Executive summary

The purpose of this paper is to develop a comprehensive managerial report for the decision-making procedures in solving financial problems. Seneca Hill Winery, a hypothetical company specializing in winemaking, is used as the case study to examine the appropriate decision the company should make when considering plating one or both types of grape tree varieties, Chardonnay and Riesling, based on annual profit projects and demand projections. The managerial decision-making process is developed through a decision tree as well as the expected value (EV) approach with the help of an Excel software tool for quantitative decision-making.

Introduction

The case deals with a hypothetical wine-making company known as Seneca Hill Winery that expects to develop new varieties of wines from two varieties of grape trees- Chardonnay and Riesling, but the process takes 4 years to mature for harvesting. Because of the long growth period of the trees, the company runs under the risk of changing market demands that might occur before the trees are ripe for harvesting. From an in-depth analysis, the company has developed probabilities of the market demands for each type of tree product designated “strong demand” and “weak demand”. In addition, the company has done a comprehensive analysis of the possible contributions that each variety of grape variety is likely to produce.

In this case, the analysis indicates that the Chardonnay variety is expected to contribute about $20,000 to the company’s annual profit. On the other hand, the projection shows that Riesling variety is likely to contribute approximately $70,000 to the annual profits. Noteworthy, these contributions are likely to happen if one variety has a strong demand and the other has a weak demand in each case. In addition, the analysis shows that the company can plant both varieties of grape trees at the same time. In this case, the projection indicates that Seneca Winery will obtain profits as indicated below, where the demand for both varieties of wine is considered.

Questions

The issues to be solved are:

What decision should be made, the risks and the consequences of the decision?

What is the logic used to arrive at the question (using decision tree)

What recommendations should be provided to the company? (Using the value approach to determine alternatives)

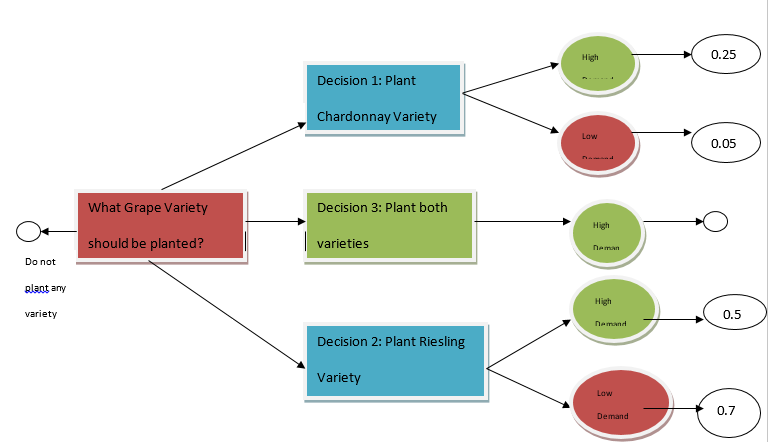

Using a decision tree to define and present the managerial decision problem (see Appendix 1)

Problem formulation

The statement of the decision problem is “to select the type of grape trees that, when planted, will lead to a large profit margin given the uncertainty concerning the demand for the resulting types of wine”

The verbal description of the project;

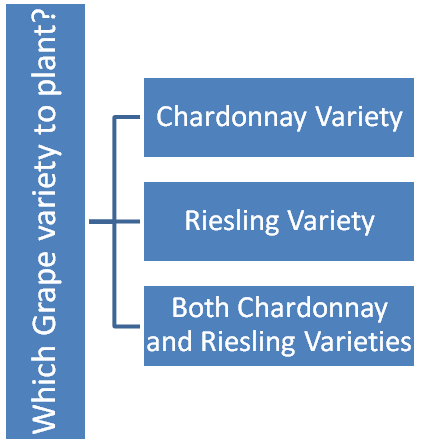

Type of the grape planting project (decision alternative);

- D1= plant Chardonnay variety only

- D2= plant Riesling variety only

- D3= plant both Chardonnay and Riesling varieties

The possible demand for the two kinds of wine (state of nature);

- S1= strong demand for wine

- S2= weak demand for wine

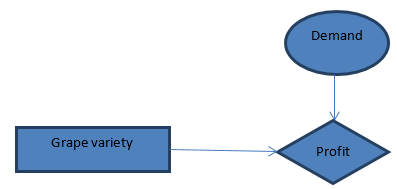

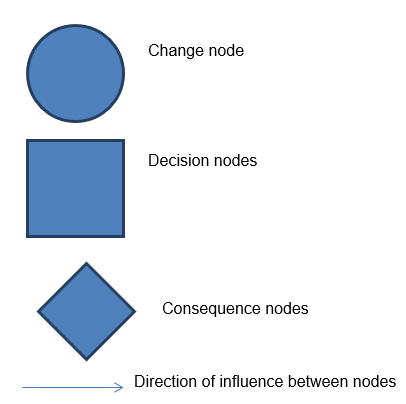

The largest profit states the consequences of making any of the three alternative decisions. To solve the problem, it is necessary to develop an influence diagram that shows the relationships among the decisions, chance events and the consequences for each of the three possible decisions (Taylor, 2010).

S1= strong demand for wine

S2= weak demand for wine Consequence: Profit

D1= plant Chardonnay variety

D2= plant Riesling variety only

D3= plant both Chardonnay and Riesling varieties (see Appendix 2)

To describe how Seneca Winery should make the right decision before starting the tree-planting project for grape wine, it is necessary to develop a decision tree that provides a graphical representation of the decision-making process together with the possible consequences, the alternatives as well as the states of nature likely to occur over time.

