Abstract

One of the biggest issues facing the owners of private companies in construction is exit strategies. For small companies, the most obvious exit strategy might be simply looking to the bigger firms to buy them, but is hoping to sell your company to a bigger player a sound strategy that will guarantee you and your family sufficient income for the future?

Selling can be great if you are in a good market cycle, in an attractive region, and have a strong balance sheet. But what if you want to retire when the construction market is in a down cycle and your valuation doesn’t reflect what you know is the true value of your business?

What if one of your partners dies or is disabled suddenly and there is no buyer for your business at market rates? Would your partner’s shares go to his estate? Do you have the cash on hand to buy out your partner’s spouse or heirs? Could you easily borrow to buy out your partner’s share?

Or worse, what if something happens to you? Would your surviving spouse or heirs have to sell at fire-sale prices to secure their own financial future?

Selling your business is a very personal and complicated decision. But one every business person must eventually face.

When and why must you sell your business?

- Sales and earnings have decreased: if you lack the working capital or management resources to grow, you may need to sell part of a business to gain access to those resources.

- The personal interest of the team that you started with is changing.

- There is a serious partnership dispute so selling the business is the only way of resolving problems.

- You may become more cautious in running the business and over time lose your market share to a more aggressive completion.

- If your venture is five to ten years old and has had substantial growth in sales duration the period and in recent years has achieved an acceptable level S of earnings.

- If your business starting to lose money and you can’t see a way of turning things around you better get out fast to keep your debts to a minimum and get the most for any assets you have left.

- There is a point in your life where you have enough security.

Or worse, what if something happens to you? Would your surviving spouse or heirs have to sell at fire-sale prices to secure their own financial future?

Planning to sell your business

Business should be sold after preparation and not because of sudden personal frustration or short-term downturn in business.

There is a conflict between running a business the way an owner wants and preparing the business for sale.

Planning to sell a business takes 3-5 years in advance. This will give you the time required to make necessary changes in accounting practices that demonstrate a 3-to-5-year track record of maximum profits.

Steps to selling your business

- Valuation – Determine how much the business is worth. Do you really want to sell? Is now the right time? Use commonly accepted methods to set a selling price for your business.

- Prepare the business for sale – Gather financial statements and tax returns, develop recast financials, and generally spruce up the business before putting it up for sale.

- Find potential buyers – Now it’s time to find some interested buyers. How do you determine who are the best buyers? And how can you reach them? Also, important – how can you keep the planned sale secret from competitors, employees, suppliers, and anyone else who shouldn’t know about it?

- Screen potential buyers – If you’ve done step three properly, you have a group of people who have expressed a preliminary interest in buying a business such as yours. Many are sharks, a few are kooks and many are wannabes, a lot of them don’t have enough money to do a deal, a few are competitors and suppliers…and a small number are qualified buyers. It is absolutely critical to qualify potential buyers before giving out any information about your business.

- Provide a selling memorandum to potential buyers – The selling memorandum is an extremely important document. It must combine salesmanship and truth, putting your business in the most positive light. It sets the stage for all future negotiations and plays a major factor in how much you’ll be paid for your business.

- Provide initial follow-up information to buyers – After receiving the selling memorandum, buyers will have follow-up questions. These can be minimized with a well-written selling memorandum, but questions invariably come up.

- Meet with potential buyers – Since this requires effort on your part and the buyer’s part, if you reach this step, it implies a good level of mutual interest. Caution: Just like there are weird people who get a charge out of attending funerals, there are a small handful of people who get some unexplained joy from touring companies for sale. Since preparing for a seller visit takes a great deal of time and planning, make sure visitors are qualified. This is especially true if potential buyers are local. In some cases, it’s advisable to get a letter of intent prior to a visit.

- Letter of intent – A buyer should now have all the information needed to provide a letter of intent. The letter lays out the deal structure including offering price and terms, as well as other important information. Although it is generally not legally binding, an LOI is a written promise to follow through with the deal if due diligence shows all the information you provided to be substantially correct.

- Evaluate letters of intent and select first choice – Now comes the interesting part, where you evaluate the deals in the letters of intent you’ve gathered and put them in the order you wish to deal with them. It is considered unethical to deal with multiple buyers, so you negotiate with only the top buyer (for a limited time) and if that falls through, you move onto buyer number two and so on.

- Due diligence and negotiating with the buyer who is your first choice – Now your number one prospect has the right (for a limited period, no more than 4 to 6 weeks and preferably less) to dig as deep into your business as they need to feel comfortable writing the big check. Intensive scrutiny of financials, physical inventories, and even interviews with key employees may happen here. It’s stressful, but you can survive due diligence.

- Complete the sale – One of the most exciting and nerve-wracking days is closing day. It’s similar to closing on a real estate sale, but usually more complicated. Deals can still fall through at this stage, but with the right professional help, the sale is usually completed.

If you don’t care what happens to your business after you sell it, you will of course sell to the highest bidder and hope for cash in return

Selling business to corporations

Every large company has an acquisitions department that is often interested in buying a business to improve their marketing positions, reduce costs and increase profitability. They are ideal buyers if you can find them, because typically they can give you the most money and fast, either in cash or in exchange for their stock.

If you sell for cash, all the uncertainty of the transaction is removed, but your profits may be taxable immediately. If you take stock in the acquiring firm, it may possible to defer taxes on the gain, sometimes permanently.

The long-term value of the deal will vary depending on the performance of the acquiring company.

Selling to partner

Selling part of all of your ownership to one of your partners is a convenient way of cash in some chips, providing that your partners are interested.

It’s a simple process legally but has the drawback that you may have to take much of your money on an installment plan. And also, tax implications that you will need to look into.

Selling to other investors

If you are one of the active partners in business operation selling all or part of your business to an individual not already associated with your company may be difficult to arrange.

