Introduction

In the last few decades, the world has witnessed increased integration of the global economy which has resulted in new opportunities for economic and income growth (OECD, 2007). For developed nations, it opens new markets for goods and services. For developing countries, it contains the promise of increasing the scope and rate of economic growth, and the improving of their industrial activities. One of the significant driving forces is globalization as it has been characterized by the production of manufactured goods and services, linked and synchronized on a global scale thus opening significant opportunities in all regions. At the same time, these effects have been experienced at various levels-individual, organizational, sectoral, national and regional. Because these losers involve the same participants in the process of global integration, there is a need to reconsider the mode of inclusion into the world economy in order to make sure that incomes are further polarized.

In that respect, the purpose of this paper is to focus on value chain as a tool that can be analyzed to provide important insights to the issue of globalization. The focus here is on the value chain analysis associated with the dynamics of inter-linkages in the productive sector, particularly the manner in which organizations are globally integrated. The rationale here is that value chain analysis surmounts many of the significant weaknesses of conventional sectoral analysis. That is, it goes beyond the firm-specific analysis found in the larger part of the innovation literature. The concentration on inter-linkages allows for the uncovering of the dynamic flow of organizational, economic and coercive functions between firm units, yet on a global scale.

The paper starts by explaining what value chain is and at the same time highlighting the importance of analyzing it. It further proceeds to investigate on how IKEA and Reebok have constructed their value chains to underpin and strengthen their business strategies. An evaluation of the aspects associated with these value chains using VRIN criteria is also important because it relates directly to the competitive advantages of the firms. In as much as the value chain corresponds to the issues of globalization, so do its analysis correspond to the identification of the organization’s strategic resources which should be managed and applied to achieve comparative or competitive advantage.

Defining the Value Chain

According to Antoniou, Levitt and Schreihans (2011), the value chain concept was first developed by Michael Porter in his work of implementing competitive advantage to attain superior business performance. His definition of value was the amount customers are willing to pay for the products offered by a firm. Therefore, he visualized the value chain as the amalgamation of several generic value added functions operating within a firm. Porter further connected the value chains between organizations to come up with a value system; although, at present environment of greater collaboration and outsourcing, the linkage between firms’ value creating activities is usually referred to as value chain. The principal focus of value chains revolves around the benefits that relate to customers, the mutually supporting activities that generate value and the ensuing demand and flow of funds that are created.

Respectively, value chain analysis describes the processes around and within a firm, and links them to an evaluation of the competitive strength (Popescu & Dascălu, 2011). Hence, it assesses which value each specific process adds to the firm’s products and services. The backbone of this notion was the fact that organization is beyond the accidental collection of people, money, machinery and equipment. Maitland and Sammartino (2012) assert that the capacity to undertake specific activities and to control the connection between them is the core source of a firm’s competitive strength.

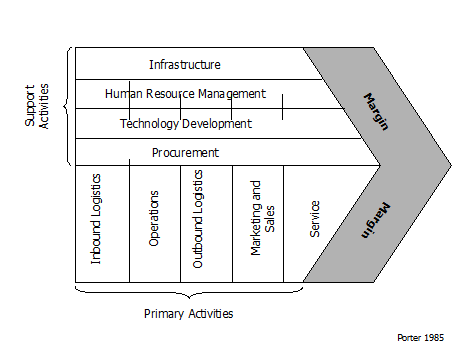

Primary activities and support activities are distinguished in a value chain (Bititci & Carrie, 1998). Primary activities deal with the generation or distribution of a good or service. They comprise of five major categories: outbound logistics, inbound logistics, operations, marketing and sales, and services. There are links between primary activities and support activities which assist in enhancing efficiency. The secondary activities comprise of four categories: infrastructure, human resource management, technology development and procurement. The value chain is described by the model shown below:

The part reflected as the “margin” shows that firms attain profits that rely on their capacity to control the linkages between primary and secondary activities in their value chains. This means that the firms are capable of delivering a good or product for which the buyer is willing to pay a higher price than the total sum of all activities within a value chain. Indeed, effective value chains should generate profits as noted by Bhatnagar (n.d., p.27). Otherwise, the organization will be destroying the value perceived by customers in its goods or services.

