Introduction

Corporate fraud has become more sophisticated than compared to a decade ago and IRS investigation team has the analytical capability of ward through numerous computerized financial records and through complex paper filing. Now, IRS special investigation agents have investigative skills on computer data that facilitate them to recover financial data that have been safeguarded by passwords, encryption or hidden with sophisticate skills.

The fall of giant corporations over night like Enron, WorldCom, Arthur Anderson and large number of corporate frauds being reported in the United States at the dawn of 21st century aggravated the need for stringent law to maneuver the corporate scandals and the result was the introduction of Sarbanes-Oxley Act (SOX). SOX was introduced in July 2002 thereby introducing a major assortment of changes.

SOX toothed SEC with more powers and authorized to impose civil penalty on erring corporations to compensate gullible investors who were victims of such scandals. To avoid auditor collaboration with fraudulent management, SOX stipulated that no consulting work should be carried over by audit firms. Further, SOX through section 404introduced more internal controls which are analogues to COSO’s internal control framework.

One another special feature of SOX is that it safeguards the interest of whistleblowers especially employees. Section 301 of SOX now requires audit committees of publicly traded companies to frame structures for “secret unknown revelation by employees as regards to suspicious accounting practices or questionable audit matters. “ Whistle blowing employees now being offered protection under SOX from being fired from the company.

The Sarbanes –Oxley Act offers additional investigative techniques to assist to control corporate fraud in America. As per the SOX, corporate officers are now made responsible for filing their corporation’s income tax returns, financial disclosure statements and to certify as to their conduct pertaining to the exploitation of corporate records. SOX now impose stricter imprisonment up to twenty years imprisonment for the alteration, manipulation, destruction or distortion of financial records so to obstruct federal tax investigations and causing bankruptcies.

Immediately after Enron fiasco, President Bush formed a Presidential Corporate Fraud Task Force in 2002 with the commissioner of IRS as a member. This task force is aimed to offer course for the investigation and initiation of prosecution of major cases involving accounting and security frauds, wire fraud, mail fraud, tax fraud and money laundering. It is to be noted that most of the investigations on corporate frauds are joint endeavors involving many federal agencies. On the fourth anniversary of President Corporate Fraud Task Force, there were strong record of successful indictment and IRS Criminal investigation has suggested action on 76 corporations or individuals to initiate action for abuses and frauds.

Valuing the transaction between holding company and its subsidiary company is another grey area where there are avenues for corporate frauds. (Telberg 2004).

Since Sarbanes –Oxley now requires a chance to reframe all gamut’s of financial reporting process, governance, standard framing and peer oversee, formation of audit committees, reporting of compliances, assessment and reporting on internal controls to public, the accuracy and correctness of financial statements is to be certified by the management etc. These are now in place and compel companies in U.S.A to deter from indulging in fraudulent activities.

These measures will enhance the financial reporting methods and assist to maintain investor confidence. It is to be remembered that inculcating ethical habits is to emanate voluntarily and cannot be instilled through regulation or legislation process alone. (Nicolaisen 2005).

Due to provisions of Sarbanes –Oxley Act, public companies that are audited by accounting firms are regulated entities now and they are liable to be inspected and public are at liberty to know the integrity of their audit methods.

In an empirical study carried over by Alexander Dyck et al in 2007, it has been proved that only about 7% of the frauds are unearthed by the SEC and about 15% are uncovered by the auditors. The whistle blowers are the industry regulators (17%), the media (14%) and the employees (19%). It is surprising that SEC investigation was able to discover only just 7% of corporate frauds where as non-regulators like media, employees and non-financial market regulators uncovered more corporate frauds than regulating bodies.

It is also perplex to note that why active players like commercial banks, stock exchange regulators and underwriters had no active contribution in unearthing corporate frauds.

Statistical data on IRS detection and prosecution of corporate frauds:

Rate of incarceration comprises imprisonment in federal prison, home detention, halfway house or some permutation thereof.