This is because in addition to the financial aspects of the transaction you must find a willing investor who is acceptable to other owners.

Selling to other shareholders

If you have several passive shareholders, as a result of raising capital through a private sale of stock you may be able to arrange to sell them the rest of your shares without any problems from other shareholders.

The share is restricted and there is no negotiation to their advantage.

Selling to the Bank for Loans

Along with financial documents, you can support your need for a bank loan by using your updated business plan to sell the success of the business and the need for new equipment or expansion.

Selling to Outside Talent

A strong, well-written business plan can entice top-level talent to come aboard. By selling your business ideas and a profitable long-range plan, you can attract talented people who may be more inclined to stay for the long haul, rather than join a company not knowing what to expect and leave at the slightest downturn.

1.3.6 Selling to the public

It’s a way to liquidate some of your assets. most financial experts advise new companies not to go public too soon.

You need pre-tax profits of at least 100,000$ and net sales of one to two million.

The advantage of this way is that the result having at least several hundred small shareholders rather than a handful of very large ones. As long as you are the largest shareholder you are likely to retain control of the company.

You can get a higher price – and also you can increase the liquidity of your founding and public shares.

The company become more visible and credible

The future selling price will escalate.

Increase legal printing and accounting fees.

Factors must be considered when a decision was taken

- consider selling the first offering of stock below value to build company momentum by selling your stocks below market value, it’s worth will rise rapidly building confidence in your company. In the next offering, you can then ask for a higher price. again people will likely jump upon your bandwagon driving your stocks up higher.

- Don’t create misleading prospectuses: many companies who write misleading prospectuses before going public are being successfully sued for large sums by groups of their initial investors. The reason for these lawsuits is that the stock price dropped substantially a short time after the offering because of a downturn in business. The lawsuits claimed, and may well be right, that the companies should have known trouble was brewing and failed to disclose the news in its prospectus offering circular at the time the stock was first sold.

- Seek security and tax lawyer’s experts: before going public you must seek counsel from experienced securities and tax lawyers. securities laws are complex especially regarding the sale of stock by officers, directors, or principal owners of a business. they change from time to time and at best are confusing and hard to interpret and understand.

How to determine the value of your business

The valuation of a business can help to eliminate guesswork and the painful trial and error method of pricing that so many owners rely on.

They arbitrarily decide on an excessive price for the business and then go to the expense and efforts of developing prospective buyers, only to be unable to strike a deal.

It is only after gradually lowering the price and repeating this folly several times that they learn what their business is really worth.

Balance Sheet

Accounts Receivable

- Obtain accounts receivable aging schedule and determine if there is a concentration among a few accounts.

- Determine the reasons for all overdue accounts.

- Find out if any amounts are in dispute.

- Are any of the accounts pledged as collateral?

- Is the reserve for bad debt sufficient and how was it established?

Adjusted book value

This value is calculated by adjusting the asset’s book value to equal the cost of replacing that asset in its current condition. To arrive at the adjusted book value, the total of the adjusted asset values is then offset against the sum of liabilities.

Adjusted book value is considered the most useful balance sheet method of valuation

Book value

Calculating by taking the figures from the company record books as depreciated at the time of sale or amortized according to generally accepted accounting principles or current tax legislation.

Liquidation value

This value is the amount that could be realized if all your assets such as inventory, equipment, and furnishing, were sold separately.

This value is usually much lower than your companies intrinsic value.

Inventory

- Make sure the inventory is determined by physical count and divided by finished goods, work in progress, and raw materials.

- Assess the method of valuation and why it was used. (LIFO, FIFO, etc.).

- Determine the age and condition of the inventory.

- How is damaged or obsolete inventory valued?

- Is the amount of inventory sufficient to operate efficiently and for how long?

Marketable Securities

- Obtain a list of marketable securities.

- How are the securities valued?

- Determine the fair market value of the securities.

- Are any securities restricted or pledged?

- Should the portfolio be sold or exchanged?

Real Estate

- Obtain a schedule of real estate owned.

- Determine the condition and age of the real estate.

- Establish the fair market value of each of the buildings and land.

- Should appraisals be obtained?

- Are repairs or improvements required?

- Are maintenance costs reasonable?

- Do any of the principals have a financial interest in the company(s) that perform(s) the maintenance?

- Is the real estate required to operate the business efficiently?

- How is the real estate financed?

- Are the mortgages assumable?

- Will additional real estate be required in the near future?

- Is the real estate adequately insured?

Machinery and Equipment

- Obtain a schedule of machinery and equipment owned and leased.

- Determine the condition and age of the machinery and equipment and the frequency of maintenance.

- Identify the equipment and machinery that is state-of-the-art.

- Identify the machinery and equipment that is obsolete.

- Should an appraisal be obtained?

- Will immediate repairs be required and at what cost?

Accounts Payable

- Obtain a schedule of accounts payable and determine if there is a concentration among a few accounts.

- Determine the age of the amounts due.

- Identify all amounts in dispute and determine the reason.

- Review transactions to determine undisclosed and contingent liabilities.

Accrued Liabilities

- Obtain a schedule of accrued liabilities.

- Determine the accounting treatment of:

- unpaid wages at the end of the period

- accrued vacation pay

- accrued sick leave

- payroll taxes due and payable

- accrued income taxes

- other accruals

- Search for unrecorded accrued liabilities

Notes Payable and Mortgages Payable

- Obtain a schedule of notes payable and mortgages payable.

- Identify the reason for indebtedness.

- Determine terms and payment schedule.

- Will the acquisition accelerate the note or mortgage or is there a prepayment penalty?

- Determine if there are any balloon payments to be made and the amounts and dates due.

The factors that can affect the business worth

The value of a business is determined by its sales, net worth earnings, and fair market value.

