Abstract

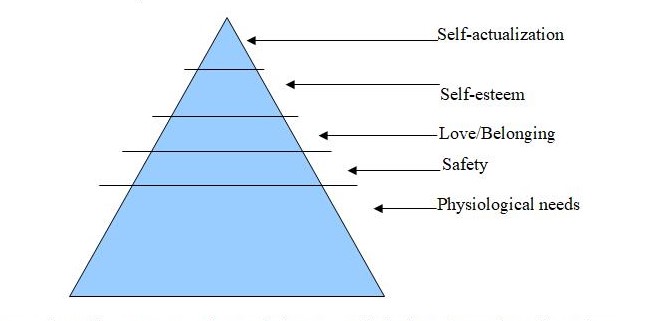

The recession has affected the world economies since 2008. Due to the connectivity of world economies, what started as US economic problem was replicated to other economies in Europe and Asia. Unfavorable climatic conditions in less developed countries of Africa only aggravated the worse situation. Many citizens who depended on the government for social welfare suffered as the economic policies required reduced spending of the government. On the other hand, governments’ economic policies encouraged people to spend more so that they could revive activities in the economy. Due to panic, many people focused on saving as opposed to spending. This reduced the governments’ revenue from taxes. Areas that were directly financed by the government were affected. Among the areas that were affected were the social welfare and medical sector. The government’s intervention of bailing out companies, lowering commercial banks’ interest rates did not encourage people to spend more. It is through spending that governments can levy taxes. With the slow economy, governments are not able to collect revenue that they can use to run their operations. Due to reduced remittances, groups of people that depend on the government are also forced to cut their spending. According to Maslow’s hierarchy of needs, people move down the pyramid towards physiological needs being the most basic. When there are constrained incomes, people tend to reduce spending on needs that are higher in the pyramid. Most of the old populations rely on the government for their upkeep. Due to the rising cost of living, inflation, and rising unemployment, the general welfare of people is affected. In line with hard economic times, old people also cut down on leisure which includes traveling. The economic slump in different economies has affected the livelihoods of its citizens.

Introduction

Since 2008, world countries have experienced a downturn in their economy. In what economists have called global economic recession, different countries have found themselves in a slump after the collapse of the Lehman Brothers in the US in 2008. Due to the speculative nature of the real estate, there was panic in the US economy occasioning what was later described as the ‘bursting of the real estate sector bubble.’ Over time the sector infected other sectors of the economy causing an increase in oil and food prices (Hurd et al., 2009). The rise in oil and food prices raised the cost of living. The rise in the cost of living affected the disposable incomes of individual citizens and hence lowering the purchasing power and a drastic drop in individual spending. Drop-in purchasing power lowered the revenues governments were collecting from companies. A decrease in tax collection affected the entire sector of the economy. Government-supported programs like the social securities were affected (Mankiw, 2009) and the old population that depends on the government was forced to tighten their spending. Among the issues that were affected were leisure spending and traveling. Demand for leisure traveling was also lowered with the deepening of recession problems.

The recession has persisted until now. Economists blame the lack of appropriate oversight and control of asset prices as being the cause of the global recession. As of 2007, property prices were increasing at a very high rate across many countries in the world. Failure to control this trend resulted in the bursting of the economic bubble (Hurd and Rohwedder, 2010). Even government intervention through bailing out of companies did not improve the confidence of investors. Due to the interconnectivity and interdependence of different world economies, more countries are finding themselves unable to finance their budgetary requirements. Different sectors were greatly affected during the economic recession. First, countries that relied on tourism and other leisure industries like hotels were most affected. When the public is faced with choices to make, people make a sacrifice on the expenses in life that do not add value to their lives. Among the areas that are affected is the leisure sector. Tourists cut down on traveling as opposed to when they have more disposable incomes. Due to reduced incomes, people tend to cut down on spending and resulting in savings. The uncertainty of the future causes panic among high-end spenders.

