Introduction

Business decisions are usually influenced by changes in the economic environment, specific trends in the industry, and fluctuations in the market. As a result, companies face a necessity of making difficult corporate decisions and choosing strategies that can be effective to address the identified problems (Ionescu, 2015). In this context, companies often choose acquisitions as their business decisions and strategies in order to address a negative impact of changes in the environment and achieve the certain progress. From this point, the orientation to an acquisition can provide a business with a range of opportunities for the further growth (Acquisition, 2016; Liang-Hung, 2014). Still, the problem is in the fact that when companies choose to develop an acquisition project, chances for success can be rather low.

Researchers determine a range of factors that can influence the success of an acquisition, and the company’s experience in this area is viewed as one of the most important forces to affect the company’s further performance (Rabbiosi, Elia, & Bertoni, 2012). However, the opponents of this idea state that acquisitions usually depend on the current approaches used by managers in order to complete the project, and much attention should be paid to the managerial knowledge and available financial resources (Hutzschenreuter, Kleindienst, & Schmitt, 2014). Although theorists focus on the managerial knowledge as a key aspect of a successful acquisition, such important decision can be discussed as efficient when it is selected by firms that have experience in organizing acquisitions because they need to be familiar with the strategy, be ready to enter new markets, and benefit from the negative or positive experience among other reasons.

The Role of Acquirers’ Experience

Familiarity Related to the Acquisition Experience

Acquisitions are usually viewed as important business decisions that are aimed at addressing the company’s strategy and improving its position in the market. As a result, acquisitions are associated with a range of complex actions that are not selected by firms that do not plan to win the leading position in the industry or expand in the market (Chatterjee & Brueller, 2015). From this point, those companies that have the significant acquisition experience tend to choose this strategy oftener than firms with less experience in this area. The reason is in the fact that complex actions associated with the process of an acquisition can be discussed as rather familiar to them (Alessandri, Cerrato, & Depperu, 2014). Furthermore, such actions and steps can be the part of the company’s strategy. From this point, such business decision as an acquisition works for those firms that have specific experience because of their preparedness to complete a range of strategic steps in order to achieve the goal (Henningsson, 2015). In this context, the aspects of ‘familiarity’ and ‘comfort’ are important to be taken into account while discussing the company’s preparedness to realize the acquisition plan.

Entering a New Market

The firms that have experience in completing acquisition plans also have more opportunities to achieve the success in the future project, especially when the focus is on entering a new market. When companies have no experience in certain markets or when they are not familiar with them, they can face more barriers and challenges (Riviezzo, 2013). Rabbiosi et al. (2012) also note that the risk of a failure can be high for those companies that plan acquisitions in markets that are new to them. However, the situation is different for companies that have experience of completing such acquisition projects. Managers in these companies can utilize more strategies while addressing competitors in a new market or while attracting more customers (Riviezzo, 2013).

It is important for a manager to understand the aspects of the market in which the firm operates, and an acquisition associated with entering a new market can become a real challenge for a manager who has no previous experience in completing a set of tasks for such a situation (Alessandri et al., 2014). The problem is in the fact that new markets can be different in terms of a variety of aspects, including the required set of resources, potential customers, suppliers, and institutional requirements, as well as other similar contingencies (Ionescu, 2015). As a result, the company that has no experience in realizing acquisitions and entering other markets is at risk of a failure because of the managers’ impossibility to refer to the previous experience and effective strategies.

Serial Acquirers

Acquisitions can also be viewed as specific business decisions that are usually taken by ‘serial acquirers’ that are companies which have chosen this strategy as appropriate for them, and they can refer to acquisitions as their main strategic approach (Henningsson, 2015). From this point, the previous experience associated with an acquisition project can be discussed as one of the key factors to determine the strategic choice of a ‘serial acquirer’. The companies that are inclined to complete several acquisition projects annually are Nestlé, AT&T, Siemens, Kraft and General Foods, Cisco, and Unilever among others (Chatterjee & Brueller, 2015; Henningsson, 2015). According to Henningsson (2015), “historically, 60% of all acquisitions have been made by serial acquirers” (p. 121). Therefore, the experience in managing acquisitions can be viewed as one of the major forces to influence the further strategic decision of these firms. This idea is also supported by Riviezzo (2013) who states that there are many ‘serial acquirers’ in knowledge-intensive industries because acquisition projects are developed with reference to the firms’ previous experiences or with reference to analyzing the competitors’ success in this field.

The Role of the Negative Experience

While speaking about the role of the acquisition experience, it is almost impossible to refer only to positive outcomes faced by businesses when they make a decision to develop an acquisition project. The next important aspect to consider is the role of negative experiences associated with acquisitions in predicting the further success or failure. It is important to note that, in many cases, negative experiences of acquirers can lead these companies to the further progress. The focus is on the time spent by firms to reconsider their experience and concentrate on transforming a negative situation into the important experience.

Thus, according to Hutzschenreuter et al. (2014), “both small losses in prior acquisitions and an adequate time lag between acquisitions will … positively contribute to the performance of the focal acquisition” (p. 1117). From this point, the negative experience provides managers with opportunities to analyze their mistakes in selecting a target firm, choosing a scope of the project, selecting an acquisition plan, and developing a strategy of integrating resources of a target company and an acquirer (Henningsson, 2015). If the company has faced some challenges and barriers while changing its operations and management associated with an acquisition, this company knows how to address similar problems in the future. In this case, it is possible to use the negative experience in order to contribute to the current success of a new acquisition project that is developed with reference to the made conclusions.

