List of Abbreviations

- AG = Auditor General

- BMA = Bayesian Model Averaging

- BNI = Bureau of National Investigations

- CAG = Controller and Accountant-General

- CAGD = Controller and Accountant-General’s Department

- CBI = Central Bank Independence

- CIDA = Canadian International Development Agency

- CPI = Corruption Perceptions Index

- DACF = District Assemblies Common Fund

- DAs = District Assemblies

- DCGC = Deposit and Credit Guarantee Corporation

- DCE = District Chief Executive

- DDC = District Development Facility

- DMMCE = District, Municipal and Metropolitan Chief Executives

- DMTDPs = District Medium Term Development Plans

- DNDMO = District National Disaster Management Officer

- DSC = District Security Council

- DACF = District Assemblies Common Fund

- DPCUs = District Planning Coordinating Units

- GFC = Global Financial Crisis

- GTZ = German Technical Cooperation

- HRM = Human Resource Management

- IEA = Institute of Economic Affairs

- IPRSP = Interim Ghana Poverty Reduction Strategy

- HAVA = Help America Vote Act of 2002

- LDCs = Less Developed Countries

- MDG = Millennium Development Goals

- MFEP = Ministry of Finance and Economic Planning

- MNC = Multinational Corporations

- MPs = Members of Parliament

- MMDAs = Metropolitan Municipal District Assembly

- MOF = Ministry of Finance

- MLG = Ministry of Local Government

- MoFEP = Ministry of Finance and Economic Planning

- NCG = Nordic Consulting Group

- NDPC = National Development Planning Commission

- NDP = National Democratic Party

- NHIS = National Health Insurance Scheme

- NVRA = National Voter Registration Act of 1993

- OECD = Organisation for Economic Co-operation and Development

- OMA = Obuasi Municipal Assembly

- PPP = Public Private Partnership

- PNDC = Provisional National Defence Council

- RAut2 = Revenue autonomy at second degree

- RSC = Regional Security Council

- SCG = Sub-Central Government

- RCCs = Regional Co-ordinating Council

- RPCU = Regional Planning Coordinating Units

- TPOs = Town Planning Officers

- USAID = United States Agency for International Development

- WB = World Bank

Abstract

Over the past couple of years, due to the potential advantages that can be derived by implementing fiscal decentralisation, it has been a significant topic for discussion and great concern, especially in developing countries. At the same time, it has also become a key problem nowadays. Fiscal decentralisation is expected to provide numerous advantages and assistance to governments in their endeavours to provide good governance.

Despite the fact that fiscal decentralisation makes government officials responsible and accountable for meeting people’s requirements, there is no considerable positive effect (as opposed to the theoretical suggestions) on the economic growth. The policy of fiscal decentralisation is introduced for an offset problem that has caused dissatisfaction with the current centralised system of governance. This paper indulges in a discussion where both the positive and negative aspects of fiscal decentralisation shall be considered. The impact of fiscal decentralisation on the economic growth of a country is governed by various factors that are influenced by the involved communities and economies.

Fiscal decentralisation is considered to be initiated when local governments are given ample power to manage projects (goods and services) involving funds. On their part, the local governments have to sincerely follow the guidelines and requirements of fiscal decentralisation. Such allocation of financial powers can either be in the form of local units that act as per the union government’s guidelines or as devolution where local governments are given considerable powers to determine the financing method of projects to be undertaken. When fiscal decentralisation is considered to be sound, it means that there is stability in the economy.

On the other hand, when fiscal decentralisation is considered to be efficient, it means that the economy of a nation has adopted better ways to deliver public goods. Fiscal decentralisation can be effective only if there is precision, clearness, consistency, and distinct guidelines in dealings. As far as revenue is concerned, the local governments should be allowed to enforce a minimum of one tax structure and to manage the services in their localities.

Self-sufficiency has to be clearly explained should be well defined and explicit and also limited to the prescribed guidelines pertaining to the borrowings by local authorities. Appropriation of funds by sub-national governments needs some equilibrium of market principles, regulations, control, and management. Supporting institutions, democratic representation, sound budget process (efficiency and democratic), collection capacity of revenues and accordance between levels of governance are crucial for the economies, especially for the transition countries, concluding to macroeconomic efficiency and growth, vice versa will have a lack on this variable.

It is quite possible that fiscal decentralisation might be a hindrance to the working of governments whose policy is to maximise revenue. In such circumstances, the competition between various levels might result in limiting the budget volume, thereby restricting the magnitude of the private sector. Fiscal decentralisation may have high impact in economy especially in macroeconomic performance and management.

Global understanding has depicted that proficient multi-tier government needs cooperation among various levels of governance, clarity, and broad exchanges of information. For sure, in almost all countries there is lack of cooperation between line ministries and local units associated with unrealistic regulations, proliferation unfunded mandates, ineffective supervision and weak supports.

Introduction

Background of the Problem

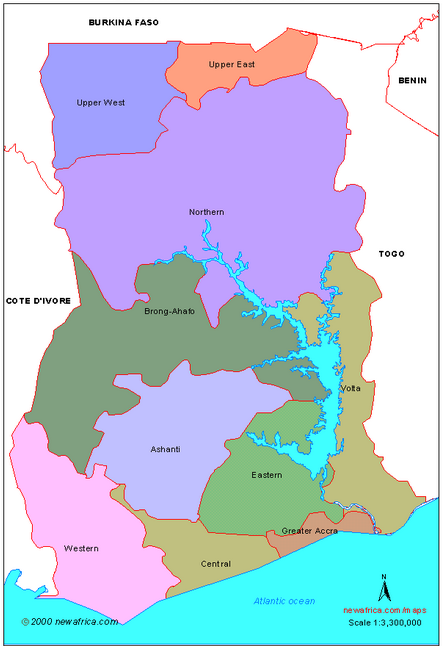

This thesis puts forth the effects of fiscal decentralisation and its usefulness in establishing a link between the actual economic situation of Ghana and the legislations. The usual process of fiscal decentralisation and the extent to which the benefits are being passed on to the public is also discussed. The World Bank (WB) and the International Monetary Fund (IMF) have laid certain guidelines to be followed by nations for fiscal decentralisation. In line with such guidelines, the parliament also passed some reforms to be carried out in order to enable the country to sustain the economic growth and encourage people’s participation.

It has been a long time that Ghana has been the epitome of fiscal decentralisation and it is now time to evaluate the level to which the country has been successful in unbiased and fair distribution of the benefits. It is also imperative to assess the level to which the government of Ghana has been able to undertake initiatives for the overall development and how far has corruption given rise to the bureaucratic red tape. The question is whether the fiscal decentralisation policy has been able to deliver and contribute in the overall development of Ghana and its people. This thesis has aimed to conduct a 360-degree investigation whether the government of Ghana has adopted a fair and dependable economic approach towards the fiscal decentralisation.

Since the past two decades Ghana has been experiencing fiscal decentralisation that has resulted in diverse knowledge and understanding of the socio-economic contributions of the country’s decentralised local governments. At this moment, it is no more than a theoretical paradigm of economic development, but the country has in fact huge practical evidence that would provide real direction for exacted policy reformation in connection to further fiscal decentralisation.

Now is the right time for the government of Ghana to assess and measure the aggregate outcomes of fiscal decentralisation that have been implemented for the last twenty years. The determination of both negative and positive influences of fiscal decentralisation would enable the government to generate new policy direction that could gain economic development confirming enhanced capabilities and accountability at local levels.

The intention of ensuring economic development through fiscal decentralisation is a great challenge for the present government. From the very beginning, fiscal decentralisation has aligned with different irregularities and corruption, in some extent. Rather than economic development, it has decentralised the corruption at a larger area of the economy; from central to local level. Even though the development partners would like to view the corruption and regulates as ‘grease’ on the wheel of fiscal decentralisation, good governance is a primary condition for a nation’s economic progress; corruption and good governance may not run simultaneously.

Adei (2010) pointed out that among the administrative and revenue staff of the local governments of Ghana, there is an absence of three essential and delicate values; their educational background, organisational values gained from the local governments, and the societal values that they live in.

There are a lot of differences in the theory and practices followed by the political leaders in Ghana. The traditional societal values are disregarded and moreover, due to their bureaucratic attitude, bureaucrats refrain from mingling with the common people. The bureaucrats as well as the other representatives of the people don’t behave ethically and boast of the facilities given to them by the government such as, lavish homes and vehicles.

People believe that the bureaucrats enjoy such luxuries at the cost of their hard-earned money that goes into public revenue. An excellent leader is one who adheres and follows the societal values but the prevailing circumstances in Ghana have developed a general perception among the locals that the leaders lack ethical values that are needed by the people. The bureaucrats of Ghana are engrossed with the colonial mentality and even though they are public servants, they are simply concerned about gaining their own interests.