Governments support the older population in social support networks. During a recession, the government must cut down on spending while encouraging people to spend more. Through public spending, governments levy taxes, and therefore they can support other programs including supporting the aged population (Hurd and Rohwedder, 2010). Older tourists have a higher propensity to spend as compared to younger tourists who are more concerned about the future. However, old people reduce their spending as they rely on remittances from social securities. When disposable incomes come down, so are the remittances to social security. And therefore supporting the older population becomes a problem.

Secondly, during the period of recession, the world was experiencing a problem in droughts due to problems of global warming. This caused a reduced food supply. There was a resultant increase in food prices. More government funds were channeled to feeding people rather than in development expenditure. More citizens lost their jobs and were not able to support their families (Mankiw, 2009). When citizens are faced with constrained incomes, they reduce some of the expenses that are not vital to their survival. Among the expenses that face truncation is leisure. Tourism and travel being part of the leisure activities have suffered most due to the reduced income of citizens.

Thirdly, being a large economy, a slump in the US economy has indirectly caused many other countries both in the developing, developed, and the underdeveloped world; to suffer from the ripple effects of the recession. These ripple effects have not only affected individual economies but also affected individuals in their respective countries. Loss of jobs and reduced purchasing powers by individuals had the cumulative effect of slow economic growth.

Statement of problem

Economic activities in different countries have been affected by the recession and more workers continue to lose their jobs as the financial predicament continues to affect various sectors of the economy. However, people that suffer more are the older people. This is because they depend on the government’s social security. When governments cut on expenses, retirees must contend with lower income. The uncertainty of the economy also drives them to be wary of the future. When the future becomes uncertain, the old population must scale down on unnecessary expenses. Among these expenses are holidaying and leisure travel.

Research Questions

In any research, it is imperative to define the guiding parameters of the research. Among these parameters are the researches questions that the study must strive to answer. This research analyses the relationship between recession and cutting of expenses in leisure travel. The study seeks to answer fundamental study questions:

- What are the effects of the global recession on the leisure spending of older people?

- How do reduced remittances and reduced government revenue affect the social welfare of old people?

- What is the relationship between the incomes of different countries and the purchasing power of their people?

- What are the effects of the global recession on the stability of world countries?

Objectives and aims of the study

Due to the interdependence of the world economies, what affects one economy has a direct impact on other economies. The study seeks to establish the link between economies as well as the link between their population and their respective governments. The study specifically looks at the effects of the recession on the spending of older people, especially on leisure traveling. To achieve this goal the study seeks to achieve the following objectives:

- To establish the correlation between spending and the revenues of governments.

- To outline the effects of the recession on the spending of older people.

Study assumptions

The study assumes that what affects one country could be a direct replica in other countries if all other factors are held constant. This means that solutions in one economy can be used to solve problems in other economies. The study is important in understanding how the recession has affected older people and what measures governments can take to alleviate the suffering of its people especially those who are already retired. Even though studies have been conducted on the impact of the recession, few have been conducted on the impact of the global economic downturn on the aged.

Literature Review

Many economists relate recession with falling property prices, rising costs of living, and the burden of personal debts. As expected those people with low incomes are most affected by the recession. More so are the people who rely on the government (Ewing, 2009). Old people rely on social securities because most of them are no longer in the working bracket. This group is also at risk of many diseases and therefore spends more on the government-sponsored health sector. If the government earning are reduced this is the group that feels the effects ahead of other groups. Traveling becomes a luxury that most of the people in this group will have to do away with as they concentrate on more core and essential services.

Definition of Recession

A recession is defined as a slowdown in economic activity in a specific geographical region (Ewing, 2009). Among the issues that are affected during the recession are the household incomes, closure of companies, rate of inflation, level of unemployment, and growth in Gross Domestic Product of a particular country, among others (Ewing, 2009). During this period of the economic slump, the government spends more on medical support for its citizen and social securities than the amount they are collecting from the employees’ remittances. In many countries, both medical care and social security are financed by workers’ payroll taxes.

