Introduction

Initial public offering (IPO) underpricing is a global puzzle consisting of a mechanism characterised by significant price differences that firms use to optimise and increase their equity bases. Alzomaia (2014) examined the theory of IPO underpricing and used empirical evidence to explain it as a result of information anomalies commonly accepted and used globally by firms to exploit the high price differences that happen between the announcement date and post-trade periods. This study focuses on an assessment of the extent of IPO underpricing in Saudi Arabia that happens when companies go public to raise capital for investment. The study was modelled on different theories showing how information anomalies drive the underpricing of Saudi Arabian IPOs. The information anomaly is explained by the asymmetric theory, which dominates the reasons for investing in IPOs. The information anomaly is explained by the asymmetric theory, which dominates the reasons for investing in IPOs. In theory, IPO underpricing is a global phenomenon that is used to exploit uninformed investors by attracting them to bid for shares without providing them the necessary information regarding the quality of the IPO.

Economic agents in the market are deemed to be irrational in taking advantage of the information gap to raise capital. The rationale is that informed investors exist in insufficient numbers, so instead the underwriter re-prices the IPO and attracts uninformed investors for the bid. However, IPO underpricing in the Saudi Arabian market is regulated by the appropriate articles of the Capital Market Laws of Saudi Arabia. The overall mission of the Capital Markets Authority (CMA) is to enhance the level of capital market efficiency and competitiveness by defining the standards for driving liquidity, transparency and market disclosure. The aims of the CMA are to protect investors, ensure market stability, attract more funds, increase the number of listed companies, and enforce rules and regulations in compliance with the Regulation of Proxy Solicitations, Restricted Purchase and Restricted Offer for Shares of companies going public and others. The quality of a firm’s investment opportunities, coupled with the decision to go public and the amount of investment capital required, provide information on which IPO pricing mechanism to use (Hearn 2014).

As Alzomaia (2014) has demonstrated, there is an emerging global trend in which small and medium sized companies at different levels of establishments and operations make stock offerings or flotation to raise quick capital to finance company operations. This study includes different categories of companies in Saudi Arabia: petroleum, manufacturing, real estate development, agriculture and food, construction and building, cement, insurance, and transportation, among others. Underpricing, which is defined as the “difference between the issue price and the closing price in the first day of listing on the stock market” (Alanazi & Al-Zoubi 2015, p.3) is a widely applied concept across different industries on the Saudi Arabian stock market (Alanazi & Al-Zoubi 2015). According to Merdad, Hassan and Hippler (2015), Saudi Arabia is the sixth largest emerging market in terms of market capitalization in the world, which is the driving factor in this study to determine the extent of IPO underpricing in Saudi Arabia.

Hoque and Lasfer (2015) found that underpricing occurs when the stock value increases against the initial IPO price. Studies show that organizations leave money on the table when the closing price is lower than the offering price. A lower price at closing than at offering depicts an overpriced IPO. There have been situations in the Saudi Arabian market when premium prices hit a high level of 315%, with the average premium at 15% (Alanazi & Al-Zoubi 2015). Despite the challenges associated with IPO underpricing, IPO valuation has been very controversial to the extent of attracting demands from the Capital Markets Authority (CMA) to develop rules to regulate IPO pricing in Saudi Arabia (Chen & Levmore 2015). This implies that IPO underpricing in Saudi Arabia can be defined by determining the correct price to ensure appropriate revenue generation for the company, which has implications on its future performance.

The goal of this study is to investigate the extent of IPO underpricing in the Saudi Arabian market by focusing on the motivations for underpricing, its theoretical explanations and associated models, and previous findings on IPO activities with a defined assessment of asymmetric information-based theories on underpricing. This investigation ultimately aims to answer the following research questions listed in section.

Literature review

IPO underpricing characteristics

Gajewski, Ginglinger and Lasfer (2007); Dobrynskaya (2014); and Hoque and Lasfer (2015) embrace a widely accepted explanation within financial circles that describes IPO underpricing as a mechanism representing the value of the shares that investors are willing to pay. A positive movement in liquidity resulting in investor gains in relation to IPO underpricing occurs as a difference between the first-day offering price and closing price. The behaviour is in response to the variations in the risk profile defining the IPOs before and after they are listed on the Tadawul stock market (Brzeszczyński, Gajdka & Kutan 2015). Often, firms are keen on lowering the price with the aim of leaving money on the table that is equivalent to many years of profits (Hoque & Lasfer (2015). According to Hearn (2014), underpricing mechanisms vary across different characteristics such as underwriter reputation, allocation mechanisms and general financial market conditions. For instance, underpricing can be of a lower level if the IPOs are large.

The theoretical explanations of the extent of underpricing in the Saudi stock exchange market are based on market dynamics of firms going public to raise investment capital. Lai, Ng and Zhang (2014) use historical evidence to show that three empirical realities emerge that define IPO offerings in any stock market that are inclusive of shares in the Saudi capital markets. According to Chen, Chen and Lee (2014), the realities that characterize Saudi market IPOs include short-run underperformance, a strong concentration of IPOs and short-run positive excess returns. Because of its great complexity, no single theory can exhaustively explain the underpricing phenomena. Much of IPO underpricing revolves around self-interested investment bankers, lawsuit avoidance, signaling and the “winner’s curse” theories (Sahoo 2014). Other theories have been suggested to explain the underpricing phenomena including bookbuilding, market incompleteness, informational cascades, and response to the regulatory environment. In Saudi Arabia, the defining characteristic of the legal and regulatory environment is compliance with sharia law. IPO underpricing is defined either by a fixed-price offering or a price auction. If the issuing firm chooses the fixed-price offering system, the firm sets an offering price per share.

IPO Rationing and the level of Underpricing

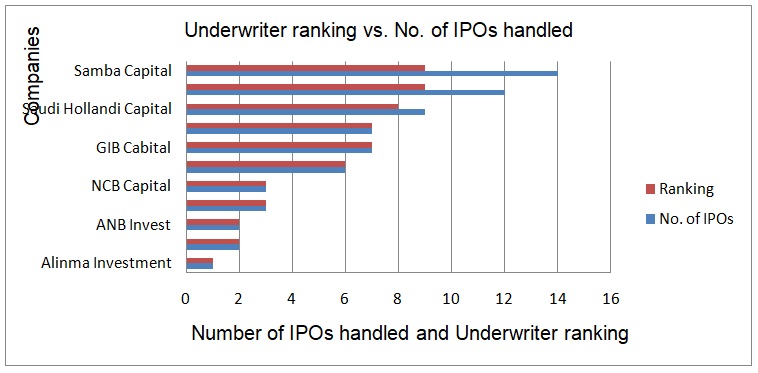

According to Hoque and Lasfer (2015), the Saudi Arabian IPO market shows a positive correlation with the extent of IPO rationing where the nature of the IPO either negatively or positively affects the level of underpricing. At this point, information asymmetry plays a significant role in explaining the nature of the variations and motivations to invest in IPOs, which drives the observed investment behaviour. Examples by MA Ahmed (2014) and Alanazi and Al-Zoubi (2015) of the market conditions in the Saudi Arabian stock market show the expected profits by the investor, the number of allocations, and other preferences. Saudi IPOs are expensive to transact because of the market’s even-handed policy. The resulting behaviour is large underpricing and strong rationing. However, several market changes have been introduced, such as making the IPOs cheaper and available to both the domestic public and foreign investors (Pour & Lasfer 2013). The extent of underpricing is affected by the IPO allocation mechanism in Saudi Arabia, the strong financial market condition and underwriter prestige. According to Al-Zoubi (2015), different companies such as Alinma Investment have different rankings and have issued different IPOs. Alinma Investment has the lowest ranking of 1 with one IPO issued, while Samba Capital has a ranking of 9 and 14 IPOs.