Determining the value of a business can be very difficult if its worth depends on intangible assets such as goodwill company image. the value of your business will also be subject to the skill as a negotiator -giving on some point physiology and how anxious your buyer feels you are to get out.

Condition of the company

The general condition of your facilities, equipment, and completeness, and accuracy of your books and records have a bearing on its market value.

Economic conditions

The economic climate in your area m especially the cost and availability of financing can directly affect the value of your business.

Fair market value

This is the value of the business that buyers and sellers trade similar businesses in an open marketplace, adjusted for specific or local differentials. It’s upon the amount that could be realized if your business entity were sold as a whole and not in parts.

Determining this value often involves researching and comparing similar businesses in your area.

Future profit potential

If your type of business is on the verge of a market explosion, or at the least on the verge of taping into a new market with a new product or service m your asking price can be higher.

Goodwill value

This value is difficult to calculate and is based on what your business has accomplished m where is it going and how fast did it take to get there.

Goodwill value can range from nothing to millions.

Income statement value

This method of valuation is most concerned with recent profits or cash flow produced by the business’s assets.

Intrinsic value

This value is based on having the right combination of company assets m earnings m assured prospects, management.

Businesses with high intrinsic value can readily be expanded to a very large size, by timely infusion of additional management by access to national media or to national markets or by any combination of these.

Market demand

If the particular type of business is the latest fad, and as soon as it goes up for sale ten people are knocking on your door then, obviously, your asking price can be higher.

Opportunity Cost

The buyers will look at what is known as its opportunity cost. That means – the rate of return on their investment.

Special circumstances of seller or buyer

The more anxious or desperate for sell the more cautious will be and the lower your asking price.

If you sense a buyer is anxious to buy although you may have difficulty raising your asking price m you might be able to negotiate more favorable terms.

Calculating the value of your business

There are a lot of methods to calculate the value of a business

Using the rule of thumb formulas

Calculated as a percentage of either sales or asset values or a combination of both. The rule of using rule-of-thumb formulas for pricing a business.

Business values

- apparel shops and retail stores

- 0.75 to 1.5 times net+ equipment +inventory.

- beauty salons

- 0.25 to 0.75 times gross + equipment+ inventory.

- grocery stores/supermarket

- 0.25 to 0.33 times gross including equipment.

- personal agency

- 0.75 to 1 time gross.

- restaurants

- 0.25 to 0.5 times gross including equipment.

- travel agencies

- 0.04 to 0.10 times gross.

The problem with this formula is that rely too much on a one – size fits all approach, no two businesses are identical. They address only a few of the factors that affect a business’s value.

Using adjusted book value method

This method is useful when a business generates earnings primarily from its assets rather than contributions from its employees or when the cost of starting a similar business and get revenues past the break-even point doesn’t greatly exceed the value of business assets. using this method is adjusted to equal the cost of replacing those assets in their current condition. the total of the adjusted assets values is then offset against factors such as:

- Account receivable: adjust down to reflect the lack of collectability of some accounts.

- Inventory: usually adjusted down since it may be difficult to sell off all of the inventory at cost.

- Furniture, fixture, and equipment: adjust down if the items have become obsolete. Adjust up if those items in service have been deprecated below their market value.

- Real estate: adjusted up or down depending on whether the value of the real estate has increased or decreased since it was purchased.

Using the income statement method valuation

Although the adjusted book value method is sometimes the most accurate means to value a business, it is more common to use an income statement.

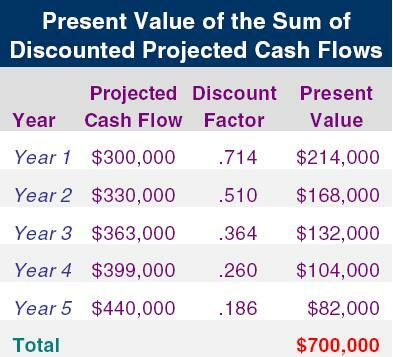

One of the more frequently used methods is the discounted future cash flow method.

We won’t split hairs here, even though there are some differences between cash flow and earnings the philosophy is the same. The price is based on the company’s ability to generate a stream of profit (which can be defined in different ways) or cash flow (sales fewer expenses). The seller then projects this stream of cash over five or more years to calculate the worth of the business. Often, discounted future earnings are used which takes into account the time value of money – cash received in year five is discounted based on projected interest rates.

In this method, disagreements can occur regarding the calculation of cash flow and estimated sales projections. Many cash flow and EBITA (earnings before interest, taxes, and amortization) projections use “recast” numbers to reflect the effect on profits of perks that a business owner takes from the business. This recasting is extremely important and is discussed in a separate article directly below this one.

This method calls for future cash flows of business before taxes and debt service to be calculated using formula

Project cash flows for the next three to five years: we can compute it as

- project the net profit or loss of the business using a historical cash flow basis for this projection.

- Add the owner’s salary in excess of an equivalent manager’s compensation.

- Add discretionary benefits paid to the owner.

- Add interest unless the buyer will be assuming the interest payment.

- Add non-cash expenses such as non-recurring legal fees.

- Add non-cash expenses such as deprecation and amortization.

- Subtract equipment replacements or additions.

Example for cash flow projected to be 300,000$ per year with a 10% yearly increased

Cash flows can be classified into

Operational cash flows: Cash received or expended as a result of the company’s core business activities.

cash flow provided by operations or cash flow from operating activities refers to the amount of cash a company generates from the revenues it brings in, excluding costs associated with long-term investment on capital items or investment in securities.

Operating cash flow = Cash generated from operations less taxation and interest paid, investment income received and fewer dividends paid gives rise to operating cash flows per International Financial Reporting Standards.

To calculate cash generated from operations, one must calculate cash generated from customers and cash paid to suppliers. The difference between the two reflects cash generated from operations:

Cash generated from customers

- revenue as reported.

- increase (decrease) in trade receivables.