This particular attitude of the officials of the local governments in Ghana has created a void between the public and the local government bodies. Fiscal decentralisation is a program initiated through the local government bodies; since the people don’t have faith in the local government, this program is expected to face severe defeat. As such, it becomes inevitable to encourage people’s participation in the public welfare and service delivery programs. If the people are ignored, then instead of bringing in benefits, the fiscal decentralisation program might create havocs and hamper the prevailing economic growth of the country as well.

According to a GNA (2009) report, the local government system of Ghana is experiencing a severe threat due to the power sharing conflict among the DMMCEs (District, Municipal, and Metropolitan Chief Executives) and the MPs (Members of Parliament). This has resulted in bitterness, unfriendly working condition, and lack of patriotism among the officials; the scenario hints at the unavoidable and pathetic outcome of the fiscal decentralisation program.

The partisan politics of the country has actually paralyzed the decentralisation process at the local level and it has now become very difficult to execute any accord. But the political situation in Ghana was not the same earlier; after its independence in 1957, the country witnessed meaningful decentralisation and responsible actions of the local government bodies. The current situation in the country is greatly influenced by the so-called development agencies. The party politics in the country has also been aligned with the policies of such agencies.

The Local Government Act of 1961 has clearly distinguished the central government from the local governments. Most of the important powers are vested with the central government but the amendment of 1993 in the Local Government Act integrated provision for decentralising at least twenty two central departments and ministries that generated 103 District Assemblies (DAs) including three Metropolitan and four Municipal Assemblies in the country.

The amended act clearly states that there has to be a minimum of thirty percent reservation for technocrats and experts in the District Assemblies; unfortunately, the current positions in the District Assemblies are occupied by political activists.

The Act also allows certain financial freedom for the district Assemblies but here again the interference of the central government has seized that autonomy. The reason cited for this seizure is that the District Assemblies are not competent enough to handle funds and as such the central government handles the financial management.

According to Jönsson (2007), the local governments of Ghana were incapable of alleviating past tensions with the chieftains that resulted in the Dagbon crisis. It is notable that at least 30 people were killed during this crisis and the blame rests on the District Security Council (DISEC) of Yendi and the Northern Regional Security Council (REGSEC). In an appalling revelation by the Wuaku Commission (2002), the treacherous role of the District Chief Executive (DCE) was anticipated and further investigation was recommended. The District Chief Executive was believed to have favoured/disfavoured certain conflicting groups of tribal people within his jurisdiction.

The Northern Region of Ghana witnessed substantial inter-ethnic conflicts related to the local decentralisation structure of administration and tribal norms. The incidence of widespread violence and loss of hundreds of lives during these conflicts was interpreted as a civil war by the international media. The fiscal decentralisation program has started to be executed socially but if the political aspect is considered, it has certain barriers at the local and national levels. Rather than the conflict among the tribal groups, the crucial part is to sustain the chieftains with the help of local government bodies that come under the fiscal decentralisation program.

During the post-independence period, the influence of political and traditional leadership in Ghana developed through building direct competition and conflict with each other. Later on, the ease of access to the traditional state structure gave rise to conflicts; due to the race to become chiefs. Such conventional leadership of Ghana has allied with a collective expansion of security discourses in this region. Consequently, the decentralised regional units of the state have to face the challenges of upholding the common view of Ghana’s people in order to establish a non-violent and peaceful country and to avoid any ethical conflicts that might endanger the country’s security (Higazi, 2004).

According to Jackson and Marquette (2003), even the combined efforts of the traditional and decentralised local government systems have not been able to sustain the conflicts of the chieftains with the local government authorities; though it is very crucial to integrate the chieftains with the local government. Probably, the main point of disagreement is the land allocation system.

The local governmental bodies are encouraged to develop strategic plan to involve the chiefs in the new decentralised system and in this way, it would be possible to use the chiefs to motivate and gain greater support of the local people for development plans. Integrating the chiefs in the process of local governments would facilitate the understanding and use of traditions and norms of the communal prerequisite of services; chiefs could also act to interact between the communities and the local governments to accelerate education and control juvenile delinquency at the grassroots level, where the district assemblies have no remarkable success story.

Akramov and Asante (2009) conducted a survey on the decentralisation of Ghana and its level of local public services delivery and urged that the argument of gaining economic efficiency through decentralisation is not always true. Even though it is believed that empowering the local governments to deliver public services would increase the efficiency at the local level and enhance transparency and accountability of the government, the real scenario is very different.

The philosophy behind such logic is that the local authorities, due to their proximity to the grass root people, would be better informed and understood about the needs of the people rather than the central government. As such, the proximity would provide better scope to deliver services with local preference. At the same time, local people will get enhanced scope to know about the governmental programme and will be able to involve themselves with the ongoing agendas. However, the real life circumstances of Ghana have witnessed inadequate local capacity, conflicting leadership, inefficient local level revenue collection, and imbalance of development initiatives in different jurisdictions; these signs are definitely not pertinent to an efficient economy.

Graphic (2011) claimed that in 2007, the Bureau of National Investigations (BNI) arrested a few employees of the Comptroller and Auditor General Department for suspected fraud of ¢722 million from the state treasury. The incident put a question mark on the trustworthiness of the state’s top bureaucrats. Once the incident came to the limelight, the Comptroller and Auditor General even had a public debate with the Auditor General on the issue.

During the audit of the CAGD, it w as revealed that fictitious invoicing was done between anonymous companies and huge amounts were charged for rendering services to the ministry. It is believed that such treachery was committed in connivance with high officials of the ministry and the CAGD (for which the Comptroller and Auditor General was personally liable). There were several counter allegations between the Comptroller Auditor General and the Auditor General but nothing concrete has been established.

Researchers identified a series of financial and accounting frauds in the public service of Ghana and termed it as a fault of the internal control system, malfunctioning administrative measures, inferior record-keeping procedure, along with the involved unethical practice by the civil servants of the republic of Ghana (ITMT: International Records Management Trust: Ghana Case Study, 2008). The study also evidenced the following financial and accounting frauds:

- In 1998, the AG report identified 83% of the personal emoluments under the Ministry of Mines and Energy as fictitious.

- In 2002, an amount of ¢1.18 billion was cheated from the state treasury as various civil and military payroll.

- In 2003, an amount of ¢3.25 billion was cheated from the state treasury as various civil and military payroll.

To accomplish such big frauds, a complete chain from the lower level to the highest level is required. So, it is obvious that in these frauds, the people involved were bureaucrats and low level civil servants like accountants and payroll officers. The involvement of the management of the concerned departments and the bankers was also hinted. These types of financial frauds in the economy ought to have a severe negative impact on the economic growth of the country; it will hamper the augmentation of living standards of the people by increasing inflation, raising commodity prices and uplifting taxes. Thus, people would never experience any fruitful improvement from the fiscal decentralisation if the system is not rectified.

In December 2011, the USAID sanctioned a grant of US$ 1,050,000 for the non-governmental organisations of Ghana with the aim of propagating fiscal decentralisation, which they addressed as assistance for strengthening democracy and executing decentralisation by involving the local civil society (LOGODEP: USAID Gives Grants to Civil Society Organisations, 2011). Seventy nine grant applications were received and only seventeen NGOs were selected, considering the people’s participation, integrity, and comprehensive development planning for decentralisation. The grant recipients and the policy makers of Ghana need to take into account the impact of such foreign aid or assistance and the extent to which such funds could be used for true economic growth or social progress in the country.

According to a study on the foreign aid received by Ghana, conducted by Osei (2004), the foreign donors identified certain sources in the country where the funds were being donated. The government or the agencies had no liberty as far as spending the donated amount was concerned. In order to avail the donated amount, the government and/or the agencies had to purchase the required goods from the agencies nominated by the donors. As the case was, the price of goods of these agencies was much higher than even the international market price; the import price almost doubled. The end-receivers of this burden of increased prices were the local people.

While on one side the donors were benefitting from the increased price that they were getting for their products, on the other hand the government was being over-burdened by the interest. Such a situation could lead the country to collapse under foreign liabilities. It is understood that Ghana is in grave need of foreign aids and grants but the cost at which such aids and grants are obtained will surely hamper the actual economic growth of the country; Ghana needs to have more bargaining power.

The aforementioned scenario suggests the governing rules of the central and the local governments and the prevailing practice of state services (and their implications). The effectiveness of the fiscal decentralisation system has also been evaluated. The fiscal decentralisation program has been passing through a rough patch and has witnessed various changes that have complicated the situation and the link between the central and local government bodies.