Quality of IPOs

Compared to the IPO situation of the past in Saudi Arabia, a new paradigm has emerged in which a distinct difference appears between low- and high-quality IPOs (Alanazi & Al-Zoubi 2015). The classification is explained by signalling models that argue that deliberate underpricing is used to signal high-quality IPOs; in these cases, any lost or foregone money is recovered by the firm through follow-on offerings. This is emphasized by the “signalling theory on the basis of information asymmetry and the quality of firms involved in IPOs” (Alanazi & Al-Zoubi 2015, p.5). Chen, Chen and Lee (2014) used historical data to conclude that insider ownership and IPO underpricing have strong correlations with the quality of a firm. It is “imperative to argue that the degree of IPO underpricing depends on pre-IPO insider ownership” (Chen, Chen and Lee 2014, p.31). The rationale is that the level of pre-IPO insider ownership is positively correlated with the value of the IPO. Alzomaia (2014) relates asymmetric performance with the ability of insiders to make accurate predictions of the market reaction aimed at generating excess liquidity. Haron (2014) describes insiders as being known to sell shares once stabilisation has been achieved in a situation where no more foreseeable price increments will occur in pre- and post-trade periods.

Alanazi and Al-Zoubi (2015) conducted an assessment of the trading behaviour over a 36-month period which showed a trading pattern that does not react to lock-up expiry dates but rather shows an even distribution with a median value of 1.45 years. According to Sahoo (2014), lock-up expiry is usually a 90- or 180-day period that legally binds insiders from selling stock. The results show that insiders or investors with inside information tend to hold on to losers for too long but readily sell winners, which tends to reduce information asymmetry. However, “the model has not been widely applied in Saudi Arabia because the Saudi Arabia market operates with extreme over-valuation of IPOs” (Sahoo 2014, p.6). According to Alanazi and Al-Zoubi (2015), statistical evidence derived from 76 overpriced IPOs amounting to US $26 billion demonstrates the great extent to which Saudi IPOs are larger than aggregate IPOs offered throughout stock markets around the world (Alanazi & Al-Zoubi 2015). That speaks partially to the reason for the high overpricing of Saudi Arabia’s IPOs, disqualifying the possible explanation of the signalling theory and related intentions. One outstanding characteristic is that IPOs in the Saudi Arabian market are excessively underpriced.

Political motivation

One strong argument that has been proposed is that IPOs in Saudi Arabia are heavily politically driven. The unique underlying characteristics of the IPOs are that they are only issued to Saudi retailers or citizens who hold the responsibility of identifying potential subscribers. It has been demonstrated that subscribers who own shares become major suppliers later on the listing day (Alanazi & Al-Zoubi 2015). It is commonly noted that over 85% of the shares on the Saudi Arabian stock market are offered to individuals at pre-announced fixed prices. Significant variations in the way shares are issued occur among countries. For instance, France displays an average IPO underpricing of 4.2% while Japan displays an average IPO underpricing as high as 32.5%. However, Alanazi and Al-Zoubi (2015) affirm that an assessment of the “internet bubble shows that IPOs were underpriced at 65%, while in China underpricing operated at 200% for a couple of decades” (Sahoo 2014, p.9). Besides, similarities between the clustering of IPOs in Saudi Arabia and the United States have been observed. It is evident that Saudi Arabia’s restrictions on the trading of shares by inside management for 180 days is the same as the IPO underpricing restrictions in the United States.

Uniqueness of Saudi IPO market

Sahoo (2014) explains what differentiates the Saudi Arabian market from other countries in IPO underpricing is oversubscribed IPOs with a minimum recorded at 74% and 91% of the undersubscribed IPOs. In some cases, there has been evidence of IPO premium levels as high as 315% and 256% with the average levels operating between 15% and 20% and with the lowest noted value being 9.5% (Alanazi & Al-Zoubi 2015). The reason for adjustments after listing on the market is the volume of IPOs transacted. Liu, Uchida and Gao (2014) argue that the stock market dynamics reveal a situation in which rationing measures the extent of oversubscription for both underpriced and overpriced IPOs. Alanazi and Al-Zoubi (2015) note that the characteristic behaviour of investors in the Saudi Arabian stock market is defined by the subscription of new issues without due regard for the outcomes because the investors are driven by the desire to make quick profits. Evidence of the nature of subscription shows the extent to which the theory of information asymmetry comes into play, especially for the general public who do not possess enough information to make informed decisions.

Sharia compliance

A critical factor of IPOs in the Saudi Arabian market is the significant relationship between sharia compliance and the level of underpricing. Studies comparing the behaviour of shares under the Islamic insurance or Takaful companies with those of non-sharia-compliant companies have revealed that sharia compliance is an intervening variable that reduces the level of underpricing (Boulanouar & Alqahtani 2016). The goal is to prevent mispricing, avoid accidental misjudgement, and save investors from poor information and bad underwriters. A study of 80 companies that went public between 2004 and 2016 using pre-listing information revealed that sharia compliance had a positive effect on the demand for shares in Saudi Arabian market based on the number of subscribers and the ratio of oversubscription information for the shares. This has been explained by the ‘winner’s curse’ hypothesis, in which Lone and Alshehri (2015) argue that sharia compliance saves investors from mispricing, accidental misjudgements and wily underwriters.

Engagement with reputable auditors and underwriters

Empirical studies have made a number of suggestions on how to counter the effects of underpricing, which usually occurs as a result of uncertainty of risk and constraints on liquidity. Boulanouar and Alqahtani (2016); Chambers and Dimson (2009); Chen, Chen and Lee (2014); and Chen and Levmore (2015) suggest engagement with reputable auditors and underwriters as an effective way to prevent IPO underpricing. Chen and Levmore (2015) view such engagement as a reliable method of reducing investor uncertainty about the value of the shares by relying on the good reputation of prestigious underwriters to lower the level of underpricing. In this case, the correct values of a firm’s shares are reflected in the accurate accounts provided by certified and reputable auditors. In addition, Boulanouar and Alqahtani (2016) present empirical evidence showing that prestigious underwriters operate by investing in the hope that new future deals could be used to compensate investors.

Issuer characteristics

Researchers recommend the use of issuer characteristics as a tool to understand and determine the type of shares to invest in. However, the key elements that exacerbate the issue of IPO underpricing include a firm’s history of positive earnings before going public, a longer operating history, and a delay until the firm grows in size as recommended by Boulanouar and Alqahtani (2016) for effective growth.

Frequent disclosure

Voluntary and frequent disclosure of information to the press and other media outlets on the basis of reducing asymmetric information is another way for firms to reduce underpricing (Mayes & Alqahtani 2015). The result could be a reduction of information production costs that attract additional investments when uncertainty reigns.

Theories

Ljungqvist and Wilhelm (2005) argue that different theories have been suggested to explain the IPO underpricing phenomenon. Researchers have evaluated the many implications of different theories and have determined the most prominent among them to be the theory of information asymmetry (Hearn 2014). This theory is formed on empirical evidence that suggests that IPO underpricing is driven by one party’s exclusive ownership of information that the other party does not have. In general, the information asymmetry theories are classified into two groups: the life cycle theories and the market theories.

The Rock Theory

According to Dobrynskaya (2014) the Rock Theory assumes that asymmetrical information regarding the quality of the companies going public creates an environment of competition between informed investors and uninformed investors, leading the latter to make uninformed decisions and adverse selections. Wadhwa, Syamala and Reddy (2014) base the argument on the so-called winner’s curse hypothesis, in which the expected value of the share is higher than the offering price. This case characterises the majority of IPO underpricing in Saudi Arabia. If the expected value of the shares is lower than the offering price, less informed investors receive the full allocation of shares, which leads to negative outcomes or low yields for these uninformed investors (Alanazi & Al-Zoubi 2015). Because of these anticipated risks for uninformed investors, the issuer encourages them to invest in the IPOs by issuing shares at fixed prices that are much lower than the expected share value.