IRS file class action suits under federal law rather than State laws since federal law is more rigorous than that of State laws. As held in Green vs. Santa Fe, Supreme Court held that federal class action is enough to offer evidence of misrepresentation. The empirical study carried out by Thompson and Thomas in 2003 also corroborates this.

The main aim of this research is to find out how can a revenue regulating body (particularly, investigating revenue officer-IRS) could possibly play a vital role in the enhancement of corporate governance to deter corporate failures/bankruptcy. or rather the ‘Impact Of Tax Enforcement On Corporate Governance’.

Literature Review

This research paper mainly investigates how can a revenue regulating body (particularly, investigating revenue officer-IRS) could possibly play a vital role in the enhancement of corporate governance to deter corporate failures/bankruptcy.

Further , this research paper analyses from the secondary sources available on the subject which have been listed in the reference section of this paper to demonstrate the significance of fraud detection to deter corporate failures by explaining what is a corporate fraud , the various strategies perused by companies to defraud its investors and IRS , the action initiated by the IRS to punish the erring corporate during 2007 and 2008 , discussion on report to the Nation on Occupational Fraud and Abuse released by acfe.org, the role of audit committees in deterring the corporate fraud and the need for tax reform through introduction of flat tax system to minimize tax evasions by companies and to increase the federal revenue.

The case studies regarding indictment for tax evasion and tax abuses have demonstrated in crystal clear terms that IRS did help to prevent tax evasion and is helping to restitute to victims of such corporate frauds.

Finally this research concludes by summarizing the key findings, evaluating IRS role in prevention of tax evasion thereby ensuring compliance of corporate governance codes and to deter the corporate failures.

Methodology

For the purpose of this research paper, data’s and ideas have been compiled from the published articles from reputed magazines, books and periodicals. Further, recent happenings in the industry like data’s on corporate frauds have been assimilated from IRS website and from acfe.org website and enough data have been included for the purpose of elucidation and understanding. In case of data’s to prove that IRS plays a key role in reducing the tax evasion and in deterring the corporate failures , previous empirical studies on the subject have been analyzed and reference is made wherever necessary.

Finally, this research has analyzed that IRS did play a key role in deterring tax evasion and the need for flat tax system to minimize tax evasion by using secondary data’s various articles published in the reputed magazines and has come to a conclusion that flat rate tax system is a viable alternative to the existing federal tax system.

Analysis

Corporate Fraud – An IRS perspective

From the perspective of IRS, corporate frauds involve infringement of the Internal Revenue Code (IRC) and associated laws perused by giant, publicly traded or private corporations and by their top executives. These fraudulent acts are distinguished by their complexity, extent and scale of the disastrous economic side effects for society at large, lenders, employees, gullible investors and overall financial market.

IRS specialization in corporate frauds

IRS Criminal Investigation (CI) through its special agents, as financial investigators, occupies an inimitable role in the federal law enforcement division.CI role is maneuvered in majority of the regional corporate fraud task force. For the criminal infringement of the Internal Revenue Code (IRC), CI has the predominant investigatory jurisdiction. Corporate frauds are often perpetrated by infringing of the IRC through filing of bogus corporate and individual income tax returns.

Various Tax Fraud Strategies

Corporate Fraud

From the perspective of IRS, corporate frauds involve infringement of the Internal Revenue Code (IRC) and associated laws perused by giant, publicly traded or private corporations and by their top executives. These fraudulent acts are distinguished by their complexity, extent and scale of the disastrous economic side effects for society at large, lenders, employees, gullible investors and overall financial market.

The best illustration of corporate fraud decided in 2008 is given below:

National Financial Enterprises (NCFE)

Erstwhile employees were sentenced on the complaint filed by IRS for their involvement in a scheme to defraud investors about financial strength of the above company. NCFE vice-chairman was awarded of sentence of 75 years in prison and about $ 2.5 billion in repayment. Further, the defendants were to surrender about $1.7 billion worth of property and to defray fines to the tune of $ 2.3 million. The accused accepted the charges leveled against them during the trial and affirmed that they were aware that the business model presented by NCFE to the gullible investors varied abnormally with that of actual performance and thus misled the investors to invest in their notes.

