Executive Summary

The report highlights important aspects of a planned project for the Lachlan Bank (Bigg Bank) Australia. The bank plans to install over 25,000 smartcard readers across its over 600 branches in Australia and beyond. Secure-Any Systems is looking forward to being awarded the tender to undertake the project, which will be the biggest project of its kind. The report also makes a summary of the case by identifying the strategic objectives of the project, key deliverables, and performance indicators. Managing stakeholders in a project is a very critical role. The report highlights the important ways through which the implementing company will manage stakeholder concerns throughout the project. The paper also highlights important aspects of project planning and management such as work breakdown, change control, project schedule, project budget, risks, quality control, and procurement.

Strategic Business Objectives

- Incorporate Information Technology in ensuring better service delivery to customers

- Ensure process improvement by incorporating secure and integrated smartcard readers

- Offer competitive advantages by warranting fast and secure service delivery

- Improve the bank’s competitive advantage in the highly globalised and competitive environment

- Protect employees and customers from data losses or fraudulent activities

Project Objectives

The following are the project objectives:

- To install a minimum of 25,000 smartcards in over 600 branches of the Lachlan Bank

- Improve the security of the bank’s services

- Improve reliability of service delivery to the customers of the bank

- Provide service support for the installed systems

- Provide training services to the staff members in familiarising themselves with the working of the system

Key Performance Indicators

- Maintain a 10% stake on all sales to yield an income of $3,500,000

- Achieve a net profit of $350,000

- Ensure increased customer satisfaction

Major Deliverables and Milestones

Deliverables

- Successful installation of 25,000 smartcard readers in over 600 branches of Bigg Bank

- Putting in place support services for smooth implementation and configuration of the system

- Ensuring support services are provided within 3 hours of a problem call

- Installation of security devices within the planned timeframe of 24 months

Milestones

- Planning and requirements documentation

- Order equipment

- Systems prototyping

- Testing of initial prototypes

- Preparing Australian sites

- Installation (Australia only)

- Installation (Overseas sites)

- Document-changed security procedures

- Post-installation reviews and signoffs

Stakeholder Management

The main stakeholders in this project are as follows:

- Lachlan Bank

- Individual Branches (Over 600 of them)

- Employees

- Customers

- Project Personnel

Each of the above stakeholders is important in the success of the projects. Hence, since their concerns and interests are important, they must be considered and/or addressed appropriately (Project Management Institute 2013). The main concerns and interests of the Lachlan Bank include issues on the capacity and ability of the Secure-Any Systems to implement the project successfully. Further, the bank is also concerned with the ability of the implementing firm, Secure-Any System, to meet the stipulated schedule. Lastly, the bank is concerned with knowing whether the project will be implemented within the planned schedule.

To address the above concerns of Lachlan Bank, Secure-Any Systems need to put in place the necessary measures to ensure that the bank is confident of the firm’s abilities. Firstly, it is worth recognising that the project will be the biggest ever for Secure-Any Systems. However, the company has extensive experience in the implementation of security systems. This experience is well presented in the RFP documents that Secure-Any Systems has presented for consideration. However, the abilities of Secure-Any Systems to implement the project successfully lie with the project team. Hence, the company will recruit and assemble the best-qualified team for the project. For instance, the Chief Engineer, Michael Yang, is familiar with the bank’s existing hardware design and current requirements. He will ensure the successful implementation of the project. In addressing the concerns of the schedule, Secure-Any Systems will work closely with the stakeholders in ensuring that the planned activities are allocated the appropriate timeframes. Such timeframes for each activity will ensure that the project’s progress can be tracked with the successful completion of each step or activity. Further, as Hamel (2008) reveals, the implementing company will focus on putting in place reporting mechanisms where progress reports will be filed and given to Lachlan on a need’s basis. The challenges that one can face in this process relate to proving the capacity of Secure-Any Systems to deliver the work as required.