This is only the tip of an iceberg; the policymakers of the country fear a greater system failure. Considering this background problem, the researcher has decided to conduct a study that will encompass the rules that govern the fiscal decentralisation in Ghana. Such a research is expected to determine a way-out for the policymakers and regulators of Ghana to come out of the existing dilemma related to public service delivery and develop a suitable solution for the betterment of the country.

Statement of the Problem

Several researches have already been conducted with the nature and shape of fiscal decentralisation and its standard practice in Ghana, but there is no research agenda that has yet been raised with the historical complexities of fiscal decentralisation in bringing local economic development in Ghana along with the determinants of the economic progress for which the country is striving. The legislation of Ghana has already been amended several times to facilitate fiscal decentralisation with the aim of delivering superior public service to the grass root people that would ultimately enhance social progress and encourage people to contribute to the GDP growth by enhancing their individual economic performance.

The government and the civil society of Ghana are eager to upraise the productive capabilities of the grass root people and make them capable to represent their own business and improve their financial status. This can be possible if international standard of public services is adopted by the local governments. The local policy legends are much aware of the ways to prevent all sorts of unethical conduct on the part of the local governance. If conceded, it would ensure corruption free revenue collection structure, transparent accounting and recording system, fair public service delivery, and higher standards of ethical behaviour of the civil servants all over the country.

Medium term region improvement development procedure demonstrates that after the decentralized growth programs there appears to be stipulation and desire for an upgraded improvement from local groups in the area. It is a monetary reality that assets are restricted and people’s requirements are boundless. The area supply capabilities are constrained and the requests and desires from the group are high. To fathom or minimize such a space one can think how the assets availability might be expanded. In such a circumstance, discovering conceivable and effective methods for preparing local assets is similarly essential as that of searching for outer sources, for example, union government subsidies.

In such circumstances, it is necessary to have such programmes that might decrease the dependency of local governments on outer support for the financial needs of the region. An appropriate fiscal decentralisation programme can suffice such needs of the region and people.

Taking after the decentralization procedure, District Assemblies in Ghana now have the obligation to arrange and execute their ventures or projects. The local governments, to a great extent, rely on inner hotspots for the regular management of the administration. These incorporate revenue from various sources that gather as an after effect of the local government’s own exertion at income preparation and generation. The union government also transfers some funds as grants and aids. However, it has been noted that financing district development schemes in Ghana has become so challenging that it is difficult for the decentralised development programmes to sustain (Kessey & Kroes, 1992).

Objectives of the Study

The objective of the research is to support both central and local governments with better understanding of fiscal decentralisation. It also aims at establishing the contribution of fiscal decentralisation towards the local economic development by supporting free and fair public service delivery to the grassroots level with ethical standards and reflects the local governance reality to encourage small and medium local investors to formulate investment decisions.

The main objective of the research is to assess the contribution of the fiscal decentralisation on the local economic development in Ghana for the last twenty years.

The Specific Objectives are:

- To examine the extent to which the theoretical framework of fiscal decentralisation has been successful in gaining its core values through its effectiveness and implication in different countries.

- To evaluate the impact of fiscal decentralisation on the public finance of a certain country.

- To investigate if the theoretical framework of fiscal decentralisation has any correlation with the theories of economic development.

- To review the impact of fiscal decentralisation on local legislation, taxation, civil servants, poverty eradication, and market harmonisation in less developed countries.

- To interrogate the reason behind donor agencies’ encouraging and providing incentives for fiscal decentralisation and also to ascertain whether the interests of the host country and the donor country are the same.

- To juxtapose the advantages and disadvantages of fiscal decentralisation pertaining to the local economic development in Ghana.

Research Questions

The research questions are listed below:

- To what extent is the theoretical framework of fiscal decentralisation successful in gaining its core values through its effectiveness and implication in different countries?

- What is the impact of fiscal decentralisation on the public finance of a certain country?

- Does the theoretical framework of fiscal decentralisation have any correlation with the theories of economic development?

- What is the impact of fiscal decentralisation on local legislation, taxation, civil servants, poverty eradication, and market harmonisation in less developed countries?

- Why are the donor agencies encouraging and providing incentives for fiscal decentralisation and are the interests of the host country and donor country the same?

- What are the advantages and disadvantages of fiscal decentralisation pertaining to the local economic development in Ghana?

Scope of the Study

Hoffman and Metzroth (2010) claimed that the first decentralisation initiative in Ghana was taken by the British colonial rule through Municipal Council Ordinance -1859 with the aim to destroy traditional local authorities that prevailed earlier. Unfortunately, their initiatives to deliver public services such as education and public health through elected local bodies were in vain and as such, they preferred to appoint local civil and military elites in the local bodies; such elites were loyal to the British monarchy. The fiscal and judiciary powers of the local governments were withdrawn by the British monarchy.

In the modern era, the fiscal decentralisation drive was conducted in Ghana in 1989 under an undemocratic environment while the country was still under military rule and was eager to establish civil administration under the control of autocratic martial law practicing political parties (Crook, 2003; Crawford, 2004). While Ghana has come out from the reign of Rawlings’ nineteen years of military anarchy in 2000 and walked through the multiparty democracy, the democratic governments also continued the fiscal decentralisation, though it was a political agenda of the Rawlings government to keep the political institutions apart from the local governments (Abdulai, 2009).

During the long journey of Ghana for fiscal decentralisation both in the undemocratic and democratic environment, the government has gained vast experience and has issued numerous reports in this regard. All these previous governmental reports, connecting to the fiscal decentralisation, would be a powerful resource for the present study and provide enhanced scope for the present author to conduct a landmark study.

The donor agencies, academia of Ghana, development workers, and partners have successfully conducted huge research focussing on the contemporary dilemmas of fiscal decentralisation from different viewpoints, which are to some extent analogues to each other. But only a few of them have fundamental contribution to the effectiveness and implication of fiscal decentralisation. Although the present research has different perspectives of observing the local economic development deliberated from the fiscal decentralisation, the previous studies would provide enough scope to design the present research with standard norms and realistic data of previous practice.

The legislation of Ghana has witnessed different shifts pertaining to the fiscal decentralisation evidencing from Local Government Act-1961, Local Government Act- 1993 Act, National Development Planning Act-1994, Civil Service Law-1993, District Assemblies’ Common Fund Act- 1993, and Local Government Service Act- 2003 that have chronologically emerged and developed through their practical experiences (Crawford, 2004).

Every amendment of the local governmental legislation of Ghana has changed the norms of practice due to the eagerness of the government to offer good governance, uninterrupted public service delivery, and to ensure accelerated participation of people. Thus, the legislation for fiscal decentralisation is another valued resource for the present study that would provide further scope to analyse necessity of any reformation.

Moreover, the author of this thesis has unlimited scopes to develop logical foundation for local economic development within the topic area, for instance –

- The author has the opportunity to observe the extent to which existing public service delivery provisions of Ghana complied with the practice of other African countries and also with the standards of global practice of local governance system.

- In addition, this paper has the chance to observe internal implications and effectiveness of fiscal decentralisation system in Ghana, considering the amendments of Local Government Service Act- 2003 (that included guidelines for best practice), Human Development Index, and Financial Report of Ghana.

- This author has also the opportunity to scrutinise the financial reporting standards and disclosures of Ghana in consideration with Chartered Accountants Act – 1963 and Financial Administration Act – 2003 of Ghana in order to identify the extents of manipulation and corruption in the economy.

- This paper has also a scope to concentrate on the principles of national leaders’ relationship management with the local governments, identify standards on local and central leaders’ integrity, effectiveness of existing public service delivery, fiscal autonomy and performance in global best practice indicators, taxation policy, and key standards of civil servants’ ethics in Ghana.

- On the other hand, this study has also a scope to put forth the theoretical framework of fiscal decentralisation, the effectiveness of national implementation, the impact of the regulations on the local system of public service delivery, and the influence to resolve conflicts among the central and local leaders of Ghana.

- The entire process of the thesis would assist to provide a fruitful and realistic suggestion for further improvement of the fiscal decentralisation process along with applicable recommendations that would improve the existing local services delivery system with the aim of bringing local economic development in Ghana.

- Finally, the author has the prospect to collect the primary data from the local district assembly leaders and beneficiaries with the aim to analyse the concurrent implications and effectiveness of fiscal decentralisation in Ghana with economic development indicators in both macro and micro level.

Significance of the Research

During the latter half of the 20th century, the developing countries adopted various means to improve their financial systems. One of the measures was to increase the significance of market that included the private as well as public sector. During the past couple of years, the concentration has been more on developing the public sector. One of the major factors of this endeavour is to initiate policies that would introduce the decentralisation process.