General Tax Fraud

This involves willful and deliberate infringement of tax payer’s known legal responsibility to file tax returns voluntarily or to defray the exact employment, income or exercise taxes. It is to be noted that this kind of violators create a gauche to American economy and to the tax administration.

The best illustration of general tax fraud decided in 2008 is given below:

Ex CEO of the start-up company namely Vaportech was indicted by IRS for involving in mail fraud and tax evasion. He was asked to pay $0.8 million by way restitution to the above company. Further, he was asked to forfeit numerous personal items he purchased from the company’s money and used the same for personal purposes. During the year 2004 and 2005, he earned more than$1.2 million by way of salary and never filed income tax return for the same.

Money Laundering Fraud

Money laundering is a process where illegally-earned money pumped into the nation’s legitimate financial system. It results in disguised financial asset so they can be deployed with out detection of illegal activity from which it originated. Thus, money laundering helps to transform the ill-gotten funds through criminal activities into a country’s legitimate financial system. Thus money laundering process is providing a legal platform fro terrorists, drug dealers, arms dealers and other criminals. If the money laundering is left unchecked, it would erode the integrity of the nation’s financial institutions.

Drug traffic alone engenders tens of billions of dollars a year and the exact amount can not be quantified. Other than narcotics profits, it also includes money laundering through tax evasion and trade frauds, arms smuggling and organized crime, medical, insurance and bank frauds. The methods of money laundering range from compound financial transactions, carried out through the net work of shell companies, webs of wire transfers and currency smuggling. No sooner the law enforcement is aware of the new method of money laundering technique and initiates action to disturb the activities, the launderers resort with yet another, more classy method.

It is estimated total money laundered globally in a year is ranged between $ 500 billion and $ 1 trillion. FinCEN ( Financial Crimes Enforcement Network) estimates that over $ 750 billion in illicit funds is transferred world wide annually of which $ 300 billion is laundered in US alone which is equivalent to total gross sales of two world leading automobile producers like Ford and General Motors.

Money laundering is an intricate crime involving complex details, frequently involving many financial outlets and financial transactions around the globe. The CI financial investigators have the appropriate expertise to track the money trail.

The best illustration of money laundering fraud decided in 2008 is given below:

A money launderer Lou Pearlman was ordered to surrender his properties and assets, many vehicles, $ 200 million money judgment for indulging in money laundering offense and employed a bogus claim in bankruptcy proceedings. He was charged by IRS with a “Ponzi” plot thereby inducing public investors to invest in his paper companies, with a bank fraud scheme and also involved in bankruptcy fraud plot.

Abusive Tax Schemes

This involves structuring of abusive foreign and domestic trust. These schemes have designed into complicated arrangements that take benefit of the financial secrecy laws of some foreign tax heavens like Bermuda and using of debit/credit cards issued from financial institutions of tax heavens situated in the offshore.

The best illustration of Abusive Tax Schemes decided in 2007 is given below:

Digital Consulting Inc diverted million of unaccounted and unreported income to its offshore subsidiary in Bermuda mainly for tax avoidance purpose. For this, George Schussek, CEO of the company was given a sentence of 5 years in prison and a fine of $125,000 for tax evasion and tax fraud conspiracy.

Lobbying and Tax Evasion

One research study has revealed that fraudulent companies spend more for lobbying than the companies not engaged in fraud. Thus, companies engaged in fraud could able to escape fraud detection at least for 4 months and 45% of their frauds are less possibly to be uncovered by regulators. Companies use the delay in fraud detection to shift their market negative reaction and to dispose of their shareholdings as it had happened in Enron and WorldCom. Hence, an IRO (Internal Revenue Officer) should closely scrutinize the corporate spending on lobbying and should compare the same with the industry standards and with the figures of previous years. If he smells something rotten, he should immediately initiate action on the basis of his findings.

