Executive Summary

Louis Vuitton Moët Hennessy (LVMH) is one of the leading groups of companies in the world. It produces and markets luxury products. The group has operations in six major segments of the global luxury goods market. Over the last one decade, it has recorded a consistent performance both in terms of growth and returns. Among the main drivers of the steady growth are strong management strategies. The administrative approaches are differentiated, dynamic, and focused. The current study provides a strategic review of LVMH. PEST and SWOT analyses of LVMH are conducted to determine its core competencies, resources, strengths, and weaknesses. The evaluation reveals that LVMH operates in a dynamic environment characterised by intense competition. The entity faces major external threats, such as counterfeit products. However, the robust and diversified brands have helped the company overcome these threats. The study proposes further diversification strategies in the management of LVMH. It also recommends focus on various demographics to retain the market competitiveness.

An Analysis of Louis Vuitton Moët Hennessy Group’s Strategic Management

Introduction

Louis Vuitton Moët Hennessy (LVMH) is a leading producer and marketer of high quality luxury goods (MarketLine 2014). The group deals with spirits, wines, perfumes, jewellery, cosmetics, watches, and leather products (Louis Vuitton Moët Hennessy [LVMH] 2015). The company operates in five major market sectors. They include wines and spirits, perfumes and cosmetics, selective retailing, watches and jewellery, and fashion and leather goods. The organisation also has operations in holding companies and other activities (LVMH 2015).

It is noted that 2013 was one of the company’s best period in its operations. The revenues rose significantly and recurring profits exceeded 6 billion Euros (MarketLine 2014). The profits broke the record in the group’s history. The success is attributed to a competitive, buoyant, and rapidly changing market. The success of the firm is also credited to a long-term vision. The company promotes innovation and corporate citizenship among the employees.

LVMH Group’s mission entails representing most of the refined qualities of Western “Art de Vivre” around the globe (LVMH 2015). The group’s brands are associated with creativity and elegance. In addition, the products embody various cultural values. They bring together tradition and innovation. The company uses this strategy to appeal to the fantasies of consumers.

LVMH mission establishes five priorities, which reflect the organisation’s fundamental values. The values are shared by all stakeholders. They include creativity and innovativeness. Others entail aiming for excellence and entrepreneurship. In addition, LVMH Group seeks to bolster its brand image with intense determination (LVMH, 2015). LVMH brand development strategy, as well the expansion of the group’s international retail networks, has led to a strong and dynamic growth pattern.

LVMH: Strategic Review

Market Structure, Segmentation, and Target Customers

LVMH focuses on the production and marketing of luxury goods. The group’s market is subdivided into six major product categories and brands. The leather and fashion segment includes such brands as Fendi, Donna, and Louis Vuitton (MarketLine 2014). The brands include leather goods, furs, shoes, eyewear, watches, and accessories.

The wines and spirits market segment has operations in two major divisions. The two are cognac and spirits, as well as champagne and wines (MarketLine 2014). The wines and champagne division includes such brands as Krug, Dom Perignon, and Moet and Chandon. The division also deals with high-end still and sparkling wines from California, Spain, Australia, and France (MarketLine 2014). The cognac and spirits section markets cognac and vodka under the Belvedere and Hennessy brands.

LVMH Group’s watches and jewellery segment develops luxury sports watches under such brands as TAG Heuer, Hublot, and Zenith. Other products under this segment include contemporary and luxury jewellery. The jewellery is marketed under such brands as De Beers Diamond, Bulgari, and Place Vendome (MarketLine 2014). Under the perfumes and cosmetics segment, LVMH markets, among others, fragrances and skincare products. Some of the popular brands under this segment include Christian Dior, Givenchy, Fresh, and Parma.

LVMH’s selective retailing market segment is divided into two divisions. The two include selective and travel retail concepts (MarketLine 2014). The latter is made up of businesses dealing with the Miami Cruiseline and Duty Free Shoppers. The businesses market luxury products to international travellers. Retail concepts, on the other hand, include such brands as Le Bon Marche and Sephora. Le Bon Marche operates department and food stores, while Sephora deals with selective cosmetics and fragrance retail chains (LVMH 2015). LVMH Group has operations in other market segments, including media, hotel, luxury yachts, and real estate.

