Abstract

The purpose of the study is to examine the factors affecting the profitability of real estate investment projects and their impact on the profitability of such projects. The study explores in detail the different methods and techniques available for use by the real estate developers for estimating the profitability of the real estate projects. In view of large initial capital outlay and vulnerability to different internal and external factors affecting the profitability, the estimation of the profitability of the real estate development projects becomes important. The study through a secondary research addresses the merits and demerits of different profit estimation techniques. The research extends to a discussion of different classes of investors in real estate projects and their ways of estimating the profitability of the real estate projects through a case study of the real estate developers in the context of Switzerland. The case study identifies that systematic project and feasibility analysis is the major method of estimating the profitability by market developers as well as investor developers of real estate projects.

Introduction

The valuation of real estate and estimating the profitability from real estate projects is important for all businesses. “Land and property are factors of production and as with any other asset, the value of the land flows from the use to which it is put and that in turn is dependent upon the demand (and supply) for the product that is produced.” (French, 2004)

The objective of real estate development is to prepare the projects in such a way that they meet the future perceived needs for the prospective occupiers as on the date of the real estate projects are marketed. Since large real estate projects involve investment of huge initial capital, the estimation of profitability to assess the financial feasibility of the projects becomes an important issue before the developers can decide to proceed with the project. In addition, in respect of large real estate projects, the decisions taken at the pre-development stage are crucial and they affect the course of the progress of the projects. This makes the financial assessment of the project at the decision stage an important issue.

In fact, this is a challenge for the developers as the products of real estate sector take time to conceive, plan, build and market to occupiers and investors who are unknown. At the same time, the decision-makers have to function in a dynamic, social, political and technological environment, which are subject to dynamic changes affecting the progress and profitability of the real estate projects significantly. Therefore, it becomes imperative that the profitability of the projects is estimated with precision. This calls for a detailed property investment analysis. Valuation is the simplest, way in which the value at which the property may be transacted as on a particular date. Property investment analysis involves the analysis of the expected profits resulting from the acquisition and development of a property. Such an analysis enables a correct assessment of investment profitability and feasibility. The feasibility of a real estate project needs to be assessed for a wide range of purposes like purchases, sales, transfer, tax assessment, inheritance, investment and financing.

There are various factors, which influence the market value of the completed real estate projects. These factors include the prevailing interest rates, inflation rates, growth in the family income and savings and several others economic and demographic factors. In this context, the estimation of future profitability of the real estate projects is attempted using various methods. This study examines different methods, used for estimating the future profitability of real estate projects of different nature and size involving varying amounts of investment.

Estimation of Profitability – an Overview

The estimation of profitability of a real estate project is a complex issue. The estimation process is complex, since the profitability of the real estate projects is subject to the influence of several internal and external factors. The developer has to consider all the relevant factors that have an impact on the future marketability of the real estate projects. These factors cause changes in the cost of developing a real estate project, which in turn affects the profitability of the project. In order to estimate the profitability of the real estate projects, the developers have to assess the impact of the risks associated with the project. There is a number of risks associated with the development of the project which can be identified and mitigated by undertaking a serious and systematic process of evaluating the risks.

The first step in the estimation of the profitability of real estate projects is to undertake a market study. The objective of market study is to assess the prevailing market rents, prices, and demand and supply conditions of the market. The market analysis focuses on the demand and supply conditions of the market to assess whether the market is tight or soft. The analysis studies the demand conditions to determine the most likely outlook for demand, under the given conditions of future economic trends and prospects. The economic sectors, which are most relevant for the type of real estate sector under study, are analyzed. When historical data on demand, new construction projects, rents and prices are available for a longer period, it is possible to undertake an econometric forecast of these variables. The econometric study will describe the most likely future trend of the market, which provides a dependable base for carrying out the investment analysis in respect of the project under study. This study enables an assessment of the most likely movements of rents and prices over the period during which the investor is expected to hold the investment.

The next step is to prepare a feasibility report. The feasibility report pertains to specific property and the location at which the property is situated. The feasibility report presents an analytical study of the achievable prices and rents, the specific property can attain under the given conditions of market rents and the characteristic of the property under question. Internal Rate of Return (IRR) calculations provide the final profitability of the investment.

Factors affecting Profitability of Real Estate Projects

The success of a real estate project depends on identifying the risks associated with the development of the project and mitigating them by taking appropriate guards against these risks. These risks will lead to escalation in the project costs, which ultimately reduce the expected profitability of the project. The developer should make informed decisions on following various courses of action as every action will have its financial implication in reducing the revenue earnings from the project. For example, if the developer does not consider the anticipated changes in the regulatory policies of the local authorities, the development of the project may be affected involving huge financial loss to the developer. Any such changes in the operating environment of the project will ultimately impact the anticipated earnings from the real estate project. Especially in large projects, the number of risks that could affect the progress of then project is many. Therefore, the developer should carefully evaluate all the associated risks and their impact on the profitability of the projects.

The financial planning and management of large and multiple use real estate projects is a challenging task. This is because of the fact that such projects are subject to the influence of financial, political and social factors, which are uncertain and may affect the development of the projects at any stage of their development. Major issues are associated with the long-term horizon and the large amount of capital to be invested for converting the sites into commercially viable housing and other units. While the projects are affected largely by technical engineering problem, the volatility of demand is another major factor that the real estate developer needs to address. There are changing costs, which affect the projects during development and construction stages are another issue, which affect the profitability of the real estate projects. The developer “is also influenced by constraints imposed by municipal government that are troubled by the potential social costs of new developments and by the actions of the environmentalists who are concerned about the possible physical and societal impacts of a development.”

The main problem of the real developer is the allocation of scarce resources such as land, cash, lines of credit and others to various land uses in different periods so that he/she can maximize the profitability of the projects. While other areas of financial management use mathematical programming extensively, the real estate development field has not ventured into the use of such models and techniques in managing finance. However, linear programming has been identified to be of more help in the real estate development and improving profitability of the sector.

Methods of Estimating Profitability on Real Estate Projects

A real estate project to be feasible should be financially sound and it should meet the environmental criteria affecting the project. The project should be physically creative and meet social responsibility expectations. There are different factors affecting these phenomena, which in turn affect the financial feasibility in terms of profitability of the project. Therefore estimating the profitability of a real estate project with the impact of these factors becomes a crucial step in planning any large-scale real estate project.

During the predevelopment stage, the developer has to take a number of decisions to ensure the feasibility of the particular real estate project. The developer has to take into account several factors that the project performance in terms of profitability, as the decisions take during the predevelopment stage are particularly important in so far as they could change the total development program. Any changes in a real estate development program eventually results in change of the development costs, future operating incomes and expenses and other financial aspects of the project including funding. In this context, estimating the future profitability of the real estate project is an important in the whole development process. There are a number of methods, which are employed to estimate the profitability of real estate projects.