Economists approach the issue of recession from different perspectives: lowering government taxes hence lowering prices of most commodities and therefore encouraging people to spend more; bailing out companies that find themselves in the eye of the storm of recession hence keeping them afloat so as not to cause panic in the sector or cause them to collapse; and encouraging commercial banks to lower interest rates to encourage people to borrow money and hence spend more (Manning, 2009). However, due to the panic already inherent in people, these measures may count to nothing as people are focused on saving as opposed to spending. Older people are more averse to risks compared to young spenders. This is because they have already passed their productive years and hence rely on their savings. When spending is cut, leisure suffers most before important and more essential spending is affected.

A combination of the above measures by the government can remedy an economy that is undergoing a recession. However, the current global slump has defied all these interventions as economies continue to suffer losses (Hurd et al, 2009). Pumping money into economies has not raised confidence in people to affect the way they spend money and therefore lifting their economies from recession.

During the recession, economies tend to reduce their imports while expanding exports to spur growth within their economies. However, as more economies look inward in trade balances, they suffer in isolation. Governments embark on stimulus spending by pumping more money into the people to encourage them to spend more.

How to detect Recession

Many recessions can be predicted through the behavior of the stock market. When there is panic in the economy, people tend to liquidate their shares. As more people move to liquidate their shares, share prices fall. A fall in share prices causes a shrink in investor confidence in the stock market. Companies that are listed in the stock exchange, get less money to finance their operations. If companies are not able to make money to sustain the expansion, then retrenchment and laying-off of workers follow. This raises the rate of unemployment hence straining the purchasing power per household.

Relations between recession and leisure spending among older tourists

Standards of living are dependent on wages and salaries. These wages and salaries are affected by the profitability of companies that individuals are working for. If companies register reduced profits, then the resultant effect is to cut down on spending. Among the measures is reducing welfare benefits to its retired employees. Loss of jobs causes instability of families and individuals’ health through stress and stress-related diseases. A high standard of living leads to the break-up of many families. The pressure of life affects their health and hence the government spends more on the health of its people when they are making less money from the collection of taxes.

The cyclic effect of recession is delicate to contain. While interventions by governments may reduce losses that different companies incur, cutting on leisure becomes the instinctive way for companies and individuals to reduce their costs.

Research Model

A research model is the general overview of interrelated constructs of expression of the issues under investigation (problem domain). In this case, the study will explain the relationship between disposable incomes and reduced spending on leisure for older people. This is a group that relies on social security and whose budget is high in terms of medical support from the government. The research model, also called the research paradigm, will comprise concepts that are related to explaining the problem.

This research is aimed at explaining the relationship between hard economic times (recession) and the spending on leisure among older people. The research is conceptualized under the assumption that the productivity of older people is lower than their counterparts at lower ages. If a company must offload some of its staff, then the less productive older people are likely to suffer (Lincoln and Guba, 2000). On the other hand, instead of these older people retiring as expected, they may opt to extend their working years due to hard economic times. Both of these issues affect their purchasing power occasioned by the recession.

In this study, research models will identify concepts like incomes, purchasing power, per-capita income of individual countries, and how these issues are related (Gall et al., 1996). The research will endeavor to relate assumptions and theories with income and spending especially of the older population. This is the group that is dependent on the government for its survival.

The research defines the problem that compounds itself. While it appears natural on the onset, it acquires a life of its own. Different aspects of recession take a cyclic nature as people withdraw from purchasing commodities that are not essential in their lives; they perceive that saving would make life better (Patton, 1990). However, by reducing their propensity to purchase, the government does not have the requisite income to provide services to its people. Reduction in revenue affects the entire economic sector. Among the people who suffer most, are the ones who rely on the government in social security and provision of medical cover. A majority of this group lies with an aged population who are outside the working bracket. When they cut their spending, travel, holidaying and tourism are among the areas that suffer budgetary cuts.

For households experiencing reduced income levels, the most probable adjustment would be to cut down on spending. According to US Health and Retirement Study, financial distress increases the probability of delaying retirement. This is due to the uncertainty of social welfare. According to the report, people aged between 50 and 61 expect to work full-time so as increase their savings.

