Introduction

The purpose of this paper is to provide a detailed overview of Vivartia, and to discuss the strategies of the company to endorse its chocolate milk in the Greek market; therefore, this paper will focus on the size and sales of Vivartia, its product categories, market description and segmentation, major competitors, elements of the marketing mix, and so on.

Information on the Company

Company Background

According to Vivartia (2011), in 2011, as a multinational corporation, Vivartia has continued to keep up its position as the market leader in the Greek food industry, whilst remaining a major player in the European Union; as an extremely popular MNC, it is currently having operations in thirty nations throughout the globe, serving approximately one billion customers annually. This company sells about two and a half billion items every year in the EU; moreover, estimations suggest that nine out of ten homes in the domestic market purchase Vivartia’s groceries, whereas nearly ninety-nine percent people are familiar about the business – this brand-reputation, together with the pioneering differentiations of its products, has played significant roles in boosting the Greek GDP. The following figure demonstrates some recent facts about the firm in summarised format:

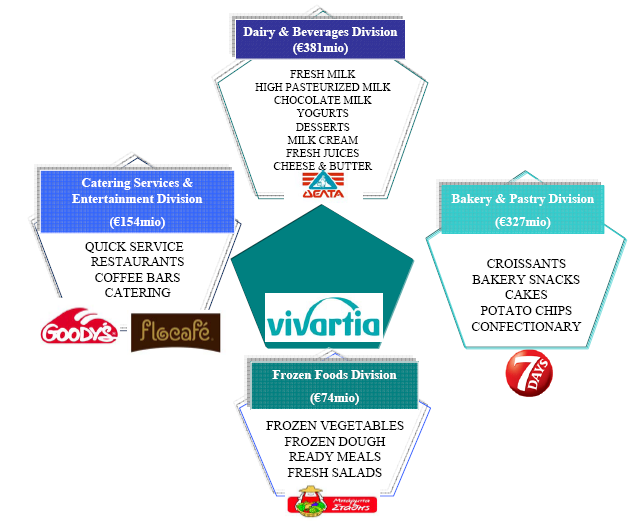

Vivartia has established in 2006 after taking over Goody’s, Barba-Stathis, Delta-Holding, and some other firms; however, today, besides of the entire EU, it also has operations in Africa and GCC nations; additionally, to attain more market share and boost long-term vision of expansion and growth objective, it has merged with UMC, a Bulgarian corporation, together with Christie’s Dairies (Vivartia, 2009). The following figure shows current organisational structure of Vivartia for a better understanding of the way in which the business has segmented all the departments according to the production functions:

Size, Sales, Profit, and Other Resources of the Company

This multinational corporation holds about thirty per cent share of the Greek food and groceries industry, illustrating the size and scale of its operations; the table below outlines a financial overview of the company for the past four years, conveying the trends of sales, profits, resources, and other financial determinants:

Table 1: Four Years Financial Trends of Vivartia. Source: Generated from Bloomberg Businessweek (2011)

Basic Product Categories Along With the Brands in Each Category

Vivartia offers a range of products to the global consumers, which are more often available through different brands; a brief description of these products and brands, together with the shares in different markets has outlined below:

Table 2: – Descriptions and Shares of Different Product Categories and Brands. Source: Self generated from Vivartia (2009)

Information on the Market

Market Description

As discussed above, Vivartia holds a strong position in the Greek food industry; however, at this stage, it is essential to focus on describing the general environment of the market in order to assess the suitability of its strategies to sell chocolate flavoured milk in the country. Christidis et al (2011) noted that there is an increasing trend of consumer awareness for functional foods in Greece; this has created an opportunity for Vivartia to boost its chocolate milk sales, which is processed with the most fresh and healthy ingredients, having high nutritional value. Theodoridis & Chatzipanagiotou (2009) argued that Greece possesses an increasing growth trend in its supermarket and retail store industry; this indicates that the public demand for fast moving consumer goods are gradually increasing in the country, creating a vast space for boosting the sales of chocolate flavoured milk. However, the high saturation in the food industry of the country, according to Artikis (2007), has caused a rivalry amongst different companies to establish low cost production plant in different places, which has in turn, raised the price of plant locations. In this context, it is important to argue that although the demand for chocolate flavoured milk is quite high in the market, it would not be viable for Vivartia to increase production through establishment of new plants in Greece, which can severely affect its cash flows due to the high expenses involved.