Reebok Value Chain Analysis

Reebok value chain revolves around the organization of four primary parts: supply of raw materials such as synthetic and natural fibers; provision of gears like fabrics and yarns by textile firms; production networks such as foreign contractors; export channels enabled through trade liaisons; and marketing arrangements at the retail level (Adidas Group, 2010).

Primary activities

- Inbound logistics. Reebok has integrated an effective management of inventory. For example, the company ensures that it has sufficient raw materials in its warehouses. On a global perspective, inbound logistics in Reebok might also imply manufacturing units in Asia, America and other parts in Europe. Within these units, facilities are spread across 14 countries with own warehouses (Adidas Group, 2010, p.78). Most of the footwear sold by the company is produced in China while India leads in attire manufacturing. Approximately, half of the total apparel sold by the firm is manufactured in India.

- Operations. According to Meiners (2004), Reebok has a well developed research and development department. The department is charged with the responsibility of new product development and improvement. Reebok also installed the current technologies in its manufacturing plants and laboratories. This has enabled the firm to be effective in producing high quality sports products. In addition, Reebok has developed an internal creative team that oversees the implementation of innovations originating from the research department.

- Outbound logistics. In an effort to ensure that its products are effectively distributed, Reebok has developed an efficient distribution network by establishing a number of franchised stores, directly managed dispensation counters, and directly managed retail stores. By 2011, Reebok had established 1,300 franchised stores in India, 138 directly managed retail stores and 299 directly managed dispensation counters (Sportzpower, 2012). The company has also developed a comprehensive distribution and dispatch system that comprise of shipping and flying networks.

- Marketing and sales. The firm’s management team has appreciated the fact that its success depends on the effectiveness with which it conducts marketing and sales activities. To be successful in its marketing and sales activities, Reebok Company has incorporated the concept of continuous market research. Furthermore, the company has also incorporated the concept of Integrated Marketing Communication. As Texier (2000) confirms, this is an effort to understand the needs of its diversified markets and different segments. Sports products are ultimately positioned according to those market needs as the company engages in various activities of the Integrated Marketing Communication.

- Services. Reebok has managed to attract and maintain a large customer base. According to company’s annual reports, Reebok Company has attained this by integrating favorable after-sales services and ensuring that its products are of high quality (Adidas, 2010). The main goal is to make sure that its customers reach a high level of satisfaction. Mark, Philip and Adrian (2007), who are renowned marketing professors, assert that offering after sale services is an effective way of enhancing the customer experience.

Support activities

- Procurement. Reebok has developed an effective procurement system through effective management of its outbound activities. This has significantly contributed towards its effectiveness in undertaking its production activities. Reebok has also nurtured an effective relationship with its suppliers. These producers are mainly located in Asia where low materials and skilled labor are available at a cheaper cost.

- Human resource management. Reebok’s management team considers its employees as one of its most vital asset. In addition to employees, the activities also involve the management of work councils, trade unions, acquisition risk and work stoppage (Adidas, 2010). As a result, the firm has incorporated efficient human resource management strategies such as effectual employee remuneration, employee training and development. This has contributed towards increased employee motivation.

- Firm’s infrastructure. To attain efficiency in its operation, Reebok has designed an efficient organizational structure that is composed of different departments. The departments in the firm include Research and Development, Finance, Marketing and Sales, Human Resource management and Information Technology. These departments work jointly through the vital focus on achieving organizational goals.

- Technology development. Reebok has appreciated the importance of continuous product innovation and development. As a result, the firm has established several laboratories which are used in the process of product development such as undertaking mechanical testing of the footwear products. To maximize its sales revenue, the firm has adopted e-commerce strategies through the integration of online shopping. Acquisition of Business intelligence (BI) applications such as SAP information management is part of technology improvement (Reebok, 2004, p.16).

VRIN Framework

- Valuable. In its operation, Reebok has been able to develop a number of internal strengths. One of the firm’s valuable strength relates to its ability to carry out complex inbound activities. Over the years it has been in operation, Reebok has been effective in controlling inventory. This has enabled the firm to maintain effective flow of raw materials necessary for the production of its sports equipment. The other value lies in the firm’s ability to outsource operations to regions where the input cost is low.

- Rare. Since its establishment, Reebok products have achieved substantial recognition in the global market. One of the factors that have contributed to this achievement is the effectiveness with which they enhance the performance in different sports. Additionally, many sportsmen consider Reebok products as their brand. This has significantly contributed to the firm’s competitive advantage.