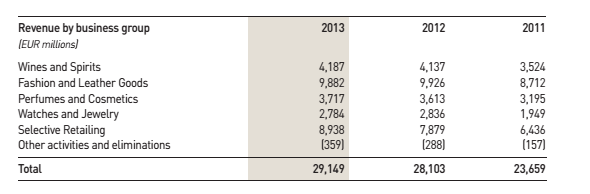

Figure 1 below illustrates LVMH’s market segments and performance:

Given that LVMH focuses on luxury products, majority of its consumers come from the upper-middle and upper class populations. MarketLine (2014) describes LVMH target customers as “high net-worth individuals”. They are individuals with the ability and willingness to purchase luxury products, such as gold watches and expensive leather. Typical LVMH target customers have a keen eye for fashion and related trends.

According to Bain & Company (2013), a survey carried out in 2000 revealed that a total of 7.2 million individuals from around the globe held more than $1 million in financial assets. The individuals constitute a key target market for LVHM. The figure was an increase of 3% from the previous year, indicating that people were getting wealthier. Consequently, LVMH Group’s target market is expanding. The number of people in LVMH’s target market is small. However, they control a substantial portion of the global total wealth (MarketLine 2014). The implication is that the population has an ultra-high purchasing capacity. Figure 2 below illustrates the number of individuals owning over $1 million in financial assets in 2010, 2011, and 2012. The individuals constitute the major target market for luxury brands companies:

Figure 2: Individuals owning more than $1 million in financial assets (in millions)

SWOT and PEST Analysis for LVMH Group

SWOT Analysis

One of the evaluations conducted on LVMH is a SWOT analysis. It entails an assessment of the firm’s internal strengths and weaknesses. It also analyses external opportunities and threats. According to Flint and Fleet (2005), the analysis reveals an organisation’s abilities and chances of influencing competition and succeeding in the market. In addition, the evaluation reveals the shortcomings and incompetence that inhibit the organisation’s competitiveness and ultimate success.

Strengths

One of LVMH’s key strengths is its strong brand portfolio, which drives growth of the organisation’s business (MarketLine 2014). LVMH markets its products under a list of strong brands, which operate under a multi-brand concept. It has more than sixty product lines in the various market segments. In addition, LVMH products hold leading positions in very strong markets.

LVMH has diversified its businesses with regards to market segments and geographical locations (MarketLine 2014). In addition to the six market segments, LVMH has an expansive network of stores in diverse regions. The significant presence of the company in the diverse geographic locations protects its businesses from market volatility. The diversity protects the group from market downturns in relation to geographical location and business segment.

Over the last one decade, LVMH has performed fairly well, leading to an enhanced market position [see figure 1] (LVMH 2015). LVMH has recorded consistent growth in profitability and revenues over the years. Consequently, the group has established a strong cash position, providing it with the financial flexibility necessary for pursuit of growth opportunities (MarketLine 2014).

Weaknesses

The major weakness of LVMH is a high proportion of indebtedness (MarketLine 2014). The company’s balance sheet has a significant amount of debt. For instance, its net financial debt stood at E4,261 million in 2012 and E4,660 million in 2011 (LVMH 2015). The substantial debt obligations can act as a hindrance to the organisation’s desire to acquire additional financing for capital expenditures in the future. The financial obligations can also limit the group’s flexibility in relation to planning and reacting to changes in business and industry.

Opportunities

The growth in demand for luxury goods, especially in Asia, poses a major opportunity for LVMH (MarketLine 2014). Such countries as India and China are experiencing rapid economic developments, which have led to increased disposable income in some segments of their population. In China, for instance, 60% of the total luxury spending in 2012 was on overseas products. The products included leather, watches, and jewellery (Bain & Company 2013). LVMH’s focus on these emerging economies provides the organisation with an immense growth opportunity.