Market Segmentation

In order to take full advantage of the market, Vivartia has segmented the market according to age and income levels. Index mundi (2011) suggests that Greece have 14.2 percent of its population aging from zero to fourteen years, and 66.2 percent aging from fifteen to sixty-four years; therefore, although Vivartia mainly concentrates on just kids aging from five to fourteen, as this population is relatively small, it will soon focus on youths, aging from fifteen to thirty-five. Conversely, in order to compete better in an industry that is extremely innovative and aggressive (Chryssochoidis, 2008; and Oustapassidis, 1998); Vivartia’s marketing strategy is to create new-fangled and differentiated product, which requires high production costs. Consequently, this necessitates the firm to charge a bit higher for the chocolate milk, which in turn has forced it to focus on high and middle-income earners in the country.

Size of the Market and Segments

The size of grocery industry of the country is about twenty-one per cent of the entire industrialized production sector; the following graph shows the size of the grocery segments:

Trends

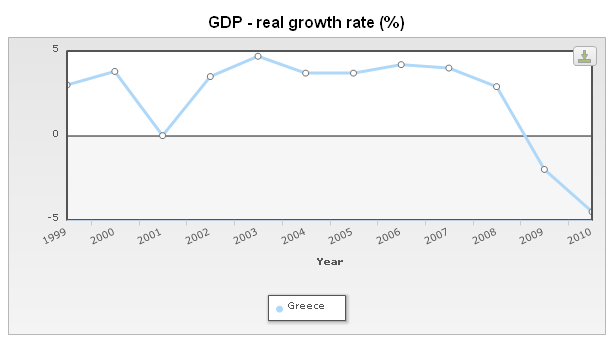

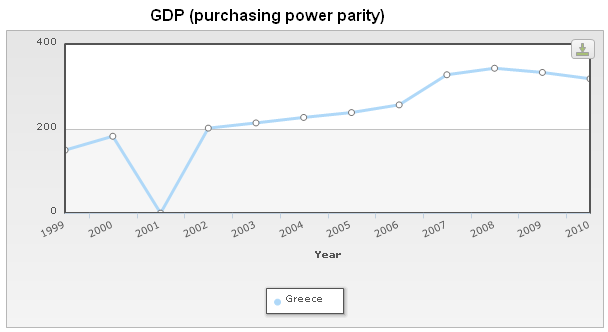

It is important to note that the global financial crisis has resulted in downward trends in the Greek economic determinants; the following chart shows the GDP growth rate trends of the country:

The recessionary impact has also lowered the purchasing power of the customers, as shown in the chart below:

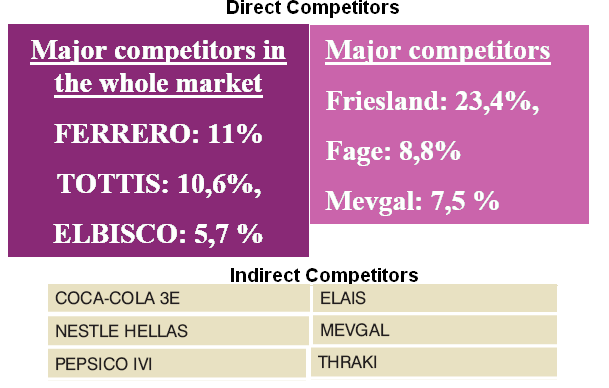

Competitors of Vivartia

Vivartia faces intense competition from a range of direct and indirect competitors, which are either multinational of local players; the list of the major rivals of the firm has outlined below:

The Marketing Strategy

Target Market

Porter (1979) pointed that players in any particular industry could turn out to be better performers if they are able to target the market in an appropriate way; therefore, it is essential to mention that in order to keep up its leading position in the market, it is quite important for Vivartia to reassess its targeted market. As stated earlier, so far, for selling the chocolate milk, the business has widely targeted about 14.2 percent of Greece’s population with average age of seven years; however, such a small target group means lower sales and lower profits, for which it will be extending its market to include youths, aging from fifteen to thirty-five years. Therefore, the marketer of the chocolate milk will be targeting the new promotional messages to include this age group as well as the high and middle-income earners in the country.