Estimating the profitability of real estate projects is accomplished by assimilating information from the past, identifying the influence of various factors on the profitability of the projects and for drawing conclusions on the future profitability of the projects. The conclusion on the profitability can be arrived after applying typical estimating techniques. There are several income investment measures, which can be extracted from the cash inflow streams. The traditional methods include payback period, first-year cash flow ratios, and equity dividend rate and income capitalization method. Payback period refers to the time that elapses before the initial cash outlay on a real estate project is returned. Cash flow ratios are calculated by dividing the anticipated cash flows (before or after the impact of taxation) to the ownership interest for a single year by the value of ownership interest. With respect to real estate projects, the first year cash flow rates are referred to as the capitalization rate, which also is capable of indicating the likely profitability of the project concerned. However, the cash flow rates cannot be considered to address the specific issues of profitability, as they are only “snapshot” ratios. These ratios at best can be used for comparing the expected performance of different projects. Yield rates on the other hand, directly address the profitability of the projects, and these rates can be.

These methods do not take into account the time value of anticipated cash inflows from the project and hence they are considered inferior to other discounted cash flow analysis. In addition, these methods do not consider the risk-taking attitude of the investor, which also makes the techniques inferior.

There are modern techniques of estimating the profitability of real estate projects like Net Present Value (NPV) and Internal Rate of Return (IRR) techniques. “Internal rates of return are calculated either by hand, or by electronic means using an iterative process to calculate the rate of return that would discount a specific set of forecast periodic cash flows to be received by an ownership interest to a present value equal to the ownership interest itself.” (Fisher & Martin, 1991) In real estate parlance, these internal rates of returns are called the yield rates. Net Present Value and profitability index calculations are similar to the IRR approach. In both the techniques, profitability is addressed by taking into account the analysis of a complete schedule of expected future cash inflows. The cash inflows include income from operations as well as a forecast resale. However, there are some differences in the method of calculation. In the NPV method, a particular level of investment yield rate is determined in advance, which represents the target yield rate for the proposed investment. As the second step, the total value of the present value of the anticipated cash flows is calculated by using the target yield rate as the discount rate. Finally the original investment is compared to the total present value to make appropriate investment decisions. In the case of NPV, the total initial investment is subtracted from the total of the discounted present values and if the Net Present Value is equal to greater than zero, then the project is considered as profitable and hence financially feasible.

Financial feasibility analysis thus includes the estimation of rental income/price that any particular real estate project will command upon the completion of the project. The competitive position of the real estate development project, anticipated cash inflows from the project and their NPV and the expected revenue from the project over a specific period determine the financial feasibility. Usually in large projects the holding period is reckoned as 5 to 10 years, while in smaller projects, a smaller time horizon is considered for such an analysis. “Financial analysis is one of the most crucial components of property investment analysis, because it incorporates the conclusions and implications of the other studies in terms of the profitability of the investment, and provides the final assessment as to whether the investment is worth pursuing or not.” (Property-Investing, 2007)

The next chapter on the review of available literature discusses these methods used to estimate the profitability in detail.

Aims and Objectives

This study aims at exploring the different methods of estimating the methods that can be engaged for estimating the profitability of the real estate projects. In the process of achieving this central aim, the study accomplishes the following objectives.

- To review the past literature relating to real estate investments and various approaches in analyzing the investments

- To study in detail the risks associated with investments in real estate projects and factors affecting the profitability of the large multi-use real estate projects

- To examine the salient aspects of the methods of estimating the profitability of real estate projects

- To examine the merits and demerits of the different methods of measuring the profitability of real estate projects

- To study the relationship between Internal Rate of Return and Net Present Value methods of assessing the profitability of real estate projects and their suitability as profit estimation techniques

Purpose of the Study

In the present day competitive business environment, it is essential that the available resources be allocated to most productive uses. Especially in the real estate sector, which is vulnerable to the influence of several economic, social and political factors, the assessment of profitability of large real estate projects has become an absolute necessity. There are a number of different assessment tools and techniques, which can be employed to assess the profitability of real estate projects. However, it is important that the management employ a proper technique to assess the profitability. Since each method has its own merits, demerits, and different factors to be taken into account, the study of the methods of assessing the profitability of real estate projects becomes significant.

Method

For the research on the methods used for estimating profitability of real estate projects, primary research has been conducted using case study method. The secondary information is collected through the detailed review of the available literature on the topic. The choice of research method to be employed is dependent upon the research problem on hand. Positivism and post-positivism are the two basic research philosophies identified by the social scientists. Positivism refers to the process of creation of new knowledge by undertaking research. This method emphasizes the model of natural science. “The scientist adopts the position of objective researcher, who collects facts about the social world and then builds up an explanation of social life by arranging such facts in a chain of causality,”(Finch, 1986). Post-positivism on the other hand deals with a reality, which is socially constructed rather than being determined on an objective basis. This implies that the social scientist has the responsibility to appreciate the several constructions and meanings, which people have placed upon their experience. Because of its very nature, positivism is closely associated with quantitative research approach and post-positivism uses a qualitative approach.

Qualitative research places its emphasis on processes and meanings, which are not rigorously examined in terms of their intensity or frequency. Case study has been considered as a qualitative research method, which is concerned with the ways in which things happen allowing the investigation of contextual realities. Case study is intended to focus on a particular issue of an organization and it enables a complete understanding of the complex real-life activities. Because of the distinctive features of case study, which are ideal to conduct the study relating to estimation methods on the profitability of real estate projects, this research has chosen case study as the research method.

This paper is structured to have different chapters. First chapter introduces the topic of study and details the aims and objectives of the study. Second chapter presents a review of the relevant literature. Chapter 3 describes the research method followed by chapter 4 containing the findings of the research and an analysis of the findings. Chapter 5 presents a summary of the research and few recommendations for further research.

Literature Review

The literature on the field of profitability estimation and feasibility of real estate projects is extensive and several research studies have been undertaken in the area of valuation of real estate property (Titman, 1985; Grenadier, 1996; Cauley and Pavlov, 2002; Yavas and Sirmans, 2005; Paxon, 2005). Use of real option models to assess the uncertainties in real estate development, has been studied by Bulan, Mayer and Sommerville (2004). The purpose of this chapter is to review these and other literature relevant to the state of knowledge and technological development in estimating the profitability of real estate projects. The review examines previous studies and research publications in the fields of development of income-producing real estate development and the estimation of profitability from such projects.

Introduction

Real estate projects involve significant capital investment and the development of real estate projects needs a multidisciplinary approach. The process by which a real estate property is altered over time to generate profitability by its value or usefulness is usually described as ‘real estate development’ (Blew, 1989). Roulac, (1996) has identified a number of stakeholders associated with any real estate development. These stakeholders include people from various disciplines such as real estate developers, investors, owners/managers, service providers, lenders and bankers and other service providers. It is equally important that the public interest likely to be affected by any particular real estate development be taken into account. Real estate development because of its complicated nature requires expertise and knowledge in both physical and financial dimensions (Sharkawy, 1994). Usually, real estate developers represent the key players in the whole process of development and are entrusted with the responsibility of coordinating the development activities spanning from initiation to construction, operation and eventual disposition.