- Inimitable. Reebok Company has developed a strong relationship with its customers. As a result, the firm has been able to develop a strong customer loyalty. Despite the large number of firms in the global sports equipment industry, many cannot be able to replicate the customer loyalty that Reebok Company enjoys.

- Non-substitutable. Reebok Company has sufficiently developed its distribution network and supply chain management. Despite the fact that other firms can copy its strategy, they cannot perfectly substitute the firm’s strategy.

IKEA Value Chain Analysis

Sekhar, a strategic management specialist asserts that an organization’s value chain illustrates a firm’s commitment towards delivering value to its customers (Sekhar, n.d, p. 115). IKEA has integrated an effective value chain that is composed of primary and support activities in an effort to satisfy its customers hence attaining its organizational goals.

Primary activities

- Inbound logistics. IKEA has established a wide base of producers and supplies responsible for the manufacturing and supply of furniture parts. The extensive array of regional warehouses is integrated with an efficient management of inventory driven by the need to ensure that the right parts go to the right customer at the right time. Storing the furniture components as a single package is a cost saving approach as the stores need not to be as big as might be expected (Gillespie, Jeannet & Hennessey, 2010).

- Operations. IKEA has continued to expand and increase its customers across all its market segments. Isaksson and Suljanovic (2006) observe that IKEA is the only firm in the furniture industry that has managed to attract customers across the world without changing the original concept of management. This has been achieved through the development of unique product designs with basis on an almost sacred dedication. Other operations include market and product research which add to the competitive strength of the business.

- Outbound logistics. In an industry that is considered local by many, IKEA has become global as a result of its comprehensive distribution network. Presently, the firm delivers low cost quality furniture to major markets across the globe. Indeed, it is the only distributor in the industry to have established on a global scale. It has stores spread in Europe, North America, Asia and recently established operation in the Asian Pacific. Low cost distribution is enabled through the innovative way of dealing with logistic sourcing and retailing whereby the products are knocked down and shipped in flat boxes (Gillespie, Jeannet & Hennessey, 2010); involving consumers in value addition by transporting and assembling the furniture by themselves.

- Marketing and sales. Marketing in IKEA is accomplished through the renowned IKEA catalogue which has existed for years. This marketing tool is the cornerstone in the firm’s concept and is distributed freely to the households within the stores’ principal market areas. The sales are driven by the numerous customers visiting the stores as a result of the catalogue. Every year, the company experiences an increased number of visitors due to the new products advertised though the catalogues. No other forces drive sales in IKEA much like the catalogue which is reinforced by the homely environment of the stores.

- Services. The great success of IKEA has been enabled through the homely services offered in the stores. The stores have been likened to IKEA homes where a customer can get any household services including dining, children playing zones and instructions on how to assemble products on their own. This kind of high-level service maintains the attractiveness to and competitive advantage of the firm.

Support activities

- Procurement. To establish a long standing competitive advantage, IKEA has put an emphasis on the area of strategic sourcing. The firm has developed a durable partnership with furniture manufacturers and other suppliers. As Gillespie, Jeannet and Hennessey (2010) note, this relationship is founded on the capacity of these stakeholders to supply long runs of components. These producers are mainly located in regions where low materials are available, especially in Scandinavian forests which form the larger part of the material base.

- Human resource management. In order to have an effective and motivated workforce, IKEA has adopted unique management style and practices. Managers are expected to share information with employees as well as their knowledge and skills. Employees at all levels are encouraged to make own decisions and making mistakes is appreciated as ‘learning by doing’. The management approach in IKEA is egalitarian which makes it easy for motivated staff to climb the ladder with little training (Nankervis, 2005). The IKEA-Way supports employee development through discussions rather than extensive, costly training programs. This is one of the activities that contribute to the success of the low-cost strategy pursued by the firm.

- Firm’s infrastructure. IKEA’s organizational structure is vertical integration where hierarchy is not emphasized. In many stores, there are just three levels of responsibilities separating the manager and employees. In fact, employees are referred to as co-workers and problem solving as well as decision making is through consensus.

- Technology development. IKEA uses modern technology such as RFID when shipping products as a way of managing inventory effectively. Producers have also been encouraged to use new technologies when manufacturing components to an extent of the firm providing them with technical assistance in order to increase productivity. The firm has also created a lasting relationship with technology firms in an effort to track new technologies.