Expected value approach

The expected value (EV) approach of a decision is the sum of the weighted payoffs for the alternative decisions (Anderson, Sweeney & Williams, 2012). In this case, the weight for the payoff defines the probability of the state nature and the likelihood of the occurrence of payoff. This approach is defined by the following equation:

(Hillier & Hillier, 2009)

(Hillier & Hillier, 2009)

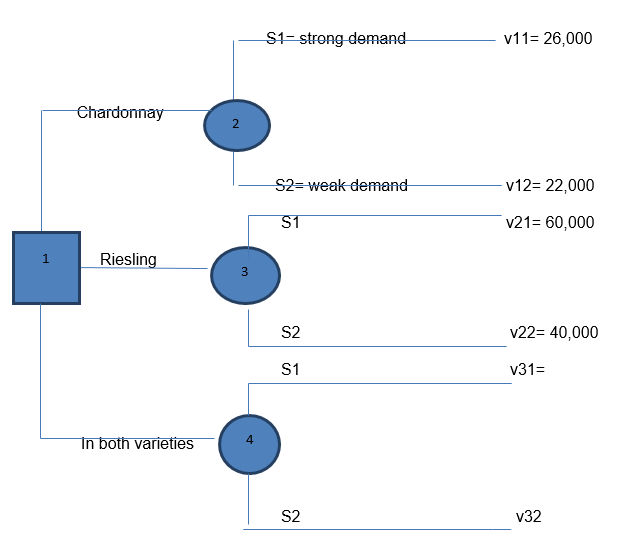

In the case of Seneca Winery, the decision making process using the EV approach is presented by;

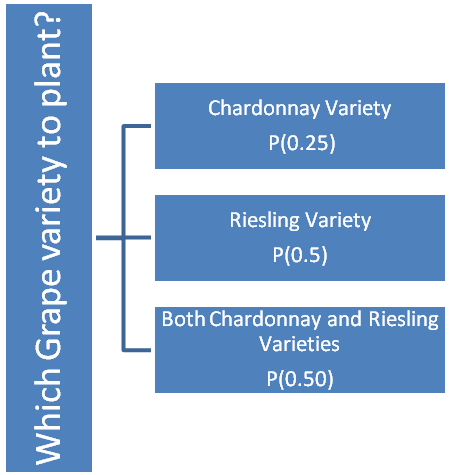

P (S1) = 0.25

P (S2) = 0.5

EV (d1) = 0.25 x 26,000 +0.75x 22,000= 81,500

EV (d2) = 0.25x 60,000+ 0.75x 40,000= 45,000 (see appendix 2)

Thus, the expected profit from the Chardonnay grape variety is 81,000, which differs significantly from the 45,000 profit expected from making wine using the Riesling variety of grape trees.

At this rate, the best decision is to consider Chardonnay as the best grape tree, because the profit is higher than that from the Riesling wine. However, the EV approach shows that the decision to plant both trees at the same time has a return of about 86,000, which differs significantly from the 81,000 expected from plating the Chardonnay grape variety alone.

Thus, the EV approach recommends Seneca Winery Company plant both varieties of trees and start making wine from them when they are ripe, which is about 4 years from the time of planting the trees.

Logics

The decision tree provides a comprehensive analysis of the logical process that the EV approach uses to arrive at the above decision (Papoulis, 2009). First, it is worth noting that the company has only three alternatives. The company can decide to plant the Chardonnay variety alone or has an option of planting the Riesling variety alone. Finally, it has the option of planting both types of trees at the same time. However, making one decision has both strengths and weaknesses. The strength of a decision is to find the market with a strong demand for the type of wine made from the variety of grape the company has planted.

On the other hand, the weakness of a decision, in this case, is to find the demand for the specific wine variety weak, which is likely to comprise the profitability rate. Thus, these weaknesses and strengths of decisions are represented in the probabilistic approach when using the EV method. If the company chooses to plant a Chardonnay variety of grape trees in its premises, it is likely to find strong demand for the specific variety of wine being either high or low. (see Appendix 4)

Conclusion

The probability of finding better profits is provided by the probability of finding the demand for the wine variety high and the demand for the alternative variety being low (Hillier, Hillier, Schmedders & Stephens, 2011). This can be also applied to the Riesling variety, where the probability of making the best profits is equal to the probability of finding high demand for the variety and low demand for the Chardonnay variety.

If each of the results, the profits expected from plating the Chardonnay variety alone is 85,000 while the profit expected from the Riesling alone is about 45,000, judging from the probabilistic approach. Thus, according to the logical approach, the EV approach shows that the best way regarding profitability is to plant both types of trees at the same time.

References

Anderson, D. R., Sweeney, D. J., & Williams, T. A. (2012). An Introduction to Management Science: Quantitative Approaches to Decision Making. Mason, OH: Cengage

Hillier, F. S., & Hillier, M. S. (2009). Introduction to management science: A modeling and case studies approach with spreadsheets. New York: McGraw-Hill, Irwin.

Hillier, S. F., Hillier, M. S., Schmedders, K., & Stephens, M. (2011). Introduction to management science. New York: McGraw-Hill, Irwin.

Papoulis, A. (2009). Probability, Random Variables, and Stochastic Processes. New York: McGraw-Hill.

Taylor, B. W. (2010). Introduction to Management Science, 11/E. New York: Prentice Hall.

Appendix 1

Appendix 2

Appendix 3 Excel representation of decision tree

Appendix 4: Systematic analysis of decision-making using a decision tree