Introduction

The objective is to make investment decisions, and for that purposes analysis of available financial statements of Sleeman Breweries Ltd (SBL) have been made keeping in view projected expansion and other plans of SBL. The financial analysis includes an assessment of profitability, liquidity, and overall financial performance of SBL in comparison with available industry standards. The assessed information is analyzed keeping in view available information on the current operating strategy of SBL and recent happenings to arrive at investing recommendations for Chantal Dumont.

Financial Performance Assessment

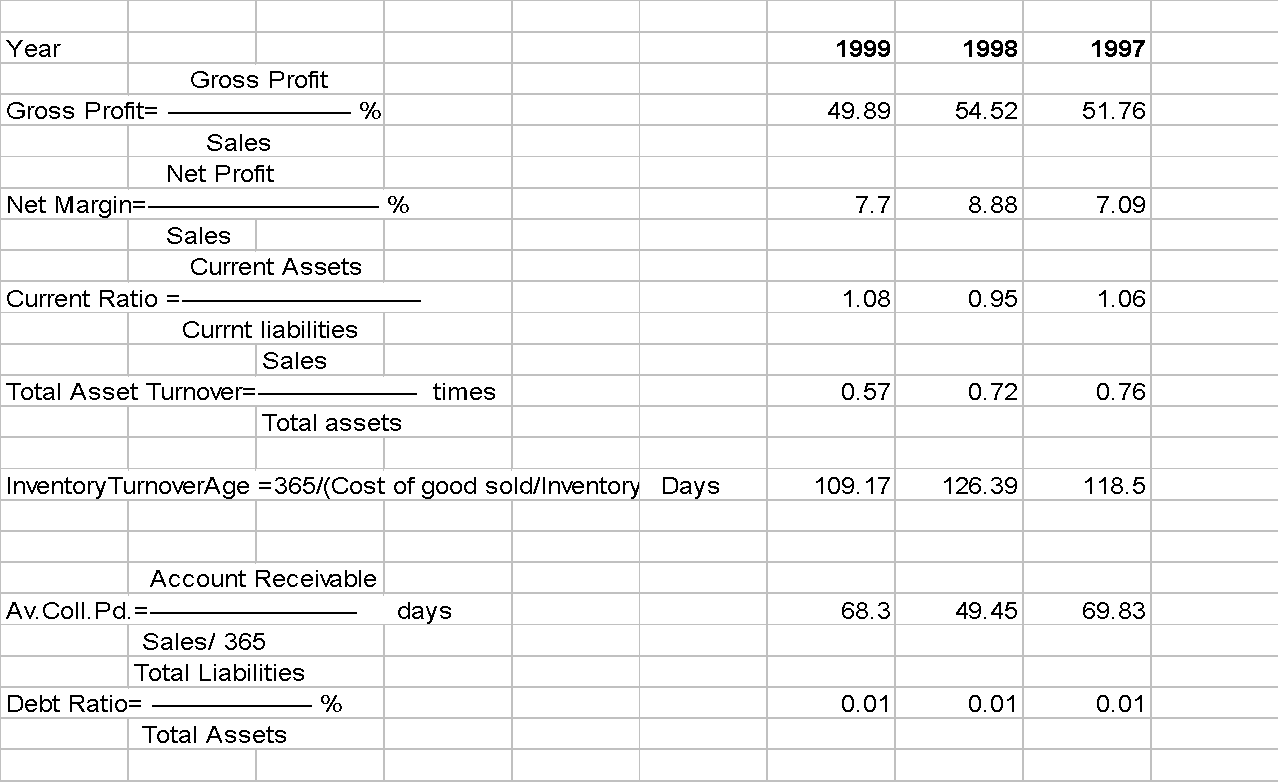

In order to evaluate the financial performances of SBL, various financial ratios have been calculated for three years in the appendix attached herewith. Based on ratio analysis the financial performances are evaluated hereinbelow.