- investment income (disclosed separately).

- other income that is noncash and nonsales related.

Cash paid to suppliers

- costs of sales

- other expenses as reported less

- increase (decrease) in trade payables

- noncash items such as depreciation, provisioning, impairments, bad debts.

- financing expenses

Investment cash flows: Cash received or expended through capital expenditure, investments, or acquisitions.

Financing cash flows: Cash received or expended as a result of financial activities, such as receiving or paying loans, issuing or repurchasing stock, and paying dividends. All three together are necessary to reconcile the beginning cash balance to the ending cash balance.

Benefits from using cash flow

The cash flow statement is one of the four main financial statements of a company. The cash flow statement can be examined to determine the short-term sustainability of a company. If cash is increasing (and operational cash flow is positive), then a company will often be deemed to be healthy in the short term. Increasing or stable cash balances suggest that a company can meet its cash needs, and remain solvent. This information cannot always be seen in the income statement or the balance sheet of a company. For instance, a company may be generating profit, but still have difficulty in remaining solvent.

The cash flow statement breaks the sources of cash generation into three sections: operational cash flows, investing, and financing. This breakdown allows the user of financial statements to determine where the company is deriving its cash for operations. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Companies that have announced significant writedowns of assets, particularly goodwill, may have substantially higher cash flows than the announced earnings would indicate. For example, telecoms firms that paid substantial sums for 3G licenses or acquisitions have subsequently had to write-off goodwill, that is, indicate that these investments were now worth much less. These write-downs have frequently resulted in large announced annual losses, such as Vodafone’s announcement in May 2006 that it had lost £21.9 billion due to a writedown of its German acquisition, Mannesmann, one of the largest annual losses in European history.

Despite this large “loss”, which represented a sunk cost, Vodafone’s operating cash flows were solid: “Strong cash flow is one of the most attractive aspects of the cellphone business, allowing operators like Vodafone to return money to shareholders even as they rack up huge paper losses.

In certain cases, cash flow statements may allow careful analysts to detect problems that would not be evident from the other financial statements alone. For example, WorldCom committed an accounting fraud that was discovered in 2002; the fraud consisted primarily of treating ongoing expenses as capital investments, thereby fraudulently boosting net income. The use of one measure of cash flow (free cash flow) would potentially have detected that there was no change in overall cash flow (including capital investments).

When analysts and the media refer to ‘cash flow’, they are most likely referring to “Operating Cash Flow”. This is only one of the three types of cash flows. There are inherent problems in isolating only this type of flow because businesses can easily manipulate the classification.

Common methods of distorting the results include

- Sales – Sell the receivables to a factor for instant cash. (leading)

- Inventory – Don’t pay your suppliers for an additional few weeks at period end. (lagging)

- Sales Commissions – Management can form a separate (but unrelated) company act as its agent. The book of business can then be purchased quarterly as an investment.

- Wages – Remunerate with stock options.

- Maintenance – Contract with the predecessor company that you prepay five years worth for them to continue doing the work

- Equipment Leases – Buy it

- Rent – Buy the property (sale and leaseback, for example).

- Oil Exploration costs – Replace reserves by buying another company.

- Research & Development – Wait for the product to be proven by a start-up lab; then buy the lab.

- Consulting Fees – Pay in shares from treasury since usually to related parties

- Interest – Issue convertible debt where the conversion rate changes with the unpaid interest.

Taxes – Buy shelf companies with TaxLossCarryForward’s. Or gussy up the purchase by buying a lab or O&G explore co. with the same TLCF.

Example of a positive £40 cash flow

In this example the following types of flows are included:

- Incoming loan: financial flow.

- Sales: operational flow.

- Materials: operational flow.

- Labor: operational flow.

- Purchased Capital: Investment flow.

- Loan Repayment: financial flow.

- Taxes: financial flow.

Let us, for example, compare two companies using only total cash flow and then separate cash flow streams. The last three years show the following total cash flows:

Company A

- Year 1: cash flow of +10M

- Year 2: cash flow of +11M

- Year 3: cash flow of +12M

Company B

- Year 1: cash flow of +15M

- Year 2: cash flow of +16M

- Year 3: cash flow of +17M

Company B has a higher yearly cash flow and looks like a better one in which to invest. Now let us see how their cash flows are made up:

Company A

- Year 1: OC: +20M FC: +5M IC: -15M = +10M

- Year 2: OC: +21M FC: +5M IC: -15M = +11M

- Year 3: OC: +22M FC: +5M IC: -15M = +12M

Company B

- Year 1: OC: +10M FC: +5M IC: 0 = +15M

- Year 2: OC: +11M FC: +5M IC: 0 = +16M

- Year 3: OC: +12M FC: +5M IC: 0 = +17M

OC = Operational Cash, FC = Financial Cash, IC = Investment Cash

Now it seems that Company A is actually earning more cash by its core activities and has already spent 45M in long term investments, of which the revenues will only show up after three years. When comparing investments using cash flows always make sure to use the same cash flow layout.

Examples of Positive factors (that raise multipliers) include

Proprietary products, with a strong brand and/or patent or trademark.

Diversified customer base – no one customer more than 10% of sales.

Strong management team with few key personnel.

Weak competitors and a healthy market share for your company.

Products that are early in the Product Life Cycle.

Diversified products – no one product more than 15-20% of sales.

The ability of the company to meet some growth with current plant and equipment.

No pending legal or government action.

Financial ratios that are near or above industry averages.

Examples of Negative factors (that lower multipliers) include

“Me-too” products that are just like competitors.

One or a few customers make up more than 25-30% of sales.

Strong competitors and a weak or declining market share for your company.

Products that are near the end of the Product Life Cycle.

One product makes up more than 20% of sales.

Major investment needed soon in plant and equipment.

Pending legal or government action.

Financial ratios that are below industry averages.

