Introduction

The types of risk faced by the present day construction industry have proliferated over the period. These risks range from the liabilities arising out of meeting the environmental obligations to meeting the compensation for injury and death of workmen in the construction sites. The risks also extend to the builder’s commitment to professional liability. However the construction insurance from the beginning has been applied with a limited scope based on the responsibilities of each of the parties involved in the construction projects with the main thrust on the completion of the project without hindrance from any financial problems emanating from losses or damages occurring during the periods of construction. Thus construction insurance is expected to deal with the exposure of the industry to risks arising during construction without considering other risks related to the location of the project and other lifetime hazards. The conventional insurance practices in the construction industry have just been sufficient to cover few of the problems and disputes in the industry. This has resulted in development of overlaps and gaps in the insurance cover for the construction industry which played a major role in the performance of large construction projects. The effect of such overlaps and gaps in the insurance cover has increased tremendously with the enlargement in the size of different construction projects. In this context the objective of this research is to examine the impact of different types of insurance covers that can be applied to construction industry and their effect in facilitating the insurance companies to expand their activities to riskier and large projects. As a case study this paper considers the impact of insurance on the functioning of the construction industry in Dubai UAE.

Insurance Practices in Construction Industry – An Overview

The definition of the term ‘insurance’ implies that insurance can be resorted as a mechanism for smoothing the costs of losses. At no point of time insurance can be equated to mechanism that transfers the losses from the insured to the insurance company. Insurance is an element that assists the guarantee of the future financial stability of any organization against the financial and business consequences of business risks which are speculative in nature and which occur unexpectedly (Edwards, 1995, p 28). Insurance in some cases operate as an option to ensure peace of mind to those who do not have the means to face huge losses or who do not have the capabilities, knowledge or inclination to run their business with a sophisticated approach. In some other cases there is the statutory or contractual liability to cover insurance. In those instances direct insurance is the one which is commonly adopted approach by most of the small and medium sized organizations to cover their exposure to risks. In the case of large corporations, insurance is considered as the cheapest method for managing the physical risks to the assets of the corporations. The corporations also cover higher levels of liability exposures by resorting to appropriate insurance coverage.

In the case of construction companies there are various types of insurance coverage which the construction companies need to provide for in order to carry on their business with exposure to reasonable risks. Insurance covering workplace safety, general liability insurance, property damage liability insurance, personal injury insurance, insurance against damages by fire and wrap up insurance are some of the common types of insurance which the construction companies normally cover during the currency of their business. Lack of adequate and proper insurance coverage expose the construction companies not only to financial losses but also to unnecessary litigations.

Construction projects are prone to inherent hazards and risks to people and property. This makes insurance an important factor in running construction business of any size. Insurance for the construction companies such as Builders Risk Insurance provides insurance cover to the construction business owners against the injury to the construction workers on project sites. However the mere coverage of insurance by the employer does not exempt him from maintaining safety in the workplace. Claims against construction insurance policies are paid out only when workplace safety and health is maintained in the constructions sites strictly in accordance with the required standards. Certain types of construction insurance policies cover the materials and machinery on the construction sites from the perils of accident, fire or theft. The high cost of construction materials in the current economic situation makes the construction insurance more significant.

However, the costs of insurance to construction industry have risen in the recent years due to various reasons including natural calamities, terrorist attacks and other economic events affecting the functioning of the construction industry. The occurrence of such types of events has made it impossible for several insurance companies to leave the industry unable to achieve profitability. Most of the insurance companies have exited the construction industry in order to eliminate further risks of underwriting the construction industry (Harris, 2003). The current market forces like non-availability of skilled labor, increasing litigations in the industry and exposure to unpredictable damages have made the cost of insurance in the construction industry spiral upwards. As of the year 2003 the cost of risk financing on a global basis amounts to 26.9% of the revenues from construction industry (Harris 2003, p 3). It appears that with the current economic conditions of the construction industry, the insurers have to change their methods of offering insurance services to the construction industry and develop new ways of providing insurance cover to the industry. Most of the insurance companies consider the construction industry to carry unusual risk factors which makes significant changes to the conditions of the policies including reduced coverage for the same amount of premiums and requiring the construction companies to go in for multiple policies to get the same quantum of insurance coverage. The insurance companies also resort to other options like increased warranties and penal clauses in the insurance policies and increase in the number of deductible clauses. Such practices have severely hindered the growth of the construction activities and it therefore necessitates looking into alternative and innovative ways of providing insurance cover to the industry. Precisely this forms the objective of this study to examine the current and future role of insurance in the construction sector.

Rationale

Insurance and law are interwoven in running the business of construction, necessitating those involved in the industry to cope up with the learning of insurance and law which already are complex and intense in nature. The procedures used in construction industry in all its facets like construction, design, supervision and operation make acquiring adequate knowledge of insurance critically important for the owners and managers to successfully run the business. From an insurance perspective such knowledge should extend to the identification of the risks and adequately covering them. To this end, this study is expected to add to the existing knowledge on insurance applications in the construction industry. Escalating insurance costs being a significant cost factor in construction makes it essential for the decision-makers to have a thorough understanding of the risks, liabilities, and indemnities, as these play an important role in defining the relationship between the various parties involved in the construction contracts. This study since it examines the impact of insurance on the expansion of business opportunities in the construction industry also provides some additional insight into the significance of new avenues of insurance applications in the construction industry.

Aims and Objectives

The aim of the study is to study the impact of different insurance policies to looks into the diverse covers available to engineers and contractors in the construction industry. The study therefore attempts to examine both existing and emerging trends in insurance covering the construction sector. The study also examines whether such policies contribute to the growth of the industry in the current economic situations. The objectives of the study are:

- To study the salience of risk identification and assessment in the risk management practices in construction projects for ensuring effective risk transfers

- To examine the role and responsibilities of different stakeholders of the construction industry with respect to covering the risks associated with the industry

- To study different types of key construction insurance policies along with their exclusions to assess the risk cover under these policies

- To study the perceptions of construction industry professionals and managers about the risk management and insurance coverage in the construction industry

Hypotheses

This research will try to find theoretical support to the hypotheses that:

- Greater use of insurance will lead to increased construction services.

- Insurance will make contractors to enter into risky construction activities.

Method and Structure

This study will use quantitative research method of survey questionnaire to accomplish the objective of examining the role and contribution of insurance to the growth and development of construction industry. The survey questionnaire will be distributed to some of the major construction companies in UAE to gather information on the insurance covers purchased by them in respect of their exposures to various industry risks.

This paper is structured to have different chapters in order to present a comprehensive research report on the topic of insurance applications in the construction industry. Immediately following this introductory chapter, the next chapter presents a detailed review of literature relevant to the topic. The objective of chapter two is to extend the existing knowledge on the insurance practices in the construction industry. Chapter three provides a descriptive analysis of the research methodology used by this study. Findings of this research will be presented in chapter four. This chapter will also contain an analysis of the findings of the study. Chapter five concludes the paper with a recap on the text of the report with a few suggestions for effective use of insurance for the promotion of the growth of construction industry.