The Impact of Experience on Managerial Decisions

In addition to the negative experience, the successful acquisition performance in the past can influence firms’ further projects directly. In this context, the focus is on management and sharing ideas among employees. Riviezzo (2013) states that the main barrier faced by leaders while developing acquisition projects is the inability to organize the work of several departments that are created as a result of an acquisition. Leaders can also have problems while managing the work of the higher number of employees (Alessandri et al., 2014). Henningsson (2015) notes that it is extremely important for a management team to analyze the acquisition experience and adapt business strategies in order to achieve the higher results in the future.

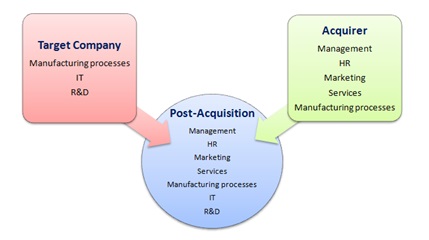

The technique of analyzing the previous experience is followed by many leaders in their industries, including companies from the IT, food, electronics, and automobile industries among others (Chatterjee & Brueller, 2015). These firms choose acquisitions as business decisions and strategies because they know from the previous positive experience that acquisitions work in this particular market, and they can lead to increasing the competitive advantage (Henningsson, 2015; Riviezzo, 2013). Thus, managers should know what strategies to apply in order to guarantee a successful merger of a target company and an acquirer as a result of integrating their services and operations (Figure 1). From this point, acquirers are inclined to draw conclusions from their both negative and positive experiences in order to develop the most effective management system to work with new resources in the changed environment.

Alternative Visions

In spite of the fact that the majority of researchers and practitioners discusses the previous experience in completing acquisition projects as a key reason to refer to this business strategy one more time, the opponents of this view state that the concept of knowledge is more important in this case than the practical experience (Hutzschenreuter et al., 2014; Liang-Hung, 2014). Even if managers have experience in realizing acquisitions, they need to focus on the ideas of mindfulness and creation of the certain knowledge that should be shared among all employees in order to achieve success (Hutzschenreuter et al., 2014).

The reason is that the positive experience does not guarantee that the acquisition which involves uniting resources of particular companies can lead to expected outcomes. Instead, it is possible to notice that managers often do not know how to create the positive working environment and how to share the knowledge. As a result, Hutzschenreuter et al. (2014) refer to the findings of the study where it is stated that the relationship between the company’s experience and the further acquisition performance can be absent or even negative. The other researchers state that the quality of learning can have more noticeable effects on the acquirer’s performance than the nature of the previous experience (Ionescu, 2015; Liang-Hung, 2014). From this point, the role of experience in developing acquisition projects is questioned by some theorists.

However, it is important to note that even if managers focus on the concepts of knowledge and mindfulness while realizing their acquisition projects, they can fail to complete the acquisition procedure and achieve the high-level performance if this project is the first attempt for the company to use this challenging strategy. According to Alessandri et al. (2014), those organizations that have experience in completing acquisition projects also have many chances to succeed. This aspect is important while comparing the chances for success in relation to experienced acquirers and their competitors for which this business decision cannot be regarded as familiar or usual (Henningsson, 2015). In the majority of cases, the experienced acquirers cope with challenges of acquisitions more effectively in comparison to non-experienced firms.

Conclusion

In spite of the fact that many managers and researchers state that a range of factors can influence the success of an acquisition project, the key aspect that should be taken into account while discussing the appropriateness of this business decision is the company’s experience. Those firms that have experience in realizing an acquisition also have the potential to succeed in the future projects because they are familiar with principles of the acquisition strategy, they are ready to enter new markets, they can act as ‘serial acquirers’, they can refer to and analyze both negative and positive experiences, and they can develop the most effective approach to integrating services, operations, and resources during the acquisition process. From this point, in order to make a reasonable business decision and complete a successful acquisition project, companies need to refer to the past experience and decide on the appropriateness of this strategy for their particular case.

References

Acquisition. (2016). Web.

Alessandri, T., Cerrato, D., & Depperu, D. (2014). Organizational slack, experience, and acquisition behavior across varying economic environments. Management Decision, 52(5), 967-972.

Chatterjee, S., & Brueller, N. N. (2015). A new M & A methodology: Five lessons in anticipating post-merger resource interactions and challenges. Strategy & Leadership, 43(4), 26-37.

Henningsson, S. (2015). Learning to acquire: How serial acquirers build organizational knowledge for information systems integration. European Journal of Information Systems, 24(2), 121-144.

Hutzschenreuter, T., Kleindienst, I., & Schmitt, M. (2014). How mindfulness and acquisition experience affect acquisition performance. Management Decision, 52(6), 1116-1123.

Ionescu, R. (2015). Mergers and acquisition – ways of developing business. Calitatea, 16(2), 83-87.

Liang-Hung, L. (2014). Exploration and exploitation in mergers and acquisitions. International Journal of Organizational Analysis, 22(1), 30-47.

Rabbiosi, L., Elia, S., & Bertoni, F. (2012). Acquisitions by EMNCs in developed markets. Management International Review, 52(2), 193-212.

Riviezzo, A. (2013). Acquisitions in knowledge-intensive industries. Management Research Review, 36(2), 183-212.