The second concern is related to the individual branches in Lachlan Bank’s networks. Firstly, each bank has its unique interests and organisational culture, which must be considered. Some of the concerns of the bank may include interruptions of service delivery and/or losing customers. Therefore, the main challenge to addressing this issue is the resistance to change due to uncertainties of the effectiveness of the system. In this case, Secure-Any Systems will work with individual banks to guarantee consistency of services in every bank. In addition, the organisation must focus on working closely with the managers to ensure service consistency and clarity of each major step in the implementation of individual aspects of the project (Doppelt 2009).

The third stakeholders are the employees who will be concerned with understanding the new system to determine whether it will be as appropriate as the existing one. There will be resistance to change since people are used to the original and existing system. In other words, resistance to change is inevitable. However, with the right approaches, the employees will understand the need and appropriateness of the system and consequently embrace it (Paton & McCalman 2008). The customers are major stakeholders of the bank. Hence, the proposed project will greatly affect them, whether positively or negatively, since they are the main target for the project (Jacobs & Chase 2010). The other problem will involve convincing customers who may fear that their deposits may be lost in the process of changing to the new system.

Lastly, the other main stakeholder, namely the project labour force, is also very important. It will be the role of Secure-Any Systems, to ensure that the labour force is supplied with the right resources and materials for the successful conduction of the project (Walker, Di Sisto & McBain 2009). This strategy will warrant no delays since the person can work within the stipulated timeframe without concerns about the support they receive in their work. Concisely, addressing each stakeholder’s concerns will require collaboration between the stakeholders and Secure-Any Systems. Further, the involvement of the top management of Lachlan Bank will be critical in the overall success of the programme.