Risk Management in Construction Industry

The objective of this chapter is to review the available and relevant literature on the topic of insurance coverage of construction industry. This review is undertaken with the intention of adding to the existing knowledge on the insurance policies covering the risks of construction industry and the benefits accruing to the industry. This chapter will also review the latest developments in the field of insurance in the construction industry.

Introduction

Construction insurance is the mechanism by which the interests of the parties involved in a construction project against contingent claims in exchange for a fixed amount of charges levied as premium. Insurance is being practiced in the construction industry as a major tool for risk management. By insuring the construction projects, the insurers undertake to indemnify certain types of risks by getting such risks transferred to themselves from clients, contractors, subcontractors and other parties connected with the construction projects. This enables the construction projects to obtain contingent funds at times when the construction projects sail through difficult periods. Construction insurance plays an increasingly pertinent role in making large and small construction projects successful with the financial losses resulting from natural disasters and other contingent events shared by the insurers. The irony is that the role and importance of insurance in construction industry is some instances not recognized and is also not given the attention it deserves. This is mainly due to the lack of knowledge of the practitioners on risk assessment in the construction industry and non-allocation of necessary resources for adequate insurance cover. This ignorance prevents them from implementing appropriate strategies for risk management through different and suitable insurance covers. A thorough study of the nature of construction risks would enable the identification of the areas of exposure to risks which need to be covered against such exposure.

Overview of Construction Risks

The inherent characteristics of construction projects present a number of risks associated with construction works and make the projects more vulnerable to financial risks (Bunni, 2003). There are a number of risks identified with the progress of the construction projects. (Palmer, 1999) categorizes these risks in the areas of

- timing,

- project nature,

- approvals,

- owner structure,

- project delivery, and

- project controls.

Timing risks are associated with not only the time spent on preplanning of a construction project but also the time taken by the project during its progress. Time is the essence of any construction contract and without a proper preplanning the project cannot be physically completed within the agreed time. Due to lack of time, if the construction work is done in a fast-track manner, there is the likelihood of quality problems arising out of the construction. Therefore, in this case the level of risks is higher for possible disputes on design and quality of construction.

Project nature relates to various attributes of the project in terms of type, size, complexity, location and completeness of design plans which go to define the overall scope of the proposed project. The chances of problems arising out of commercial buildings designed to meet normal specifications are much less as compared to the construction of industrial process plants which are built to unique and specialized designs. However, each risk factor affects the progress of the construction in varying degrees of intensity based on the circumstances. For instance, the construction of an office block in a new geographical area with an incomplete design specification may also pose larger issues to resolve.

‘Approvals’ is another area which might cause hindrance to the timely completion of the construction projects. In a construction project approvals are required at various stages of completion and even before the construction starts. Especially, construction projects that are supposed to meet stricter environmental regulations are likely to result in more time delays and cost overruns than other normal projects. This is because of the fact that the provisions in the construction to meet the environmental standards are to be reviewed by different government agencies at various levels. Similarly projects which are opposed to general public perception of better living like nuclear plants are prone to delays due to problems in approval than the construction of a park or other recreational facility for public use.

In respect ‘ownership’ a construction project is subjected to several risks on the consideration of the type and experience of the owners. All the future problems in a proposed construction project are closely associated with the ownership. It is always the case that an ownership organization having only limited experience and which has not appointed professionally qualified construction management professionals is prone to innumerable risks than an organization which engages defined set of procedures and professional controls over its working. Owners who have the knowledge and skill on running the construction business normally understand the repercussions of changing the scope of work as to the cost and risks involved. Therefore they try to complete the work on schedule so that the construction contractors are not put to losses. In addition those owners who do not plan the work ahead with the backing of adequate contingent funds face significant hazards to the progress of the construction activity.

The category of risks under project delivery is concerned with the type of contractual relationship that exists between the parties and the organizational structure designed to oversee the progress of the project. Oftentimes it is found that fixed-price or lump sum contracts are less risky than the fast-track construction contracts where the mode of working is cost-plus type of arrangement. Similarly, under circumstance where the owner himself takes up the responsibility of fulfilling the contract by subcontracting the whole or substantially whole of the project work is likely to face severe risks with regard to the completion of the project on schedule.

Project management control is one of the areas that have significant impact on the completion of the construction project. With proper project management controls in place it is possible to discover the likely problems in the construction before they lead to significant cash outflows. Lack of efficient and effective project management control lead to a number of operational risks in the progress of construction projects of any size (Palmer, 1999).

In addition when the parties involved discuss and settle the cost of change orders up-front during the continuance of the project instead of arriving at the amount of settlement after the project is completed, it would avoid exposure of the project to a number of potential risks. In the matter of assessing the project risks, it is essential that all the risk factors are critically evaluated in advance so that any uncertainty relating to the project is detected before the commencement of the project. For instance areas such as ownership structure and project management controls are likely to be associated with more risks than others. Once the risk factors are identified and evaluated it becomes easier to deal with them individually by developing appropriate course of action including insuring the possible risks. This way the risk associated with the project are reduced to manageable levels to ensure the unhindered continuance of the project.

Alternatively, the risks associated with the construction project can be grouped as

- internal factors,

- external factors, and

- management aspects.

The internal risk factors include the presence of a number of stakeholders and huge capital outlay. There are also other elements like great diversity of end users of construction projects and varied work sites using large and mobile equipment. The fact that works and locations are fixed having long gestation period and are of high monetary values increase the risks involved in the projects. Natural hazards like flood, lightning, earthquakes and storms and varying site conditions including the characters of soil pose significant risks to the progress of the projects. The structures surrounding the location and the risks of theft of materials at site are some of the additional factors that determine the level of risks associated with the project. War, unproductive labor and strikes also contribute to the slow pace of work in any construction project. Certain management aspects like contractual obligations between the parties involved, cost control and time control add to the risks of construction projects. The time span of a construction project is usually a lengthier one involving various phases such as planning, investigation, design, construction and completion of the construction. The formation of temporary project teams for completion of the contracts is yet another source of risk disrupting the progress of the construction. There are other areas like environmental issues, health and safety management at the work sites and political risk management which need to be considered while planning the schedule of completion of any construction project. Because of the presence of a number of stakeholders such as clients, suppliers, manufacturers, contractors and subcontractors the construction projects are often found to be inundated with several hazards and risks. The unique characteristics of each project lead to significant probability of risks and claims during or after the completion of the construction. Therefore there is the need for according special treatment to the construction projects. Although a number of techniques and processes exist to identify and assess the risks associated with construction projects there are no standard techniques or processes that are earmarked for specific project assessments (Walewski et al., 2002). It is shown that there is a gap between existing risk management techniques and their application and use by the contractors and owners (Han & Dickmann, 2001).

Risk Pricing in the Construction Sector

The unique nature of the industry and the projects within make the industry prone to higher degree of risks. The peculiarity of these factors necessitates the pricing of the construction project before production by a proper and careful assessment of the risks involved in the completion of the projects. Competitive tendering as a means of awarding the contracts, low-fixed capital requirements, higher preliminary expenses, possible delays in realizing the cash flows, tendency of the owners to operate within low working capital means, seasonal effects on the completion schedule, governmental regulations and interventions, uncertain soil conditions, impact of unpredictable weather on the construction activities and lack of performance liability or long-term guarantees are some of the other peculiar characters associated with the construction industry (Calvert et al., 1995, p 53). Construction projects are categorized by long production cycle, involving the input from a number of participants and the projects are also expected to meet complex regulatory requirements and standards (Kwakye, 1997, p 6). The higher rate of business failures in the construction industry goes to prove that the industry is yet to master the mitigation of risks associated with the industry.