On the basis of this theory, the problem of adverse selection becomes worse for investors who decide to remain uninformed, causing the level of uncertainty of the expected value of the company to increase significantly. According to Alanazi and Al-Zoubi (2015), this situation, however, encourages the underwriters to increase their efforts in persuading more investors to spend time discovering information before making any decision about whether or not to invest in the IPO. With an uncertainty of the ex-ante value of the company getting deeper in IPO underpricing, the issuers of the IPO compensate for this problem by making the fixed price of the shares much lower and thereby fulfilling the need for a greater expected yield (MA Ahmed 2014). The variables that have been used in this case include information on the sales revenue for the fiscal year preceding the IPO, the age of the company, and the volume of the offer. This underscores the need to denote Saudi Arabian IPO underpricing on the basis of ownership retention driven on the paradigms of information asymmetry. As MA Ahmed has explained, the “stakes retained by the pre IPO-owner have been shown to be an important value driver of the IPO and also a good indicator of the belief the company has in their future operations” (2014, p.11).

The Winner’s Curse hypothesis

Chambers and Dimson (2009) explicitly explain information as an asset that clarifies the true value of shares. Asymmetric information and careful rationing based on the uncertainty of the new shares are evident in the majority of IPOs on the Saudi Arabian market. The rationale is that investors with the correct knowledge regarding the realized value of the offering more readily invest in high-quality IPOs than the uninformed investors, including the issuing firm and the underwriter, who invest in lower-quality IPOs. However, unfairness is evident in the distribution of information among investors (Boulanouar & Alqahtani 2016). The dynamics in the Saudi stock market reveal that the expected value of the shares cannot necessarily be used as reliable information because the share prices are set below the true value as opposed to the expected value. Moreover, informed demand based on the theory of information asymmetry has a strong influence on the allocation of shares; while on the other hand, the investors who are more informed withdraw from the market because they have knowledge of the overpriced shares. Such an imbalance often forces the uninformed to abstain from participating in the market at all unless the shares are offered at discounted prices.

These results can be summarised into the fact that zero returns result due to rationing, which is contested by other authors. An extensive assessment of the winner’s curse model shows that institutions and individuals play a significant role in the share market. However, fairness can be a driving attribute that underpins the benefits of information homogeneity, making underpricing much lower. Ex-ante uncertainty plays a significant role in the high IPO pricing, which is defined by many different contributing factors such as prospectus disclosure; offering characteristics, which include underwriting fees, offering price, gross proceeds and certification because of the underwriter reputation; venture backing; aftermarket variables; and auditor reputation. A positive correlation has been observed between underpricing and reduced information symmetry for uninformed and informed investors.

The monopoly hypothesis

The rationale for the underpricing of IPOs in Saudi Arabia has barely attracted enough reasons to compel an exhaustive conclusion on the matter. Under the monopoly hypothesis, the investment banker is deemed to have monopoly power over the issuer (Dobrynskaya 2014). The rationale is that commercial banks are prohibited from undertaking corporate equity underwriting, making it a monopolistic source of earning profits when underpricing new issues. Using commercial banks as a source of loans for investors to buy shares is a contentious issue among religious leaders in Saudi Arabia who contend that it is haram and against Islamic teachings because the loans accumulate interest (Chen & Levmore 2015). That was the case for the National Commercial Bank (NCB) when it went public in 2014 with an underpriced IPO with shares at SR45 (US $12) each.

This enables the investment bank to spread the offer between the offer price and the bid price on the basis of its monopoly power over the issuer and to determine the degree or extent to which the offer price is marked down, which is usually below its true valuation in the market. Here, the monopolistic investment banker’s primary incentive to underprice an IPO is to increase the probability that the shares will be sold to outside investors and to reduce the risk to an acceptable level, resulting in a high spread of investment banking (Chen & Levmore 2015). It is worth noting, however, that pro-competitive effects could emerge and decrease the overall degree of underpricing of an IPO. The underlying assumption is that banks in Saudi Arabia are risk-averse, a fact that resonates well with the private nature of companies with a limited capital base and the potential for facing significant losses.

Research by Zaremba and Żmudziński (2014) has depicted the monopoly approach as appropriate when firms rely on a monopolistic possession of information. However, such companies have already gone public with the intention to issue shares by listing them at 5%, which could make them number among the largest and most valuable energy firms not only in Saudi Arabia but in the world (Zaremba & Żmudziński, 2014). Despite the intention to offer shares, the offering is characterized by some degree of monopolistic information, more specifically in terms of “an appropriate percentage” of shares to issue and the underwriting firms that have worked on the listing for Aramco. In this case, information regarding the true market value of the firm is in prior possession of the underwriter, who optimises it by taking advantage of it and turning turn it into a bargaining tool.

This is another case of information asymmetry in which two unbalanced components come into play: the issuer and the underwriter and the informed investors and uninformed investors (Zaremba & Żmudziński, 2014). It is relevant to argue that information asymmetry varies as a function of the underwriter or the issuer’s issuing mechanism. The accentuating factors include whether the IPO shares are released at an auction price or at a fixed price. The issuing mechanisms have been observed to show evidence of a high probability of mispricing, which in turn underpins the adverse selection that occurs as a result (Pour & Lasfer 2013). Other authors look at the reasons for IPO underpricing from the perspective of various parties exploiting the windows of opportunity that arise. A summary of classical literature gravitates towards classifying underpricing as a premium for ex-ante uncertainty, but recent research links underpricing to after-market liquidity embedded in other IPO aftermarket uncertainties. Here, asymmetrical information and residual uncertainty play a significant role in influencing companies to underprice their IPOs.

Bookbuilding hypothesis

The hypothesis on bookbuilding denotes the situational significance of the asymmetric information theory on price setting, the role of investment banks and discretion in share allocation decisions. However, Zaremba and Żmudziński (2014) note that the possibility of problems arising between the issuing firm and the investment agency define the agency-related problems. In the Saudi Arabian stock market, the bookbuilding mechanism is used to attract investors to bid on the process, leading to oversubscription and eventual rationing as opposed to a true auctioning of the company’s IPO (Pour & Lasfer 2013). The basic mechanism relies on the cooperation of influential investors or institutions with prior knowledge of the share prices based on information from experienced investors. This resonates well with the classical reasoning argument made by Sahoo (2014) regarding the oversubscription concept, which does not reliably provide accurate data on the subscribers who become the major suppliers in the first day of trading. The use of pre-announced fixed prices defines the basis of IPOs in Saudi Arabia by targeting retailers in 85% of the IPOs.

The investment banker intervenes by compensating investors through underpricing, which is used to induce investors to provide the truthful, accurate information required to properly value the IPOs (Gajewski, Lasfer & Ginglinger 2007). The result could be a partial adjustment of the offer price that differs between the preliminary and final prospectus. In this case, it is more common for heavily underpriced IPOs to have the prices revised upwards than downwards (Wadhwa, Syamala & Reddy 2014). Underpinning the market feedback mechanism is the asymmetric information theory that is used to explain the nature of how information can be revealed to the public. This strategy includes the use of the pre-selling period to determine the accuracy of the suggested fixed offering price. However, to some researchers, this method has not held true across different markets given the evidence that the approach failed in Japan, Singapore, Western Europe and Taiwan in the 1980s and 1990s.

Due-Diligence insurance hypothesis

A discourse of the due-diligence insurance hypothesis shows that the fear of potential legal problems arising from issues of overpricing is one of the main reasons for IPO underpricing—despite the fact that this is a very costly way of reducing the chances of a lawsuit (Bell, Filatotchev & Aguilera 2014). Company directors must exercise discretionary care to ensure the accuracy of all information detailing the offer to investors because of the liability directors are exposed to during the IPO process. If a mistake is made or intentional fraud occurs, it is possible for the company directors to be prosecuted under the law or to be sued for providing incorrect information by investors who end up holding heavily overpriced issues (Wadhwa, Syamala & Reddy 2014). In Saudi Arabia, IPO investors can argue that the share was either good or bad, which in most cases is overcome by an underwriter who persistently tries to underprice the IPOs. This leads to the conclusion that legal penalties could underscore the need for investment bankers to underprice.