Fiscal decentralisation and local government empowerment are the main concerns of governments of developing countries. Unfortunately, such attempts (wide-ranging and costly ones) have not yielded much as far as attaining the prescribed objectives is concerned. Such a bumpy performance of the developing countries with regard to fiscal decentralisation has given rise to the necessity of conducting research on the ways to alleviate the problems.

Earlier researches have tried to find out ways to be adopted by countries to have an efficient fiscal decentralisation system and to ensure a competent local system that may deliver better public service than the central government. Encouraging civil servants to be answerable to the people has also been the point of contention. It has also been researched how the local government could increase economic revenue by increasing the national policymaker’s confidence.

Previous researches on fiscal decentralisation have concentrated on the conflicting dilemmas of central and local governments with regard to state power sharing and to establish the appropriateness of the local governance system. Some researchers have drawn attention towards stabilising the state services through balancing power between central and local governments of Ghana in a manner that there is a way-out of the system that has been prescribed by the donor agencies without any local consideration. Most of the remarkable contemporary researchers have concentrated on the local system standards, relationship between the national and sub-national governments, and regulatory reformations for fiscal decentralisation.

But unfortunately, no overarching research agenda has been proposed as yet on whether the fiscal decentralisation is a conscious drive of the economic development or is it a political agenda rather than economic emancipation of Ghana. There is no remarkable research in the area that has focused on the question pertaining to the contribution of fiscal decentralisation to the local economic development in Ghana.

The rationale of this research is to analyse the role, implication, and effectiveness of fiscal decentralisation in Ghana (experienced by observing the real scenario of Ghana’s local governmental systems) and to evaluate the extent to which the existing practice of fiscal decentralisation is effectual in gaining economic development of the nation by ensuring effective local service delivery. By this time Ghana has come a long way towards fiscal decentralisation and has gathered lots of real life experiences in this regard without doubting the recommendations of the donors. Thus it is the proper time to investigate whether fiscal decentralisation is an effective tool to bring local economic development in Ghana or not.

In addition, this research has aimed to escalate the awareness of legislators and regulators to take control over the local economic development in Ghana with local consideration rather than just following the recommendations of the donor agencies. The country has already experienced the impact of the global financial crisis that has socked its economic growth significantly, including the disturbed public services delivery to the local communities of Ghana.

The policy makers are anxious to bring back the national citizens’ confidence on the overall system. Moreover, this thesis has aimed to assist the academia, regulators, political leaders, and national policymakers with better understanding about the implications and effectiveness of fiscal decentralisation and its economic consequences. This would instigate them to rethink about the whole process and to take appropriate measure for local economic development through decentralisation.

This thesis also identifies the economic indicators that would contribute towards making the Ghanaian bureaucracies to understand the conflicting norms between the national interest and those of the donor agencies. This would enable them to gain better bargaining power to ensure local economic development through the fiscal decentralisation and never to consider economic development as synonymous to the public service commercialisation.

Meanwhile, this study would also urge to unite the political forces with greater national interest rather than having conflicts over any sectarian interests. If the fiscal decentralisation system is free from any external influence, if there is an agenda of integrating the people without bothering about the political affiliation, and if economic emancipation is considered as top priority, an excellent progress can be expected.

This paper would also make broader sense for the policy legends that the economic development is not a consequential product of the fiscal decentralisation, but a challenge that necessitates political commitment, transparency, and ethical performance, far away from fraudulent practice. By this investigation and its outcomes, the public services providers and investors will get a potential investment environment within the local system of Ghana and the local governments will enjoy better level of investors’ confidence. This ought to endow a competitive advantage over the country in bringing economic development at the local level.

Limitations of the Study

Besides the described scopes for the entire study, the researcher has suffered from a number of dilemmas in investigating the economic impact of the fiscal decentralisation in Ghana, for instance:

The topic of this thesis has a mixed area of investigation that deliberated with the political economy along with legal aspects, like ‘decentralisation’ is a political agenda for good governance but when it integrates with ‘fiscal’, it turns into economic aspect of taxation. To take any reformative measures for taxation structure, it is essential to concentrate on legislative reformation, governmental rules and regulation, and central bank’s guidance along with people’s mandate.

Moreover, the local economic development is directly linked with the appropriate use of local resources for productive initiatives by taking into account the local market demand and all other economic activities, rather than any political agenda like decentralisation. For such local economic development, the primary requirement is capital inflow; the less developed countries like Ghana have serious deficiency of such capital inflow.

There is logic that fiscal decentralisation would enhance resource mobilisation through effective taxation structure (locally) and the development partners would provide grants for reformation, which could be a resource of capital mobilisation. In this context, a question arises that pertains to the utilisation of resources for local economic development by nations such as Ghana and whether they have to utilise such resources for local economic development or do they have to use those resources only for the non-economic development initiatives prescribed by the donor agencies. If the answer to this question is yes, then the local economic development cannot be possible.

Thus, this research has engendered with a complicated area of political economy which has no direct solution. The argument that fiscal decentralisation has much contribution for local economic development could be more authentic if the spirit of decentralisation would be aimed at economic emancipation rather than political agenda.

Meanwhile, there is no previous study, which aimed to observe the decentralisation drive from the local perspectives by concentrating on the local economic development from where this author could get the required data. As a result, ‘fiscal decentralisation and local economic development in Ghana’ is a complicated issue for research to deal with economic, legal, and political issues due to the limitation of data sources and lack of previous research on the specific area.

In the case of fiscal decentralisation, most of the state employees and bureaucrats and political elites like to praise the donor agencies rather than exploring their own viewpoint of safeguarding national interest; in spite of the fact that they have individual analytical capabilities to categorise national progress and economic improvement. Decentralisation in Ghana was introduced by the military autocracy where the civil servants were bound to follow the orders of martial law proclamations without questioning.

Due to long time autocratic practice, the attitude of the civil administration and policymakers has shifted to an extent where they consider that the recommendations provided by the donor agencies are correct. This type of sensitivity of the state employees and bureaucrats deliberately leads to the wrongful path of development and generates confrontation for independent investigation, without interference of the donor agencies. This study has dared to stand for local economic development without bothering about the predetermined studies of the donor agencies and it is a challenge for this research to bring a free, fair, and imperial outcome in favour of local economic development.

In addition, most of the local researches with fiscal decentralisation have funded by the development agencies or guided by their nominated intellectuals. Probably, this is the reason why the outcomes of such studies have reflected the viewpoints of the donors without safeguarding the local interest of economic development. Until now, the donor agencies have been allocating huge grants to the civil society and non-governmental organisations of Ghana to propagate in favour of fiscal decentralisation. But none of the beneficiaries have doubted the intentions of the donor agencies in spending for gaining public support in favour of fiscal decentralisation. As a result, such conflicting reality of local economic development is another limitation for this study.

This author has engaged his efforts towards identifying the scope of economic development from the ongoing drives for fiscal decentralisation without any donation or grant. Due to financial constraints the budget for this research was very small and it has proved to be a limitation for this study. There are numerous studies and journal articles with information on the implication and effectiveness of fiscal decentralisation in different countries that apparently seemed very imperative to this author, but the price of such articles was not affordable by this author.

Another limitation of this study is the time constraint; the author has involved himself in this study with the aim to fulfil his academic needs for the PhD degree, so the author has to finish the study within the deadline provided by the supervisor appointed by the University. It is very difficult for this author to conduct a vast research with fiscal decentralisation in such a short period as there is a necessity of wider data collection from different districts.

Operational definition of concepts

If the accounting and financial reporting system of a country misrepresents the outcomes of fiscal decentralisation and economic reality of a public service, the capital flow would be misguided to the inappropriate sectors. Such wrong allocation of assets would hinder the local economic development and investment environment and as such, the local investors will have to pay higher opportunity cost (that will be more than the returns).

As a result, the optimistic business sector at the local level (the national small and medium enterprises) may suffer from lack of confidence. This might deprive them from proper investment because the national business concerns would make their strategic investment decision depending on the defective and manipulated information. This type of circumstance would generate a new evidence of corporate failure in Ghana, which is quite undesirable to both the central and local governments and also to the stakeholders. To avoid such a risk, it is essential for the legislators to ensure appropriate fiscal decentralisation enclosures for public service delivery with standard financial reporting system at local level.

Thus, it is most essential to investigate the extent to which the ongoing fiscal decentralisation process has enabled the local governments in ensuring business friendly environment within their jurisdiction. Such an environment could be created by facilitating uninterrupted public service delivery, hindrance free business entry, transparent financial reporting for all stakeholders along with a suitable taxation structure.