Lobbying is one of the tactics perused by corporation to camouflage their frauds and this is evident from the corporate spending about $2.15 billion on lobbying alone in 2005. Corporations employ almost half of the former senate members or congressmen as their lobbyist. For instance, Enron spent substantial sum on lobbying and it was able to get favorable treatments from federal, state, congress and from various regulating and monitoring agencies on about 50 occasions since 1997. Some of the favors that Enron was able to muster were to ease the government blocking on their derivative trading, doing away with controlling of natural gas prices, to obtain government approval to treat some types of book debts off the balance sheet etc.

It is important to note that lobbying do impact corporate governance in the area of detection of fraud. This has been corroborated from the evidence that WorldCom and Enron was able to shun detection of frauds and able to prolong their misdeeds for years together by spending million of dollars on lobbying. Hence, it has been proved beyond doubt that lobbying does impact companies which intended to avoid fraud detection either directly or indirectly.

One empirical study perused by Gupta and Swenson in 2003 tried to establish that companies do engage in lobbying to reap tax benefits that end up in loss of tax revenues to government.

Another empirical study made by Dyck, Morse and Zingales in 2006 tried to prove that which monitoring agencies are more vibrant in fraud detection and role of IRO’s in fraud detection efforts.

Corporations in U.S.A do lobby to get advantageous tax laws. For instance, tax subsidization has been recently announced for the oil industries. About $ 1.5 billion equivalent of tax benefits were given to oil companies through the Energy Policy Act of 2005 and oil industries reported extraordinary profits in 2005 due to this tax incentives. Likewise, American nuclear utilities enjoyed about $4.4 billion worth of tax incentives due to above mentioned legislation.

An earlier empirical study carried over by Gupta and Swenson in 2003 reveal that company’s political contributions are directly connected with tax advantageous.

The cost of lobbying expenses will be really high as lobbying expense is non-deductible expense.

Case study on Lobbying

In the case filed by IRS against Jack Abramoff, erstwhile lobbyist ordered to pay $ 24 million in payback to his victims for tax evasion and conspiracy in addition to 4 years imprisonment in 2008. Abaramoff confessed that he utilized the unreported income for his own advantages. He also admitted that he filed false reports of some non-profit organizations which he controlled and thus engaged in tax evasion.

When there is a high rate of marginal tax say up to 40%, people generally resort to two types of manipulation one is to evade tax and other is to influence politically for favored tax treatment. Had the marginal tax is in the range of 10 to 20 %, they will rather pay the tax honestly rather than searching for political influence or evasion tactics. For example, the members of ways and means of US congress has the extraordinary power to shape the nation’s tax laws and they always successful in getting about 30% more total campaign funds than the other member of the congress.

Corporate Watchdogs in U.S.A

In U.S.A, the following are the corporate watchdogs.

- Internal Revenue Authority (IRA),

- The Government Accountability Office (GAO),

- The Office of Government Ethics (OGE),

- Federal Bureau of Investigation (FBI}

- Securities and Exchange Commission

- Postal Inspection Service

- National Association of Securities Dealers

- Commodity Futures Trading Commission

- Department of Labor

- Defense Criminal Investigation Service

- Federal Energy Regulatory Commission

The above mentioned agencies can help the government and could veil influence in fraud detection efforts by regulators. (Telberg 2004).

Role of FBI in Prevention of Tax Evasion

As a part of preventing financial frauds by corporate’s, FBI is employing Certified Accounting Professional (CPA) as special analysts and agents to deter corporate frauds. About 1.300 accountants are already under the rolls of FBI. FBI accounting agents will be responsible for averting accounting frauds.

Thus , AICPA and FBI will work together to deal with the issue fraudulent accounting practice , to recognize common accounting methods , collaborate with each other effectively and under the effect of Sarbanes-Oxley Act and associated rules and ordinances.

Currently, FBI is perusing more than 2010 corporate fraud issues representing billion of dollars in financial losses and tens of hundreds of victims.