VRIN Framework

- Valuable. The strength of IKEA at present originates from its mastery of three major elements of the value chain: unique sourcing; tightly controlled logistics; and unique design capabilities. Therefore, the firm is able to offer products that are unique enough to give market recognition, reduce inventory, and secure sourcing for long-runs. This strength has ensured that the firm leads in the industry and steadily increases the market share.

- Rare. Throughout history, IKEA has been able to produce new designs and offer products just next-door from the stores. Isaksson and Suljanovic note that IKEA is the only industry player that has been able to offer a variety of designs to a wide customer base (Isaksson & Suljanovic, 2006). Indeed, it is widely accepted that IKEA leads in those two aspects.

- Inimitable. As the activities of the value chain suggest, IKEA has strong relationship with their customers starting from the products offered to the services given. Many of the competitors lag far much behind in terms of customer loyalty and the few that surface are only known to the locals. IKEA enjoys global recognition due to its ability to offer the typical Swedish furniture taste, yet with a sense of the differing consumer needs.

- Non-Substitutable. The iconic aspect of self-assembly emphasized in IKEA is more of an imagination. The developments that have led to this achievement have taken years and whole commitment of the firm leaders. Even if the other competitors tried to imitate such an approach, they will not only invest costly in building trust with producers, but must do better than IKEA to dissolve the recognition the company has gained.

Conclusion

Globalization has been the force behind the integration of the global economy, yet it has led towards unequalization within and between economies, and an increasing occurrence in the absolute degrees of poverty. This has changed the norm of determining the basis of firms’ competitive strength and comparative advantage calling for more effective tools. Consequently, the value chain which refers to the amalgamation of several generic value added functions operating within a firm has proved to be an effective tool for analyzing the strategic position of a firm. It consists of primary and support activities that are interlinked in such a way that effective management of these linkages lead to profitable performance.

The analysis of Reebok and IKEA value chains suggests that the firms have strategically developed competencies and acquired resources that influence the attainment of strategic goals and objectives. The aspects that are critical to Reebok’s competitive advantage as identified through VRIN analysis include efficient control of inventory, substantial recognition in the global market, strong customer loyalty, and comprehensive distribution network and supply chain management. For IKEA, the critical aspects include unique sourcing, tightly controlled logistics, unique design capabilities, strong relationship with their customers and self-assembly service offered to consumers.

References

Adidas Group. (2010). Annual report. Web.

Antoniou, P. H., Levitt, C. E. & Schreihans, C. (2011). Managing value chain strategy. Journal of Management & Marketing Research, 9(1), 1-11.

Bhatnagar, A. (n.d). Textbook of supply chain management. New Delhi, India: Sanbun Publishers.

Bititci, U. S. & Carrie, A. (1998). Strategic management of the manufacturing value chain: proceedings of the international conference of the manufacturing value-chain, August ‘98, Troon, Scotland, UK. New York, NY: Springer.

Gillespie, K., Jeannet, J. & Hennessey, D. (2010).Global marketing. Florence, KY: Cengage Learning.

Haag, S., Baltzan, P. & Phillips, A. (2006).Business driven technology. New York, NY: The McGraw-Hill Companies, Inc.

Isaksson, R. & Suljanovic, M. (2006). The IKEA experience. Web.

Maitland, E. & Sammartino, A. (2012). Flexible footprints: reconfiguring MNCs for new value opportunities. California Management Review, 54(2), 92-117.

Mark, S., Philip, L. & Adrian, T. (2007). Research methods for business students. London, UK: Prentice Hall.

Meiners, A. (2004). Reebok International case. Web.

Nankervis, A. R. (2005). Managing services. London, UK: Cambridge University Press.

OECD. (2007). Making the most of globalization. OECD Economic Surveys: United Kingdom, 2007(17), 17-56.

Popescu, M. & Dascălu, A. (2011). Value chain analysis in quality management context. Bulletin of the Transilvania University of Brasov. Series V: Economic Sciences, 4(2), 121-128.

Reebok Inc. (2004). Annual report. Web.

Sekhar, G., (n.d). Business policy and strategic management. London, UK: IK International Publication.

Sportzpower. (2012). Adidas to shut 300 Reebok India stores; ex-country head prem sues over sacking. Web.

Texier, F. (2000). Industrial diversification and innovation: an international study of the aerospace industry. London, UK: Edward Elgar Publishing.