The government’s expenditure is directly related to the revenue collected from its citizens. These revenues depend primarily on taxes. When people spend more, governments collect more taxes, and therefore they can provide services to their people (Manning, 2009). If people become apprehensive in spending, then it means that they will not be enough taxes levied to support government operations. Among the operations that are likely to suffer is social welfare for the aged and their medical cover.

The study seeks to explain how remittances for the aged population are affected by reduced purchasing power. If these citizens do not spend money which they are supposed to get from the government, then money for leisure activities like traveling and tourism will not be available. These are the activities that reduce the pressures of the aging population. If the government cannot support this group, there is an increase in panic in the economy and the cycle repeats.

Table 1: Different Countries compare the Gross National Income and the Social Support Network

It is evident from the table above that social support network is closely related in Gross National Income. For developed countries like US and UK their social support is higher than less developed countries like Kenya. However, more leisure spending among the older population is more evident with people from developed countries than it is less developed countries. Movement of tourists outside the country is from developed countries to less developed countries.

Research Methodology

A research paradigm has been defined as a set of theories under which the research is based. A research paradigm is the world view of the problem under investigation: in this case the impact of the recession on leisure traveling for older people. A paradigm, therefore, gives a conceptual framework through which the researcher sees and understands the problem (Gall et al, 1996).

The research methodology, therefore, defines how research designs were formulated, how data was gathered and interpreted, and how results were presented. According to Macdonald et al, (2002), there are many research paradigms ontological (study of reality and how incomes affect people’s purchasing power and ability to spend); and methodological approach (deducing how people’s ability to spend are related). Based on trends of economies and people’s behavior, methodological study leads to an understanding of how purchasing power affects other sectors of the economy.

The research will use a combination of both qualitative and quantitative approaches to painting the picture of the impact of the recession on the leisure traveling of older people (Creswell, 2003). The research will use analysis of reports and data available from different countries according to how they have been ranked in support of their older people in comparison to the national resources committed to this course.

In qualitative research, the analysis will be based on how data collected supports theories that have been explained. It gives the fundamental relation between empirical observation and the mathematical data collected. In qualitative methods, general conclusions are arrived at after a general trend has been established from the data collected (Lincoln and Guba, 2000). Qualitative methods are used to verify the hypothesis. Unlike quantitative methods, the qualitative approach involves mathematical models.

In a quantitative approach, research will be based on the analysis of data of old people from different countries that have different poverty indexes. The quantitative approach will endeavor to prove the hypothesis that the higher the poverty levels, the lower the individual incomes and the less the disposable incomes (Smith and Ragan, 1999). The method endeavors to show the correlation between different factors but do not show the causation of one aspect over the other.

The study bases its conclusion on the submission of older tourists who admitted to having reduced their trips to other countries during the recession. This was attributed to slow growth in the economy and fewer savings available for spending on secondary needs, for instance, leisure and traveling. The group relied on the support of the government to take care of their needs.

The table below shows the average number of trips made by old tourists interviewed over the period before the recession until after the recession.

Table 2: Showing the number of trips made by one tourist during the period of recession

The graph above analyzes data collected over a period of six years shows that this tourist reduced his trips during the time of recession due to the effects of global recession. This is data shows how leisure travelling had been affected by recession over that period of time.

According to US Health and Retirement Study (2011), many people had to cut down their travel budget over the period during the recession. Old people, who relied on the government, were forced to cut down on the trips they made both locally and abroad following the effects of economic slump across the world.

Results and Discussion

Recession affected resources countries have committed in support of their aged population and therefore constraining their incomes and spending in leisure activities. Due to the slump in economy, expenditure on leisure travelling was reduced in favour of more pressing needs of food and health. According to Maslow’s hierarchy of needs leisure and entertainment comes way above basic and physiological needs. When there is constrained incomes, leisure and entertainment are among the first to be affected by reduced incomes. Recession affects general amount of money available for spending by individuals. Those who depend on the government for social support suffer most as the focus is shifted towards cutting government spending so as to stabilize taxes levied.