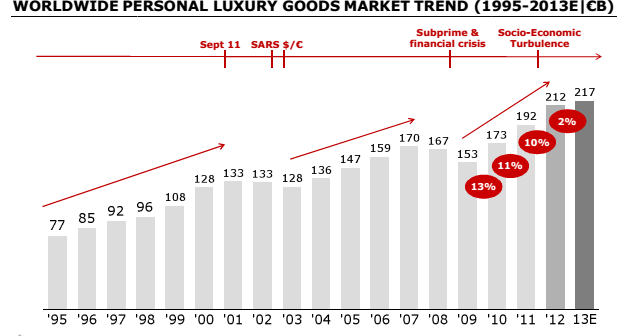

The global luxury goods market is recording a consistent positive growth trend. The development provides businesses with an opportunity for further investment. Figure 3 below indicates the market trend over the last decade:

Recently, LVMH has been focusing on strengthening and establishing its businesses through acquisitions (LVMH, 2015). Consequently, the organisation has an opportunity to increase and enhance its share in diverse brands. In 2013, for instance, the organisation acquired 80% of Loro Piana, an Italian cashmere clothing brand. In addition, the organisations acquired Hotel Saint-Barth Isle de France (MarketLine 2014). The fragrances market is also experiencing a positive outlook globally (Bain & Company 2013). Given that the group markets these products in Asia, Americas, Middle East, and Europe, the opportunity for growth in sales is significant.

Threats

The major threats facing LVMH include intense competition and increased marketing of counterfeit products (MarketLine 2014). In the recent past, counterfeit market has grown significantly, especially over the internet. The low quality imitation products hurt customers’ loyalty to the organisation’s brands. Consequently, the group is working hard to protect its brands, especially through legal battles, such as those waged against Wal-Mart and eBay (MarketLine 2014).

LVMH is facing intense competition in the industry, especially in the fashion and accessories segments. Some of the group’s leading competitors include Compagnie Financiere Richemont, Ralph Lauren, and Signet Jewellers (MarketLine 2014). The high level of rivalry can negatively affect the group’s market share.

LVMH’s SWOT analysis reveals that in spite of the high debt ratio, the organisation has the capability and resources to sustain global competitiveness. The consistent performance indicates the competence of management and successful overall operations. Some of the key competitive factors the management should consider in future include development of new products. Others include customer service and support, product price, and identity. The factors will determine the future of the industry. As such, they require attention in the organisation’s strategic direction.

PEST Analysis

PEST analysis describes the various macro-environmental factors essential in the strategic management of an organisation (Hill & Jones 2012). Given that LVMH is a multinational corporation, it is influenced by these environmental elements. The factors determine the success of the organisation’s operations.

Political factors

LVMH has operations in virtually all the continents. Consequently, the activities of the group are influenced by the various political and regulatory conditions of the countries it operates in. Political factors include policies and regulations on luxury products. Policies on tariffs and excises affect the development of the global luxury goods market (Cole 2004). In some countries, protectionist measures limit trade, especially with regards to importation of luxury products. However, the World Trade Organisation (WTO) has made efforts to open previously protected markets (Bain & Company 2013). Consequently, the sales of luxury products is gaining ground, increasing the opportunities for LVMH’s expansion.

According to Fionda and Moore (2009), the fight against counterfeit products has a major impact on luxury markets. Countries are adopting stringent policies and regulations against these products. The move supports the marketing of authentic brands, such as LVMH.

Economic factors

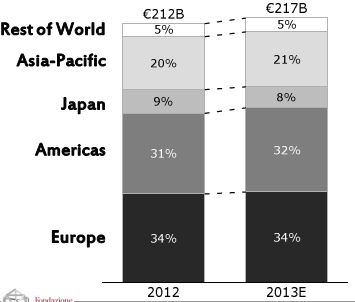

The global economy is slowly recovering from the recent economic crisis. According to Bain & Company (2013), the global economy was weakened in 2012. However, in spite of this dip in growth, the luxury goods market continued to flourish. The US, Japan, France, and Spain are the leading markets for luxury products. However, such emerging economies as Brazil and China are accounting for a substantial portion of this market segment (Bain & Company 2013).