It has been evidenced from the fiscal decentralisation drives that the semi-autonomous tax agencies at local level could facilitate an important opening towards strengthening the performance effectiveness and influencing the decentralised tax system to collect local taxes along with non-tax revenues more successfully than the traditional tax collection process. It is thus essential to have an investigation on the existing tax and revenue collection model of Ghana.

The taxation standard in Ghana and its disclosures in context of decentralisation are facing chronological development with quick shifts for enhanced revenue mobilisation and to improve fiscal health. The regulators are trying to accomplish radical changes that can ensure transparency, accountability, and easy access for all without any hindrance. Although tax reformation authorities are always publicising that increasing tax structure has a well-built macroeconomic growth effect, but investigation with historical data of Ghana, comparative study on taxation and economic growth, and micro-level indicators like labour supply, investment demand, and productivity growth do not support such a verdict.

The global scenario of the public services delivery through local governments and recent socks of global financial crisis suggest that the disturbed regular service delivery in Ghana has emerged and developed because of external political economy rather than the internal factors of the public services providing local governments. Due to an unavoidable integration with the global economy, Ghana couldn’t keep its economy evade the negative impact of global financial crisis and the consequential collapse of the public service delivery system.

The implication and effectiveness of fiscal decentralisation are not poles apart from donor countries’ concurrent crisis. This study is thus, aimed at scrutinising the understanding of the emergence and development of fiscal decentralisation in Ghana along with the implications and effectiveness of the system in adopting the political economy of globalisation. The objective will be achieved by adopting an economic development approach based on the theoretical framework and with practical evidence from Ghana.

This thesis aims to investigate the following aspects:

- Do the historical perspectives of the implications and effectiveness of fiscal decentralisation linked with local economic development suggest a watchful drive of decentralisation legends?

- Does the fiscal decentralisation in Ghana improve the citizens’ standard of living by delivering improved quality of public service and effectual taxation structure in the country?

In addition, the more refined and vastly structured aim of this thesis has been designed to respond to the following six research questions; the answer to these questions would facilitate the legislators and policymakers to organise a policy towards a greater motivation for increased confidence of citizens on their local government’s performance and effectiveness.

Organisation of the thesis

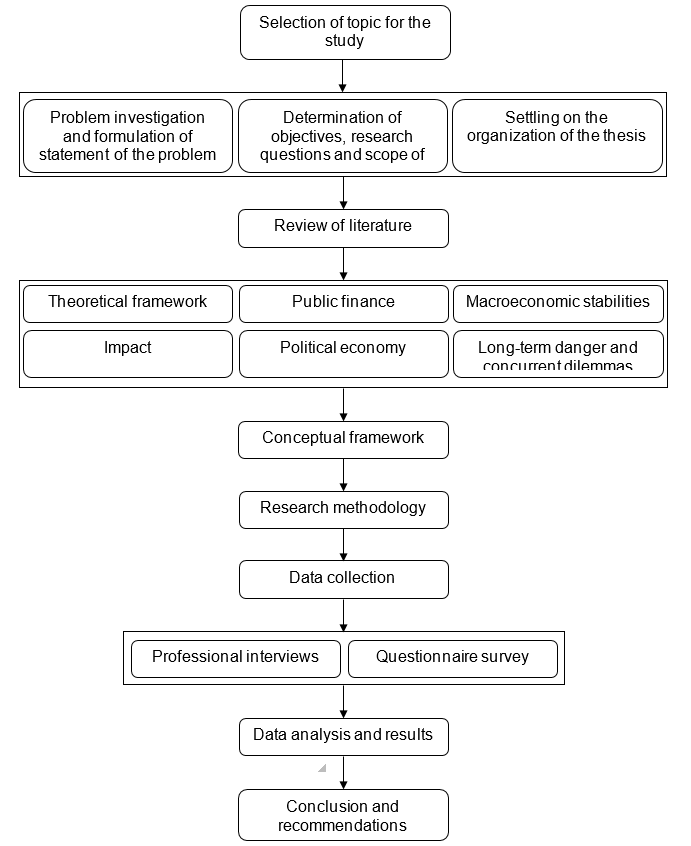

In order to assess such issues, the thesis has been divided into six segments (chapters) as mentioned below:

Introduction

This segment brings forth the developments being done in Ghana and the factors that have an impact on the fiscal decentralisation program. It also brings forth the theoretical principles of the fiscal decentralisation program and the national policymakers’ dilemma in executing the same. It also raises the research questions and affirms the limitations and scope of the study used within this present thesis.

Review of Literature

This segment includes views of various scholars about fiscal decentralisation and the prevailing economic practices being followed by the government. Further, it illustrates the latest literature suggesting innovative methods to be used by national policymakers and how to foster efficient link between the local and central governments. This review also makes us understand the actual measures to be taken for economic development and how far they are being followed at the local government level in Ghana. In addition, the interpretation – by the national policymakers – of the achievements of the theoretical structure of fiscal decentralisation and the approach of the local government departments of Ghana have facilitated the delivery of state services.

Conceptual Framework

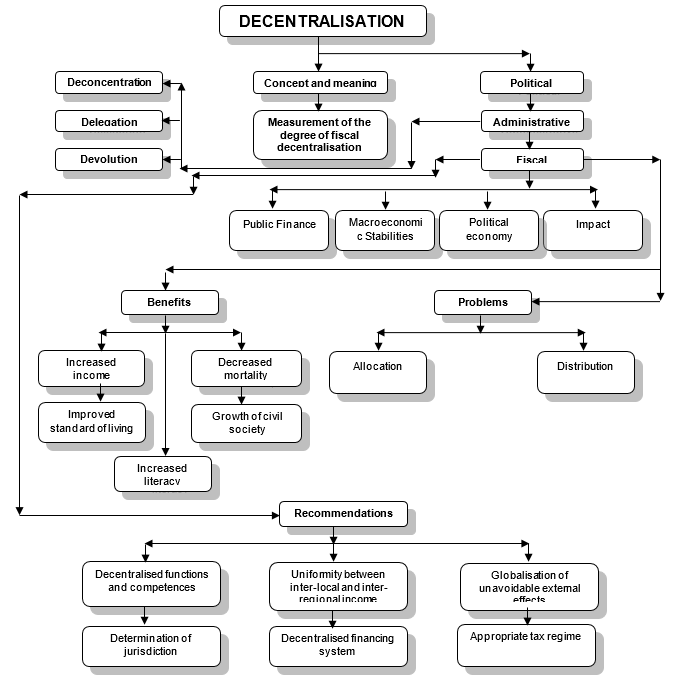

The following topics shall be discussed:

Decentralisation

- Concept and Meaning

- Measurement of the Degree of Fiscal Decentralisation

- Political Decentralisation

- Administrative Decentralisation

- Deconcentration

- Delegation

- Devolution

- Fiscal Decentralisation

Public Finance

Macroeconomic Stabilities

Political Economy

Impact

Fiscal Decentralisation and Public Health:

Fiscal Decentralisation and Compulsory Education:

Decentralisation and Social Capital:

Fiscal Decentralisation and Civil Society

Electoral System for Fiscal Decentralisation

- Benefits

- Increased income

- Improved standard of living

- Decreased mortality

- Growth of civil society

- Problems

- Allocation

- Distribution

- Macroeconomic effects

- Recommendations

- Decentralised functions and competence

- Determination of jurisdiction

- Uniformity between inter-local and inter-regional income opportunities

- Decentralised financing system

- Globalisation of unavoidable external effects

- Appropriate tax regime

Research Methodology

A crucial aspect of this segment is to establish a link between the chosen research methodology and the main aim of this thesis. The author has aimed to conduct the research in accordance with the quantitative analysis along with a case study approach and it should highlight the grounds that provide the researcher to adopt applicable research methodology in accordance with the previous research in this area that would be chosen through a critical appraisal. This segment will further enhance the author’s understanding on how the research on fiscal decentralisation will be conducted. It will also guide the author about population selection criteria, data assembly and treatment, and qualitative analysis, thereby explaining the process and the limitations of this study.