For a considerable period of time the industry practitioners have adopted unsystematic mechanisms like depending on their intuition and unsophisticated in-house techniques in the evaluation of risks while estimating the cost of the projects. Mochtar & Arditi, (2001) out of a study of the pricing strategies of 400 top US contractors observe that the contractors mainly relied on their intuition in setting up the mark-ups for their projects after a subjective evaluation of the competitors and their moves.

It is the usual practice of the contractors and other players in the construction industry to apportion the risks based on a fixed percentage or as a lump sum amount to the base estimate of the project cost to allow for any escalation due to uncertainties in the project. In order to mitigate the issues involved in the arbitrary allowances for contingencies, the Hong Kong government has implemented the Estimating using Risk Analysis (ERA) technique as the logical way of apportioning the value of contingent risks in the project estimates (Mak & Picken, 2000). In general the construction industry has no systematic way of analyzing and evaluating project risks and safeguard against such risks.

Risk in construction projects represents the events that have an impact on the traditional project objectives of time, cost and performance including quality. Risk can be defined as the chances of occurrence of certain events affecting the project performance either positively or negatively with such occurrences emanating as a consequence of uncertainties associated with the project. Risk event is represented by the probable happening to the detriment or in favor of the project (Al-Bahar & Crandall, 1990). According to Aqua Group, (1990) risk is the possible loss arising from the difference in what was expected to happen and what actually happened. Cost overruns, time delays, poor quality of construction and design and disputes among the parties to a construction contract are some of the common problems arising in a construction project. Risk therefore is a major factor for consideration by the contractors as well as the clients and consultants in the construction industry. However because of the complexity of risk assessment they have been poorly understood by people in practice.

Ways of Tackling Risks in Construction Industry

Research report of RICS, (2004) has identified five different ways in which the practitioners in the construction industry tackle the risks against the completion of construction projects. They are

- Umbrella approach – under this approach the owner allows for every possible eventuality and therefore adds a large amount of risk premium to the contract estimate,

- Ostrich approach – under this approach the practice is to bury the head in sand with the assumption that everything is in place with the project and the project will somehow be completed within the time and cost schedule,

- Intuitive approach – wherein the owner or the managers do not believe in any systematic risk analysis for evaluation of the associated risks but depend on their intuitions for managing the risks,

- Brute force approach which focuses only on those risks which remain uncontrollable with the decision to force things for achieving the project objectives and

- Snowboard approach in which it is assumed that the owner or manager is placed on a snowboard on the downhill on their run.

This approach envisages a preplanning and analysis of all possible risks recognized as pitfalls on the way and providing for corrective actions as and when the projects encounter those risks, by having a record of the risks in mind. It is also recognized that it is possible to control certain things like speed and route but not other things like weather and competition. The focus under this approach is therefore centralized on the possible corrective actions needed to control the risks and make the project successful. It may be observed that with the present economic situation the first four approaches can be effectively adopted only by very few organizations which also explain the reasons for a number of business failures in the construction industry.

The absence of systematic analytical models however, cannot be said to indicate a poor approach by the contractors in dealing with the risks associated with different projects. It is observed that from the beginning of the 19th century when the contractors resorted to forms of general contracting, they have put in use different mechanisms to tackle the risks and survived the repercussions of such risks. However insurance has not been found to be one of the important tools in mitigating the construction business risks. Most of the contractors have resorted to other methods like speculative house building during the 19th and 20th centuries in order to sustain the available labor force and overhead costs of the business. By adopting speculative house building the contractors were able to sail through the peaks and troughs of construction sector. In the modern times, there is a marked change in the approach in which the contractors use their positive cash flows to invest in other projects rather than on house building. Few successful contractors have entered other business areas with shorter cycles so that such businesses supplement their construction activities (The Oxford Encyclopedia of Economic History, 2003, p 1: 511). There are other ways by which the contractors reduce the risks involved in the business. Some of these ways are not accepting works which are considered too risky, subcontracting a large portion of the construction works involved to other parties and apportioning large amounts in wage structures to take care of eventualities. By resorting to these practices, the contractors are able to pass on the risk to other parties. Still insurance has not been looked at a possible option for risk avoidance by the contractors. Although there is no systematic way by the contractors are able to provide for pricing risks in construction contracts, the contractors use their intuition to make adjustments either in quantities or per unit rates or both so that the uncertainties resulting from the associated risks to the business are taken care of. On the other hand there are several insurance plans that may be applied to the construction industry to mitigate the risks which can be favorably looked into by the contractors.

Risk Management in Construction Industry

A number of uncertain factors pose challenge to the different parties involved in a construction project. All these factors are categorized as risks. Arriving at decisions based on assumptions, expectations, estimates and forecasts of the likely future events gives rise to risks associated with any construction project. In risk and uncertain situations the actual outcomes for a particular event would deviate from the anticipated outcomes causing disturbances to the progress of the event (Rafetery, 1994, p 9). The nature of activities involved, processes, and external environment relating to the construction industry makes it more dynamic, risky and challenging venture. However the construction industry has been identified to possess poor risk management skills leading to delay in completion and cost escalation in various construction projects. This in the past has resulted in significant losses to clients, contractors and the public (Edwards, 1995). Construction risks are considered to be events that have a profound effect on the cost, time of completion and quality of construction. While it is possible to predict and easily identify some of the risks associated with the construction processes, there are other risks which are totally unforeseen and unpredictable (Ahmed & Azhar, 2004). The level and scope of the risks associated with the construction industry varies with the size and nature of different projects. In general these risks are directly related to the context of the contract implying the environment in which the project will be built such as the geographical location and regulations governing the construction. They are also dependent on the scope of physical elements of the project such as scope, budget and materials representing the content of the project (Davis & Prichard, 2000).

It is usual that with the construction project becoming more technical and complex, that there would be an increase in the risks associated with the contracts. This ultimately leads to the increase of negative impacts to the execution of the project itself. Therefore, for managing risk efficiently there is the need to identify the risk in time and analyze them for mitigating them.

Gray and Lars observe the risk management as a proactive approach undertaken to control the level of risk and to offset the impact of such risks. Risk management enables the project manager to face the risks with the possible advantage of time, cost and technical issues connected with the project. Efficient risk management assists the project manager to have better control over the future events and in achieving the project objectives of meeting the time and the expected standards of technical and functional performance (Gray & Larson, 2008, p 4).