Conclusion

IPO underpricing represents an indirect cost for the issuing firm, and the extent of underpricing varies across IPOs based on different issuing characteristics. That is besides allocation mechanisms, the desire to overcome the adverse selection problems and the need to discourage low-quality issuers from mimicking high-quality offers. Underpricing encourages uninformed investors to pursue a high volume of share allocations, while enforcing the protection of the reputation of investment banks and the reduction of legal liability in the case of price declines. Beyond facilitating aftermarket trading, underpricing also increases the revenue of investment banks (Lasfer & Hoque 2014). The approach does not benefit the issuing firms. Two critical elements that arise here include the dissemination of information that is produced from the relevant sources. The approach increases the number of investors and shares to buy, which gradually increases aftermarket trading and liquidity levels and enables better control of the firm. Here, market liquidity is positively driven by IPO underpricing.

Reasons for IPO underpricing

According to Lasfer, Gajewski and Ginglinger (2007), Underpricing makes investors more willing to accept the offer because of the confidence that such an offer carries less risk, while at the same time, it allows firms to avoid the potential for sudden loss from the threat of arising legal disputes with investors (Lasfer, Gajewski & Ginglinger 2007). Lasfer, Gajewski and Ginglinger (2007) found that companies use the signalling theory to deliberately underprice their IPOs to give off the perception that they are of high quality and to attract external investors. The perception that the IPO is of high quality is designed to discourage low-quality issuers. Underpricing is also designed to overcome the adverse selection problem that happens on the basis of information asymmetry.

Arguments made by Falconieri, Murphy and Weaver (2009) rationalize underpricing in the bookbuilding framework based on the upward adjustment of IPOs made by the investment bank, which acts on the premise that the value of the share is high, resulting in money left on the table for investors. However, Chen, Chen and Lee (2014) note that non-financial reasons do not have a significant impact on IPO underpricing in Saudi Arabia. The potential of firms to issue equity in Saudi Arabia through the capital market has grown exponentially due to the significant demand for funds to invest in profitable ventures. Compared with the more traditional sources of financing such as retained earnings, owner’s equity and bank loans, issuing IPOs has been the best option (Boutron, Gajewski, Gresse & Labégorre 2007). The share prices offered by firms to the public are usually pegged at lower prices than those investors are willing to pay when the shares start trading in the secondary market. The driver in this case is the perceived value of the company, which is defined by the pre-IPO capital structure of institutional investors in the context of closed-ended funds.

Empirical evidence suggests that market imperfections come into play. Here, Saudi Arabia’s IPO underpricing enables companies to tap into public finances by offering a fixed set of shares at a predetermined price. This is an important phase of the life cycle of private firms and has implications in terms of firm ownership. Besides the principal reason of raising funds, various reasons have been suggested as to why firms would go public in Saudi Arabia, one of which is to achieve a more dispersed post-IPO ownership structure to create a liquid second market. On the other hand, however, some researchers argue that underpricing enables companies to develop a more concentrated ownership structure.

Retained capital

According to Pour and Lasfer (2013), one reason for underpricing is to increase the value of the firm. The argument that defines the relationship between firm value and retained capital by insider traders based on the agency theory shows the need to align new shareholders with the retained capital. Bell, Filatotchev and Aguilera (2014) observe that firms with diverse capital structures, as opposed to firms with concentrated capital structures, are net gainers (Field & Sheehan 2004). However, a firm’s value can be reduced if it has a limited cash flow. A high proportion of capital can be retained if the managers are confident that the value of the shares will increase in the long term (Sahoo, 2014). Here, a strong correlation exists between the level of retained capital and the true value of the firm, which is signalled by existing owners. Besides, higher risks of cash flow and minority rights expropriation result from high levels of retained capital. The desire to attract more potential investors becomes yet another cause of severe underpricing.

Underwriter price support

Lai, Ng and Zhang (2014) assessed the initial underperformance of IPOs and underwriter reputation over 10 years and noted the presence of a strong negative correlation between the two variables. Underwriter price support leads to a reduction in the agency costs because of prestigious underwriters. Boulanouar and Alqahtani (2016) present empirical evidence that suggests that firms struggle to associate with high-quality underwriters because such firms are perceived to have to correct information on a company’s value. The argument shows that reputable underwriters play a significant certification role which strongly correlates with the performance of IPOs (Che-Yahya, Abdul-Rahim & Yong 2014). The rationale is that effective underwriters play a significant role in reducing information asymmetry between potential investors and firm owners (Lai, Ng & Zhang 2014). Here, the ongoing relationship between a potential underwriter and speculative investor who wants to make quick profits positively influences the level of underpricing.

Oversubscription rate

An anticipated positive growth and relatively cheap offerings driven by information asymmetry constitute the reasons for IPO underpricing (Lasfer & Hoque 2014). An assessment of IPOs in Saudi Arabia suggests that demand increases on the basis of information asymmetry where stocks with an initially high price are offered, as occurred in the case of the Riyadh-based NCB. Such offers trigger positive demand for increased participation from more investors, which makes publicly generated IPO underpricing appealing for more bidders due to information heterogeneity. This was made particularly evident in May 2007 when six Saudi Arabia insurers were oversubscribed by seven times. Among the oversubscribed firms were Saudi Arabian Cooperative Insurance, the NCB and the Allied Cooperative Insurance Group. Including Al Ahli Takaful’s 26.5 million riyal, the IPOs were 10.2 times oversubscribed (Boulanouar & Alqahtani 2016).

The NCB shares themselves were oversubscribed 23 times, representing the largest oversubscription of all of these insurers at a value of US $6 billion. The reasons for oversubscription in this case included the generous loans provided by banks to the customers to buy shares, which were expected to double with an expected public issue of US $7.2 billion (Al-Hassan, Delgado & Omran 2010). An assessment of the IPOs suggests that “the Riyadh-based NCB offered 25% of its shares at 45 Saudi riyals ($12) each for sale in an IPO that ended on November 2, 2014. The 15% retail tranche, open only to Saudi citizens, consisted of 300 million shares, while 10% was allocated to the kingdom’s Public Pension Agency” (Boulanouar & Alqahtani 2016). This situation occurred despite the reaction from Islamic leaders who affirmed that the role of the bank was haram because it takes profits on loans provided to the investors to buy the shares.

The oversubscription level is explained by Rock’s winner’s curse model, in which it is assumed that both the informed and uninformed investors invest in “good” IPOs (Chen & Levmore 2015). The IPO offering by the NCB was classified as a good IPO because the level of oversubscription was a strong indicator of the positive perceptions of investors, besides the knowledge that Saudi Arabia is one of the richest countries in the world. Another argument by Wadhwa, Syamala and Reddy (2014) related to information asymmetry suggests that the quality of the IPO offered by the NCB was high.

Listing time

The IPO underpricing phenomenon has various factors that define the outcome on performance of the IPO trading in the Tadawul All Share Index (TASI). For instance, prior announcements had projected that 19 October and 2 November 2014 would be the most appropriate time for the NBC to list its 500 million shares on Tadawul, the Saudi stock market (Chen & Levmore 2015). The shares started trading on 12 November 2014 with an initial surge of 10% above the maximum recommended value and held steady until the close of trading. However, the overall outlook on the TASI was unchanged, and it closed down at 0.02%. Here, the theory on signalling did not seem to play a role in influencing the outcome of the volume of shares traded at that time.

Hearn (2014); Wadhwa, Syamala and Reddy (2014); Chen and Levmore (2015); and Dobrynskaya (2014) analysed the advantages and disadvantages of IPOs and came to the following conclusions presented in section 2.5.5 and section 2.5.6, respectively.

Advantages

- Researchers argue that companies are driven by the urge to issue shares to raise excess capital without necessarily trying to avoid debt financing using banks loans and other sources such as individuals or private financing. This approach enables the company to raise capital from the public by using the variable equity base in the market. Companies that go public provide capital with cheaper access and enhanced management based on a contract established between the issuer and the underwriter.

- In the case of an IPO, the market gets the opportunity to independently and objectively value the company by all investors. High-quality shares provide the company with the opportunity to increase or decrease share prices based on the theory of supply and demand.

- The ownership structure of the company is relinquished from the initial private ownership depending on the specifics of the decision to change.