According to FBI, the 1980’s were manifested by the savings-and-loan frauds and in the 1990’s were witnessed by healthcare insurance scandals which prolongs to this day. The recent fraud in series is the financial restatement perused by companies in America. About 920 restatements were monitored by FBI since 2002. It is to be remembered that just because a company reports restatement not necessarily mean that it engaged in fraud but it may trigger a warning signal for FBI to initiate investigation.

Why restatement triggers a lot of attention is that it involves revenue recognition issue where almost 50% of SEC cases are centering around restatements of accounts only. It is to be observed that restatement for improper revenue recognition also ends in extensive plummet in market capitalization than nay other method of restatement. According to FBI data, about 9 out of 10 decline in market value losses pertained to revenue recognition issues in 2000 alone. Out of these 10 companies, just three top companies lost about $20 billion in 2007, in just three days owing to revenue-recognition issues which is equivalent to Russia’s GDP (Gross Domestic Product).

Corporate Frauds cases initiated by IRS and decided in 2008

In the year 2008, IRS was able to prosecute the following for corporate frauds.

Apopka, Florida

Four employees of the above company were engaged in a scheme to deceive the U.S.A by hampering the collection of taxes by IRS. The main charges against the employees were that they created false invoices and received a disguised income of more than $1.5 million during the period 1999 through 2003 thereby evading income taxes on their unreported income.

National Financial Enterprises (NCFE)

Erstwhile employees were sentenced on the complaint filed by IRS for their involvement in a scheme to defraud investors about financial strength of the above company. NCFE vice-chairman was awarded of sentence of 75 years in prison and about $ 2.5 billion in repayment. Further, the defendants were to surrender about $1.7 billion worth of property and to defray fines to the tune of $ 2.3 million. The accused accepted during the trial that they were aware that the business model presented by NCFE to the gullible investors varied abnormally with that of actual performance and thus misled the investors to invest in their notes.

Sigma-Aldrich (SA) Corporation

In scheme devised to defraud the above company, erstwhile product manager Wandler, supplied chemical compound to one Corporation of America (BCA) with chemical compounds from SA. BCA would then sell these compounds again to SA and Wandler would be paid some kickback. Wandler was directed to defray $ 5 million to SA as reinstitution.

Olen Properties Corp

IRS claimed that the founder of the above real estate company indulged in filing a false income tax return for the year 2002 thereby failed to reveal foreign bank accounts to IRS. IRS was paid $52 million by the company by way of previous years withheld taxes, interest and penalties.

Global Money Management (GMM)

The hedge fund was asked to pay $ 49 million as restitution to mutual fund investors. Fund manager acknowledge that he indulged in diversion of funds from the above hedge fund to his personal entities and over reported the performance of GMM hedge fund. The fund manager Friedman diverted the funds from GMM fund to his personal entities and shown the same as capital contribution thereby receiving payments without tax.

Domecq Importers Inc

Former president of the company was indicted by IRS and he was ordered to pay $ 4.5 million in restitution for having indulged in tax evasion and defrauding Allied Domecq PLC.

1st Atlantic Guaranty Corporation

The chairman of the above face-amount certificate company was indicted by IRS for tax evasion, embezzlement from an investment company and for wire fraud. He indulged in misappropriation of $ 3.1 million of investor’s funds and charged with underestimation of his taxable income over $ 1 million.

Sadoff & Rudoy Industries

Erstwhile chief executive Sheldon J. Lasky of the company was directed to defray $1 million by way of reinstitution. Lasky agreed that through the years 1999 to 2002, he claimed his personal expenses as business expenditure and thereby reported his income to the tune of 1 million during the years.

Wyoming Feeders Inc

Former official John C.Kuchinski was directed to pay $1.2 million to the above company by way of restitution and $0.2 million to IRS for filing bogus tax return and engaged in child fraud. Over the period of a decade, Kuchinski withdrew $1.4 million from the company and met the personal expenses out of it.

Vaportech

Ex CEO of the above start-up company was indicted by IRS for involving in mail fraud and tax evasion. He was asked to pay $0.8 million by way restitution to the above company. Further, he was asked to forfeit numerous personal items he purchased from the company and used the same for personal purposes. During the year 2004 and 2005, he earned more than$1.2 million by way of salary and never filed income tax return for the same.