Figure 4 illustrates the geographical distribution of the global luxury goods market in 2013 and 2014:

Sociological factors

Socially, the population of wealthy, upper, and middle class consumers is expanding, especially in the emerging markets (Fionda & Moore 2009; Goh 2004). As such, the lifestyle of this population is changing, leading to increased consumption of luxury products. The culture of consumerism and brand loyalty is also gaining ground globally. The growth provides the marketers of luxury products with an opportunity to expand their market.

Technology

Technological advancements have supported the marketing of luxury products (Bain & Company 2013). For instance, organisations are using the internet to promote their products. Most of the consumers associated with luxury goods conduct online research about the products before they purchase them. However, the internet has also supported the proliferation and sale of counterfeit products, undermining genuine brands, such as LVMH (MarketLine 2014). In addition to providing a platform for marketing luxury products, technology poses a challenge to marketers of genuine brands.

A PEST analysis of the luxury market indicates that the various macro-environmental factors pose both challenges and opportunities with regards to LVMH’s growth. The major elements driving this industry include the emerging middle and upper class population. Technological factors also provide companies in this industry with opportunities for growth by availing them an interactive marketing opportunity.

An Analysis of LVMH from the Perspective of Porter’s Five Forces Model

Porter’s model identifies the forces that influence competition. It analyses how the forces can be used in assessing the position of an organisation in the industry. The model’s central focus is on the dynamic relationship between an enterprise and the structure of the industry (Porter & Kramer 2006).

The five forces include competition, potential of new entrants, supplier and buyer power, and threat of substitute products (Porter & Kramer 2006). Entry and exit hurdles may jeopardise the success of LVMH. Entry barriers in the luxury market include differentiation, access to unique factors, unrecoverable expenses, and economies of scale (Cole 2004; Fred 2005).

LVMH is a seasoned player in the luxury industry. As such, it enjoys the advantage of access to cumulative volume and volume over time. In addition, the organisation has identified niche markets and sustained brand loyalty (Goh 2004; Porter & Kramer 2006). Consequently, LVMH has cost advantage over other players due to specialisation and research and development establishments.

Exit hurdles range from mild to low for LVMH. The company can sell some of its assets to rivals if it needs to exit the market. The move eliminates the costs associated with an exit. The combination of low exit and high entry barriers offers the organisation an opportunity for increased stable returns (Fionda & Moore 2009; Porter & Kramer 2006). The development is evident in the consistent performance of LVMH in the recent past.

Rivalry in the luxury industry is relatively low (Bain & Company 2013). There are few players in the industry due to the apparent high concentration in the industry. The rates of growth and differentiation are high. The market is also characterised by diplomatic and diverse competitors (Bain & Company 2013). What this means is that competition is low.

Majority of players in this market operate flagship stores. Others adopt the store-in-store strategy. As such, there is reduced need for retailers and buyers (Bain & Company 2013). Such vertical integration leads to low buyer power (Goerzen & Beamish 2003; Priem 2007). In addition, majority of companies in the industry have the power to select the market for their products.

According to Fred (2005), the high differentiation of products in the industry makes it difficult to evaluate the negotiating power of suppliers. The stakeholders have significant power considering that acquisition of high quality raw materials is important in the industry. Ultimately, the availability of substitute products outside the luxury market is infinite (LVMH 2015). Consequently, customers may forego status if the cost of a product is acceptable. However, since the products are highly differentiated, consumers rarely experience price ceilings.

