, and four part time employees.

Personnel

It is assumed that:

- The earnings of the partners will be increased to € 2,500 per month for the second year and to € 3,000 for the third year

- There will be an addition of one full time employee and one part time employee in the second year

- The full time and part time employees will be paid an increment of 10% of their salaries in the third year.

Financial Plan

The growth in annual sales is estimated to be a minimum of 15 percent with the possibility of earning excellent profit margins. The earnings are estimated to be in the order of 20 to 25 percent ensuring an adequate cash flow. The marketing costs are estimated to be well below 5 percent of the sales. The company will invest the excess cash flow in stocks of good companies and also in prime real estate properties.

Important Assumptions

The following are the important assumptions that have been made in the making of this business plan for Café Coffee Day.

- The positive industry growth in specialty coffee drinking sector which has been happening for the past 20 years will continue to happen at the same rate for the next two decades.

- The coffee house industry has shown its resilience against the national and world economic events and it is expected that this trend will continue. Despite the recession there has been a strong growth in the coffee house industry every year and it is assumed that this trend will continue.

- It is also assumed that the quality of the national coffee house chains will continue to be the same or it may decline slightly giving way to competition from stores using increased automation and mass production techniques.

- Drinking coffee will continue to be regarded as an ‘affordable luxury’

- There will be a minimum sales growth of at least 15 percent annually during the next three years.

- No profit is expected from the online store for the first three years of establishment of the website as the company will just be using the site for sales promotion and hence no profits have been assumed to be emanating from the online activity. The website is considered as a tool for sales promotion of the coffee shop.

Break Even Analysis

Based on a break even analysis calculation done, the project needs annual sales of € 338,236.25 to break even and meet the fixed expenses to make no profit or loss. When reduced to the monthly sales the project should be able to make a turnover of € 28,186 per month as sales value to meet the fixed expenses including the partners’ salaries and fixed repayment of the loan amount to the bank.

Projected Profit and Loss

The project is expected to result in a net profit from the first year of starting. Based on the industry averages the growth rate has been assumed to be 15 percent considering the prevailing local conditions. The number of customers that the coffee house on the basis of the estimated sales of € 588,500 for the first year at 150 to 160 with an average billing of about € 12.00 per person. Out of the gross revenues of € 588,500 for the first year the business is expected to make a net profit of € 159,253 before taxes. Assuming a tax rate of 30 percent the net margin after tax works out to €111,477 for the first year. The figure for the third year increases to € 251,871. The margins from the business appear to be good. The profitability is mainly due to lower direct cost of sales and the low operating costs of a coffee house in general. It may be noted, “Higher staff salaries, owner/operator salaries, marketing costs, and rent for a premium location depress profits, but, conversely, they also ultimately contribute to higher earnings and profits”.

References

- Café Coffee Day ‘Customer Profile’

- Dagmar Winkler-Helmdach (2003) ‘Franchised Coffee Bars and Bistros’ International Market Research Report Canada

- Deutschland – Germany. Web.

- Manfred Komer (2001) ‘German Coffee Shops Gaining Ground’ Tea & Coffee Trade Journal. Web.

- Starbucks Case Analysis.

- Tchibo – Corporate Website. Web.