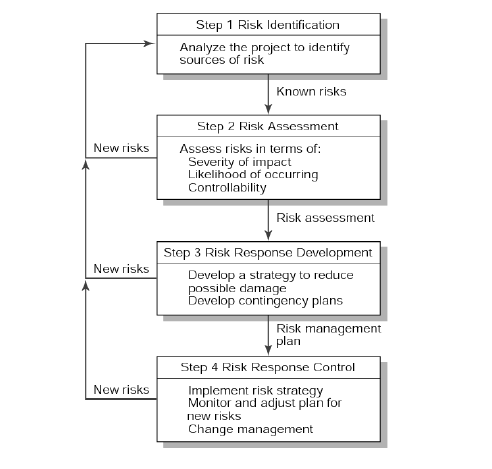

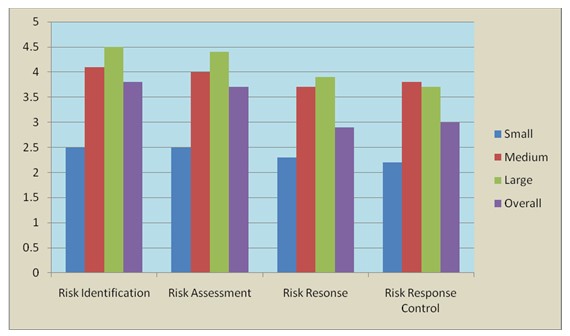

The figure 2.1 illustrates the steps involved in the risk management process.

Risk Identification

The first step in the risk management process is the identification of the risks. This step involves generation of a list of all possible risks that could influence the performance of a project. The risks associated with a construction project may take the form of

- natural disasters like flood, hurricane,

- physical challenges such as injuries onsite to workers, fire, damage to machinery, equipments and materials,

- financial and economic challenges such as inflation, paucity of funds,

- political and environmental issues such as changes in regulations, political regime,

- design-related issues like defective or incomplete design,

- construction –related issues like change orders, variation in productivity (Al-Bahar, 1990).

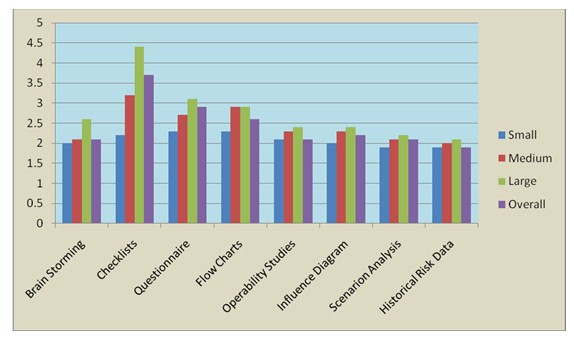

There are various techniques available for identifying the risks associated with construction projects. Hillson, (2002) has identified processes like brainstorming, workshops, checklists, questionnaires and interviews as the possible tools available for risk identification. Delphi groups and other diagrammatic approaches such as Cause-Effect diagrams, Systems Dynamics, Influence Diagrams are some of the other techniques considered suitable for risk identification. However, no single technique or combination techniques have been identified to be suitable for risk identification (Hillson, 2002).

Risk Assessment

Risk assessment is the process which helps the project management in estimating the potential impact of risks. This assessment helps the manger to arrive at the decisions regarding the risks that may be retained with the business and segregating those risks which need to be transferred to other parties. Risk assessment can be carried out by employing quantitative and qualitative techniques. When the data available are strong enough and are reliable, the project manager can use quantitative methods. The quantitative methods in these cases provide accurate results by relying on probability distribution of risks. Contrastingly, personal judgment and past experiences of the analyst form the basis for qualitative techniques. The results out of qualitative techniques may vary for assessments conducted by different persons. Therefore, when both quantitative and qualitative techniques can be used, it is advisable to use quantitative techniques in preference to qualitative techniques (Chapman & Ward, 1997, p 14).

Risk Response Development

Responding to risks identified in a construction project is a critical step in the process of risk management. This step can be completed by four typical ways in response to the risks identified in a construction project. They are

- Risk elimination – this is achieved by placing suitable preconditions in the bid,

- Risk transfer – which involves hiring subcontractors or arranging for suitable insurance coverage,

- Risk retention – this process involves reducing the impact of risks through strategies developed in advance,

- Risk reduction – which is accomplished by training the staff about different perceptions of risk and ways in which risks can be managed (Panthi et al., 2007; (Thompson & perry, 1992, p 23).

Risk Response Control

The last step in the process of risk management is the risk response control. This step involves the elements of executing the risk response strategies, monitoring triggering events, initiating contingency plans and watching out for new risks to emerge. Establishment of a change management system to take care of the risk response control process is one of the essential elements of this step. This is required to deal with events requiring formal changes in the scope of the project, altering the budget and/or schedule of the project (Gray & Larson, 2008, p 35).

Gnerally the construction project managements do not use the risk management processes extensively due to many reasons. Lack of knowledge about risk management techniques and sophisticatied nature of these tehcniques and doubts about the suitability of the techniques are some of the barriers identified to have impeded the use of the risk management techniques by the projects. However, an incrased use of sophisticated risk management techniques would result in improved profitability, reduced costs, better time management and improved customer relationships which are vital for the success of any construction project.

Risk Transfer and Insurance

A construction project is surrounded by a number of uncertainties in the completion. Managing these uncertainties involves managing the risks associated with the projects. Risk management system outlined in the previous section is designed to manage the risks faced by the construction projects. Various definitions of risk management have been evolved based on different perspectives of risks identified with the construction projects. Generally, the focus of risk management centers round managing the adverse impacts of risks. Flanagan & Normann, (1993) defines risk management as a discipline structured to live with the possibility of the future events causing adverse impact on the progress of any project. Other definitions describe risk management as the process leading the management to arrive at decisions to reduce the likelihood and/or impact of the possible occurrences of risks (Broome, 2002; Bunni, 2003; Treceno et al., 2003).

Any risk management process has to recognize that it involves both positive and negative outomes. Risk management has to be carried as a continuous process during which the sources of uncertainties are identified in a systematic way and the impact of such uncertainties are assessed and qualified. It also involves the assessment of the imact of the uncertainties and mangement of the likelihood of such uncertainties to arrive at an accepable balance of the risks and opportunities (Dawson, 1997; Williams et al., 1998). Smith, (1999) defines the risk managemnt as the process of understanding a project and arriving at a better decision to manage the project in the future.

Although different definitions have attributed different connotations to the term ‘risk management’ Dawson (1997) has summarized the essential similarities among the definitions and has listed the following as the common characteristics of risk management as identified by these definitions. Risk management has a formal process and it employs systematic and scientific methods to assess and manage risks. The objective of risk management is to identify the risks in any business including a construction project and to evaluate the impact of the risks on the conduct of the business or completion of the project. Risk management also provides mechanisms for monitoring and controlling the individual risks with a view to reach an acceptable level of overall exposure. Risk management is a continuous process and cannot be considered as a one-off event.

As observed in the previous section the objective of risk identification is to identify all the possible sources, events and causes that cause risks while progressing with a project. Risk assessment deals with the technical evaluation of risks with a view to find out the possible impact on the progress of the project. Risk analysis enables the project manager to analyze the different aspects of risk including the risk dependency chains. This process would enable the project manager to evaluate the impact of the risks on the completion of the project (Tah & Carr, 2001).

Effective risk control enables the project to reduce the exposure to different types of risks and thereby helps the project management to mitigate possible adverse impacts and losses. Essential elements of risk control involves

- risk retention or absorption,

- risk reduction or mitigation involving education and training of the project staff to identify potential risks affecting the progress of the project, physical protection to the equipments and machinery to reduce the possibility of physical losses to property, systems to ensure consistency in the approaches dealing with potential risk situations,

- risk transfer including the processes of insuring against the consequences of possible losses occurring as a result of an event, sub-contracting to different parties and modifying the conditions of the contract to ensure that there is suitable modification in the risks and

- risk avoidance.