Leisure and traveling are among the needs that appear high above in Maslow’s hierarchy of needs. When there are constrained finances and incomes the persons affected will reduce spending on needs above the pyramid for the benefit of lower needs (Howie, 2008). Physiological needs being the most basic take the highest priority as opposed to needs way above the pyramid.

The economic slump led to political instability in many developing countries as economists had predicted. In 2011, many African countries including Egypt, Tunisia, and Libya deposed their leaders. This was attributed to hard economic times and unfavorable political policies. Other economies like Greece and Italy have experienced riots occasioned by the global recession.

Conclusion

The recession has affected the economies of different countries and the Governments affected by the recession are forced to cut down on spending. In the US for instance, the recession began with the bursting of the housing bubble in many parts of the country and its effect on the stock market. As people reacted to the financial crisis purchasing power was duly reduced. This reduction of purchases led to reduced amounts of sales in different companies. The resultant effect was the laying-off of employees and a reduction in government revenue.

Unemployment and loss of revenue from taxation led to reduced government spending. Social securities that rely on government support were greatly affected. Many of the old people who had planned to spend more on traveling and tourism had to revise their plans following the tightening of purse strings by the government. More retired people suffered losses in their accounts. Financial uncertainty also affected the stock market.

The global recession came about as a result of reduced trading activities around the world as well as high levels of product prices and joblessness. Companies found themselves with reduced incomes and they started retrenching people. This was intended to lower their operating costs. Loss of jobs and increase in commodity prices resulted in reduced purchasing power for those who remained in the job sector. Medical and social securities were strained and the government incomes were cumulatively affected. The residue effect of low purchases means low sales for many companies; hence their profits are also lowered. Older tourists who are less productive and dependent on either the government or charitable organizations find themselves with less money to spend.

Unlike young tourists, who have larger disposable incomes, older tourists may have lower incomes because most of them have passed their productive ages and therefore can only rely on social securities. If these securities are affected by the global recession, then even remittances are also affected as more people continue to lose their jobs. Older people being high-end travelers will be more concerned about their upkeep than leisure. Many people cut down on leisure traveling while saving money for other pressing needs like food and medicine. The global recession resulted in slow growth in international travel and holidaymakers. Those countries especially in Africa that rely on tourism as their source of income registered slow economic growth. This lowered the value of their local currencies.

References

- Creswell, W. (2003). Research design: Qualitative, quantitative, and mixed methods approach. Thousand Oaks: Sage.

- Ewing, J. (2009). Economic Woes Raising Global Political Risk. Published in Business Week, 2009.

- Gall, D., Borg, R., and Gall, P. (1996). Educational Research: An Introduction (6th ed.). White Plains, New York: Longman.

- Howie, M. (2008). Rates Cut Likely as Recession Grips Services in ‘The Guardian’, 2008 pp 1.

- Hurd, D., Reti, M and Rohwedder, S. (2009). The Effect of Large Capital Gains or Losses on Retirement. Chicago: University of Chicago Press.

- Hurd, M. and Rohwedder, S. (2010). Effects of the financial crisis and great recession on American households. Web.

- Lincoln, Y. S., and Guba, E., G. (2000). Paradigmatic controversies, contradictions and emerging confluences. Handbook of Qualitative Research (2nd ed., pp. 163-188). Thousand Oaks, California: Sage Publications, Inc.

- Macdonald, D., Kirk, D., Metzler, M., Nigles, L.M., Schempp, P. and Wright, J. (2002). Theoretical perspectives and their applications in contemporary pedagogical research. NY: Sage Publications.

- Mankiw, G. (2009). Principles of Economics. Ohio: Cengage Learning Publishers

- Manning, S. (2009). Experts: Financial crisis threatens US security. Published in the Associated Press, 2009

- Patton, M. Q. (1990). Qualitative Evaluation and Research Methods (2nd ed.). Newbury Park: Sage.

- Smith, P., and Ragan, T. (1999). Instructional Design. 2nd ed. London: John, Wiley & Sons.

- US Health and Retirement Study National Institute of Aging (2011)