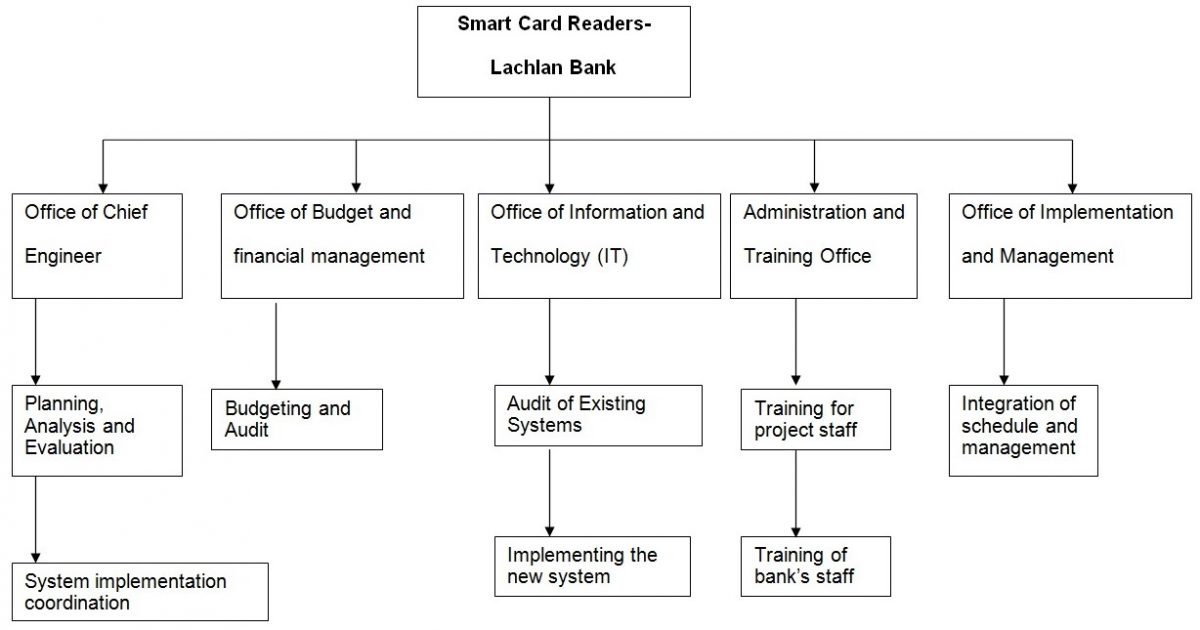

Work Breakdown Structure

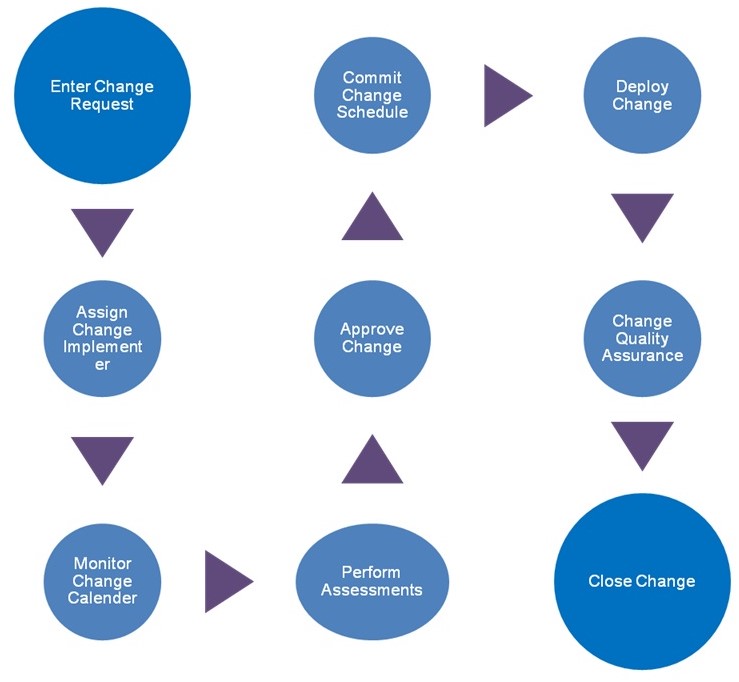

Change Control

The implementation of the project indicates a change in the organisation (Cachon & Terwiesch 2009). However, it is important to manage the change process, with a clear identification of the change areas, as well as the naming of parties who can initiate the change in the project (Project Management Institute 2013). The following flow chart represents the change process during the implementation of the project:

The table below represents a change management table that highlights the people who can request changes and the respective people who can implement such changes. Further, it shows how changes will be approved in addition to how the changes will be tracked in the process.

Each change that has been approved will be incorporated into the overall project plan. It will be tracked appropriately through the progress reports that Secure-Any Systems will present. Approving the changes requires the consideration of various factors. The requested changes must have a significant impact on the success of the project (Jeston & Nelis 2014). For example, changes that are requested by the chief engineer may touch on the issues of the security of the systems or the phase of project implementation. If the suggested changes have such impacts, the approving team must consider them seriously. Further, change requests that relate to the finances and budget must be considered appropriately since they have a direct impact on the success and completion of the project (Yeung 2008). Lastly, the changes must also consider the budgetary implications to reveal whether Lachlan Bank can support the budgetary increment of the project. If it cannot handle any increment, it is important to consider alternative ways of affecting or avoiding the changes altogether. This process should be followed at all times in the change management process. Concisely, the changes must meet the defined threshold as stipulated by the management for approval to be possible. Otherwise, not all changes can be approved.

Project Schedule

The table below shows the major activities that will be important for the implementation of the project.