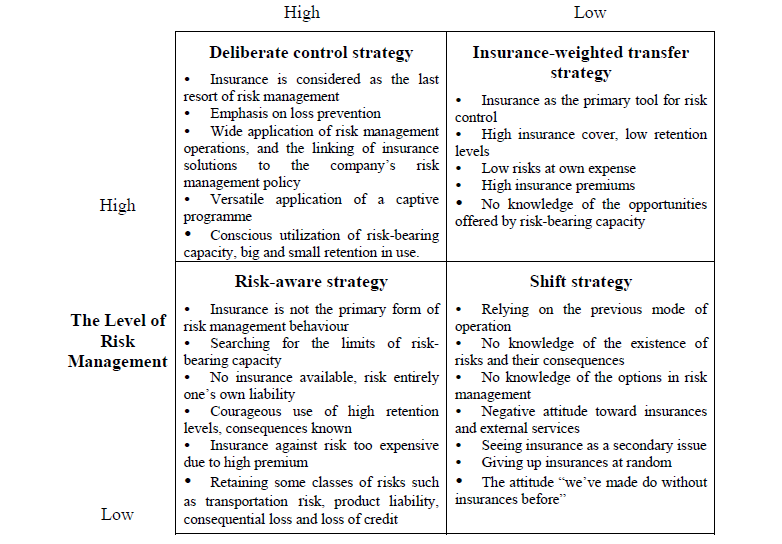

The important consideration in transferring the risk is to make an assessment of whether the receiving party has the competence of making a fair assessment of the risk and is having the necessary expertise to minimize or reduce the impact (Kangari, 1995). The traditional objective of entering into a contract is to use it as a tool for risk sharing and allocation. There might be changes in the nature and extent of risks as the project progresses with new risks emerging and existing risks changing in their scope and importance. Such changes might also have the effect of aggravating or easing other risks associated with the project (Rahman & Kumaraswamy, 2002). However, with the contract conditions alone, it is not possible to ensure that there is an efficient and exhaustive allocation of risks (Rahman & Kumaraswamy, 2002). Basic risk management behavior adopted by the management can exhibit the risk management solutions implemented by it. The different dimensions of risk management are expressed by the level of risk management adopted and the strategic consciousness of the management. For instance, the application of an insurance-weighted transfer strategy or a deliberate control strategy would imply a high level of risk management. On the other hand, a risk-aware strategy or a shift strategy would imply lower level of risk management and this would lead to a higher level of risk-taking by the organizations.

When the organization is not following a practice of managing the risk through insurance, it implies that the level of risk management and the strategic consciousness of the management both exist at low levels in the organization. Alternatively when the risk management level is high and the strategic consciousness of the management is low, the management indulges in pursuing insurance as a frequent option to control risks. However insurance has not been considered as the best option for risk management on all occasions. With the increase in the strategic consciousness the management tends to look for alternative avenues of risk management.

The following figure illustrates the level of risk management and risk control strategies of the organizations at various levels.

Conclusion

Construction projects inevitably involve a number of complicated and onerous risks causing loss or damage to properties. In the present day’s economic climate, the risks associated with construction projects are compounded by changes in legislation. The efforts of public authorities in recovering claims from the personnel managing the projects, the adoption of non-standard building contracts and increased activity in design and build projects and the problems arising out of projects put on hold or suspended also add to the risks in construction projects. All these additional risks make it compulsory for the professionals concerned with the construction industry to review and update their knowledge about various insurance programs available to cover such risks. Traditional construction risks such as liabilities arising out of loss or damage to contract works, public liability, loss or damage to plant and equipment of the contractor, delay or inability to complete the construction still continue to have relevance to the projects. However construction industry professionals need to extend their risk management practices covering liquidated damages, pollution liability, project-specific professional indemnity and contingent contractual liabilities. In this context the review of literature dealt with by this chapter has enriched the knowledge on risk identification and risk assessment in the construction industry including a discussion on different types of insurance coverage available to the construction industry.

Review of Contract Insurance Concepts

Insurable Risks

In order to understand the implications of insurance on managing construction project risks, it is important the concept of insurable risks is understood in its proper perspective. Insurable risk in general is a risk that can be covered by insurance. If a risk is to be accepted by the insurer as an insurable risk, it should be a ‘pure risk’ having a downside effect only with the possible opportunity for loss. Traditionally insurers do not cover speculative risks. The risk in order to be covered by the insurers should possess the characters of being sudden and accidental. In addition the risks should have statistics so that the insurer will be able to simulate the past events occurred and arrive at a premium that is creditable and accurate.

For covering the physical damages to properties used in construction, project managements use Contractors’ All Risks policies. These policies cover all materials whether in transit or in storage or forming part of the contract works. Irrespective of the fact that a risk is insurable, there are various other factors such as the insurance limits, cost of insurance and premium payable, period of coverage, negotiations and flexibility of the insurance contract and limitations and exclusions under the policy are some of the issues relating to the policy that need consideration to extend the coverage for any risk. Sharing risks with the insurers in terms of deductibles, market standing of the insurer, ability and reputation of the insurer in settling claims implied as the security of the insurance contract and insurance gaps and overlaps are some of the other factors which determine the insurable nature of a risk.

The deductibles are one of the sensible things to be considered in arranging the insurance coverage. Howard, (1997) identifies two possible reasons to include the deductibles in an insurance contract. These are (i) to reduce the number of small claims where there is a possibility of the administrative costs exceeding the claim amounts, and (ii) to ensure that the insured complies with all their obligations in terms of taking the precautions and steps necessary to prevent the loss or damage to the insured property. Therefore, it can reasonably be stated that insurance encourages managing the risk in a better way especially through the process of risk reduction.

Insurance has been identified to be an effective tool for mitigation of risks at the country, market or project level (Wang et al., 2004). For instance risks arising due to changes in legislations, expropriation and political instability can be mitigated by resorting to political insurance coverage. Liabilities arising out of improper designs can be managed through design liability insurance and claims payable to public and third parties can be managed by taking coverage under third party insurance. However it has to be remembered that it is not possible to transfer all the risks through insurance mode. Risk assessment checklists function as one of the effective means of identifying the insurable risks (Williams et al., 1998). Similarly insurance surveys and questionnaires can serve the purpose of identifying insurable risks.

Contract Insurance – an Overview

From a legal perspective, the purpose of insurance is to allocate the risks to which the project is exposed between the parties involved in the project. From an insurance point of view, risk becomes the basis of insurability and calculation of premium amounts (Bunni, 2003). According to Dickson, (1983) insurance can be regarded as a mechanism used to transfer the business operations from a state of uncertainty to a state of certainty at a cost which is known as the premium. Insurance is a cost-smoothing exercise employed by the contractor to substitute an unknown potential loss with a regular known amount of premium.

FIDIC (1986) and CII (1993) have defined insurable risks having the following characteristics. They are:

- an insurable risk should be capable of being measured in quantitative terms. It should also be possible that the theories of probability and law of inertia of large numbers can be applied to the measurement of the quantitative terms.