- The best corporate governance practices based on market evaluation dynamics can be achieved through positive responses to market evaluation reports.

- Risk diversification entails new company financing methods and better publicity.

Disadvantages

- The IPO results in a loss of control from original and first-equity ownership due to the firm’s entry into the market and subsequent diversification of ownership.

- Increased costs are observed in the context of auditing costs, market information costs and issuing costs.

- The possibility of maintaining the initial selling price is an opportunity made available for exploitation by the lead manager, which is defined as the Greenshoe concept.

Determinants of IPO premiums in Saudi Arabia market

According to Alanazi and Al-Zoubi (2015), information asymmetry characterising frontier markets shows various factors that point to the use of underpricing as a means of reducing information gaps among the investors involved in IPO underpricing in Saudi Arabia (Mayes & Alqahtani 2015). Arguing on the basis of the winner’s curse hypothesis in which rewards from underpricing tend to gravitate towards the informed investors rather than the uninformed investors, research studies based on the behaviour of the international stock market derive their conclusions based on the ex-ante uncertainty hypothesis. In this context, the uncertainty surrounding the IPO is deemed to be the driving factor of IPO underpricing (Bell, Filatotchev & Aguilera 2014). Here, the underwriter plays the significant role of reducing uncertainty on the basis of the certification role. According to Alzomaia (2014), the results of lower ex-ante uncertainty are demonstrated in situations in which underpricing by prestigious underwriters is very low (Fan, Wong & Zhang 2014). On the other hand, a summary assessment of the effects of the signalling model shows that good firms use underpricing as a means of raising funds when future conditions become favourable by using seasoned equity offerings. This argument leads to the conclusion that firms that withstand losses at the initial stage of the offerings wait to make returns on investment in the long term.

History of Tadawul

Tadawul, which constitutes the largest stock exchange in the Gulf region, is not very old. The stock exchange first started in the 1930s after the establishment of the Arab Automobile Company, which began the first joint stock company.

During the 1980s, the number of companies on the exchange had increased to 48, which doubled in 1995 but reduced significantly to 88 in 2000. Despite the fact that trading in the stock market was not being regulated, oil prices started to increase and both the volume market capitalization and trade were increasing significantly (Liu, Uchida & Gao 2014). The broker-based system was abandoned in 1985 in favour of the Saudi Arabian Monetary Agency (SAMA), which authorised local banks to act as brokers.

As of now, there are 175 listed companies on the stock market, all of which are divided into various sectors and subsectors: banks and financial services (12), cement (14), multi-investment (7), petrochemical industries (14), telecommunication and information technology (4), agriculture and food industries (16), hotel and tourism (4), retail (17), energy and utilities (2), building and construction (18), real estate development (9), media and publishing (3), transport (5), industrial investment (15), and insurance (35) (Tadawul 2016).

The Royal Decree No (M/30) dated 2/6/1424 H under the Capital Market Law established the formal recognition of the Saudi Arabia Capital Market Authority (CMA). The provisions of the Capital Market Law provide guidelines outlining the areas that are the sole responsibility of the CMA. It is worth noting that the “CMA administrative structure is headed by the prime minister with subunits that include finance, administration, and legal oversights” (Bell, Filatotchev & Aguilera 2014, p.3). The responsibilities that fall within the jurisdiction of the CMA include:

To regulate and develop the capital market, regulate proxy and purchase requests and public share offerings, regulate and monitor full disclosure of information related to securities and their issuers, develop measures to reduce the risks pertaining to securities transactions and Achieve fairness, efficiency and transparency in securities transactions. In addition, other elements in the mandate include developing, regulating and monitoring the issuance and trading in securities, protecting investors and the members of the public from unfair and unsound practices involving fraud, deceit, cheating, manipulation and insider trading, and regulate and monitor the activities of entities subject to the control of the CMA. (Chen & Levmore 2015 p.9)

Other areas of jurisdiction include conflict resolution, communication with market participants, capital market development strategies, the enhancement of the CMA’s organizational excellence, the promotion of investor protection and the improvement of the regulatory environment.

Past and present stock market behaviour with time

In 1984, the Saudi stock exchange market was turned into a government institution that later operated under the Saudi stock company known as Tadawul. The Saudi government enacts laws to regulate the trading within the stock market. A summary of IPO offerings and trading in the TASI shows the behaviour and relationship between the past and present IPO indices. Chen and Levmore (2015) describe the dynamism in the behavioural changes that happen due to observed changes in risk composition, where lower-risk IPOs are priced lower than higher-risk IPOs. Zaremba and Żmudziński (2014) present a critical analysis using the equilibrium condition by arguing on the basis of underpricing as an equilibrium condition that shifts positively or negatively depending on external and internal market factors. Risk is used as a tool to price IPOs in proportion to the level of perceived risk for investors. Here, the changes that have happened in the Saudi Arabian market are reflected in the increased uncertainty of IPO valuation.

Other researchers associate the stock market changes with the nature of the market itself, which can be classified into hot and cold markets. A hot issue market is one in which IPOs show abnormal returns. A typical example happened in the United States in 1980, when the mean returns on IPOs were at 48.4%, a situation that lasted for 15 months. Another event that has been described as a hot issue market is the internet bubble, which consisted of a period in “which the average first month performance (or aftermarket performance) of new issues [was] abnormally high” (Zaremba & Żmudziński 2014, p. 4).

However, significant changes in IPO trends have been observed, with a recovery being noted in the post-2009 period marked by a positive surge due to increased investments in insurance IPOs compared to the 2006-2007 period (Lasfer & Hoque 2014). When analysed, the results showed high average returns compared to regional and international markets. Moreover, it is clear that higher median returns were positively correlated with smaller offer sizes, which reveals that smaller companies witnessed higher price swings and volatilities (Chen, Wang, Li, Sun & Tong 2015). It is evident that regulations in the market introduced to cap the amount of daily price changes have led to more stable market dynamics and radical short price increases.

IPO underpricing issues

Saudi Stock Exchange (Tadawul)

This section provides an overview of the structure of the Tadawul stock market in Saudi Arabia. The listing requirements, information disclosure, volatility level of efficiency and other elements are discussed in detail as they relate to the issue of IPO underpricing in Saudi Arabia.

Market structure

The Tadawul market structure is primarily comprised of retail investors who by 2009 constituted 88% of the transactions. Empirical evidence suggests that 7% of the orders were placed on behalf of Saudi corporations, with mutual funds accounting for only 1.5% of all orders. This is in stark contrast with the London bourse, where 90.5% of the transactions are made by institutional investors. On the other hand, “3% of the shares go to the Gulf Council Cooperation (GCC) countries with resident foreigners in Saudi Arabia accounting for only 0.2%” (Alanazi & Al-Zoubi 2015, p.4). However, a few transactions have also been noted to be carried out by foreign investors; though these purchases account for only 1.2% of the total, this figure represents a relatively a significant amount of purchasing by foreign investors.

The Tadawul market structure is defined by equities that are divided into 15 sectors, which include banks and financial institutions, among others. The market has been evolving from specialising in single product equities by incorporating a wider array of markets. Legislation has been introduced in the form of a consumer protection law designated as the Capital Market Law. The law stipulates antifraud clauses that protect investors against manipulation, fraud, and misrepresentations of facts and omissions.

Listing Requirements

Recent literature has shown some interest in Saudi Arabia opening up to foreign investments through swap derivatives transactions with a licensed broker, which is a change from earlier legislation that expressly prohibits foreign ownership. Alanazi and Al-Zoubi (2015) established that the key points for operating in the Saudi stock market include a 30% minimum free float with a minimum number of shareholders of 200 and a requirement on paid-up “share capital to be SAR 2 million (approx. $530,000) [and] where shares are being offered to the general public this is increased to SAR 10 million (approx. $2.7 million)” (Alanazi and Al-Zoubi 2015 p.11). The minimum shareholder equity (i.e. net assets) is SAR 100,000, while it remains SAR 50,000 for the case of bond listings and other securities and SAR 100,000 in the case of share listings. The Saudi stock market regulator is the Capital Markets Authority (CMA), which was established under the Capital Markets Law of 2003.