Profitability

Gross profit margin and net profit margin of an entity describe its complete profitability performance. “The Gross Profit margin measures the percentage of each sales dollar remaining after e firm has paid its goods. The higher the gross profit margin the better (that is lower relative cost of merchandise sold. ” (Lawrence J. Gitman, page 67)1 Gross profit margins of SBL are showing a fluctuating trend. It rose from 51.76% in 1997 to 54.52% in 1998, and then fall to 49.89. This fluctuating trend is caused by the same trend of fluctuations in the cost of goods sold, though sales have a rising trend since 1997. In the year 1998 the cost of goods sold was reduced to 45.47% of sales as compared to 48.24% in 1997. But again in the cost of goods sold rose to 50.10% of sales in 1999. That implies that certain direct cost factors are not in control of the company and those are causing their effects on the gross margins of the company. But when compared with the industry average of 39.4%, the margin in 1999 of 45.47% sounds much above industry average performance.

Lawrence J Gitman (2006, page 67)2 also states that “net profit margin measures the percentage of each sales dollar remaining after all costs and expenses, including interest, taxes, and preferred stock dividends, have been deducted.” The net profit margins for the year are 7.7%, 8.8%, and 7.09% for the years 1999, 1998, and 1997 respectively. Net profits increased in 1998 as compared to 1997 and then went down in the next year 1999. The industry average is much lower at 1.9%. Though profitability SBL is performing much better than the industry average, looking at the trend of net margins since 1997 SBL is following the same trend of fluctuations as in gross margins. This indicates that the company is having complete control over its overheads and the effect on net profit margin is also because of the fluctuating role of the cost of goods sold explained hereinabove.

Liquidity Review

The liquidity status of a company explains its short-term solvency position. In this respect, the current ratio provides a better look at the liquidity position of the entity. “The current ratio compares the current assets with current liabilities. A ratio below 1.0 means that current assets are less than current liabilities. This is a clear indication that the company has liquidity problems.”(Edward, page 83)3 The optimum current ratio for any industry is considered at 2:1. However current ratio needs to be developed taking into consideration the circumstances of the firm and industry.

From a liquidity point of SBL is struggling. The current ratio of SBL is 1.08, 0.95, and 1.06 in1999, 1998, and 1997 respectively, and that is much lower than even the minimum required standards. Even the industry average is 1.6:1. Though SBL is making real efforts and the current ratio has rising from 0.95 in 1998 to 1.08 in 1999, but still SBL has liquidity trouble; and it might not able to meet their short term obligations, when those become due.

Overall Efficiency Review

For measuring financial efficiencies of an entity, three activities ratios, namely, total assets turnover ratio, inventory and average collection period, have been considered keeping in view the nature of business of SBL.

“Total Assets Turnover shows the relationship between the dollar volume of sales and the average total assets used in the business. The ratio indicates the efficiency with which the company uses its assets to generate the sales.” (Hermanson, Edward, and Maher, page 442)4 The higher the assets turnover the better it is. SBL has rotated its assets 0.57 times, 0.72 times, and 0.76 times in 1999, 1998, and 1997 respectively to generate sales. This reducing trend over the period indicates the creeping inefficiency of SBL in exploiting its assets to generate revenue.

“The inventory turnover ratio provides a helpful overview of how effectively the company manages what may be its most valuable assets, its inventory. It describes the relationship between the cost of products sold over the course of a year and the average inventory the company maintained to support those sales.”(Edward Fields, page 89)5

SBL has held its average inventory for 109.17 days, 126.39 days, and 118.5 days in 1999, 1998, and 1997 respectively to meet the requirements of the cost of goods sold for generating the required sales. There is no doubt that SBL has increased efficiently if we compare the 1999 performance of 109.17 days with 118.5 days in 1997, but 1998 was not a good year when the average inventory was held for 126.39 days. The industry average is just 77.6 days. Accordingly SBL is not at all rotating its inventory in an efficient manner to generate the revenue. This can also be one of the contributory factors of liquidity crunch as stated earlier.