Recasting

This means adjusting past financial statements to better reflect true cash flow. you should plainly label recast financials as such. And you’ll still be providing non-recast financials to the buyer.

You’re a small business owner. Chances are you’ll be selling your company to someone who has also been a small business owner. All small business owners play the “perk game.” Any personal expense the owner can legitimately hand off to the business to reduce taxes is fair in the perk game. The perk game reduces taxes but the profit and loss statement usually takes a beating.

Now that you want to sell your business, it’s time to own up and tell the buyer what you’ve taken out of the business and to what extent it has reduced income-taxable profit. They won’t think less of you, because they’ve done it too. You should also admit to inefficiencies that you’ve let slide because the new owner is much, much smarter than you (at least that’s what they think) and will do a better job than you could ever do to boost sales and profit (at least that’s what they think).

Formula for recasting starting with your last three years of regular financials

- Deduct from expenses the owner’s salary, bonus, and all other direct payments to the owner(s). Then add a reasonable salary for a manager to take your place. Be realistic here!

- Deduct from expenses all non-direct owner expenses – retirement or profit-sharing plan contributions, automobile lease or payment, auto insurance, and all other perks the owner receives.

- Adjust for any leasebacks or other arrangements (cars, real estate, etc.) your company has with you or family members.

- Deduct any surplus staffing. Are you carrying anyone on the payroll that could be eliminated by the new owner?

- Cut out all extraordinary items – legal fees for a lawsuit that has already been settled, the accounting fees for updating your records to prepare the business for sale, extraordinary bad debt that was due to one bad customer in one year, extraordinary product development costs, large equipment purchases that were expensed up to the legal limit.

Discount cash flow back to their present value

This is done by selecting a reasonable rate of return for buyers’ investment.

The selected rate of return varies substantially from one business to the next and is largely a function of risk.

The lower the risk associated with an investment in a business, the lower the rate of return that is required.

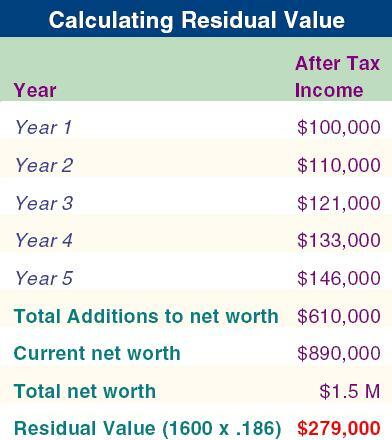

Calculate the residual value of the business

The residual value is the present value of the business’s estimated net worth at the end of the period of projected cash flow.

The residual value is added to the present value of the sum of discounted projected cash flows

Example how to calculate residual value

How to get the highest price for your business

Getting your company ready to sell means sprucing up operations as well as making sure your financial statements, budgets, and business plans are ready to be scrutinized by potential buyers. Although this preparation is time-consuming, many business owners find that preparing the business for sale improves management practices and greatly increases the value of the company. And should a great offer come through soon after the business is put on the market, the preparation will put you in a better position to close a deal quickly.

To understand what’s necessary to get the business ready for sale, we must first look at what information buyers want to see.

There are two basic types of buyers, financial and strategic. Financial buyers look for businesses they can buy in which they can finance 50% to 75% of the price, and that have sufficient cash flow to repay that debt. With few exceptions, they value a business by using a multiple of three to six times earnings before interest and taxes (after making adjustments for expenses that would not continue for a new owner – they rely on what are called “recast” financial data, which is discussed in an article in the Valuation section).

They deduct from the price any interest-bearing debt that they will assume. In terms of preparation, there are disadvantages to selling to a financial buyer: since financial buyers don’t care about synergies or other intangibles, they tend to scrutinize financials to the max. Because they typically borrow money for a significant part of the purchase price, they are under pressure to increase the cash flow.

Strategic buyers expect synergies with their other businesses (in other words, they think it is a great fit with the other parts of their business). On one hand, they sometimes are willing to pay a premium but on the other hand, they may not need to because they already know the market. This also makes them trickier to deal with, because they could be able to use confidential information that you provide to compete against you. The ideal strategic buyer is not a direct competitor. If you would like to remain involved after the sale, be aware that strategic buyers may have plans for the company that differ greatly from yours.

In most cases, the business needs to be prepared for both types of buyers, unless it is being marketed on a very limited basis to a short, hand-picked list of potential strategic buyers or sold aggressively to financial buyers only.

Financial statements

Financial statements are the best indicator of the future performance of the business. Since the buyer will be relying heavily on the statements, one of the first questions they will ask is whether you have audited financial statements.

Audited statements are where a CPA firm verifies much of the financial information – they might be closely involved in taking a physical inventory, or they will carefully trace supporting invoices and checks rather than relying on the business owner’s General Ledger. Audited statements are reassuring to a buyer – and to the bankers who are financing a purchase – but they are very costly to prepare. The accounting firm may end up getting sued for providing incorrect information in audited statements, so they charge an arm and a leg. Generally speaking, most small businesses don’t require audited statements to operate and a buyer who insists on them is being unreasonable. If you don’t have audited statements, ask the insistent buyer if they would be willing to pay to have them done – that usually puts an end to the issue.

The advantage of audited statements is that they may strengthen your hand in the negotiations and allow you to demand better terms since the financial information is considered very trustworthy. But in most cases, financials compiled or reviewed by a reputable accounting firm are adequate.

In any event, make sure some kind of formal financial statements are available for at least the past three years, and even better, for five years. Tax returns for the same years should also be available since they support (at least they should – the buyer will check this!) the data on the financial statements. Review the financials in detail and be ready to answer questions about sales, profits, expenses depreciation, inventory valuation, and every other aspect of the financials. Also, buyers like to see data showing gross profit (and return on assets) by activity or product line, so be sure that financial data is broken out in this way.