- the insurable risk should contain a large number exposure units which are homogenous and are relatively independent,

- the risk should contain losses which are determinable and measurable and also are accidental and unintentional,

- the insurable risk should be capable of being covered by an economically feasible risk charge or premium and in respect of which there are reliable estimates of past frequency of claims and severity available,

- there must be an insurable interest present for the insured on the object which he proposes to insure.

From these essential characteristics of insurable risk it follows that, in order to use insurance as a tool for mitigating the associated risks depend on the elements like

- the insurability of the risk,

- the adequacy and suitability of the policy,

- a comparison of the cost of insurance (premium) and the potential losses occurring out of the risks,

- trust and confidence of the insurers in connection with their solvency and servicing of the claims,

- non-availability of other risk transfer solutions.

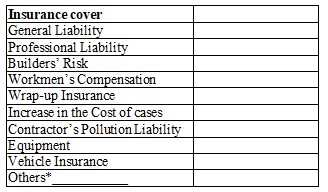

Generally a typical construction project would consider covering insurance in respect of damages to materials, liability to third parties, damages to materials in transit, damages to equipments and plant at construction sites, liabilities on account of consequential losses and non-negligent indemnity. Insurance may cover employer’s liability on account of workmen compensation, auto insurance, professional indemnity for the negligence of architects and consulting engineers, contract performance guarantee bonds and liabilities for inherent defects in construction.

Perspectives on Risks from Parties to Construction Contract

Risk management involves a process in which decisions are made to accept a risk identified and find ways to eliminate or mitigate such risks (Treceno et al., 2003). However, the issue concerned with contract insurance is to fix the responsibility on a party for carrying the risks and the cost at which the risk is to be carried. There are varied parties involved in a construction contract like clients, contractors, subcontractors, insurers and suppliers. According to Chapman & Ward, (1997) the different parties involved in a construction contract have different perspectives on risks based on the background of the parties and the benefits accruing to the respective parties. Clients consider the risk of the project not being completed within the scheduled time and within the budgeted costs. On the other hand the contractors are concerned with the cost of the contract and the margin that they can earn out of the project and this is considered as the risk arising out of the construction project. The workers of the project perceives the risk as ensuring health and safety in the workplace and the risk of meeting with accidents and suffering from diseases incidental to working in the project (Anderson, 2000). In addition some of the risks are peculiar to one party and some other risks are shared among different parties. This phenomenon gives rise to a number of conflicts among the parties to a construction contract and consequent claims against each other. Because of different degrees of knowledge and perceptions of risks of different parties interacting with the individual objectives and priorities, the risk sharing among the parties under an insurance contract becomes a complex affair. It is to be noted that the risks associated with the project are carried efficiently by the party which is involved in the management of the project and who is able to best manage the factor giving rise to the particular risks (Flanagan & Normann, 1993). For instance the clients should cover the political risks, while the contractors can be made responsible for risks concerning safety of the project. Similarly design consultants can assume the responsibility for risks arising from design defects. Thus contract insurance can cover the interests of clients, financiers, contractors, subcontractors, architects, engineers and suppliers.

Clients

Since the clients of the construction project are the parties ultimately responsible for settling the bills, it becomes important to understand the needs and expectations of this category of stakeholders. From the perspective of the clients, the risk management encompasses the total process starting from briefing the project details until the handing over of the project to the users. Clients are the first party responsible for conducting the risk management process. They are the ones to involve contractors during the starting stage of the contract or at other stages according to the procurement method fixed for the contract. For example in construction and design contacts, contractors are to be involved even from the design stage of the contract. Clients are keen in achieving their desired objectives in terms of cost, time and quality of construction.

According to Edwards, (1995, p 39) the major concern of the promoter or the financier who happens to be the client is to obtain a reasonable rate of return for the risks undertaken. The clients are equally concerned with the likely impact of changes in estimated costs, benefits and timings on the rate of return on investment in the construction project. According to the traditional approach to construction insurance the more the client transfers the risk to other parties, the more are the chances that the project budget would remain safe and secure (Boothroyd & Emmett, 1996). However, it is important that an overall analysis of costs and benefits of the construction insurance proposals is undertaken to balance the risk transfer.

Failure to mobilize the necessary funds, failure to make payments to contractors/subcontractors at different stages of the progress of construction, additional administrative costs incurred due to governmental action, risks associated with acquisition of land, non-availability of materials furnished by the client, major changes in contract requirements, interference among the parties and delays in project are some of the main risks faced by the clients. These risk factors may lead to adverse consequences such as escalation in cost, faulty project completion, frequent maintenance issues, abandonment of projects in incomplete stages resulting in wastage of huge investments.

Contractors

Contractors are the set of stakeholders who carry the major responsibility to carry the risks associated with the construction sites. They are the people responsible for successful completion of the project within the time and cost and within acceptable quality standards. The project performance entirely depends on the capabilities of the contractors to efficiently manage the risks associated with construction (Wang & Chou, 2003). In the recent past the trend is to transfer the majority of risks in respect of construction contracts to the contractors under various clauses included in the contracts between contractors and clients (Lynch, 2003). The contracts provide that in cases where there is no specific allocation of any risk, then it becomes the responsibility of the contractor to undertake such risks. These types of risks normally include risks arising from unexpected disturbances to the progress of construction by third parties like illegal waste disposal, threats to construction by local gangs and requests for contribution by the local communal outfits. Therefore it becomes important that the contract should provide clear allocation of risks among the parties. When the contract does not contain specific directions on the allocation, it may lead to misunderstanding resulting in disputes with the other parties. Such misunderstanding may sometimes result in the failure or stoppage of the project.

It is to be appreciated that risks to be assumed by the contractor may arise at any stage of the project starting from the bid agreement through the completion of the construction and may extend even through the follow up maintenance contract. However it may not be possible for the contractor to carry all the risks associated with the project, as the costs may not justify such assumption. Therefore it becomes inevitable that the ability of the contractor to control and bear different types of risks is considered before allocating the risks (Boothroyd & Emmett, 1996). Better understanding of the risks and their impact on the construction process enables an efficient allocation of risks among the parties who are in a position to control them efficiently.

In any construction contract while some of the risks may be predicted easily, some of the risks may arise surprisingly. Palmer et al enumerates the risks that may arise from the perspectives of the contractors. The risks include damages or delay due to bad weather conditions, delays in availability of suitable sites, present site conditions, inadequate details in drawings related to construction, delay in delivery of materials, unexpected price variations, failure on the part of the subcontractors to deliver in time and in the required quality, labor strikes and lower labor productivity due to other factors, delays and damages due to labor strikes, risks relating to design and defects in construction, damages, penalties and costs resulting from the delays in completion of the project and many others which have a likely adverse impact on the completion of the project in time. In order to mitigate or eliminate these risks, contractors should consider various contract insurance and transferring the risks to other parties like subcontractors, insurers or consultants. Risk responsibilities, risk pattern, risk management capabilities are some of the important elements that a contractor should consider while deciding on any suitable risk management strategy (Wang & Chou, 2003).