“The average collection period is the average length of time that sales dollar remain in the form of trade debtor. The longer the average collection period, the longer the operating cycle and greater your investment in trade debtors.” (John W English, page 119)6 The company improved the average collection period from receivable in 1998 when this period came down to 49.45 days as compared to 69.83 days in 1997. The collection period again rose to 68.3 days in 1999. The longer collection period is a sign of inefficiency. This average collection period is much better than the industry average of 43.7 days. In that way, the otherwise inefficient year of 1998 proved to be best so far as collections from receivables are concerned. But SBL has not worked up its collections efficiently over a period of three years and that is why SBL suffered on the liquidity front. The result was that the company’s cost of production went up in 1999 as it could not take the benefit of cash discounts on direct purchases due to its precarious liquidity position.

Investors’ Criteria and other factors of consideration

- Investors are mainly concerned with dividends on their equity investments and the earning per share yielded by the company. The information provided as per cash flow statements for the year 1998/99 and 1997/97 reflects that the company has not paid any dividend during these years. Accordingly no dividends have been declared for equities. This may be due to difficult liquidity position of the company during these periods; despite the fact that net profits after interest and taxation are showing a study increase in absolute terms since 1997.

- Dividends might not have been declared as the company is more interested in its current operating strategies that involve growing of domestic market, expanding distribution and control over provincial distribution system, expanding strategic alliances within the international brewing community , and creating a vision of ‘family’ of premium craft brewers across Canada. All these activities involve further investments. That is why investments in fixed assets have increased in 1999 by an influx of $6167100 over and above the existing investments on fixed assets in 1998. But it is pertinent to note here that long-term debts have also hugely gone up by $47165256 in 1999 when compared with 1998.

- The result is that there is an almost equal investment of owned capital and debt funds for financing the total assets of the company. The capital structure of the company is neither high geared nor low geared because of hike in the retained earnings has made equities more or less equal to debt funds. That is why the debt ratio for all three years is 0.01. This may be a normal capital structure, but at the same time, it reflects that the management of the entity is not at all adventurous. To earn rewards there have to be comparable risk-taking abilities, and such abilities are not missing from the existing capital structure and otherwise handling of the affairs of the company. Under such a scenario, how is it possible to achieve the objectives enlisted in the current operating strategy list?

Recommendations

Increasing profitability does not indicate efficiency as efficiency is more related to making the basis for future earnings. SBL has inefficient inventory turnover. Inefficiency is also creeping in assets turnover. The liquidity situation is risky as the company is facing a cash crunch. Though certain figures may be encouraging when compared with the industry average of those performances, keeping an absolutely safe capital structure does not provide a base for the future. The approach of management is passive and not enterprising. Keeping these factors in view, it is not advisable to suggest making investments in SBL under such circumstances.

Conclusion

The given platform of SBL is enterprising but its management’s move as reflected from its three years financial statements is pessimistic. There is no risk-taking move, like keeping a passive capital structure, precarious liquidity position, inept handling of inventories and assets, and above all non-declaration of dividend despite the absolute increase in profits. The management is not interested in bringing about a cheerful atmosphere among the investors. Accordingly, fresh investments in SBL will not be a wise move

Appendix A

References

- Lawrence J Gitman, Principles of Managerial Finance, Eleventh edition, Pearson Education, 2006, page 67

- Ibid, page 67

- Edward Fields, The Essentials of Finance and Accounting for Non Financial Mangers, AMACOM Div American Mgmt Assn, 2002, page 83)

- Hermanson, Edward, and Maher, Accounting Principles, Freeload Press Inc., page 442

- Edward Fields, The Essentials of Finance and Accounting for Non-Financial Mangers, AMACOM Div American Mgmt Assn, 2002, page 89

- John W English, How to organize and operate a small business in Australia, Allen, and Unwin, 2006, page 119