Distinct characteristics of real estate investment and associated market inefficiencies pose the major factors that expose the real estate projects to different types of risks and affect the profitability of the projects. Etter, (1995) observe different types of risks in terms of business, management, financial, political, inflation, liquidity and interest rates that affect the real estate project developments and their profitability. Even though some of these risk factors are uncontrollable, the primary characteristics of real estate projects present the developers with many opportunities for generation of extraordinary profits (Phyrr et al., 1989).

The future operations and the factors influencing the future operations of real estate projects affect the investment performance of income-producing real estate projects. In other words, the future operating income and the expenses to be charged off against such income play a major role in determining the degree of success of investment in any real estate project. In order to establish strategic planning for successful development of real estate projects, it is essential that studies be undertaken at the early stages of income-earning real estate development projects, since such studies form the basis for such strategic planning process. The peculiar characteristics of real estate projects make the current decisions important to determine the future investment performance of the respective projects.

For arriving at the future profitability of the real estate projects, the real estate developers must make a careful assessment of the development scenario, which extend to physical configuration of the projects, market situations affecting the salability of real estate projects, and venture structures to ensure “physical sustainability, product marketability, and financial feasibility.” Therefore, it becomes imperative that many of the development alternatives are considered by the developers before a strategic decision can be arrived. Nevertheless, real estate developers are constrained to conduct the analyses within the boundaries of limited resources and usually within a narrow timeframe. “Developers have to put much effort in time-consuming processes, which include finding the most reliable information, and repeatedly performing comprehensive analyses.” (Leelarasamee, 2005)

Decisions that the real estate developers make at the early stages of real estate development projects assume greater importance as they significantly affect the future profitability and income generating capability of the project. Implementing strategies, which are improper, would lead to lower return on real estate investments. Improper strategies may lead to the bankruptcy of the developer and leave the developer with serious indebtedness. Therefore, the uniqueness of decision-making with respect to profitability of the real estate projects provides opportunity of extensive research into the salience of different models of assessing the profitability of real estate projects.

Analysis of Real Estate Development Investment

Since the profitability of the real estate projects depends on the income-producing capacity of the real estate development projects, understanding the current state of knowledge in assessing nature of investment in real estate projects is important. This review focuses on:

- real estate market research,

- systematic investment analysis

- feasibility and risk assessment.

Real Estate Market Research

Developers cannot be successful if they supply a product that is already in the market. Instead, they must seek an unmet need; in supplying that unmet need, they must achieve a sustainable competitive edge that will allow them to reap the benefits of their monopoly position (Etter & Massey, 1995, p. 44)

The supply and demand for real estate properties within a given area, decides the marketability of the properties and therefore the analyses of demand and supply form the basis of real estate market research. The market research with respect to real estate projects is undertaken primarily to identify the highest and best use of a real estate property. The highest and best use of a property is defined as “The reasonably probable and legal use of vacant land or an improved property that is physically possible, legally permissible, appropriately supported, financially feasible, and that results in the highest value” (Appraisal Institute, 1996, p. 297).

A number of publications provide the basic principles and the process of real estate market analysis (e.g. Clapp, 1987; Clapp & Messner, 1988; Fanning et al., 1994). Schmitz & Brett, (2001), and Etter & Massey, (1995) have presented case studies which explain the real estate market analysis. There are other studies, which present an in-depth analysis of specific types of properties such as senior housing and some of the studies cover specific market environment (Gimmy & Boehm, 1988; Brecht, 2002). A review of the different literature portrays that different sources use different definitions and quantification of steps in the analysis of real estate market. Market trends and segmentation, consumer profiles, market area and market supply and demand are some of the factors that are to be analyzed in the real estate market research in order to identify the highest and best use for the property (Clapp & Messner, 1988; Etter & Massey, 1995; Schmitz & Brett, 2001).

Systematic Investment Analysis

There have been a number of research publications and studies have covered the subject of systematic investment analysis of real estate projects in the last four decades. Statistical methods for evaluating risky real estate investments were introduced by Hiller, (1963). Hertz, (1964) advocated the use of a quantitative assessment model – ‘Monte Carlo Simulation,’ – which uses probabilities for the evaluation of risks involved in the real estate investments. Harris & Pringle, (1985) suggested risk-adjusted discount rates that can be made use of in estimating the feasibility of investments in real estate projects associated with atypical financing and non-average operating risks.

Feasibility and Risk Assessment

In order to make a proper assessment of the risks associated with profit-earning real estate properties, it is important to understand the nature of association of the risks with the characteristics of the real estate assets (Etter, 1995). The following table exhibits some of the characteristics associated with primary real estate properties.

Table: Characteristics of Primary Real Estate Properties

In order to ensure the desired outcome from the real estate projects, the associated risks should be mitigated. However, the characteristics of the real estate properties present certain types of risks, which are inevitable while developing the projects. The degree of associated risks determines the difference between desired level of income and actual profitability of the projects. Etter, (1995) identifies seven different types of risks associated with the real estate development. By exercising control over certain types of risks, and on controlling certain critical factors like location of the project, the daunting characteristics can be converted into sustainable competitive advantages ensuring superior profitability from the real estate investments. However, it is vitally important that the investment feasibility of such assumptions have to be fulfilled without fail. The following table presents the different types of risks associated with real estate developments.

Table: Risks Connected with Real Estate Investments

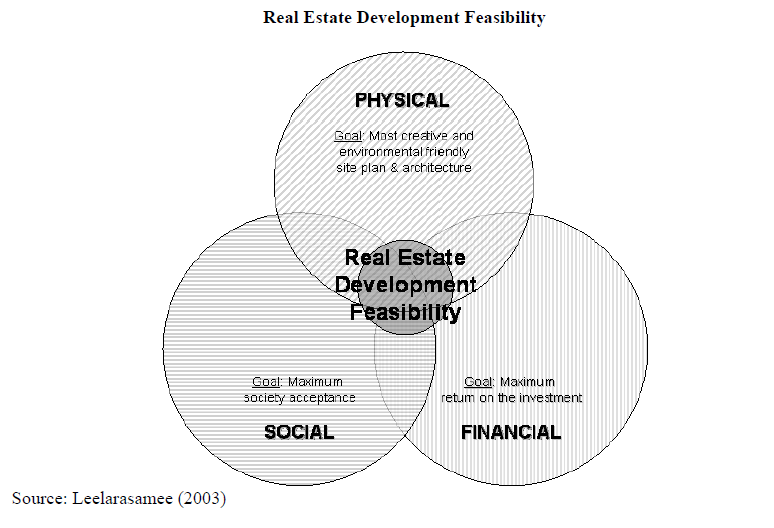

A real estate development project must meet the financial feasibility standards and at the same time, the project should also meet the environmental requirements and must be physically creative (Sharkawy, 1994). Social responsibility of the project is an additional requirement, which the project must meet (Leelarasamee, 2003). Therefore, it can be inferred that the feasibility of a real estate development is a balance of environmental, physical, financial and social dimensions. The following figure illustrates this point clearly. Consequently, it becomes imperative that the factors influencing each dimension have to be harmonized, synthesized and balanced to make the real estate development project successful.