Results

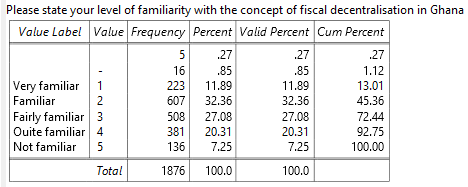

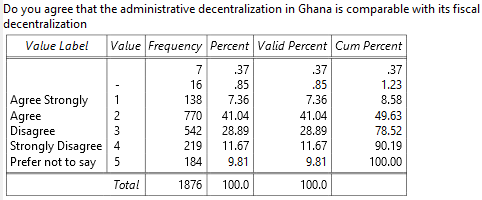

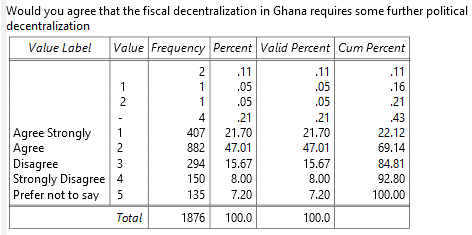

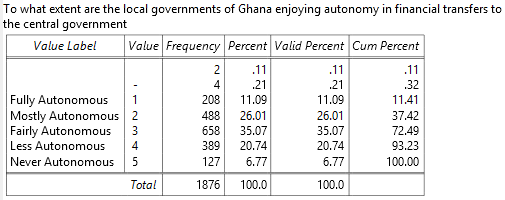

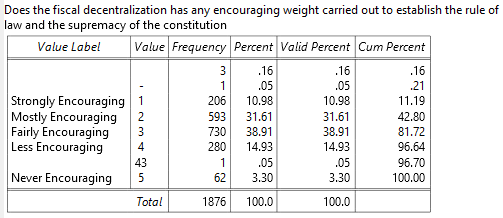

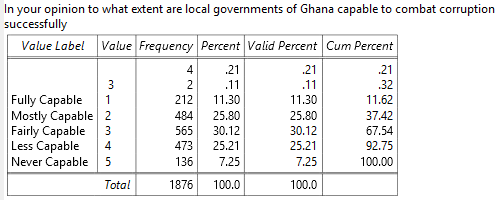

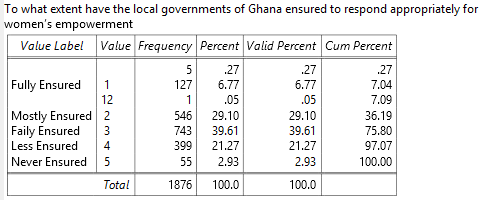

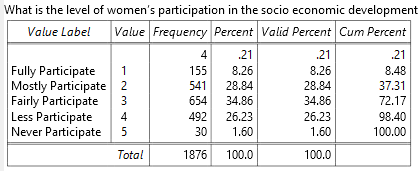

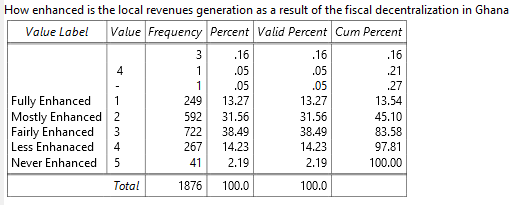

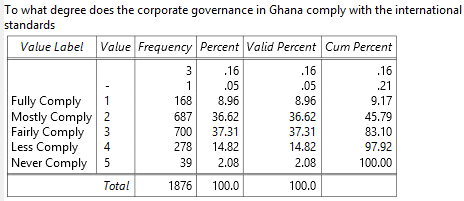

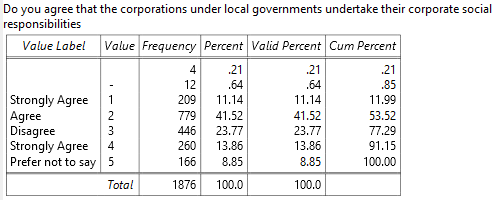

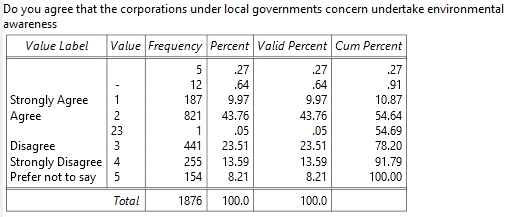

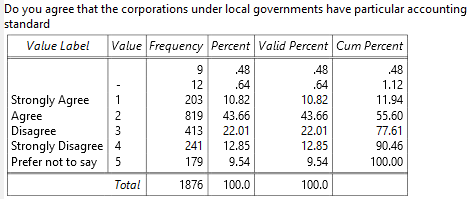

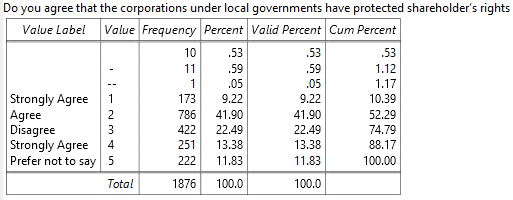

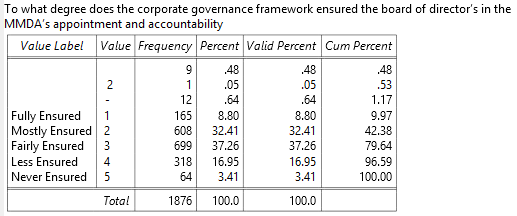

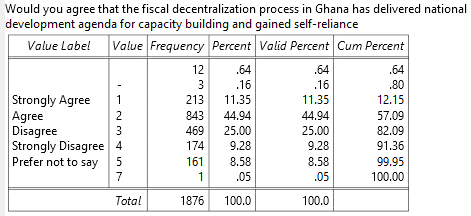

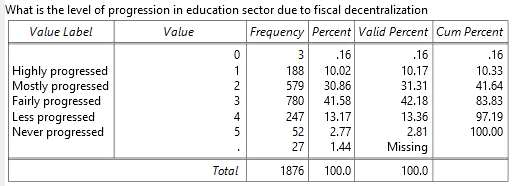

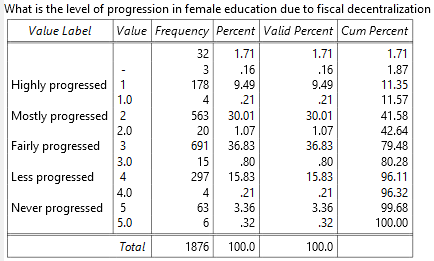

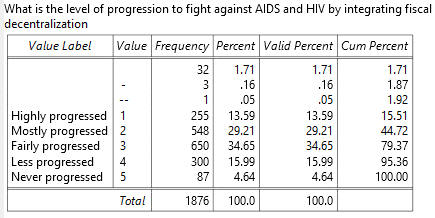

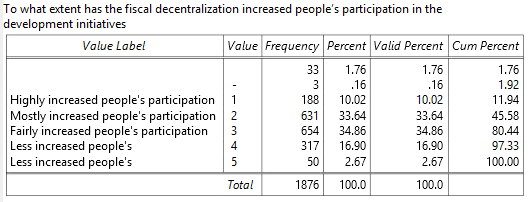

This particular segment focuses on the collected statistics. It refines the obtained data, concentrates on the findings, makes the author understand the theoretical aspects of fiscal decentralisation, and generates an idea for the research. The primary data that has been collected from the response of the public representatives and beneficiary groups would be analyzed to bring the finding from each question of the questionnaire. This chapter would further statistically analyze the collected data using SPSS with an aim to generate the outcome of interviews and to process them in order to present the primary research outcomes of economic development of Ghana through fiscal decentralisation.

Discussion

This segment will include explanation of the results by reflecting an analytical view of the research and confer validation of the findings. Further, the findings will be linked to real-life evidences where the stakeholders are influenced to respond to the implication and effectiveness of fiscal decentralisation in local government bodies of Ghana.

Summary, Conclusions and Recommendations

This will be the final and concluding segment where all the findings will be clubbed to arrive at a conclusion. Some important recommendations will also be made here. Any scope for further research will also be discussed.

Review of Literature

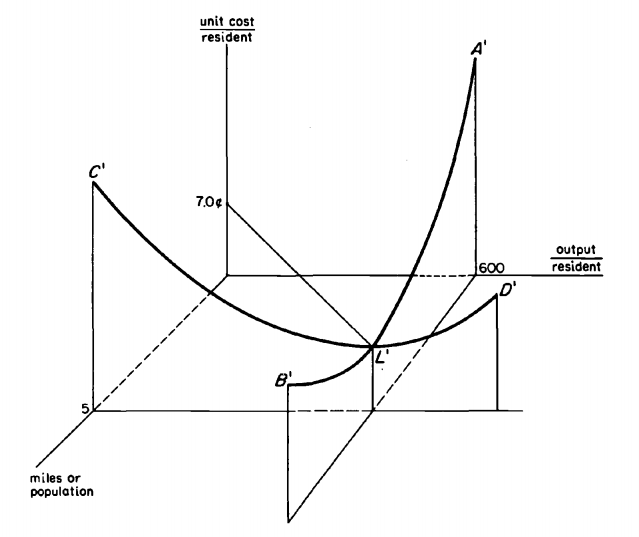

This literature review explores the theories of the fiscal decentralisation and different models with the aim to integrate motivation of the national policymakers and local governments and allow them to function under the factors that uphold the implications and effectiveness of fruitful fiscal decentralisation. Prud’homme (1995) argued that in modern era, the emerging economy draws its attention towards fiscal decentralisation and has significantly exploded due to a number of factors (forces). The most significant driving force is doubtful benefits that might carry out allocating and cost production efficiency.