Information disclosure

A statement of fact shows that investors are protected “from the effects of the winner’s curse problem by the CMA taking the responsibility of ensuring appropriate information disclosure and adherence to the regulations governing underpricing and conducting business in the stock market” (Boulanouar & Alqahtani 2016 p.6). Companies that are protected from the problem include both listed companies and individual investors.

Level of efficiency

Boulanouar and Alqahtani (2016) established that the Relative Strength Index (RSI), which measures the upward and downward movements of the closing price, describes the level of efficiency of the stock market for the 2012 and 2016 period. However, the measure varies greatly over time and does not remain constant, though the trend is observed to fall towards 2016.

Recent assessments of the Saudi Arabian stock market indicate varying trends in IPO share performance for 2014, 2015 and 2016 to date. For instance, Lone and Alshehri (2015) noted that four IPOs were issued in 2015, compared to the same period in 2014 in which seven IPOs were issued. Despite the disparity in the number of issued IPOs, a 28% enhanced performance was witnessed compared with the same period from the previous year, leading to the conclusion that company valuations had made positive improvements (Esmalifalak, Ajirlou, Behrouz & Esmalifalak 2015). On the side of the activity in the stock market, there were five offerings in 2015 that raised a total of $1.34 billion, while a similar period in 2014 raised a total of $1.85 billion with an offering of nine IPOs. The result shows a decrease of 28% in total proceeds. On the other hand, it was observed that a 44% decrease in offerings occurred within the same period under analysis.

Volatility

The volatility of the Tadawul market is driven by the long-standing dominance of retail investors that have a great deal of interest in the underpriced IPOs and that show a tendency of selling their holdings to fund new issues. An assessment of the stock market between 2003 and 2006 shows a staggering 700% increase in the index with capitalisation having reached two-and-a-half times the nominal GDP of US $800 billion, making Tadawul the tenth largest stock market by 2009.

Saudi Arabia IPO issuance procedure and allocation

The allocation of IPOs in Saudi Arabia is made exclusively to eligible Saudi citizens, and the procedure limits the entry of international investors at the initial stage of the IPO offerings. Sahoo (2014) performed research into the behaviour at the onset of issuing IPOs in 20 countries and established evidence of a similar trend among investment bankers that shows an inclination in favour of local investors as a wealth creation mechanism. According to Boulanouar and Alqahtani (2016), the concept is based on the provision of shares at a low price that are later provided at higher prices immediately on the listing day as a sure way of generating profits.

While different types of IPOs have been conceptualised, empirical evidence shows that Saudi Arabia’s IPOs can be classified into established and non-established IPOs (Boulanouar & Alqahtani 2016). The condition for entering Tadawul, the capital market trading company in Saudi Arabia, includes three years of prior trading experience in the stock market with audited accounting information made available to the public (Hearn 2014). The details present in the audited information include the number of shares to be traded, the prices at which the shares will be offered, the original owner of the company, the retained ownership, the share subscription date, the purpose of the issue, and the quantity of conditional subscriptions comprising the maximum and minimum numbers.

It is established within the rules that guide the issuance of shares that no alterations can be made within the subscription period regardless of the number of shares issued. Institutional investors that show interest in the IPOs are given preferential treatment. Hearn (2014) pegs the ratio of remaining shares between individuals and institutions to be 3:7. In spite of the process requirements, the company and its investment banker have the sole rights to change the percentage distributions of the shares between the individuals and the institutions.

Studies shows that the “shares allocation method is pegged on specifications made on the IPOs to ensure that the minimum number of shares is allocated to the retailers as per policy or the number of conditional subscriptions” (Esmalifalak, Ajirlou, Behrouz and Esmalifalak 2015, p.11). Each retailer is allocated shares that are determined using a redistribution factor among retailers pegged on the proportion of the initial subscription (Lone & Alshehri 2015). The allocation mechanism depends on excess shares. In Saudi Arabia, “excess demand characterises the IPOs the Capital Market Authority (CMA) intervenes on the basis of even-handedness because of subscriber needs that exceed the number of offered shares” (Lone & Alshehri 2015). The goal is to ensure fairness for all investors.

In Saudi Arabia, it is a requirement that the underwriter takes up the shares prior to starting to trade in the market. Formal trading in this case starts after the listing. A unique feature of the subscription process in Saudi Arabia includes the aggregate subscription method in which families come together and make subscriptions to reduce the transaction costs and increase the potential for higher allocations. This strategy is in some ways a reflection of the “collectivist” culture of Saudi Arabia, which links some of the preferred subscription methods to the local culture. After the subscription is done, the managing underwriter provides information on subscription results after the subscription period and before the listing period (Lone & Alshehri 2015). Once trading starts, the fluctuations usually vary within a 10% range on either side. However, un-owned assets cannot be sold as that could violate sharia law.

Effect of IPO underpricing on Saudi stock

Saudi Arabia’s stock market is the largest among the GCC countries in the world, and the country is the richest in the Middle East, accounting for over 50% of the total capital of the region (Lone & Alshehri 2015). An assessment of the effect of IPOs on the Saudi economy reveals that they have played a significant role in facilitating the growth of the economy. For instance, in 2005, a significant increase in the TASI occurred, doubling from 8.206 in 2004 to 16.712 in 2005. A similar trend was observed in 2006 when the Tadawul All-Share Index reached the 20.634 mark. This growth represents a 230% annual increase; however, the market later experienced a downward trend that cost Saudi investors a significant amount of money (Merdad, Hassan & Hippler 2015). However, the loss directed the government to start restructuring and take appropriate action to enhance the performance of the stock market. Typically, the average price-to-earnings ratio had risen to 47, being in excess of 100 in late February 2006. Preceding the actual results were not reflected in the growth in corporate profits.

Some of the sources of problems in the Saudi stock market include a lack of corporate transparency, a lack of IPOs and the presence of many first-time investors within a limited time period. Due to the corrections that were introduced into the market, a significant number of investors protested. However, greater losses were experienced by the Saudis who lost large amounts of money due to the fluctuations. For instance, Boulanouar and Alqahtani (2016) describe a situation in which during a three-month period, TASI lost more than half of its value and closed at 53% below its initial price. Within the two extremes, a loss of $480 billion occurred, which was equivalent to 140% of the country’s GDP. However, is worth noting that the pattern has repeated itself among other GCC countries including Qatar and especially the UAE, both of which went through turbulent periods of steep surges in share prices.

The results of the study indicate that 94.5% of the investors are at the individual level, with 5.5% coming from the Gulf Council Cooperation, which makes international participation very limited. It is imperative to note that the Saudi IPO policy has problems especially in terms of asymmetric information. The resulting losses were due to the failure of the relevant authorities to provide investors with correct information in the IPO offerings, a clear demonstration of the mechanics of asymmetric information in IPO underpricing (Chambers & Dimson 2009). A summary of the reasons that made the IPO underpricing a failure from the perspective of the investor include bad practices by the authorities, a lack of rationality in IPOs and ineffective participation of the brokers because of their interest in making profits without due concern for investor interests. The other causes emphasized by Boulanouar and Alqahtani (2016) include investor overconfidence, which was pegged on the disposition hypothesis that claims that investors are much more interested in making fast profits than they are in the risk of making losses.