Financial Feasibility of Real Estate Projects

Various decisions made at the predevelopment stage of the real estate development projects influence the progress of the projects. These decisions result in potential changes in the development program, which in turn leads to changes in development costs, future operating income and expenses, and other financing criteria including profitability of the project concerned. Once the major project decisions are made, the developers proceed with the preliminary documentation concerning the development. The next step is to estimate the financial feasibility of the project. Etter (1995, p 3) states that “If the property can generate adequate net operating income to support sufficient debt to finance the property, and provide satisfactory cash return to the developer-investor, the project is financially feasible.”

Different professional journals and publications prescribe multifarious steps of financial feasibility analysis and a number of models and techniques to assess the profitability of the real estate projects. Nevertheless, most of the studies have identified development cost, operating income and expenses, financing and return on investment as the most important variables determining the profitability of real estate projects (Cooper, 1974; Cooper et al., 1983; Wiedemer, 1985; Canestaro, 1989; Jeffe & Sirmans, 1989; Phyrr et al., 1989; Ford, 1994; Etter, 1995).

Financial feasibility studies undertaken at the early stages of real estate development, aim at the evaluation of the interests of the key stakeholders of the proposed project. Present value, Net Present Value, Return on Investment and Internal Rate of Return are some of the measures proposed for evaluating the investment performance of real estate projects. Since it is not possible for the key stakeholders to make precise financial forecasts, risks existed in the real estate investments cannot be mitigated easily. Therefore, progressively more detailed risk analyses are required to identify and mitigate the different risks associated with the projects. “Five levels of risk analysis have been proposed, namely basic financial feasibility model, discounted cash flow from most likely outcome, internal rate of return partitioning and risk absorption analysis, sensitivity analysis, and Monte Carlo risk simulation.” (Leelarasamee, 2005)

Real estate investment analysts normally have to sift through a mountain of information and data for making rational decisions with respect to the investments in particular real estate projects. There are varying approaches ranging from snap judgments based on some tips to a time-consuming analysis of financial and economic data on the profitability of the real property. “Investors often compromise by using rules of thumb based on past experience or benchmark profitability based on market observation.” (Greer & Kolbe, 2003) There are some most commonly encountered traditional techniques, which proceeds from popular ratios measuring profit/price relationships and operating results. The techniques also include complex tools employed extensively by the professionals and analysts engaged in traditional investment analysis. The following sections will review some of the techniques of measuring real estate profitability.

Tools for Measuring Returns from Real Estate Projects

There are various evaluation tools available to the real estate developers for measuring the earnings from the real estate projects and for determining their financial feasibility. These tools enable the investors to compare the anticipated returns with their own financial objectives. The real estate developers are keen in evaluating the risks associated with the projects in addition to assessing the financial returns from the projects. Such an evaluation will help them to decide whether there is a match between the risks and returns from the real estate investments they propose to undertake. There are several real estate return measures, which can be calculated for assessing the investments in the real estate properties.

‘Periodic return’ is the anticipated earnings from a real estate investment over a specific time. Periodic return is not dependent on the scheduled gestation period of the project. Normally the returns from investments in real estate projects are measured over a period of one year period. In some cases the period is reckoned as a month.

Holding period real estate return provides the calculation of the expected profits from an investment horizon. An investment horizon represents the investment in a particular portfolio over a definite time. “Holding-period return calculations consider the expected resale (reversion) price of the property at the end of the investment horizon and therefore any capital gains or losses that the investor may realize upon termination of the investment,” (Property-Investing, 2007). The holding-period returns takes into account the likely fluctuations in the net cash inflows from the property.

‘Income return’ denotes the earning from the real estate investments realized as rentals or other ways. Income return from the properties represents the net operating income that can be realized out of the investments in such properties. “The calculation of the income return does not take into account any changes in the property value over the period for which the return is calculated,” (Property-Investing, 2007).

“Appreciation Return Appreciation return measures actually the change in value in percentage terms over the period for which the return is calculated,” (Property-Investing, 2007). Total return of a real estate investment is the sum total of both the income-return and appreciation return. “As the term indicates, before-tax real estate return measures are estimated without taking into account any income/corporate taxes that the owner may have to pay in association with income earned by the property (property taxes though are taken into account),” (Property-Investing, 2007). However, in respect of the evaluation of financial feasibility of real estate investments the developers take into account the after-tax returns. Developers consider the after tax earnings in situations where it is necessary to deal with the total anticipated earnings from the investments. “The most common before-tax measure is the income return, as it is calculated using the property’s net operating income that does not take into account any income tax payments, as well as other expenses such as capital expenditures, leasing commissions and debt service payments, if the property is burdened with a loan.” (Property-Investing, 2007)

After-tax return from the real estate investments express investment returns taking into account the after-tax and net of debt service, cash inflows from the project. The cash flows are calculated considering the income-tax payable in connection with the income earned by the property. It is the usual practice in real estate profitability calculations to consider after-tax returns. In the case calculation of holding-period returns, any taxed on potential capital gains on the sale of the property need to be taken into account as well.

Return on equity is the return calculated on the own capital of the investor used in acquiring the real estate property. “If no borrowing is used then the investors capital or equity will include all acquisition and pre-acquisition costs (legal, market study, valuation and any other due diligence costs associated with the purchase of the property),” (Property-Investing, 2007). When the developers make use of loan funds in the investments, a part of the total investment would be the equity of the developer. “When borrowing is used then the return on equity requires a Leveraged Return calculation that will take into account the effect of borrowing on property cash flows,” (Property-Investing, 2007). If borrowed funds are not used, the investor’s return on equity will be equal to unleveraged return. Unleveraged return calculation assumes no borrowing by the investor in investing in the real estate property. Real estate developers mostly use Internal Rate of Return (IRR) as tool for measuring the earnings from the real estate investments.

Ratio Analysis

The purpose of ratios is to gauge the reasonableness of relationships between various measures of value and performance. For example, income multipliers are used to denote the relationship between market value of the real estate property and operating income resulting from the property. Operating ratios, on the other hand express the relationship between the gross income expected to be realized from the property and the operating expenses. Break-even ratios highlight the percent of gross income required to meet the case expenditure on maintaining the property. Debt coverage ratios exhibit the relationship between net operating income and the debt service obligation on the amount of loan obtained to invest in the property.