Haas Automation, Inc

The owner of the above company Gene Francis Hass was indicted by IRS for having avoided reporting more than $ 34 million as income to IRS. Haas paid $ 5 million by way of fine to IRS and also paid about $ 70 million to IRS to resolve his tax obligations for the year 2000 and 2001. Company lost a patent case and paid about $ 9 million settlement to its rival and blamed a federal judge who chaired the patent abuse legal suit for this loss. Company devised many tax fraud schemes and recovered from the government $ 9 million plus legal costs which it paid to its competitor company for patent infringement.

- A Louisiana Attorney was charged with filing false tax returns and indulged in tax evasion and directed to pay $ 270,000 as fine to IRS in 2008. The Attorney met his personal expenditure from business income and claimed deduction of these personal expenses as business expenditure.

- A money launderer Lou Pearlman was ordered to surrender his properties and assets, many vehicles, $ 200 million money judgment for indulging in money laundering offense and employed a bogus claim in bankruptcy proceedings. He was charged by IRS with a “Ponzi” plot thereby inducing public investors to invest in his paper companies, with a bank fraud scheme and also involved in bankruptcy fraud plot.

- A Pennsylvania business man Timothy Heffner was ordered to pay $ 2.2 million by way of restitution. Heffner paid to kick backs to product manager of SA for reselling the compound received from SA.

- Jeffrey F.Grous, an ex-employee of an investment firm was charged for his involvement in mail fraud, wire fraud, filing a false tax return and tax evasion. Gorus accepted over the period of last ten years, he swindled about $5.3 million from his employer by making fictitious payments to his sham companies.

Corporate Frauds cases initiated by IRS and decided in 2007

In the year 2007, IRS was able to prosecute the following for corporate frauds.

Digital Consulting Inc

Company diverted million of unaccounted and unreported income to its offshore subsidiary in Bermuda mainly for tax avoidance purpose. For this, George Schussel, CEO of the company was given a sentence of 5 years in prison and a fine of $125,000 for tax evasion and tax fraud conspiracy.

Beaulieu Group, LLC, Georgia

The above company remitted $ 32 millions as penalties, back taxes and other costs on the ground of submitting false tax returns in 2007.IRS in this case uncovered that Beaulieu intentionally overstated its deduction of depreciation to the tune of $ 1 million. The company also warned by IRS that they should not indulge in state, local and federal tax violations in near future. The company is now mandated to file quarterly reports to update its business ethics policies to tax court regularly.

Superior Electric Company

CEO of the company was ordered to pay about $ 5 million to IRS and to National City Bank for bank and tax fraud. Company perused a scheme by falsely accounting expenses and evading taxes and manipulated its accounting records for SEC purpose.

E-Star Inc, New Jersey

E-Star Inc is the American subsidiary of Hon Hai Precision Industry Company Ltd, Taiwan. The above company was by IRS for failing to defray federal taxes on its $ 99 million employee stock bonuses. On IRS investigation, company agreed to pay $ 42 million in taxes, fines, interests and penalties. The company failed to report the stock bonuses on its IRS returns.

Americable International Inc

In about 39 tax evasion and fraud charges, the company pleaded guilty and agreed to pay a fine of $ 4 million to IRS. By devising false accounting and financial documents, CEO of the company diverted nearly $ 50 million of company’s income to his personal use.

Haas Automation and CNC, Inc.

IRS filed a charge against the company that it had created bogus expenses thereby avoiding in defraying about $20 million in federal income taxes. Company lost a patent case and paid about $ 9 million settlement to its rival and blamed a federal judge who chaired the patent abuse legal suit for this loss. Company devised many tax fraud schemes and recovered from the government $ 9 million plus legal costs which it paid to its competitor company for patent infringement.

Baker O’Neal Holdings Inc (BOH)

The company paid more than $ 9 million in restitution to IRS for its diversion of funds of its subsidiary to pay ex president’s personal expenses.