There are certain risks which are insurable like fire, theft and other physical risks. Certain other risks like quality of materials, workmanship and quality of construction can be transferred to subcontractors. There are risks like bureaucratic delays which may be shared with the clients. Risk management thus can be seen as one of the important decision-making process to be undertaken by the contractors. The decision of the contractors centers round the direction of retaining, reducing, transferring or avoiding risks depending on the circumstances of each case. By adopting a systematic strategy of risk management the contractor would be able to improve the probability of mitigating or avoiding the adverse impact of risks associated with the project.

According to Boothroyd & Emmett, (1996) the contractor should be provided with an adequate compensation for any risks that he undertakes on behalf of the client. This can be considered as the most cost-effective route for a client from the insurer’s perspective. Traditionally the contractor is motivated to follow the route of adequately insuring the works so that he would be able to meet the expectations of the client satisfactorily. For instance a ‘contractors’ all risk insurance’ policy is one of the ways the contractor ensures the client’s satisfaction. This route is mostly adopted by the contractors since the clients expect the contractor to make good the loss or damage to the contract works during the continuance of the project by repairing or replacing the works in the event of any such loss or damage for which the contractor has undertaken the responsibility. In addition, the client expects to be indemnified by the contractor against the possible claims from the employees of the contractor or from third parties and the contractor is under obligation to indemnify the client in such cases. The contractor usually arranges for employer’s liability and public liability insurance in such cases to mitigate the risks.

By entering into an insurance contract the contractor would be able to achieve a proper allocation of risks and responsibilities arising under the contract. Therefore insurance can be considered as a major risk transfer tool and insurance therefore needs to be considered as a critical part of an integrated risk management program. The process involves three major steps:

Assessment of Risks

It is critically important that the contractor assess and segregate the risks that need to be insured and those to be retained. In cases where the insurance policies are not issued properly based on the risks assessed, it might lead to situations where the contractor would find himself without cover in respect of claims arising from the contract. It is for the contractor to design the policies more specifically in accordance with the needs of individual circumstances. Therefore it follows that an insurance policy should be carefully designed based on nature of the project undertaken, the type of procurement method followed, and the provisions of the construction contract defining the responsibilities of the contractor under the contract. Innovative insurance ideas meeting the specific needs of the circumstances must be evolved by the contractor and the contractor should also be able to obtain reduced premiums by implementing improved loss control and risk management techniques with the help of his experienced team members.

Selection of Insurer and Policies

The contractor should possess an extensive knowledge on a wide range of construction insurance policies available to meet his needs. It is also vitally important that the contractor makes an assessment of the financial strengths, claims paying ability and market standing of the insurers offering those policies. It would be possible for the contractor to assess the exact nature and quality of an insurer only when the insurer is presented with a claim to settle.

Underwriting and Settlement of Claims

The contractors have an important role to play in the matter of deciding on the value of items to be insured and the negotiation of premiums to be paid on the insurance policies. However the contractor cannot decide on taking the cover under an insurance policy purely based on the price factor. There are other aspects like the quality of the insurers in settling the claim and support in the management of risks which need to be considered while deciding on the insurance coverage. The following are some of the factors that a contractor should keep in view while employing any construction insurance. The contractor should

- understand the perceptions of the insurers on the construction industry in general including the development of latest technologies,

- develop and maintain a good rapport with an insurer who has the expertise and is qualified in the field of selling construction insurance products,

- ensure that effective risk management systems, safety management programs and quality control measures are installed so that there would be an efficient control over the risks,

- follow the track record of the performance of the insurer over the period and

- educate the workers and staff to improve their understanding on the current insurance trends.

Insurers

While it is for the contractors to identify the risks and place their mitigation in the hands of right insurers, the insurers are the people responsible for the successful risk management related to a construction project. The insurers are in a position to provide a better risk management with the help of their expertise to recognize potential risks associated with the project and reducing the probability of occurrence of such risks. By undertaking to provide an insurance coverage, the insurer acknowledges the intensity of the efforts of an insured to maintain work place safety and health control and environment (Williams et al., 1998).

Construction risks are perceived to be highly complex and hazardous in nature preventing an efficient assessment with respect to their pricing and control. Therefore, the insurer has to render an utmost efficient insurance service with the highest quality facilitated by constant training, research and up to-date engineering knowledge and information technology (Heidenhain, 2001). In view of certain inherent elements contract insurance more particularly the Contractors All Risks Policies is not liked by all the insurers. These elements are described below:

- According to Costner, (2002) construction projects are more vulnerable to losses. As against ordinary construction projects, those projects which employ many new technologies (most of which have not been proven yet), or which require massive organization and control are likely to meet with failure and result in both insurable and non-insurable losses.

- There are too many parties including owner/principal, contractor, sub-contractors, financiers and suppliers to be covered by insurance.

- The risks associated with construction projects are often complex and are interrelated with each other. There are also a number of objects or subjects to be covered by insurance including construction/erection risks, loss or damage to third parties, personal injury risks to workers, loss or damage to plant and equipment in premise, loss or theft of materials in storage.

- Construction insurance, unlike property insurance is only a one-time business without any scope for renewal thus limiting the interests of the insurers.

Thus, a construction project comprises of many parties and subjects of risk coverage. The ability of the construction insurer to make the insurance contracts profitable lies in proper drafting, negotiating and concluding the insurance arrangements which are bearable, long-term and covering multi-insurance agreements. In some cases the coverage may extend to periods of more than ten years (Heidenhain, 2001). The complexity of the construction contracts provides a number of opportunities to the insurer and at the same time expose the insurer to huge risks and losses.

Relationship of Insurer with Contractor

The complexity and severity of risks, the probability of their occurrence and the appropriateness of the risk management system being followed by the contractor significantly influence the insurance premium and the acceptance of the risk by the insurer. Therefore it becomes important that all the parties to a construction insurance contract cooperate with each other since it is the objective of all concerned to accomplish the completion of the project successfully within the cost budgets and within the allotted time (Treceno et al., 2003).

Insurers can be of great help to the contractor by advising him the means to reduce the probability of risk occurrence, reducing the size of a claim when there is an event necessitating the claim, provide a better understanding of the risks to the contractor during the process of underwriting and increasing certainty on financial exposure. The insurer undertaking contract risks would be provided with the opportunity of keeping in close touch with the risk by engaging himself from the early stages of the project and throughout the different stages of construction, erection, testing, commissioning and during the initial operating years (Heidenhain, 2001).

Role of Insurer in Risk Management

With their knowledge and expertise the insurers will be able to provide guidance to the contractors on the risk management practices. The insurers work based on their experience on the historical events and the claims processed by them in the past (Anderson, 2000). However there is a potential danger that the management of construction firms would become complacent and may not be prepared to face the hazards in cases where there were only few losses have occurred in the past. The experience of the insurers based on the surveys could help the insured to organize their risk management program and enable the insured to recognize the potential hazard and reduce the probability of such hazards (Treceno et al., 2003). It is to be noted that the efficiency of the risk management system being followed by the insured has a significant bearing on the amount of insurance premium. The availability of skilled staff and adequate resources with the insured is definitely an added aid for the construction insurer to provide an expert service in insurance and risk management.