Income multipliers analysis though a simple technique has been highly useful as one of the oldest technique in evaluating the profitability of real estate assets. The multiplier highlights the correlation between the gross or net income from the property and the price of the property. For instance, in the single-family-rental properties, monthly income is used as one of the factors in calculating the multiplier and in the case of all other properties, the annual income from the property is considered to evaluate the profitability.

Income multipliers cannot work as better tools of evaluation by themselves. Nevertheless, they help analysts to reject the unacceptable projects easily and without putting much time and efforts in analyzing such proposals. They can focus on properties, which exhibit greater profitability. In order to use the multiplier effectively it is imperative that the relationship prevailing between price and income in the respective area is ascertained and is kept as the benchmark. All proposals that do not meet the benchmark profitability need to be rejected automatically. Only those investments that pass this preliminary screening may be taken to the next stage of evaluation.

Financial ratios are employed usually for making comparisons between different real estate projects. Commonly used financial ratios are operating ratio, break-even ratio and the debt-coverage ratio.

Operating ratio shows the percentage of effective gross income spent on operating expenses. However, there is a shortcoming associated with operating ratio as this ratio reflects in part the efficiency of the management and that of the property itself. Some of the investors look for properties, which exhibit high operating ratios, indicating to reduce the ratios through efficient management and thereby enhance the indicated property values.

Break-even ratio often known as default ratio is found to be useful when the ratio is used when applied on a before-tax cash flow basis. The ratio points out the relationship between cash inflows and outflows from all the sources. A lower break-even ratio implies a decline in the gross income from the property, which in effect indicates higher operating expenses. This may eventually lead to negative cash flows from the project.

Debt coverage ratio indicates the extent to which the net operating income can go down before it becomes insufficient to provide for the financial obligation to meet the servicing of the debt. This ratio indicates the safety level associated with the use of borrowed funds that are applied in the respective real estate property.

Traditional Profitability Measures

One of the common characteristic of all the traditional profitability measures is to relate the cash investments in a real estate project, with the expected cash returns from the project in some systematic fashion. The techniques are designed differently based on the degree to which the available data is incorporated in the calculation. “They differ also in that some ignore the issue of risk and others make rudimentary attempts to adjust for risk differentials.” (Greer & Kolbe, 2003)

Income Capitalization Approach

This technique is also known as free-and-clear rate of return. The overall capitalization rate takes into account the first year’s expected net operating income and expresses the income as a percentage of the market price. In general, the income capitalization is a valuation method adopted by the appraisers and real estate investors for the estimation of profits from investing in income-producing real estate. The method is based upon the premise of the expected future benefits likely to result from the sale of real estate. This method of estimating the profitability is related to (i) the market rent, which a property can be expected to earn and (ii) the resale value that can be realized when the property is sold. Therefore, in the income capitalization approach, the rentals expected from the property and the future sale value of the property is related through the capitalization rate. Capitalization rate is the ratio of Net Operating Income (NOI) to the investment in the real estate project. This rate has a specific role in the property valuation since the income capitalization model covert the NOI inflows from the real estate property into an estimated asset value by dividing the NOI inflows by the capitalization rate (Brueggeman & Fisher, 1993 p 438). If expenses incurred on the property are related to the rentals from the property, the property value can be derived the capitalization rate, because NOI is the difference between effective rents and the associated operating expenses. The capitalization rate is a rate of return on investment, which can be equated to the dividend earned on a stock. The real estate investors use the capitalization rate as the benchmark to determine the value for a property. In appraising the profitability of real estate projects, the capitalization rates can be arrived from the sales of similar investment properties in the neighborhood.

In a typical negotiating session, the investors often make a trade-off between price and financing terms. However, this trade-off is not reflected in the overall capitalization rate. Therefore, this method makes the comparison of rates between properties with financing arrangements, which differ significantly and such comparisons would be misleading. This is a limitation of the capitalization rate method of evaluating profitability of real estate projects, which makes the technique less useful.

Equity Dividend Rate

Equity dividend rate is a measure of profitability of real estate projects, which incorporates the effect of using borrowed money to some extent. This technique compares the equity cash flow with the amount of equity investments. Under this technique, the equity dividend rate presents before-tax cash flow comprising of the net income less the debt service costs as a percent of the required initial cash outlay (purchase price less the borrowed money) for investing in the real estate property. This measure of profitability of a real estate project also suffers from a limitation in that it does not take into account the tax implications of the income from the property. It must be noted that comparison of cash flows from different projects on a pre-tax basis will be helpful in deciding on any particular investment opportunities only when the competing investment opportunities are subject to uniform tax consequences. The tool can be made more meaningful by calculating the rate based on after-tax cash flows from the project, in which case the method is called ‘cash-on-cash return’ method. Even with this change of including the tax implications of cash inflows does not make the method more useful, since the method fails to incorporate the impact of investment performance of the real estate projects with changes in the values and changes in the after—tax cash inflows over longer duration. Rational investment decisions demand that all the consequences during the holding period of the properties are included in the analysis (Greer & Kolbe, 2003).

Broker’s Rate of Return

With their intention to cast the best possible image of a property, which they attempt to sell, the brokers sometimes insist on modifying the cash-on-cash return to reflect the build up the equity of an investor. “The broker’s rate of return adjusts the equity dividend or cash-on-cash rate to include both income tax consequences and equity build-up resulting from amortization of mortgage debts.” (Greer & Kolbe, 2003) This way, the brokers are able to increase the indicated return from the property to the equity position and make the property appear more attractive. Some of the brokers follow the practice of adding the anticipated rate of increase in property value to after-tax cash flow plus equity build-up. With the increased broker’s rate of return, the property looks even more attractive from an investment perspective. Even though this measure of profitability is widely in practice, the results are misleading. “The important measure of potential cash flow from the disposal is the difference between market value and remaining balance on mortgage indebtedness, less estimated brokerage commission and other transaction costs.” Since there is the possibility to realize this cash flow only on sale of property and not on an annual basis there is no point in including equity build-up in the measure of annual cash inflows.

Payback Period

Payback period is one of the simplest and most common methods used to estimate the number of years required to recoup the initial investment in a real estate project. In this evaluation method, alternative real estate project proposals are ranked according to the number of years required to equal the initial cash investment with the annual cash inflows from the respective projects. If the returns from the real estate investment are equal over the years, then the payback period can be arrived as the factor derived by dividing the initial investment by the anticipated yearly cash inflows. However, in most of the real estate projects the cash inflows from the projects may not be the same each year. In that case, the cash inflows from the projects need to be summed up for arriving at the payback period for until the total equals the initial cash outlay. This calculation of payback period helps comparing the profitability and feasibility of different competing projects (Greer & Kolbe, 2003).