Management and personnel

A business that is excessively dependent on the owner and/or key employees increases risk in the eyes of a prospective buyer. Appointing a second-in-command and department managers enhances a company’s value by alleviating that risk. For key employees, it is possible to establish a bonus program that rewards the key employee for staying with the new owner for some period, for instance, a bonus of $5,000 or $10,000 at the end of one or two years. Carefully outline your role in the business and be ready to explain how it will run smoothly and profitably without you.

Eliminate weak areas

Focus on the strengths of your business. For example, a buyer will discount inventory carried for weak product lines – chances are you’ll receive less than full value, so it’s often better to eliminate the product line if it is weak or not profitable. Buyers don’t favor diversified businesses; they want to see assets concentrated in your strongest activities. Are there other assets in the business (such as land) that are not contributing to earning power? Your price will probably be higher if you improve your overall financial ratios and sell those assets before preparing financials for prospective buyers.

If your company carries inventory, update it by weeding out obsolete and outdated items. If buyers start questioning the value of some inventory items, they often overreact and discount the entire inventory unfairly.

Real estate is an important asset, and who owns it should be considered. In some cases, it is advantageous for the seller (or another corporation owned by the seller) to own the real estate. For example, let’s say the business is a manufacturing concern that the buyer plans on relocating. The real estate won’t be worth much to the buyer and will likely be discounted in the price, so if you keep it you will have a significant asset that the buyer didn’t want anyway.

Maybe it isn’t time yet

Take a hard look at the financial statements and compare the numbers to what you expect (or require, or desire) to be paid for the business. If the financials and your expectations don’t match, one or the other needs to be adjusted. I was once involved with a fast-growing business in which the owners wanted at least $1 million, but annual sales were less than one-half that. The owners felt that the growth was a “sure thing,” but potential buyers wouldn’t have paid anywhere near the asking price. The owners waited 18 months, and as they expected, sales more than doubled. They marketed the business using the Business Sale Center System and sold it for well over $1 million. It may take several months (or even a year or two) to whip the business into selling shape to get the maximum price.

Prepare a selling memorandum

A “selling memorandum” is a booklet (or book in some cases) that describes the company for sale and contains the information needed for a buyer to determine whether they are interested or not in pursuing a purchase. If the buyer is interested, they will then ask for more detailed information.

The selling memorandum is extremely important – it must be a seamless combination of salesmanship and utter truthfulness. See the article on “How to prepare a selling memorandum” on the Qualifying Buyers page. Many brokers and business advisors prepare the selling memorandum (sometimes called “selling book”) but we advise that the owner play a major role in preparing it.

Projections and business plan

Financial projections and business plans are of primary interest to buyers, but small business owners rarely are comfortable in preparing them. Their business plans and projections are often less formal than buyers would like to see. Although many small business owners don’t like making projections, a business plan reflects well on a company’s management and provides comfort for the buyer.

Curb appeal is important

How does your business look to an outsider pulling into the parking lot and walking in the door for the first time? Many sellers (especially of businesses that don’t routinely have customers come to their place of business) are so busy with daily operations that they forget about “curb appeal.” But this first impression can turn off (or turn on) buyers when they visit for the first time and add or detract value from the business. Spruce up the business – clean, paint, reorganize – anything that will make it more appealing to visitors. A neat, clean, organized place of business tells buyers the company is well run.

Respect the buyer

As you prepare your business for sale and assemble the information that you will be showing to buyers, remember this fact: You will NOT fool a savvy buyer. If you are less than forthright in your initial information, and the buyer becomes interested and looks deeper, they will uncover the truth, your credibility will be destroyed and you will lose a buyer. Think of it this way – to afford your asking price and payment terms, a person will need to have some serious cash, and people with serious cash tend to be pretty sharp. You can certainly dream about it, but don’t count on having the dim-witted nephew of a rich, recently deceased uncle as your business buyer

A delay in the decision-making process causes the worst exit conditions which result in going bankrupt or selling the company at an unexpectedly low price.

Preparing a presentation package

After you have decided to sell your business, there are three important preparations:

- put together a business presentation package.

- Gain insights into how your business will be perceived and evaluated by potential buyers to prepare for and influence their conclusion.

- Anticipate and prepare for the multitude of questions they might have.

How to prepare a presentation package

When looking at a business for sale, buyers generally start by reviewing the business’s history and the way it operates.

They also ask for information on how the business was started, how its goals may have changed since its inception, and what past events occurred to shape its current form. they also seek to understand the business’s present methods of acquiring and serving its customers and how the function of sales, marketing, finance interrelate.

The package must include:

- history of your business.

- Description of how your business operates.

- Description of your facilities.

- Discussion of your suppliers.

- Review of marketing practices.

- Description of your competition.

- Review of personal including an organizational chart m description of job responsibilities, rates of pay, and willingness of key employees to stay on after the sale.

- Identification of all owners.

- Explanation of insurance coverages.

- Discussion of any pending legal matters or contingent liabilities.

- Compendium of 3 to 5 years financial statements.

- Valuation report that clearly states how you arrived at your asking price.

The second step in preparing a business for sale is understanding how buyers will evaluate your business. and the questions may be asked by buyers like leasing costs, equipment age, does the business have negative cash flow? and why?…

How to find buyers for your business

Print Advertising

Business opportunity classified ads are a viable way to advertise a business for sale. Many ads are placed by intermediaries (business brokers or merger and acquisition specialists), but some are placed directly by business owners. The larger local newspapers are the best source of such ads for smaller, privately-held businesses. Sundays are generally the most popular days for these ads.

Business opportunity ads, whether for small or large businesses, usually describe the business in several short phrases, keeping its identity anonymous, and list a phone number to call or post office box for the reply. The ad should be worded to demonstrate the business’s best qualities, (both financial and non-financial) and many of them include a qualifying statement describing the kind of cash investment or experience required. A telephone number in the ad will draw more responses than a post office box number but may not permit the anonymity of a post office box.