Tyco International Ltd

The company not reported in excess of $170 million in Income on its 1999 corporate tax return thereby causing a revenue loss of about $ 60 million to IRS. Company failed to state the $ 170 million capital gain earned by back-dating certain documents.

Ralph’s Grocery Company, Los Angeles

Company paid $ 70 million to IRS by way of compensation and criminal fines for illegally hiring many locked-out union members when the company faced a labor strike during 2003-04. Company employed a strategy of reemploying of locked-out members under bogus identities led to the submission of faked tax details to IRS and the Social Security Administration.

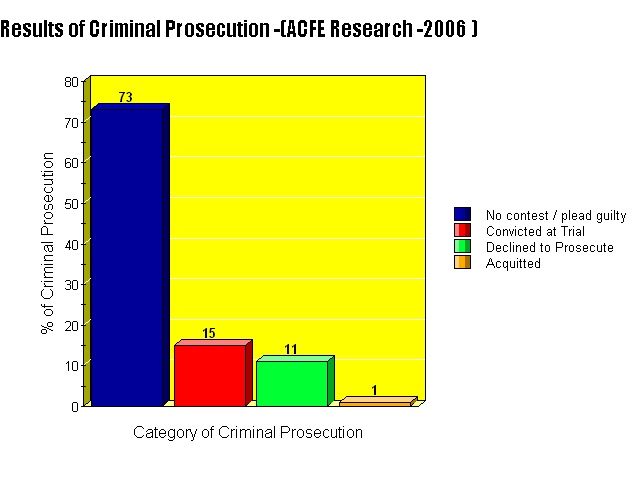

Acfe and Fraud Detection

The Association of Certified Fraud Examiners [ACFE] in their recent research publication which throws some light on the occupational abuse and fraud for the year 2006. According to the above report, the corporations in U.S.A have lost 5% of its annual income to occupational fraud alone. It is to be noted that U.S GDP in 2006 was around $ 13.037 trillion and U.S corporate have lost about $ 652 billion in frauds and abuses alone.

This spillage of $652 billion is equivalent U.S.A’s negative trade imbalances during a year mainly to escalating cost in importing oil from other countries. In other words, if American government is able to plug the loophole of revenue losses due to tax evasion, it will have a favorable balance of trade. In other perspective , the American government could solve the current energy crisis by spending $ 652 billion which is the pilferage of revenues due to corporate frauds to defray the whole cost of establishing solar energy facilities for all household consumption in America. (ACFE 2006).

Executive Summary of the 2006 Report to the Nation on Occupational Fraud and Abuse

This research covered 1134 cases of corporate frauds with estimated losses of total value over $ 652 billion between January 2004 and January 2006. The data was collected by Certified Fraud Examiners who also investigated these cases. The research revealed that there was a tremendous financial loss to companies that affected by abuse and fraud and established that total annual loss due to fraud was equivalent to five percent of the company’s annual income and total loss was estimated at $ 652 billion which is equivalent to 5% of U.S.A’s GDP. Thus, the median loss caused by abuses and frauds in this research was estimated at $159,000. Further, about 25% of the cases resulted at least $ 1 million in losses and about 9 cases reported losses to the tune of $ 1 billion or more.

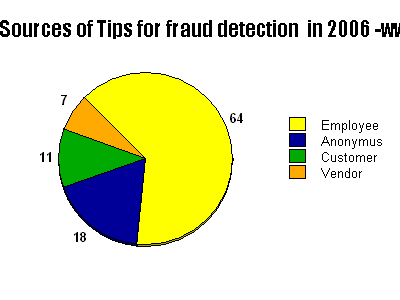

This research strongly recommends that requirement as per SOX for audit committees to introduce confidential whistle blowing mechanisms in companies without fail. According to this research, large quantum of fraud could be detected by a tip rather than through other sources like external audit, internal audit and internal controls.

From the above graph, it is evident that among frauds perused by top executives and owners, which had severe financial bleeding in the said companies, over fifty percent of all frauds were detected by a tip only. The above graph corroborates this finding.