The merit of payback period is its simplicity in calculating and its adaptability as a policy tool. The investors can choose the investment on a real estate of specific type and location by specifying the maximum payback period based on their perceptions of associated risks. The payback period suffers from a disadvantage in that it fails to consider the cash inflows that occur after the payback period. This lacuna makes the real estate assets with poor appreciation appear more appealing than those do, which can fetch more revenue over the holding period. Another major drawback of this method is that it does not take into account the time value of cash inflows even during the payback period. “A project with most of the benefits in the early years would look no better than one offering the same total benefit spread evenly over the entire payback period or with the bulk of its cash flow in later years.”(Greer & Kolbe, 2003) This results in the failure to choose the project with the greatest potential returns.

Weaknesses of Traditional Profitability Measures

In order to review the shortcomings of traditional investment performance measures, it is important to review the major concepts of the expected returns from real estate projects. There is the initial investment in cash, against which the investor expects to receive annual cash inflows in the form of income from the property during the holding period and cash from disposal on termination of the investment position by selling the property. In this proposition, there are the following factors, the interaction of which determines the attractiveness of any project in terms of its profitability.

- The amount and timing of initial cash outlay as capital investment in the real estate projects

- The amount and timing of expected net cash inflows from the projects as income

- The certainty with which the investments are made in the real estate projects

- The comparable yield available from other investments which the investor can consider

- The risk-taking attitude of the investor

Irrespective of the risk-taking attitude and other particular characteristics of the investor, the anticipated benefits from the real estate projects need to be adjusted for quantity (or value), quality and timing in order to have a meaningful assessment of the profitability of the various projects. Quantity (or value) indicates the amount of expected net cash inflows from the real estate project after adjusting them for all income tax consequences and debt servicing obligations connected with the borrowing for investment in the project. Quality of the investments denotes the certainty with which the investments in the real estate assets are held. Timing refers to the expected time during which the anticipated cash inflows are likely to occur. All these factors need to be evaluated from the point of view of risk-adjusted yields that the investor can expect from other alternative investments available (this anticipated return is termed as the opportunity cost of capital) and the attitude of the investor towards risk-taking. It is important that a profitability measure take into account all these factors to become an ideal one. One of the common weaknesses of the traditional profitability measures is that they fail to take into account the timing of net cash inflows.

Discounted Cash Flow Analysis

According to the economic theory of firms, a business should operate at the point where the marginal revenue equals marginal cost. When this theory is applied to the evaluation of real estate investments in terms of their profitability, the investments will become acceptable as long as the rate of return on investment at least equals the cost of investible funds. There are two common applications of the basic decision criteria with respect to real estate investments. They are present value and internal rate of return. “Both have merit as investment analysis techniques, both can be supported with compelling logical arguments and several variations of each have been developed in the literature.”(Greer & Kolbe, 2003)

Present Value

Present value is the value today of the anticipated future benefits likely to accrue from the real estate project. Present value of cash inflows is arrived at by adjusting all the expected future cash inflows from the project at a predetermined rate over the time. A present value in excess of the initial cash investment in a real estate project implies that the project can be expected to result in a rate of return in excess of the discount rate applied. If the discount rate assumed were the minimum expected rate of return acceptable from the project, any positive present value would make the project worthy of further consideration. A project with a present value, which is less than the initial capital investment in the project, has to be rejected automatically.

Net Present Value (NPV) of any project is arrived at by deducting the required initial capital investment from the present value of projected cash inflows of the project in question. A positive NPV implies that the returns from the project would increase the investor’s wealth in current value dollar terms and the project is expected to yield a rate of return higher than the discount rate which makes the project financially feasible and worthy of consideration for investment.

NPV of less than zero implies that the project is expected to yield a return, which is less than the minimum acceptable rate and therefore makes the project unacceptable.

Internal Rate of Return

Because there is an inverse relationship established between discount rates and NPV, there should exist some rate, which exactly equates the present value of the anticipated cash inflows from a real estate project with the initial cash investment in the project. This rate is usually indicated as the Internal Rate of Return (IRR). When the IRR from the investment in real estate is more than or equal to the anticipated rate of return from the investment, the project is financially feasible. On the other hand, when the IRR is less than the anticipated rate of earnings it is not advisable to accept the project.

The major distinction between IRR and present value method is that the calculation of present value method approach requires a predetermined discount rate. In the case of IRR calculation of profitability of real estate projects, there is the need to specify some minimum threshold rate against which the IRR is measured, to determine the feasibility of the project. Thus, the users of IRR method only delays the comparison of a predetermined rate, although the investor’s required rate of return is eventually considered for deciding on the acceptability of the project. It is also possible to express the decision criteria based on IRR analysis in terms of present value or NPV calculations. IRR method therefore cannot be considered superior than other profitability measures, as the method does not have any special attribute to disclose on the profitability of the real estate projects.

Problems associated with IRR Method

While the internal rate of return method has no significant advantage over other methods of using discount rates to the expected cash inflows, it also has several weaknesses, which are not found in other methods. It is curious to find a persistent and continuous support to a technique containing flaws. The use of IRR method can be attributed to the reason that there are no plausible alternatives to IRR method. Problems associated with the IRR method could lead to conflicting signals on investment decisions. “Potential dissonance stems from peculiarities of the internal rate of return equation, which can yield more than one solution and from problems associated with the reinvestment assumptions inherent in choices among alternative investments that exhibit different patterns of anticipated after-tax cash flows.”(Greer & Kolbe, 2003)

One of the major problems of using IRR method is concerning the application of reinvestment rate to alternative project proposals. IRR method will become meaningful to differentiate among the available projects only when the other acceptable projects are expected to yield a comparable higher rate of return. This situation may not arise when the IRR is significantly higher than the opportunity cost of capital. The issue relating to the application of reinvestment rate presents a limitation on the use of IRR method for evaluating the financial feasibility of the projects when choosing among alternative projects having different useful lives or holding periods. If the expected IRR is unrealistically high, reinvestment at such a high rate will be an unreasonable assumption and the use of IRR method may not lead to proper investment decisions.

Another problem with IRR method is that it cannot be relied to give a solution to a situation of multiple projects presenting them as available opportunities. In general, the NPV of a real estate project is a decreasing function of the discount rate employed. When the discount rates go up successively, at a point of time, the NPV will become zero. This rate is the IRR and expecting any higher rate of return will result in a negative NOV. When the discounting equation behaves in this fashion, there could well be one IRR representing one discount rate that would equate all cash inflows with all cash outflows. However, in reality, the cash inflows from different real estate projects are not behaving in this fashion and different investment proposals may have different IRRs.

Comparison of NPV and IRR

Both NPV and IRR techniques will present the same decision signals in respect of most of the real estate investment proposals. When this is the case, there can be no significance in choosing either of the techniques to evaluate the profitability of the individual projects. The rules in this case are:

- When IRR technique is engaged in assessing the feasibility, it is necessary that all the projects whose IRR is less than the minimum required rate. Only those projects whose IRR is equal to or greater than the minimum required (hurdle) rate are considered for further analysis and possible investment.

- When the NPV technique is employed, it is customary to discount the present values with the minimum acceptable rate. All those real estate projects with NPVs less than zero are rejected. Only those projects with NPV greater than or equal to zero are considered for investment.