Trade Sources

Trade sources can be a viable source of information on businesses for sale. Key people within an industry or in companies on the periphery of the industry, such as suppliers, often know when businesses come up for sale and may be aware of potential buyers. Every industry has a trade association and trade association publications can do a good job of communicating the sale of a business in their industry. If a seller thinks a buyer is likely to come from the same industry, the trade association’s publications department should be contacted to see if classified advertising is permitted.

Intermediaries

Business opportunity intermediaries generally can be divided into two groups,1) business brokers and 2) merger and acquisition specialists. The differences between these two groups are subtle, but in general, business brokers primarily handle the smaller businesses, and merger and acquisition specialists handle the larger middle-market companies. Both groups usually ask for a contract with a 180 day or more exclusive right to sell the business.

Business brokers charge a fee usually as a percent of the purchase price. Merger and acquisition specialists also charge fees, although often the fee is well under 10% since the transactions they work on are much larger. Often, a good merger and acquisition specialist receives a portion of the fee in advance, paid as either a flat fee or an hourly fee. In exchange, the intermediary performs some tangible service such as preparing a presentation package for prospective buyers and a valuation report. Although it is sometimes paid by the buyer, it is more common for the seller to pay the intermediary’s fee.

An experienced intermediary can offer assistance in

- pricing the business.

- setting the terms.

- compiling a comprehensive presentation package.

- professionally marketing the business.

- screening potential buyers.

- negotiating and evaluating offers.

- making certain that proper legal steps are taken.

The result can be a considerable saving of the business owner’s or business buyer’s time and effort.

Structuring transaction

The sale of a business can be structured in either of two formats:

- The purchase of the assets of the seller’s business.

- The purchase of the stock of the seller’s corporation.

Assets transaction

all assets of the business as specified in the contract m expect for cash and accounts receivable and non of the liabilities of the business, are transferred to the buyer. The buyer purchases all of the business’s equipment, furniture, and trade names goodwill and other intangible assets and s responsible for none of its liabilities.

It’s up to the seller to use the proceeds from the sale to liquidate all short-term and long-term liabilities such as federal and state income taxes and legal actions. The seller must also pay taxes on the difference between his basis in the assets and the price paid by the buyer for the business.

Stock transaction

Generally, call for all of the assets and liabilities of the seller’s corporation to be transferred to the buyer.

The buyer and seller may choose to exclude certain assets or liabilities from being conveyed. The seller must pay taxes on the difference between the seller’s basis, the stock, and the price paid by the buyer for the stock.

How the purchase will be paid?

It is rare for a privately held business to change hands for an all-cash price.

Installment sales

provide for the seller to receive some cash, but the bulk of the purchase price to be owner financed. for small privately held businesses, the down payment often ranges from 10% to 40 % of the selling price and the buyer executes a promissory note for the balance.

Leveraged Buyouts

Uses the assets of a business to colorize a loan to buy the business. the difference is that the buyer in a leveraged buyout typically invests little or no money, and the loan is obtained from a lending institution.

Earn outs

It is a method for paying to a business that helps bridge the gap between the position of the buyer and seller with respect to price. it’s can be calculated as a percentage of sales, gross profit, net profit.

Earnouts don’t preclude the payment of a portion of the purchase price in cash or installment notes.

Stock exchange

In some instances, a business owner may want to accept the stock of a purchasing corporation in payment for a business.

The stock receives may not be resold for two years. If the stock may not be freely traded. It is not as valuable as freely traded stock, and its value should be discounted to allow for this lack of marketability.

The advantage of this transaction is that taxes incurred by sellers on the gain from the sale of the business are deferred until the acquired stock is eventually sold.

It’s termed a tax-free exchange by the IRS.

Negotiate the transaction

Terms: Price is just one aspect of the transaction to be negotiated. terms are just as important, particularly the period over which the debt is to be repaid and that allocation for tax purposes of the purchase price.

The role of advisors

A variety of resources are available for those buyers and sellers wanting to obtain professional advice. these resources include business owners in the industry.

More serious business valuation experts, accountants, and attorneys may play more important roles.

Business valuation experts

Can independently appraise a business’s value. They rely on the representation of the seller. they render a conditional opinion based on the assumption that the financial statements are accurate and complete.

Accountants

Accountants are best used to perform an audit, help interpret the financial statement, or provide advice in structuring the transaction to minimize tax consequences for buyer and seller.

Attorneys

Probably the most often consulted advisor in the purchase or sale of a business is an attorney. Attorneys are asked to do everything from assessing the viability of a business and appraising its value to negotiating the purchase price and preparing necessary documents.

The primary function of attorneys is to prepare the purchase and sale documents as negotiated by the parties. it should include reasonable and balanced protections for both parties.

Finally, the seller must write the selling contract and close the sale.

The seller must:

- meet all the conditions of the sale.

- hire an attorney or an escrow to handle the settlement.

- make sure all the necessary documents are included and failed.

- Take into account any contingent liabilities.

Examples of sold business

Midwest Building Supply Company

Frank Hill had owned Midwest Building Supply Company through times both thick and thin. The company, based in a Midwest city of about 75,000 people, had prospered during building booms and suffered during downtimes. To minimize the peaks and valleys, Frank had diversified into the distribution of some construction tool lines, but even with diversification, the latest down period had been particularly difficult. The company was $400,000 in debt and, even worse, Frank had reliable information that a national building supply chain was seriously considering opening a store in his city.

Frank resisted the idea of selling – he was 55 years old and had three kids in college. He couldn’t afford to retire and his employment options weren’t very attractive. On the other hand, given the company’s near-desperate financial position and the impending new competition, he took the first step toward selling.