Elements of the Marketing Mix

Marketing mix is a strategic framework through which firms are able to undertake marketing decisions in an encoded manner (Kiser, Rao, & Rao, 1974; Thorne, 1971; and Anthony, 1997); the marketing mix for Vivartia has discussed below:

- Product

Vivartia produces the most fresh and healthy chocolate milk and other foodstuffs, which possess high dietary values; moreover, the company focuses on packaging those in an attractive manner in order to please the customers; the key products and brands are shown in the following figure:

- Price

Because of high production-costs resulting from differentiations in the products and inflation in the economy, besides of the chocolate flavoured milk, the pricing of all products of the company are slightly higher than that of the competitors. However, the annual report 2009 of the company suggests that it has an objective to lower the prices by lowering production costs, which is achievable by ensuring better capacity utilisation.

- Promotion

As besides of the kids, Vivartia will also be targeting the adults for the chocolate flavoured milk; apart from TV, the new advertising media should be including online campaigning, newspapers, magazines, billboards, radios, and company-owned websites to address all the age groups. It is also viable to offer discounts and gifts with the products as part of its sales promotions; furthermore, building public relations is also a significant way to communicate to the mass people, for which Vivartia will also be holding press conferences.

- Place

In addition to the company owned retail stores, all the products and services of Vivartia are available in the superstores, malls, and retail outlets throughout Greece.

Conclusion

Although the Greek food and groceries industry is a prospective growth sector, the potential risks of a great depression that may result from the Eurozone crisis could cause Vivartia to face declining share of the market; therefore, the company needs to focus on sustainable strategies to assure its position as the market leader even in adverse environment.

Reference List

- Anthony R. B. (1997) The five Vs – a buyer’s perspective of the marketing mix. Marketing Intelligence & Planning, 15: 151-156.

- Artikis, G. P. (2007) Plant Location Decisions in the Greek Food Industry. International Journal of Operations & Production Management, 11(5): 57-70.

- Bloomberg Businessweek (2011) Vivartia Holding SA (DDS1:Berlin).

- Christidis, N. et al (2011) A cross sectional study of consumer awareness of functional foods in Thessaloniki, Greece. Nutrition & Food Science, 41(3): 165-174.

- Chryssochoidis, G. (2008) Innovativeness and NPD processes/practices in the Greek food industry. EuroMed Journal of Business, 3(2): 202-222.

- Demiris, N. et al (2008) Food Industry in Greece. [pdf] Web.

- Index mundi (2011) GDP (purchasing power parity). [Online] Web.

- Index mundi (2011) GDP real growth rate (%). [Online] Web.

- Index mundi (2011) Greece Demographics Profile 2011. [Online] Web.

- Kiser, G. E., Rao, S. R. G., & Rao, C. P. (1974) Clues to the design of a marketing mix. European Journal of Marketing, 8: 168 – 179.

- Oustapassidis, K. (1998) Performance of strategic groups in the Greek dairy industry. European Journal of Marketing, 32(11): 962-973.

- Porter, M.E. (1979) The structure within industries and companies performance. Review of Economics and Statistics. 61: 28-214.

- Theodoridis, P. K. & Chatzipanagiotou, K. C. (2009) Store image attributes, and customer satisfaction across different customer profiles within the supermarket sector in Greece. European Journal of Marketing, 43(5): 708-734.

- Thorne, A. R. (1971) The marketing mix – a problem analysis. European Journal of Marketing, 5(4): 207-216.

- Vivartia (2006) Presentation to Investors: 1st Annual Greek Road Show.

- Vivartia (2007) Annual Report 2007 of Vivartia.

- Vivartia (2009) Annual Financial Report 2009 of Vivartia.

- Vivartia (2011) The Company At a Glance.