The mathematical calculation involved in these techniques make both the techniques appear similar. The only difference between the techniques is the discount rate. In the case of IRR, the discount rate employed is the effective yield and the NPV will be exactly equal to zero when the IRR equals the minimum expected rate of return from the project. However, there are certain circumstances under which these techniques may present contradicting signals to the real estate investor. In many instances, both the techniques might present the alternative proposals in different investment orders. Since it is the ultimate objective of the investor to consider investing in any one project by undertaking the financial feasibility analysis, and not to make a simple choice of accepting or rejecting a project proposal, the different ranking order by both the techniques may pose a serious issue from an investment perspective. In the case of limited equity funds, the choice is to be made from among several opportunities all of which are most likely to meet the minimum acceptance criteria. In some other cases, where the competing projects differ in the size of the initial investment or in the timing of cash inflows and outflows, there may be an inconsistent project ranking, which makes the investment decision a complex one.

In case where the IRR and NPV techniques present different decision signals, it is usual to prefer the results provided by NPV method. This follows from the principle that most financial analysts believe that by investing in projects based on the results from NPV, the investors are likely to maximize their wealth.

Summary

This chapter presented a detailed discussion on the characteristics of real estate properties and the types of risks associated with real estate investments as a prelude for the review of different techniques, which are used for evaluating the profitability of investments in real estate properties. The idea was to provide an in-depth insight into the basics of real estate investments so that the review on the techniques of profitability assessment could be easily understood. The chapter also provided an extended discussion on different types of returns from real estate investments, traditional methods of estimating the profitability on real estate investments and the discounted cash flow techniques of profit estimation. A detailed description of the research methodology adopted for the current research will be presented in the next chapter.

Research Methodology

The purpose of this chapter is to present a description of the research method used for conducting the research on the techniques for estimating the profitability of real estate projects. According to Denzin and Lincoln (1998), the choice of research method depends on the research questions to be answered and the research questions depend on the context of social research. Applied to the context of the research, which aims at examining the salience of the techniques of estimating the profitability of real estate projects, this study used a qualitative research approach.

This chapter provides a rationale for engaging a qualitative approach to the research. The chapter also discusses the preferred method of case study.

Research Philosophy

Research philosophy describes the belief about the manner in which information and data about a phenomenon should be gathered, analysed and interpreted for presentation. Epistemology is the term, which encompasses different philosophies of research approach. Epistemology (what is known to be true) is the opposite of doxology (what is believed to be true). The purpose of scientific research is the process of transforming things, which are believed to be true into things, which are known. Western tradition of science has identified two major research philosophies namely positivist and interpretivist.

It is the belief of the positivists, that reality is stable, which can be described from an objective perspective (Levin, 1988). The subject or issue can be described without interfering with the phenomenon being studied. “Positivism has a long and rich historical tradition. It is so embedded in our society that knowledge claims not grounded in positivist thought are simply dismissed as ascientific and therefore invalid” (Hirschheim et al., 1995 p.33). Positivism focuses on the manipulation of reality with respect to one single variable so that regularities can be identified from the relationship of some of the constituent elements of the social world.

Contrastingly, interpretivists argue that reality can be understood only through intervention in reality by undertaking subjective interpretation. Interpretivists believe in the study of phenomena in their natural setting, based on the argument that scientists cannot describe the reality without affecting the phenomena studied by them. According to interpretivists, although there may be several variations of interpretations of reality, these interpretations are to be construed as part of scientific knowledge. Interpretivism has an equal glory as that of positivism.

“Post-positivism” is another school of research philosophy evolved later. ‘Critical realism’ represents the common version of post-positivism. According to critical realism, there are issues which cannot be attempted to clarify by science. Positivism differs from post-positivism in that post-positivism believes that all observation is fallible. Therefore, these observations are to be deemed as having some inherent errors and that all theories can be amended. In other words, the critical realist is critical of our ability to know reality with certainty. “Where the positivist believed that the goal of science was to uncover the truth, the post-positivist critical realist believes that the goal of science is to hold steadfastly to the goal of getting it right about reality, even though we can never achieve that goal.” (ResearchMethods, 2006) Based on the discussion, the current research follows the research philosophy of critical realism, which is a common form of post-positivism. Since post-positivism addresses the social phenomena from a subjective sphere, it advocates the use of a qualitative research approach. Therefore, this study follows qualitative research approach.

Characteristics of Quality Research

Denzin & Lincoln, (1998) offer a general definition of qualitative research, which is as follows:

“Qualitative research is multimethod in focus, involving an interpretative, naturalistic approach to its subject matter. This means that qualitative researchers study things in their natural settings, attempting to make sense of, or interpret, phenomena in terms of meanings people bring to them.” (Denzin & Lincoln, 1998)

This definition identifies complex human experiences and situations as the subject matter of qualitative research. More particularly in respect of social sciences, this calls for insight, discovery and interpretation rather than just testing the hypotheses. The motivation for undertaking qualitative research as opposed to quantitative research is because qualitative studies can understand people and the social and cultural contexts within which the people live. Kaplan & Maxwell, (1994) state when the research examines quantitative data, the participants will not be able to understand the phenomenon from the social and institutional context. This is one of the shortcomings associated with the quantitative research approach.

Research Strategy

Theorists and research scholars have identified a number of research methodologies (e.g. (Galliers, 1991; Alavi & Carlson, 1992). The following table presents the different methodologies prescribed by (Galliers, 1991, p 149).

The current research has selected case study method and the relevant features of case study method are described in the following section.

Case Study Research

There are a number of works, which have identified case study as an important research approach (e.g. Yin, 1984). Case study is considered as a viable research method since it provides for the study of the phenomenon in its natural setting. The researcher can ask questions, which enable the researcher to understand the nature and complexity of the processes taking place. Case study research can be conducted in those areas where previous studies have been conducted. There is no standard definition provided for case study in the literature. However, a comprehensive definition has been compiled from different sources as below: A case study examines a phenomenon in natural setting, employing multiple methods of data collection to gather information from one or a few entities (people, groups or organizations). Case study is to be regarded as an empirical enquiry, which is concerned with a contemporary phenomenon within its real life context. Such a study uses multiple sources of evidence. Anderson, (1993) states case studies focus on how and why things happened to investigate contextual realities. Case study states the differences between what was planned and what actually occurred.

“Case studies become particularly useful where one needs to understand some particular problem or situation in great-depth, and where one can identify cases rich in information.” (Noor, 2008)

A number of factors need to be considered before deciding to use the case study method. When the research needs to focus on contemporary events or phenomena in a natural setting, then case study is the ideal research method that can be used. Similarly, if there is no strong theoretical base for the research topic, case study is the appropriate research method. However, case study cannot be considered as an appropriate research approach if there is the need to control or manipulate different variables in connection with the research to be conducted. Therefore, it is the nature of the research problem, which decides the suitability of case study rather than the ability of the researcher.