Analytical framework

This investigation on IPO underpricing in Saudi Arabia covered the period between June 2010 and June 2016. This study was conducted on the basis of underpricing theories to explain the extent of underpricing and how it relates to different theories that have been proven in stock markets around the world. It is noted that the “winner’s curse hypothesis [and] information asymmetry divides the investors into informed and uninformed” groups (Lone & Alshehri 2015). The quantification of variables used in the deductive investigation was based on data from the Bloomberg database and Tadawul stock market spanning the period between June 2010 and June 2016. The IPO documentation was obtained from the CMA official website. In addition, this study used the list issued by the Sharia Board of Alrajhi Bank, the largest Islamic bank in Saudi Arabia and GCC states, to distinguish between Sharia compliant and non-compliant firms. The data collected for analysis is presented in Appendix I. The IPO performance data was used to test the extent of the IPO underpricing using the t-statistic test on the basis of the confidence interval of the mean, µ. To ensure the results were reliable, the test value was set to zero, leading to following null and alternative hypotheses:

H0: (Null hypothesis): ≤0

Ha: (Alternative hypothesis)>0

The null hypothesis is not rejected when the sample mean is above zero, denoting the presence of the underpricing phenomena. The use of the t-test in this research is valid based on the assumption that the data has a normal distribution and that the sample size is more than 30, allowing it to conform to the central limit theorem that is applicable for large samples.

Linear regression analysis was used to analyse the data to determine the relationship between the dependent and independent variables, with the dependent variable being underpricing and the independent variables being the age of the firms, the offering price, the ownership share retention, the underwriter prestige and time lag. It is evident that by treating one variable as a dependent variable and several other variables as independent variables, the behaviours among the variables depict a situation where dependent and independent variables have effects on the resulting behaviour of the Saudi Arabian stock market.

Dependent variable:

Stock underpricing on the listing day = (Pt-Po)/Po, where Pt represents stock closing price and Po represents the issue price of stock only.

Table 3: Independent variables and Dependent.

Table 3 shows the variables that were used in the statistic tests to investigate the extent of underpricing in Saudi Arabian market.

- Underwriter ranking: This is where investment bank is ranked on a scale of 0 to 9. The most prestigious is ranked at 9 and the least prestigious ranked at 0. This is shown in Appendix II.

- Number of IPOs issued

- Turnover rate on the first day (TR): This provides information on the IPO issuance of stock turnover ratio and the trading volume and stock.

- Offering stock price

- The time interval (T): This is the time lag between the offering and listing time

To discover the effects of the degree of underpricing and the characteristics of the IPO, the first objective is analysed using the following equation: (first day’s closing price – issuing price)/issuing price = IR. The results can be computed using the following equation: AIR=IR-(change in market index on the first day of the offering)/market index on the first day of the offering. The second objective constitutes research variables from 36 Saudi IPOs from June 2010 to June 2016 to address the research objectives and show the effects of the variables on the research outcomes (Abdul Rashid, Kamil Ibrahim, Othman & Fong See, 2012). Variables of interest include the book value of the company issuing the shares, the level of profits of the issuing company, its debt ratio and the external auditor that could underpin the descriptive nature of the statistics to be done on the data: β, t statistics and p-values. Lastly, the third objective is defined by offered shares, number of subscribers, allocations, delays, percentage oversubscription, offer prices, low prices, closing prices, opening prices and high prices. This could be the basis for developing the hypotheses for the study.

Hypothesis

The above results lead to the following testable hypotheses:

H1: The Number of shares offered to public by IPO/firm is a function of the underwriter ranking.

This is the basis of the avoidance of the ex-ante uncertainty for old firms compared with young firms in Saudi Arabia.

H2: Market capitalization is a function of the closing price, time lag and underwriter prestige.

H3: There is a positive relationship between underpricing and time lag (time interval) from offering to listing (in days).

Highly priced IPOs are underpriced, and the chance of failure is significantly reduced for the underwriters.

H4: Initial underpricing is positively correlated with the turnover rate on the first day (TR).

A longer time gap between IPO offering and listing increases uncertainty.

H5: There is a positive correlation between sharia compliance and underpricing.

Survey data and analysis

IPO underpricing characteristics

Figure 2 shows the unique characteristics of Saudi Arabian IPOs dynamics of the underpricing characteristics using the closing price of stock and the offering price of stock on the vertical axis and the horizontal axis for the number of shares offered to the public on the Saudi Arabian market between June 2010 and June 2016. The two line graphs indicate the extent of underpricing by indicating the behaviour of the shares at the time of the offer and the time when the first day of listing.

In figure 1, the behaviour of the market in terms of offering price and closing price of the stock indicates big differences between offering price and closing price of stock. In June 2016, the price difference is very steep compared with other periods.

A statistical analysis of data in Figure 2 correlates underwriter ranking and the number of IPOs offered by the 11 firms as detailed in Appendix II. Figure 2 is a bar graph that compares the two variables for each firm. Samba Capital has a ranking of 9 with 14 IPOs offered, HSBC has a ranking of 9 with 12 IPOs offered, Saudi Hollandi Capital has a ranking of 8 with 9 IPOs offered, Saudi Fransi Capital has a ranking of 6 with 7 IPOs offered, and GIB Cabital has a ranking of 6 with 7 IPOs offered. Riyad Capital has a ranking of 6 with 6 IPOs offered, NCB Capital has a ranking of 3 with 3 IPOs offered, and FALCOM Financial Services has a ranking of 3 with 3 IPOs offered, ANB Invest and ALBILAD Investment have a ranking of 2 each with 2 IPOs offered respectively, and Alinma Investment has a ranking of 1 with 1 IPO offered. The results are detailed in Appendix V.

First hypothesis

H1: The number of IPOs sold is a function of the underwriter ranking.

Table 4: Model Summaryb. Model Summaryb

Table 4 shows a model summary of the behavior of the underwriter ranking, which uses a linear regression model to compare the effects of underwriter ranking on the number of IPOs handled by the underwriter. In this model, an adjusted R2 value of 0.907 was used to show the level of consistency with the theoretical rules that show that a bigger R2 value of 0.917 indicates a high degree of fitness. The baseline regression analysis shows positive increases in values, which confirm the hypothesis with a positive order of magnitude on Durbin-Watson that has a value of.557. The value is an indicator of the positive effects of underwriter ranking on the number of IPOs handled by the underwriter because of the level of confidence of investors in the stock market. The accumulated single-day returns on the first day of IPO offering assume errors due to statistical bias resulting from time-based variations.

Table 5: Correlations.

Table 5 shows the effects of underwriter and the number of shares offered to public when tested on the Pearson Correlation statistic test. The results show that the number of IPOs sold is a function of the underwriter prestige, which is driven the date of listing (going public), offering price of stock, closing price of stock on the first day of listing, market capitalization of the company on the first day of listing, turnover rate on the first day (TR) and sharia compliance. When tested on a Pearson correlation statistic, a value of.957 was generated, verifying the Durbin-Watson value of.557 and confirming the hypothesis of the relationship between underwriter ranking and number of IPOs sold. The results are consistent with the study by Falconieri, S, Murphy, A & Weaver, D 2009, Alzomaia (2014), and Chen, Wang, Li, Sun and Tong (2015) who in their studies ranked the most prestigious underwriters on a scale of 0 to 9, with a value of 9 being the most prestigious and that of 0 being the least prestigious.

Second hypothesis

H2: Market capitalization is a function of the closing price, time lag and underwriter prestige. Table 6: Model Summaryb

Table 6 is a model summary that shows the relationship between the market capitalization of the company on the first day of listing as the dependent variable and the closing price of stock in the first day of listing, time lag (time interval) from offering to listing (in days), underwriter ranking as independent variables. A regression analysis was performed to determine the relationship between the dependent variable and the independent variables, which include underwriter ranking, the closing price of stock on the first day of listing and the time lag (time interval) from offering to listing (in days). This analysis provided a R2 value of.031 and an adjusted R2 value of -.060, which are consistent with the theoretical movement of the values and the nature of the market. The Durbin-Watson is 2.098 without any negative autocorrelation occurring, which is in accordance with the decision rule defining the market capitalization hypothesis. Predictor and criterion variables measured on an interval scale have been used. The results are consistent with the findings by Dobrynskaya (2014), Lone and Alshehri (2015), and Boulanouar and Alqahtani (2016).

Third hypothesis

H3: There is a positive relationship between underpricing and time lag (time interval) from offering to listing (in days).

Here, highly priced IPOs are underpriced and the chance of failure is significantly reduced for the underwriters.

Table 7: Statistics.