Involvement of Insurer in Loss Prevention

It is for the insurer to take an active involvement in the risk management efforts of the insured so that the risk incidents can be reduced leading to reduction in the number of claims. For achieving this, the professional appointed by the insurer should have familiarity with the type and nature of projects and experienced with risk identification. The professional should also have the ability to analyze the risk management processes and the ability to recommend better solutions for an effective risk management. The insurance survey should be carried out by a meaningful cooperation between the professional of the insurance company and the contractor. This survey will enable the insured to have a clear understanding of the past, present and future risk situations of the project and will assist the insured to compile a list of weaknesses that may lead to potential risks. Based on this analysis the contractor would be able to work out the necessary measures for improvement and increase the awareness of the parties involved.

Review of Key Types of Construction-related Insurance

Construction projects are characterized by inherent risks with accidents or unexpected events taking place in the worksites resulting in significant losses to the owner or the contractor. Such incidents might also enlarge the liabilities of the owner/contractor to third parties. Construction insurance policies are the best protection available to the parties involved in construction projects against such risks. Construction insurance also ensures that the benefits of undertaking a project are not overweighed with the potential costs resulting from the associated risks. Even though knowledge exists that construction risks are covered by insurance, there is little knowledge on the areas which are covered by insurance. It is also important that one should know the different aspects of a construction activity that is not covered by insurance so that care may be exercised while undertaking such activities. However it is to be noted that construction insurance is not ‘one size fits all’ as different construction insurance policies cover different aspects of construction projects allowing a party to build an insurance framework of insurance to cover the specific requirements of the particular project undertaken to be performed.

Globally there are a large number of insurance policies available that provide coverage to different aspects of the construction industry. The key types of coverage include

- Commercial General Liability Insurance,

- Property Insurance,

- Builders’ Risk Insurance,

- Professional Liability Insurance and

- Wrap-Up Insurance (Vetsch, 2009).

Commercial General Liability Insurance

This insurance covers liabilities resulting from damages caused by the insured to third parties. This policy is designed to cover the claims made by third parties against insured as a result of some event occurred for which the insured can be made responsible. However the commercial general liability insurance does not cover loss or damage to the person or property of the insured. In order for this insurance to become effective, the liability event should have arisen as a result of occurrence of an event which can be designated as an ‘accident’. An accident is defined to include the happening of an unexpected event or mishap which has not been designed or anticipated to happen. The term includes liability events occurring because of the negligence of the insured.

Commercial general liability insurance normally covers the legal obligation of the insured to pay compensation to any third party for loss or damage resulting from the following categories of events.

- Property Damage to include the physical injury to any tangible property including the loss of such property,

- Bodily Injury – covering the physical injury or distress to a person; in order to fall within this category, the injury must have been caused by any external force and it covers the associated medical expenses,

- Personal injury as distinct from bodily injury extending to a number of offences such as malicious prosecution, libel, slander and false imprisonment that do not represent any direct physical harm. Personal injury covers intangible injuries.

The scope of an insurance policy is greatly narrowed down by exclusions included in the standard commercial general insurance policy. The exclusions to the commercial general policy include the liability events which prevent coverage for acts done intentionally by the insured and injuries that are related to employment which are covered under Workers’ Compensation. Exclusions also include liability arising out of the use of the motor vehicle of the owner and liability arising out of pollution related issues. There are other specific exclusions which are prescribed by different insurance companies in respect of individual policies. However there are three exclusions which are most critical in Commercial General Liability insurance. These exclusions prevent the recovery of claims from the insurer for damages to the insured’s own products, property and work.

Property Insurance

While the commercial general liability insurance covers the claims on account of loss or damage to the property or person of third parties, property insurance is designed to cover physical loss or damage to the own property of the insured resulting from an insured event. Commercial property insurance policies cover the damages to the own property of insured arising from a number of risks. The policy includes coverage of intentional damage caused to the property of the insured by third parties but not by the insured itself. There must be a physical alteration to the property of the insured in order to get the coverage under the policy. The alteration to the property or physical damage must have been caused by a peril falling under the scope of the policy. It is also essential that the loss or damage should be fortuitous, implying that the loss or damage must have arisen out of an event which was unexpected or accidental. Unlike commercial general liability insurance which covers both loss and physical damage to the property of third parties, property insurance covers only direct physical loss or damage to the insured property. This implies that in the absence of any physical injury or destruction to property, mere loss or use of the property as well as any other tangible, indirect, or strictly economic losses would not give rise to insurance coverage under the policy (Vetsch, 2009).

Generally property insurance policies cover a variety of perils. It is also possible that the insured selects a policy that protects only certain types of perils such as fire or hail. The insured can also opt for a policy that covers ‘all-risks’ coverage. An ‘all-risks’ policy covers physical loss or injury arising to the property of the insured caused by any external sources unless such peril is specifically excluded in the policy conditions. In such a policy if the loss to the insured’s property occurs due to the intervention or negligence or by an adverse or unusual condition, such loss would be compensated under the policy by the insurer, subject however to the policy exclusions. It must be noted that these exclusions might be having far reaching effects on the coverage under the policy which will result in restricting the scope of an ‘all-risks’ policy.

Exclusions to the property insurance may be imposed limiting the coverage of damages to the insured’s property arising from a variety of sources. These sources may include pollution, arson, moulds, and act of vandalism, change to the temperature, settlement and earth movement among several other factors. In addition to these exclusions which results in external damages to the properties, the property insurance policies may also include several internal factors which preclude the coverage to the defects in the property of the insured. However the exclusions from the internal factors are to be treated differently from the warranties against manufacturing defects attached at the time of purchase by the insured to the property. Examples of internal defect exclusions may be found in property insurance policies having exclusions on account of faulty materials, faulty design or workmanship or any other latent defect or inherent vice in the product or material affecting its use and functionality.

Builder’s Risk Insurance

This is a specialized insurance coverage in the form of property insurance obtained by the contractors to protect against the claims arising on account of liabilities for physical loss or damage to a structure or project which the contractor has undertaken to build. These policies are often arranged to cover specific projects. The necessity for such policies arises due to the fact that the commercial general liability insurance policies generally contain exclusions preventing the coverage of damages to the own work of the insured. Builders’ Risk Insurance policies are also known as ‘course of construction’ policies as the currency of these policies is limited to the duration of specific construction projects. These types of policies remain in force while a project or structure is in the process of being constructed and the policy expires when the construction is completed and handed over to the client. The coverage of the policy extends to all properties located in a construction site during the course of construction, installation or repair including temporary property such as scaffolding or forms (Vetsch, 2009).

In order that a builders’ risk policy takes effect the liability to the insured must occur out of the insured’s work on a project. It is also necessary that the liability must relate to the direct physical and fortuitous loss or damage to the insured property. Damages resulting to the project out of accidents occurring in the project site of the insured are covered under the policy, whereas willful violations or accidents happening out of violations knowingly undertaken by the insured are not protected by this insurance. The concept of ‘direct physical damage’ to the property extends to cases even where there are no tangible structural damages to the property. For example when the construction site is flooded or filled with mud requiring restoration of the working conditions of the project, then such events are covered under this type of policy. However economic losses arising out of delays in completing the project or losses on account of poor quality of construction are not covered under the scope of this policy. Builders’ Risk insurance also extends to the loss or damage to the equipments of the insured kept on site.