Strengths and Weaknesses of Case Study Research

One of the major criticisms of case study research is that it lacks scientific rigour and reliability and therefore, case study cannot be relied for generalizing the results of any research. However, case study as a research method can be relied for gaining a holistic view of the phenomenon being observed or a series of events under study. Case study is capable of providing an all round view as it examines a number of sources of evidences. Generalizations are also possible under case study, when the findings from multiple case studies are compared to arrive at some pattern or form of replication.

Data Collection

Yin (1984) identified exploratory, descriptive and explanatory case study methods. Research in business related issues are conducted using exploratory case study method. Descriptive case study explains how and what happened to a particular phenomenon. Explanatory case studies become useful when the organizational processes are studied. The current study employs a descriptive case study where observations are conducted in an organization and reported. There are six types of data collection involved in case study research approach. They are:

- documents,

- archival records,

- interviews,

- direct observation,

- participant observation

- artifacts

Depending on whether the researcher would like to choose a single or multi-model approach for the case study, one or a combination of more of the six data collection methods can be used. For the purpose of the current research, documents and archival records will be used for data collection.

Summary

This chapter presented a description of different research philosophies. The chapter also contained a detailed description on the qualitative research and case study research method. The findings of the case study along with an analysis of the findings are presented in the next chapter.

Case Study

Introduction

There are many factors, which lead to the development of residential construction project. Ball, (1996) has stressed the importance of understanding of the drivers of housing supply. Economic literature has identified that the real estate developers undertake a complete analysis of the market opportunities to maximize their profit. When the real estate developers expect to have sufficient demand for new developments of constructed buildings and other constructions, they start to acquire land and arrange for other necessary sources for constructing the buildings, develop them and offer them to potential customers. This implies that the supply in the real estate industry corresponds to the demand. There will be disequilibrium in the housing market only when there is unexpected and unavoidable delays between the time the developers observe the market conditions and the time the constructed buildings are delivered to the potential customers. However, this disequilibrium disappears when the developers adjust their supply to the current demand position (Kenny, 2003). However, according to Scanlon & Whitehead, (2006) even though, the private property owners generally take into account the current economic conditions in their decisions with respect to development of new real estate properties; there are evidences of actions taken by the developers in a shortsighted way reducing the profitability of the projects. There are other elements like “asymmetry in responses to changing opportunity costs, insufficient consideration of opportunity costs and liquidity constraints.”

Profit-Maximization Objective of Real Estate Developers

Researchers and social scientists challenge the profit-maximizing model of housing supply. There is no possibility for the developers to perceive the actions of competitors and therefore the developers prepare themselves to meet the anticipated market demand with excess supply of real estate projects. In addition, it is not the objective of all the real estate developers to make their profit from selling the projects immediately. Many of the developers have the option and they decide to remain owners of the buildings and rent them, so that the developers would be able to realize returns in a gradual manner over the period. This leads to the complexity in the calculation of profitability of real estate projects by the developers. This also makes it difficult to ascertain whether the real estate developers make a thorough profitability analysis of the new projects before they start venturing into those projects. It is observed that profit expectations have a significant role to play in the decisions of the developers and it is often difficult to meet the expectations because of the timing of the projects. According to Scanlon and Whitehead (2006), the same market signals may signify an increase in the housing investment as well as a decrease. For example, an increase in the property prices would mean the realization of smaller rental returns and greater risk for investment. The rise in the prices may also be considered as the chance for future correction in the prices of the projects. On the other hand, increase in the property price would also signify an enlarged demand. Therefore, it is important that the real estate developers undertake a thorough analysis of the price changes in the markets to predict the consequences of such changes accurately. With such a thorough analysis, the developers will be able to ensure the future profitability of the projects.

There are differences in the opinions of the experts in the ways in which the profitability of the real estate projects need to be assessed. Some of the experts ignore the capital gain components of the investment in real estate projects (Anderson H. S., 1998). Some experts are of the view that the property owners have to consider the advantage of low mortgage interest to leverage their property so that they can remain rational with respect to their investments (Ball, 2004). On the other hand, another group of experts consider that the property owners should consider freed equity in full in view of the risks and unattractive investment alternatives. The investors are advised not to invest in real estate properties in case of decline in stock market prices. Alternatively, they are advised to target fixed portfolio shares, which implies additional investments in stocks whenever there is a slump in the stock market.

When there is difficulty in making a proper project analysis, it is the tendency of many of the developers to use shortcuts and they start to believe in long life expectancy of their projects, which can generate adequate returns over a longer period. The real estate developers will venture in to new developments when they find favourable local circumstances or on the happening of some other positive events. On the other hand, even though the project analysis shows the chances of making profits, even partial negative signals such as rising land or construction prices, or economic slowdown will deter the developers from venturing into new developments.

This case study drawing from the findings of a survey, which is a part of a wider research project conducted to analyze the profitability analysis of housing projects in Switzerland during the 1990s, reports on the behavioural reasons of real estate developers for venturing into new projects, in the context of assessing the profitability of their real estate projects. The results of the project appeared in the journal article by Schussler and Thalmann (2005).

Context of the Case Study

Rental housing development accounts for more than 50 percent of all new real estate project developments and two thirds of the population uses rented houses. People had least housing choices and there was a housing shortage at the time the research was conducted. The reasons for a slack in the housing development while there was a housing shortage and the factors that contributed to the real estate development adds support to the current research on the real estate profitability and its measurement.

The Swiss housing market is characterized by a high level of fragmentation. According to Census 2000, 57% of all rental housing belonged to private individuals. The rest of the properties were owned by small pension funds, cooperatives, local authorities and few large institutional investors. There were about 4000 construction firms engaged in the main construction activity. Individuals develop over 40% of all housing projects, and construction firms and real estate companies developed some of the projects. Therefore, the real estate developers represented only a fragment of the real estate market players. In this context, it is important to distinguish between marker developers who enter into ventures for ultimately selling the completed buildings to final investors including the users of the houses and the final investors who venture to building projects themselves.

For a clear understanding of the factors affecting the profitability and the resultant development of real estate projects, it is essential to address the difference between the short and long-term oriented real estate developers. The real estate developers can be classified into three categories:

- Market developers who develop real estate projects with the idea of selling the completed dwellings or buildings with a profit

- Investor developers who would like to retain the ownership of the buildings developed by them

- Market/investor developers who sometimes decide to sell the developed projects and sometimes retain the ownership of the completed buildings

The following table indicates the change in the status of ownership during the 10 years period under study. From the table it can be observed there has been a tremendous increase in the market developers, which implies that market developers create almost 60% of the projects and they sell the flats to potential individual buyers. These developers can be classified as ‘market developers’ or ‘market/investor developers’ depending on whether the developers keep the residential properties which were not taken up by the market.

Table: Categories of Developers in 1994-1996 and 1999-2001 (based on 2004 Survey)

Project Analysis by Market Developers