But serious drawbacks, posed with interpersonal and inter-jurisdictional difficulties, hampered macroeconomic stabilisation programs. This dissertation has aimed to scrutinise the implications and effectiveness of fiscal decentralisation for public service delivery by the local governmental bodies of Ghana. The research also focuses on motivation of the national policymakers for further reformation towards a substantial socio-economic development.

Dege (2007) provided a decentralisation policy review of Ghana in 2007 with an ordinary conceptual framework of fiscal decentralisation. The framework defines how the government would run fiscal decentralisation. But considering the theoretical perspective, there were certain gaps and the government of Ghana has been implementing a policy review; it is crucial to have an elaborate investigation. In this context and in order to assess the implication and effectiveness of fiscal decentralisation in Ghana, the literature review has to be organised with wider approaches from the viewpoints of most prominent theoreticians in this area.

Thus, the proposed literature search would draw attention with concepts from growing transformation of the fiscal decentralisation with local and national orientation from the experience of different countries, their institutional approaches, business model and value chain, and local communities’ motivation. The purpose would be to identify the factors that influence the legislators and national government to standardise the fiscal decentralisation practice in Ghana. This literature review would be well thought-out with the aim to theoretically respond to the research questions from the viewpoints of prominent authors, researchers and most influential theoreticians, books, web resources, and journals aligned with the most recent development of the fiscal decentralisation literature.

The Theoretical Framework of Fiscal Decentralisation

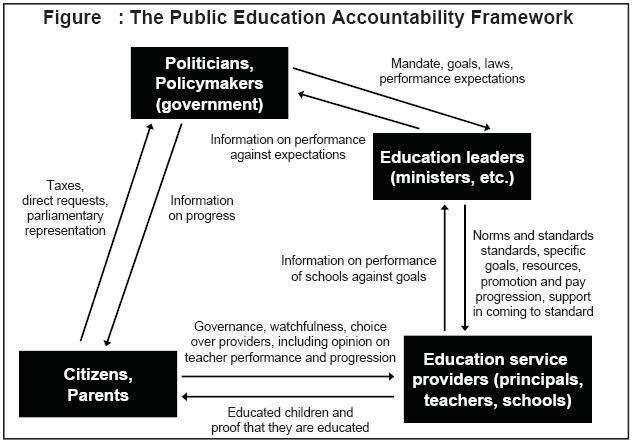

Decentralisation is a political agenda that has been prevailing as a process of increasing power at the level of the local or sub-national governments to enable better public service delivery to the local citizens through political administrative and fiscal transference, taking into account the regional interest. The concept of decentralisation has been clarified into three types, namely administrative decentralisation, fiscal decentralisation, and political decentralisation.

The theoretical framework of fiscal decentralisation deals with regional budget, local revenues, and legislative discretion of the local or sub-national governments for local taxation. Fiscal decentralisation should not be misunderstood to be pertaining to the fiscal policy or management, procedure of budgeting, or accounting standards. On the contrary, its function is to ensure effectual public service delivery through managing and administering the local government and collection of revenue in a manner that has been directed by the central government and concerned legislation.

Fiscal decentralisation has empowered the local or sub-national governments with a few rights to generate own revenues, but it does not allow them to reform the legislation according to their requirements. As a result, the local governments enjoy limited scopes to contribute towards the economic and social changes. Although the economic policy matters and the equilibrium of allocation among the regional governments are the at absolute discretion of central government, there are enough chances to hamper the development process or raise conflicts between the central and local government through fiscal decentralisation.

Both the supporters and opponents of decentralisation would theoretically promote the thought that fiscal decentralisation boosts the power of local or sub-national government, but a close investigation with the dynamics of fiscal decentralisation would evidence a horrible outcome at global level. The ongoing campaign and wave of decentralisation would possibly drive the world to spoil the conceptual framework of welfare economics and the core values towards planned and centralised welfare state. The theoreticians of fiscal decentralisation have rapidly developed their framework without any comparative study of planned and centralised economy.

They have focussed on the fiscal federalism theories that highlight the fiscal decentralisation as a higher degree of political involvement, democratic liberalisation, accountability to the people, and administrative autonomy along with fiscal efficiency. Such scholars have sidelined the comparative study of fiscal federalism or decentralisation and have concentrated on planned and centralised economy and have directed their criticism towards fiscal decentralisation. According to them, fiscal decentralisation generated soft budget constraints, macroeconomic volatility, and individualism that threatened the nationalism along with accelerated enlargement of bureaucracies. Strangely, they dropped out the comparison of economic indicators to centralised economy.

The historical evidence of decentralisation all over the world has no strong accord on the public welfare or economic emancipation through fiscal decentralisation. The features of decentralisation have delivered a boost to the powers of the sub-national officials, bureaucrats, political leaders, social elites and local rackets that ultimately nationalised corruption.

The legends of fiscal decentralisation such as the International Monetary Fund (IMF) and World Bank would like to consider corruption as ‘grease on the wheel of development’, which is a perverted outlook that may not support any economic development theories. Such logic of legalising corruption and irregularities inspire the local elites and rackets to support the spirit of fiscal decentralisation without considering the national interest or economic development; individual interest in the prime concern.

Beside the paramount literature of decentralisation, the real life evidence demonstrated that the economic development and poverty eradication is nothing but a cheap slogan. The empowerment of local governors, mayors, and other local representatives is not harmonically balanced and varies from country to country. The existing literature has failed to address the issue whether fiscal decentralisation always ensures the transfer of power to the local governments by maintaining balance of power between the central and local governments and also, whether there is any contribution of decentralisation towards the economic growth of a country.

On the other hand, the existing literature also failed to identify the masterminds who influenced decentralisation to make it a global agenda and a necessary condition for developing countries to get foreign aid from the UN and development agencies. Thus, the present literature has been aimed at bringing the factors that lie behind fiscal decentralisation to the forefront and to investigate the extent to which decentralisation is capable of contributing towards the economic growth of a country.

To do so, this dissertation would conduct a three dimensional investigation. In the first phase, it would concentrate on studying the descending redistribution of power that is gained from an obvious categorisation of decentralisation pedestal. The style of local authority in implementing the fiscal decentralisation will also be investigated.

Mastermind of Decentralisation

The United States’ federalism is the mastermind of influencing the rest of the world to align with decentralisation connecting with the core concept of democracy and good governance. The United States Agency for International Development (USAID) has fixed up its strategic objectives to patronise and promote decentralisation worldwide connecting with wider legitimacy and enhanced transparency along with accountability by reforming existing political systems towards more openness.

The organisation would provide financial assistance to the countries that implement decentralisation. According to USAID, the democratic decentralisation is the progression of shared vision and bilateral relationships among the central government and its local governments by ensuring people’s participation through democratic process of election; the engagement of election system at the grass root level would ensure sustainable democracy. Although the organisation upholds its chosen outlook dedicated to uphold the decentralisation along with democratic local governance, it has not mentioned what returns it gets through such voluntary alignment. It is also not clear why they spend a great deal of money for other counties while their home country is seriously affected by financial crisis and increasing job cuts.

The traditional sense of decentralisation pointed towards the diverse institutional reforms, while the economists in the public finance indicate decentralisation as an essence of fiscal decentralisation, aimed at improving the national and inter-governmental fiscal system as the top priorities with specific goals and objectives to gain economic growth. At the same time, academia in the field of political science considered decentralisation as an array of policy agenda that focuses on ‘who handles the power’ and ‘who are struggling’ to take control over the state machine through a democratic process at the local level.

The civil society and sociologists would consider decentralisation as a path of democratic local governance to ensure socio economic progress and people’s participation with local group’s involvement. This is the way in which USAID would like to demonstrate to the economists and social thinkers about the approach of decentralisation, but all the economists and social thinkers may not be in favour of such views and consider the real life evidences that are the results of decentralisation.

Theoreticians of international relations, who believe in the real life evidences rather than idealism, must express their doubt regarding the success of the United Nations and trustworthiness on its institutional framework to keep any positive impact on promoting global peace, even though they feel the necessity of such a noble platform. During the end of cold war era, the role of United Nations became suspicious and it failed to prove its natural responsibility as a global security provider, but has aligned to legalise American intervention in different independent territories; it echoes the voice of Pentagon by violating the principle of UN charter.