Project Budget

Risks

For a project of such magnitude, it is important to consider the risks that may negatively affect the success of the project (Weske 2012). In the process of identifying such risks, it is important to consider other case studies of such projects, if any, from other institutions. Secondly, it is important to consider the availability of critical staff officials and the impact that such officials will have if they happen to leave (Thomas & Mengel 2008). Thirdly, it is necessary to consider the availability of the inputs and systems that are required for the success of the project (Leach 2014). The project team should also consider the possible disruptions that the system may have on service delivery to customers and the possible contingency plans for avoiding such disruptions. Some of the risks that the current project is likely to face include:

- Disruptions of customer services that rely on the new system

- Unforeseen quitting of critical staff officials

- Changes in the pricing of important inputs

- Delays in the project implementation due to lack of the necessary materials

Quality Controls

Quality control is important in any project. It ensures no compromise on the expected deliverables and the expectations that the project was designed to achieve (Meredith & Mantel 2011). In this project, some of the activities that require quality standards and quality control include:

- The smartcard readers

- The budgeting and auditing process

- The security parameters of the proposed smartcard readers

- The quality of training that is offered to staff members

The Lachlan Bank has specific requirements for this project. They must be met for the project to be successful. For instance, the demand for security systems is very vital. Without it, the bank risks losing billions of dollars through compromises of the new system. Further, customers require a security system. Without such security assurance, their savings can be easily drained if their smartcards land in the wrong hands. The staff members also demand quality training to deliver quality services to customers. Concisely, it is important to ensure that the highest standards are met in all areas of deliverables as defined by the bank.

Procurement

The planned venture is a large-scale project, which requires an enormous amount of effort for it to be successful. In this case, subcontracting is important in ensuring that the project is on schedule and that no delays are witnessed in the tight schedule of 24 months that have been stipulated for the project. Some of the activities that will require subcontracting include:

- Training of bank’s staff members, especially by the manufacturers of the smartcard readers and security systems

- Auditing of the project budget

The project requires close interaction and a close relationship between Secure-Any Systems and the suppliers. The most important steps of ensuring that the suppliers deliver what is required as per the contract include timely payments of all the delivered supplies and close communication with the suppliers. Paying suppliers on a timely basis means that they will be motivated to meet the requirements of the contract (Turner 2014; Kerzner 2013). Further, the suppliers will have the necessary finances to purchase the required inputs. Communication is also important in ensuring that the suppliers and Secure-Any Systems are aware of the project progress and that the supplies can be delivered on schedule and as required.

References

Cachon, G & Terwiesch, C 2009, Matching supply with demand, McGraw-Hill, Singapore.

Doppelt, B 2009, Leading Change Toward Sustainability-: A Change-Management Guide for Business, Government and Civil Society, Greenleaf Publishing, South Yorkshire.

Hamel, G 2008, The future of management, Harvard Business School, Harvard.

Jacobs, R & Chase, B 2010, Operations and supply management: The core, McGraw-Hill Irwin, New York, NY.

Jeston, J & Nelis, J 2014, Business process management, Routledge, London.

Kerzner, R 2013, Project management: a systems approach to planning, scheduling, and controlling. John Wiley & Sons, Hoboken, NJ.

Leach, P 2014, Critical chain project management. Artech House, Norwood, MA.

Meredith, R & Mantel, J 2011, Project management: a managerial approach. John Wiley & Sons, Hoboken, NJ.

Paton, A & McCalman, J 2008, Change management: A guide to effective implementation, Sage, London.

Project Management Institute 2013, A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Project Management Institute, Philadelphia.

Thomas, J & Mengel, T 2008, ‘Preparing project managers to deal with complexity–Advanced project management education’, International Journal of Project Management, vol. 26, no. 3, pp. 304-315.

Turner, R 2014, The handbook of project-based management, McGraw-Hill, New York, NY.

Walker, H, Di Sisto, L & McBain, D 2008, ‘Drivers and barriers to environmental supply chain management practices: Lessons from the public and private sectors’, Journal of purchasing and supply management, vol. 14, no. 1, pp. 69-85.

Weske, M 2012, Business process management: concepts, languages, architectures. Springer Science, New York, NY.

Yeung, C 2008, ‘Strategic supply management, quality initiatives, and organisational performance’, Journal of Operations Management, vol. 26, no. 4, pp. 490-502.