Hill got the name of the regional sales manager for the national chain from a sales rep and made a phone call. He was low-key, saying that he had heard about the chain’s interest in his market, and added, “My business is not on the open market – I’m not trying to sell – but if I were offered the right price, I would be open to discuss a sale.” The regional manager scheduled a visit, adding he’d need to clear it with the company president before they met. That told Frank that the company president was the real decision-maker and he should not lay all his cards on the table at that first meeting.

The first meeting was casual. Frank chatted about the industry and encouraged the company to check his background, but didn’t hand over specific financial information, especially about his store’s debt. The meeting ended well and Frank waited…and waited…and waited. Six weeks later, he heard from a sales rep that the chain thought he had lost interest in selling. Frank immediately called the company and re-opened discussions. The chain’s president scheduled a visit and said he was bringing his VP of Finance for serious negotiations.

With the help of his attorney and accountant, Frank assembled his financial information and planned a strategy. When the president arrived, the parties met at Frank’s attorney’s office. The president outlined the needs of the chain – they were only interested in assets and would not pay for goodwill or intangibles. Frank agreed to these general terms, then outlined his general needs, stating he would like to retain his tool line distributorship assets – this would be his new employment and also allow him to retain two salesmen who had been with him for years. Since the chain had little interest in distributorship, there were no problems with this arrangement.

The big stumbling block was the valuation of the assets. Frank had to bite his tongue when the chain offered less than 50% of the purchase price on almost-new forklifts, racks, and other equipment. “I had bought top-of-the-line on everything and maintained the equipment extremely well. It was like new,” he said later, “I really had to struggle to keep from taking their low offer personally.”

Frank did not accept the first offer – despite his advisor’s stern warnings that he might be blowing the deal. The chain offered $450,000 for the building and inventory, which Frank accepted. But he said the $90,000 offer for the equipment was too low, calmly pointing out that the quality and condition were excellent. After several tense minutes, the chain raised the equipment offer to $150,000, lower than the $220,000 that Frank wanted, but still acceptable.

Since it was an asset sale, Frank was also able to negotiate to keep some office furniture and equipment that the chain wasn’t willing to pay fair value for, as well as some land that Frank’s company had owned. The parties shook hands, the lawyers hammered out the details over the next three weeks, and the deal closed. Frank paid off his $400,000 debt and walked away with $200,000 in cash, land worth $70,000, and a job in the distributorship he still owned. He had done his best in a desperate situation.

Eastcraft, Inc.

Michael East was the second-generation owner of Eastcraft, a maker of small gift items sold in luggage stores and department stores. Michael’s mother, Theresa, started Eastcraft, and the company provided a comfortable (but not luxurious) living for the family as Michael grew up and attended college.

Michael joined the company after earning a business degree, and his joining the firm allowed Theresa to spend more time selling. Sales increased over the next 10 years from $1.5 million to about $5 million. Then the unthinkable happened – Theresa was diagnosed with a terminal illness and passed away a few months later. Michael had little direct sales experience but knew enough to run the company, and fortunately, the customer base was strong.

Although the five years following his mother’s death were extremely busy as Michael worked hard to keep the business on a successful track, he often pondered life as a small business owner. Theresa had worked 60+ hours a week for the 35 years she owned Eastcraft and passed away before she could sit back and enjoy the fruits of her labors. He feared the same thing would happen to him. At the age of 42, Michael vowed that he would sell the company and retire within three years – and concluded that he would need to sell the business for at least $6 million to accomplish his goal.

After doing some initial research into valuations in his industry, Michael estimated that the company was currently worth about $4 million. That meant he would have to increase the value by 50% to reach his goal. He set up a plan to boost Eastcraft’s value:

- Step 1: Increase sales to $6 million from the current $5 million annually.

- Step 2: The company balance sheet had practically no retained earnings – Michael and his mother before him had typically paid out the profits in salary and expenses to minimize taxes. He needed to build some retained earnings in the balance sheet to make the business more attractive to financial buyers.

- Step 3: Michael had no children to bring into the business and had managed the entire operation pretty much on his own. There was no potential successor if Michael left. Realizing this would be a potential drag on the selling price, Michael hired a competent person to be his second-in-command.

- Step 4: New products were not Michael’s strong suit – Theresa had the sense for what consumers would buy. But he realized that buyers often see risk in an older product line without new product ideas in the pipeline. So he made a point to spend time with store buyers to learn about trends and came up with a list of ten new product ideas that Eastcraft began to develop.

Michael worked very hard to increase sales and he reached his goal of $6 million in sales within two years. The sales increase helped profits, but he also cut non-essential expenses – not critical ones, because he knew a savvy buyer would spot any critical cuts and adjust them back into the expenses.

It was nearing time to put the company on the market. The last step was to fine-tune the cosmetic image of the company – like most owners of small companies, the beauty of Eastcraft’s offices, plant, and warehouse was not a high priority of Michael’s. But he realized the importance of curb appeal so had the building re-painted inside and out and re-organized the office to clear years of accumulated clutter. This was also a good way to find and organize the records that he knew buyers would want to examine.

Today, Michael is living his dream. He sold Eastcraft for slightly more than his goal and has retired. In his case, preparation and planning paid off handsomely.

References

Ross, Stephen, Randolf Westerfield and Bradford Jordan Fundamentals of Corporate Finance.

Article published by Aaron Green (2007).

International Accounting Standards, Cash Flow Statements (2007).

Article published by James Laabs (2005). Web.

Suzanna DeBaca -Expert Business Source, 2007.

Article published by Bill Bischoff, 2007.

how to sell your business for Ney Grant Wednesday, 2008.

If you want to sell your business name your price carefully By Nancy Trejos Washington Post Staff Writer Saturday, 2007; Page F26.

Greening, Jack (1993). Selling Without Confrontation. The Haworth Press.