Introduction

The defining characteristic of the Brazilian economy is its steel industry, which ranks it as the world’s number nine steel producer. Before the 2008/2009, global economic crisis the industry grew at a rapid rate and managed to put Brazil at a good economic pedestal, ahead of its other developing counterparts in Latin America and Africa. Like most steel-producing countries in the world, the post-economic crisis period has made the steel industry in Brazil record a lackadaisical growth, sometimes forcing the government to intervene in some companies where it has shared such as Vale. Following the two major global events that Brazil will host in 2014 and 2016, World Cup and Olympic Games respectively, there has been a growing need to expand the industry to avail raw materials for the construction of the dilapidated and inadequate infrastructure that is crucial for the success of these events (Louis and Chandler 126).

Accordingly, therefore, the industry is projecting a growth rate that would increase its capacity to produce 77 million tons of steel by 2016 up from the current 44 million tons (Buhler 2). Separately, the government is working on the modalities to smoothen the hitherto investment technicalities and bureaucracy in order to attract foreign direct investment in the industry. This paper attempts to forecast the growth of Brazilian Steel Industry through the presentation of data on future steel production and future production capacity investment.

Future Steel Production

The steel industry in Brazil has been underutilized both production capacity-wise and full exploitation of iron ore. Consequently, despite its importance to the economy, the output has been low since the industry’s privatization in the early 1990s. The poor infrastructure that the country adorns has conjured up the government to stir the rapid growth of the industry so that it can get the necessary raw materials for the construction of the woefully inadequate infrastructure in preparation for the games. Therefore, projections have been made for the future steel production in the next five to ten years.

According to Brazil Metals Report Q4 2010 (Buhler 2), the total amount of crude steel that would be produced by the entire industry would amount to 33.7 million tons, considering the slow growth occasioned by global financial crisis of previous years. The report further projected that steelmaking capacity in Brazil will increase in the coming years at the rate of 5 million tons per annum. This means that in the next five years when Brazil will be hosting the Olympics the industry will produce 63.7 million tons of steel. Another important factor that has increased the demand for steel in Brazil is the international economic bloc BRIC (Brazil, Russia, India, and China) that has forced it to expand its domestic industries and conduct trade with its partners.

The projected industry growth is attributed to the country’s economic growth and its steel producers’ advantage as low-cost suppliers of semi-finished steel products to the international market. The low-cost advantage is due to the presence of naturally abundant high-quality iron ore coupled with low energy costs and labor costs. The costs of raw materials are expected to rise, but profits are projected to remain above average for the next five years (Deforche et al, 21).

Even though the Brazilian steel industry has experienced exponential growth as a result, to a large extent on the local market, the rate of growth decreased in 2010 due to the importation of cheaper steel from foreign countries. The crude steel production increased by 24.3% year-on-year (y-o-y) to 32.94 million tons in 2010, whereas hot-rolled output grew by 25.0% to 23.31 million tons (BMI para. 1). Given the influx of cheap imported steel, domestic companies were forced to cut production costs and further reduce prices by as high as 20% to avoid accumulation of inventory.

In order to protect the domestic steel industry, the Brazilian government has imposed a minimum import price for about 16 types of steel products such as wire rods and rebar hot-rolled and cold-rolled steel. This has helped reduce significantly the growth of imports since late 2010. With the low prices of Brazilian steel compared to that of the international market, the Brazilian tax authorities assign low prices to the targeted products based on their costs of production. Therefore, importers must pay an additional tax of 12% on the minimum prices instead of paying the actual value (BMI para. 2).

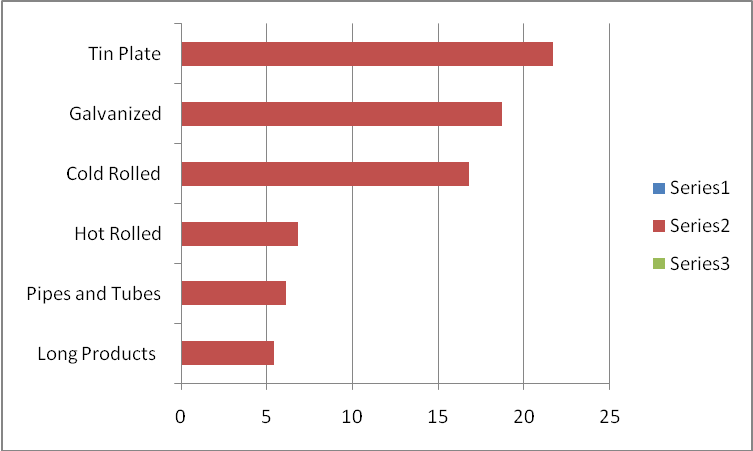

The figure below is a bar graph that depicts the anticipated annual growth rate of steel production since the Brazilian government’s protectionist policy was applied to the steel importation market.

Future Production Capacity Investment

In 2006, the Brazilian steel reached an installed capacity of 37.1 million tons up from 28.3 million tons a decade ago, thus recording an annual growth rate of 2.5%. The government’s resolve to abandon its protectionist policy and fully exploit the potentials of the steel industry has been occasioned by poor infrastructure that awaits two major world events: the 2014 World Cup and the 2016 Olympics. Therefore, the Brazilian steel industry began a new investment phase with the annual investment of US$2.18 billion used between 2005 – 2010 (Verax 27). Moreover, the Brazilian Steel Institute (IBS) recently released its forecast on install capacity for 2012 as follows: 52.2 million tons of existing plants; 6.3 million tons of new plants; and 7.5 million tons of plants under study. In total, IBS projected that an installed capacity of 66 million tons would be achieved by 2016. The table below shows the capacity of the main Brazilian steel companies from 2006 – 2016

(Adopted from Verax, Economic and Financial Feasibility Study of LLX Logistica S.A.)

Conclusion

The growth of Brazilian Steel Industry has been brought about by Brazil’s membership in BRIC economic bloc that fosters trade amongst its partners. Brazil realized belatedly that it was endowed with high-quality iron ore from which it could use to produce the steel needed to spur economic growth. This led to the privatization of the industry in the early 1990s. Even then, the industry had not picked up due to lack of proper investment, lack of skilled workforce to manage the companies, and poor government policy on importation of steel. However, the country’s choice to host both the World Cup in 2014 and the Olympics in 2016 has brought the government to the consciousness of the need to build inadequate infrastructure. It thus started by redefining its policy on steel importation and foreign direct investment to revive the full potential for the industry. Accordingly, most companies expanded their production capacities and projected a substantial increase in their total output by 2016. The total amount of steel produced by the industry is projected at 77 million tons by 2016.

Works Cited

BMI (Business Monitor International). Brazil Metals Report Q1 2011. Brazil Metals Report Q1 2011 Market Research Report.

Buhler, Rudolf. Brazilian Steel Industry- An Overview. Dehli, India: Brazil Steel Institute, 2011.

Deforche Filiep, Hemerling Jim, Kim Dowon, Piacsek Walter, Shanahan Michael, Wolfang Meldon, and Wortler Martin. Beyond the Boom: The Outlook for Global Steel. The Boston Consulting Group, 2007.

Louis, Regis and Chandler, Gary. Brazil: Lonely Planet Brazil. New York, NY: Lonely Planet, 2010.

Verax, Economic and Financial Feasibility Study of LLX Logistica S.A. Web.