Table 7 shows the statistics of the behavior of the market, which include the closing price of stock on the first day of listing, the offering price of stock, the market capitalization of the company on the first day of listing, time lag (time interval) from offering to listing (in days), underwriter ranking, Tadawul market index closing value on the day of listing and Tadawul market index closing value on the day prior to listing. With a standard deviation of 24.78233, the closing price of stock on the first day of listing has a mean of 39.9244. For market capitalization of the company on the first day of listing, the standard deviation is 16,220,236,964.53172 with a mean of 4,859,160,416.7778. The time lag (time interval) from offering to listing (in days) has a mean of 35.9167 and a standard deviation of 33.02239. The mean for underwriter ranking is 6.0556, and the standard deviation is 2.48360. A mean of 7,143.3747 is noted for the Tadawul market index closing value on the day of listing, with a standard deviation of 1,807.29340. The Tadawul market index closing value on the day prior to listing has a mean of 7,414.4258 and a standard deviation of 1,366.03581.

The mean values were tested on a one-sample t-test as shown in Appendix III. The offering price of stock has a -50.305 t-statistic value while the rest of the variables have positive t-statistic values. The closing price of stock on the first day of listing has a t-statistic value of.950, the market capitalization of the company on the first day of listing has 1.797, time lag (time interval) from offering to listing (in days) has -.015, underwriter ranking has a -72.341, the Tadawul market index closing value on the day of listing has 23.596, and the Tadawul market index closing value on the day prior to listing has 32.408. The results depict both negative and positive values that characterize the underpricing of IPOs in Saudi Arabia.

A paired sample t-statistic test was conducted to determine the statistical significance between the variables. The variables of interest were underwriter ranking, offering price, sharia compliance, closing price, market capitalization of the company in the Tadawul market, time lag (time interval) from offering to listing (in days) and turnover rate.

Table 8: Paired Samples Statistics.

Table 8 shows a paired samples statistical model. From the table, it is clear that the offering price of stock has a mean of 4.5000, a standard deviation of 2.80038 and standard error of the mean of.62618. The mean and standard deviation of the closing price of stock on the first day of listing are 31.4880 and 25.32447 respectively with a standard error of the mean of 5.66272 for the first pair.

The descriptive statistics of the market capitalization of the company on the first day of listing has a mean of 4,859,160,416.7778, a standard deviation of 16,220,236,964.53172 and a standard error of the mean of 2,703,372,827.42195. The time lag from offering to listing (in days) has a mean of 35.9167, a standard deviation of 33.02239 and a standard error of the mean of 5.50373 (Tadawul 2016). The third pair consists of underwriter ranking with a mean of 5.6000, a standard deviation of 6.11504 and a standard error of the mean of.68881. Here, the offering price of stock has a mean of 4.5000, a standard deviation of 6.11142 and a standard error of the mean of. 72312. The results were consistent with the findings by Lasfer, Gajewski and Ginglinger (2007), Dobrynskaya (2014), and Haoque and Lasfer (2015). The results are detailed in Appendix IV showing the nature of the relationships.

Fourth hypothesis

H4: Initial underpricing is positively correlated with the turnover rate on the first day (TR).

A longer time gap between IPO offering and listing increases uncertainty.

Table 9: Correlations.

Table 9 shows the positive correlation between underpricing and the turnover rate on the first day of offering evaluated on the Pearson Correlation coefficient based on a Sig. (2-tailed) test statistic was run to evaluate the relationship among the offering price of stock, turnover rate on the first day (TR), time lag (time interval) from offering to listing (in days), underwriter ranking and sharia compliance. The statistic test generated both negative and positive values of the Pearson correlation coefficient. The offering price had a negative coefficient of -.412 with the turnover rate, showing that as it increased, the turnover rate decreased significantly. Similarly, evidence of underwriter ranking and turnover rate have a coefficient of -.217, showing that for prestigious underwriters in the Saudi market, the turnover rate is high, while low-reputation underwriters experience low IPO turnover rates.

The coefficient of interaction is negative between the time lag (time interval) from offering to listing (in days) and the offering price of stock, with a value of -.408. This implies that as the time lag increases, the underwriter decreases the offering price to increase the marginal impact on the turnover rate. Here, the latent factors that match between the underwriter and the issuer must be manipulated to create a strong demand for the IPO. This is an indicator of the need for a post-listing demand to increase the number of shares sold. However, because the option of over-allotment does not exist, the allotment procedure is viably used to meet the high demand for shares. It is evident that a -.009 correlation between underwriter ranking and sharia compliance is low enough to show that a significant number of companies operating in the market are sharia compliant. Indeed, Table 10 shows that 86.1% of the 36 companies comply with sharia law, while only 13.9% do not. Merdad, Hassan and Hippler (2015), Zaremba and Żmudziński (2014), and Mayes and Alqahtani (2015) found similar results which showed a strong positive correlation between underpricing and the turnover rate on the first day of offering.

Fifth Hypothesis

H5: There is a positive correlation between sharia compliance and underpricing.

Table 10: Sharia Compliance.

Table 10 shows that 31 of 36 companies, which constitute 86.1% of the companies, are sharia compliant while 13.9% are not compliant. The possible explanations include information asymmetry, the winner’s curse hypothesis, and the practice of complying with the law to avoid legal litigation—especially because most of the institutions involved in IPO underpricing are sharia compliant. This leads to the conclusion that companies operating in the Saudi Arabian stock market have realised superior underpricing because that sharia compliance. The results are consistent with the studies by Fan, Wongand Zhang (2014), Lone and Alshehri (2015), and Alanazi and Al-Zoubi (2015) who established that sharia compliance had a positive effect on underpricing.

Conclusion and recommendations

The results show the severe extent of IPO underpricing in Saudi Arabia as a function of different variables that have strong positive correlations among themselves. The driving determiners of underpricing include underwriter prestige in the Tadawul market, which is reflected in the dynamically increasing number of shares offered to the public and a high turnover rate on the first day (TR) of offering when tested on a linear regression model. Excessive underpricing is evident in the Saudi Arabian market. However, there is not a full explanation as to why underwriters try to underprice excessively. The motivation seems to be the need to attract more shareholders to increase market capitalization and avoid borrowing from banks and other high-interest financial institutions. It is also worth noting that the level of underpricing in Saudi Arabia is associated with the size of the firm, market timing, sharia compliance and firm size.

Sharia compliance in the Saudi Arabian market helps reduce uncertainty and increases confidence in the market. However, sharia compliance makes the market more efficient and reliable despite the rapid changes such as opening up the market to include international participants. This verifies the agency theory that underscores the importance of asymmetric information in terms of having an overall positive effect on the offering price of stock, closing price of stock and underwriter ranking as a function of IPO underpricing on the first day of listing as evident in the list of 36 companies that form the sample size used for the test statistics. In this model, a Durbin-Watson value of.557 shows a positive trend, indicating that IPO returns move in tandem with the general market characteristics as the market performance is seen to be positive.

Market capitalization shows a positive autocorrelation among different variables which include the time lag (time interval) from offering to listing (in days), the closing price of stock on the first day of listing and underwriter ranking. The changes are attributed to the value association with the Tadawul capital market and the strong underwriter prestige. However, a negative R2 value of.060 shows that market capitalization is neither positively affected by independent variables or by errors that occur due to accumulated single-period returns. It is evident that firms intending to attract more institutional investors tend to set high offer prices, while retail investors are offered shares at extremely low prices.

Underwriter prestige has positive correlations with the extent of underpricing and shows the dynamics of liquidity in the market. It is recommended that further research be conducted to determine underpricing in a Saudi market with international firms.

References

Abdul Rashid, A, Kamil Ibrahim, M, Othman, R & Fong See, K 2012, ‘IC disclosures in IPO prospectuses: evidence from Malaysia’, Journal of intellectual capital, vol. 1 no. 13, pp. 57-80.

Alanazi, A S, & Al-Zoubi, H A 2015, ‘Extreme IPO underpricing and the legal environment in wealthy emerging economies’, Journal of Multinational Financial Management, 31, 83-103.