Analysis of LVMH’s Corporate and Business Level Plans in Relation to Porter’s Generic Forces and Ansoff’s Growth Strategies

The use of Porter’s five forces indicates that the luxury market is distinct and has immense global capabilities. As a major player, LVMH should capitalise on its strategic position in the industry. An evaluation of the organisation’s business and corporate operations indicates its competitiveness and competencies. The factors support its unique competitive position. LVMH should focus on the dynamic economic conditions and diverse consumer needs. In addition, it should exploit the prevailing technological advancements to boost its position in the industry and sustain its competitiveness. LVMH’s corporate strategy entails diversification in of business lines (LVMH 2015). In the recent past, majority of business conglomerates have recorded poor performance in the global market. However, LVMH has reported positive growth due to the adoption of business and management logic.

LVMH’s corporate and growth strategies are in line with Ansoff’s products market growth model. Ansoff‘s strategies include market penetration, product development, market development, and diversification (Adner & Helfat 2003; Hill & Jones 2012). LVMH is targeting market penetration through sales of established products. In addition, the firm is developing new markets by introducing its products in emerging economies. In addition, LVMH is a market leader in the development of unique products for new markets. As such, a dynamic diversification strategy is made apparent.

LVMH has outstanding strategic capabilities in brand names, marketing know-how, and reputation (LVMH 2015). Consequently, the organisation can avert competition by securing niche markets and focusing on business differentiation strategy. LVMH’s subsidiaries are able to premium-price their products. They can also offer superior quality, exclusivity, and prestige. In addition, the subsidiaries provide excellent customer service and promote innovation (LVMH 2015). As such, the organisation has been able to pursue growth and mitigate the power of substitutes and buyers. The developments are in line with Ansoff’s growth and Porter’s generic strategies.

Conclusion and Recommended Strategies

An analysis of LVMH reveals that strong leadership and innovation are the major drivers behind the organisation’s consistent growth. LVMH has adopted functional corporate and business level strategies in relation to concentric and focused diversification. The strategies have put the organisation in a unique position and sub-category in comparison to its competitors.

Given the high entry and moderate exit barriers in the industry, the organisation can increase its profitability. LVMH should invest in ‘good’ management to increase its success. The organisation should also target diverse demographics. In addition to providing premium-priced products, LVMH should expand its retail outlets to reach more buyers and to reduce the time spent by consumers researching on rare products. The proposed strategies should be implemented in unison by adopting a long-term perspective.

References

Adner, R & Helfat, C 2003, ‘Corporate effects and dynamic managerial capabilities’, Strategic Management Journal, vol. 24 no. 6, pp. 1011-1025.

Bain & Company, 2013 luxury goods worldwide market study (12th edition), Web.

Cole, G 2004, Management theory and practice, 6th edn, Thomson Learning, London.

Fionda, A & Moore, C 2009, ‘The anatomy of a luxury fashion brand’, Journal of Brand Management, vol. 16 no. 1, pp. 347-363.

Flint, G & Fleet, D 2005, ‘A comparison and contrast of strategic management and classical economic concepts: definitions, comparisons, and pursuit of advantages’, Journal of Business Inquiry, vol. 1 no. 2, pp. 2-88.

Fred, D 2005, Strategic management: concepts and cases, 10th edn, Prentice Hall, London.

Goerzen, A & Beamish, P 2003, ‘Geographic scope and multinational enterprise performance’, Strategic Management Journal, vol. 24 no. 3, pp. 1289-1306.

Goh, A 2004, ‘Enhancing organisational performance through knowledge innovation: a proposed strategic management framework’, Journal of Knowledge Management Practice, vol. 21 no. 2, pp. 37-56.

Hill, C & Jones, G 2012, Theory of strategic management, 10th edn, Cengage Learning, South Western.

Louis Vuitton Moët Hennessy 2015, LVMH group, Web.

MarketLine 2014, Company profile: LVMH Moet Hennessy Louis Vuitton SA, Web.

Porter, M & Kramer, M 2006, ‘Strategy and society: the link between competitive advantage and corporate social responsibility’, Harvard Business Review, vol. 16 no. 4, pp. 6-19.

Priem, R 2007, ‘A consumer perspective on value creation’, Academy of Management Review, vol. 32 no. 1, pp. 219-235.