As a result, it has been argued by think tanks of the member countries that UN is no more efficient to control the concurrent global unrest or to stabilise the situation of natural and democratic stability, aligned with a lot of controversy of judgment. On the contrary, in the name of fight against terrorism and peacekeeping, it holds great potential for Americanisation. In this context, the UN and its different agencies including IMF and World Bank jointly campaign for fiscal decentralisation, even though denaturalisation has spoiled the prevailing political system of different countries, corrupted the administration, criminalised the public finance, and commercialised the public services.

The US Foreign Policy

At this instance, in order to understand why the United States of America is eager to patronise decentralisation, it is essential to keep a spotlight on the American Foreign policy. Core values of US democracy comprise of individualism, liberalism, and ethnocracy along with civic national identity. Its foreign policy upholds the historical characteristic of imperialism or neo-colonial politics of ‘divide and rule’ to ensure its unipolar state of power all over the globe. In the name of multi-polarity of foreign policy, the United States has established its unipolar status of international relations.

The country does not hesitate in initiating military intervention or economic oppression to ensure its exploitation; democracy, human right, and sovereignty of states are nothing but just vague slogans. In the name of fight against terrorism, it has violated all the prevailing norms and policies of world peace, conducted a number of military aggressions in different territories, and undermined the standard of international justice and human rights agenda. Moreover, the policymakers have assisted to generate liberal institutional provisions, to give up introductory values of the country to support specific groups of US Jews’ rights- regimes that have evidenced ethnocracy, which has inspired to abuse humanity in Abu Ghraib prison, Guantánamo Bay, Cuba, Iraq, Afghanistan, and Pakistan.

US Jews were fearful of being identified during the post World War–II era due to their close alignment with Nazis and they were charged by Roosevelt, the president of the United States, during that time. Due to official pressure they were eager to hide themselves from the masses. American Jews, with their continuous efforts, organised themselves as a pragmatic and effectual power. By 1967, they turned into a sub-national group with ethical alignment to influence the United States and the world in general.

In the concurrent year, the control of Jews over the US power and politics influenced its general election, where Jews had the power to decide the election of the President of the country. Instead of considering the political situation of the United States, the candidate who was capable of giving special care to Jewish interests was supported to be the President, regardless of his/her party alignment. Jews have tremendous control over the Federal Reserve Bank and the judiciaries of the country. Their incongruent power has flourished to influence the US foreign policy to align with Israel; this has hampered the global peace including Middle East unrest.

Although the US decision makers have the best scope to put forward humanitarian approaches for resolution of ethnic conflict, the US leaders prefer to choose inflexible ethnic solutions with strong militarily aggression, even if the situation does not demand ethnocratic solutions. The world has witnessed the US drive against Saddam by having a long military aggression. The model of approving rigid ethnic solutions that applied in Iraq has provided the global policy makers an opportunity to scrutinise the US policy in Iraq. It was established that there were no nuclear weapon in that Middle East country, but America affected millions of civilian deaths.

Even though this dissertation is not aimed at discussing the US foreign policy, a brief description is eminent in order to understand the reason why the United States and its developing agencies want to inspire fiscal decentralisation. In this context, it has been identified that the US foreign policy follows the divide and rule policy to weaken the countries with the aim to establish its influence and control on them.

Decentralisation seems to be an effective tool to divide and rule by creating conflict between the central and local government. Decentralisation is more effective to threatening the sovereign of the central government and by recognising autonomous local authorities while the local authorities or sub-national governments created by decentralisation would be entitled for their development decision making. At this stage, the sub-national governments could receive different foreign aid or loans from the US or UN development agencies.

With the critical terms of the loan it is easier for US policy makers to generate further conflict between the central and local government that ultimately helps to execute divide and rule strategy in the less developed countries. Thus, the decentralisation and divide and rule strategy is almost synonymous to establishing US influence on the rest of the world and this is why US foreign policy patronises decentralisation drives all over the world.

Centralism and Decentralism Good Governance

It is essential to find an answer to the question pertaining to good democratic governance that compares centralism and decentralism. In order to answer this question they explored normative models of democratic governance. It is understood that some democratic countries have better governance than others do because in the countries having better governance, political institutions promote enhanced social outcomes.

In order to understand the reason behind such difference in performance, it is essential to study the principles of democratic governance pertaining to centralism and decentralism. Neither centralism nor decentralism (individually) could ensure “good- governance”, but it requires a mixed approach of centralism and decentralism (which is termed as Centripetalism) to ensure an enhanced model of good governance with sustainable development.

The rising awareness about the best way to organise a representative democracy and good governance in past times gave birth to constitutional regime in England, France, and the US during the 1700s and 1800s. It has been proceeding with chronologically changes to deliver better governance. History suggests that the decentralised institutions moved forward and backward within two ideological grounds, one was decentralist paradigm and the other was centralist model. Between the two paradigms, the first one argues that good governance comes from the democratic institutions that follow the decentralisation system, where numerous powers for veto allow the system to form multiple sources rather than a single entry.

The second paradigm urges that good governance comes from effectively centralised single party sources that ensure enhanced accountability. Here, this dissertation reviews the historical arguments pertaining to the dominant models of governance. The primary purpose is to set up a new dimension of democratic governance, which amalgamates positive features and attributes of centralism and decentralism for the associated institutions and local governments of Ghana.

In real circumstances, the evidence of decentralism of modern era has accelerated with quite different scenario of theory and practice of decentralisation. The leading theoreticians view the decentralised institutions as a system to avoid straight popular statute and consider it as a moderate effect. On the other hand, some devious leaders are afraid that it (decentralisation) may urge for redistribution of wealth.

The elites do not like the decentralisation of power because they think that it would bring the people closer to the government; this, in spite of the fact that decentralised decision making has the prospect of good governance. There are some common perceptions about decentralisation that are prominent within the society and politics. This myth has enhanced the popularity of decentralised government and has helped in propagation of decentralisation drive all over the world.

A limited government and centralised administration could produce good governance as the human society has been developed by the individual requirements of the people but unfortunately, the governments are organised by the wickedness of evil people. The developments within the human civilization move forward with the collective efforts of the people. Resistance and encouragements by the people have generated appropriate direction for the governments to take the right action. Sometimes, the governments align with people’s choice and preference and at other times they try to impose evilness over the people, but the social progress and development never ends. Social changes or revolutionary shifts have been introduced by the well-organised and centralised political institutions that are distant from decentralisation; decentralisation isolates the collective efforts and hampers strong accord of ideological base.

‘Society in every state is a blessing’, while the governments in every country, including those called as good governments, are a necessary evil. Paine further suggests that the government prolongs the worst and impossible suppression inherited from the monarchy. Government established its hierarchy upon the palaces of the kings, ruining their paradise, and expect people’s conscience in obeying its orders.

Citizens have to necessarily offer a certain part of their assets to the government otherwise the government will take everything. Thus, in order to secure self and property, people have to pay tax. In exchange, the government protects for the rest of their property. Security is the true devise of government that people get with least expenditure and most benefit from the state, while the other public services have further costs; decentralisation would increase such cost.

Doctrine of Decentralism

In the concurrent era, most of the theoreticians of democratic governance have delivered their literature those are typically decentralist in nature due to their common postulation is that government would deliver best services to the people while political institutions would share their powers along with multiple autonomous bodies within the jurisdiction. Almost the ordinary citizens, NGOs, and international development agencies uphold such perception decentralism; there is nothing new in this paradigm as in the ancient era of earlier than modern age, the Greece and Romans presented their decentralism views to abuse of political authority of their monarchies which also evidenced in Italian, Swiss, and Dutch politics (Bahry, 2004).

Though there were, no theoretical framework of decentralism was not prevailed in that age a self-conscious awareness of the activists moved for decentralism, while the completely expressed theory of good governance and decentralism has originated and implemented from England during the seventeenth and eighteenth centuries following the English Revolution (Bahl, 1998).

The legal framework of Brittan had organised with three separate powers, exclusively independent from each other, where the King positioned at the top; in the second layer composed with Lords Spiritual and Temporal who were independent to their piety as symbol of aristocratically while the third layer composed with chosen people’s representative that called House of Commons. During that, it was a progressive form of decentralisation and separation of power that modelled as a democracy and chronologically improved as this collective authority put into action by diverse mechanism and conscientious to dissimilar interests through the British Parliament that has the absolute disposal to coordinate the three branches.

Each of the branch of separate three entries possess enough powers to repel any negative changes that may inexpedient and dangerous to the country’s sovereignty for which the theory of the mixed constitution has arrived with appropriate balance among the three parts and turned back to the Anglo-Saxon England. Such conception show the way straight to the theory of the separation of powers and articulated the great security aligned with a steady absorption of several powers in the same branch to provide appropriate guidance concerning who would administer every one of the branches essential to the constitutional means along with individual intention to mitigate possible encounters to each other.