It should be noted that confidential reporting procedure minimizes fraud and losses substantially. For those organizations which are having established secret reporting process like fraud hotline, the median loss was about $ 100,000. For those companies which have not introduced secret reporting process, the median loss on fraud was one hundred percent higher or $ 200,000 in 2006.

It is to be noted that SOX requires compulsory secret whistle blowing process for the publicly traded companies, the above research strongly emphasizes that these programs should also cover the third party sources like vendors and customers.

It is rather a surprise to note that internal controls ranked fourth that do lagging behind by accident in terms of quantum of frauds uncovered in this study. Moreover, the frauds that were uncovered by internal controls seem to be less in size with a median loss of just $ 40,000 in 2004 which was lagging far behind of any detection process. Companies which have internal audit department had a median losses of $ 120,000 as against to $220,000 for companies without internal audit department.

Further, internal audit department helps to deduct in 18 months where it will take a minimum of two years for companies without internal audit department. This research suggest that more efficient methods of internal controls are required to uncover frauds, particularly in case of large frauds that may involve top executives and owners circumventing or overruling customary internal control methods.

One another key finding in this research is that small business witness large amount of losses due to abuse and fraud which is disproportionate to size of their business. The average median loss suffered by small business was around $ 190,000 in 2006 which is higher than the median loss suffered by very large business. In case of abuses and fraud, small business almost applied for bankruptcy as they do not have vigor to withstand those losses and hence, they should safeguard themselves from frauds as it is a question of their survival. The most common frauds perpetrated by small business include skimming revenues, writing company checks and raising bogus invoices.

Since, majority of the small business does not have any whistle blowing process and no internal audit is being carried out in regular intervals, the detection of frauds in small business is just by accident.

According to the ACFE research, about 30% of the fraud was by accounting departments, 20% of the frauds were perpetrated by top management of the company and about 14% of the fraud was perused by sales department of the company.

One another interesting finding in this research is that frauds perused by owners and CEO’s had a median loss of $ 1million in 2006 which is five times greater than the losses perpetrated by managers and about 13 times greater than the losses perpetrated by ordinary employees. Here, role of IRS is very significant as it has uncovered many cases of fraud committed by owners and made them to pay heavy fines including forfeiture of assets.

It is hilarious to note that majority of corporate fraudsters are first time offenders and frauds cannot be completely weeded out from the business since these frauds are committed by seemingly honest and loyal employees. This study reveals that about 8 % of frauds were committed by a previous offender and recommends that proper background checking would assist the companies to hire persons with clean habit and character.

One of the best strategies to minimize the fraud is to prevent it. This research revealed that if a company has been defrauded, then it will be having remote chances to recoup from its losses. The median recovery rate among companies that were affected by frauds was only 20% In other words, about 80% of the companies which witnessed abuses and fraud had an unnatural death. Though IRS helped to restitute some quantum to the victims of frauds, this study revealed that almost 41% of victims never recovered anything at all. (www.acfe.com)

The industry wise highest median losses per scheme in 2006 are given as follows:

Source: www.acfe.com.

Source: www.acfe.com.

Flat Tax System – A Solution to the tax frauds and tax evasions

Of late, tax reform is the main subject widely debated in all the corners of the US. As an alternative to the existing federal income tax system, there are many proposals such as “reduction of tax rates, broadening of tax base, reducing tax to GDP ratios, flattening of tax structure “. The Flat rate tax system is a viable alternative to the existing tax system as it offers more advantages.

There is a general opinion that current federal Income tax structure is complex which thwarts US’s growth. The ordinary working class and business community are the worst affected as they are not entitled to tax breaks that are extended to those influential community which is being backed by the high-ranking politicians. Thus why many have started now advocating for the simple and flat rate tax system.

Affordable tax structure is the significant factor in attracting talents and foreign capital investments. In the past, tax advantage is the most attracting feature for US to attract intellectual talents and top creamy layers who will in turn augment the US economy due to their productivity. The complying cost of tax burden alone estimated to the tune of $ 205 billion annually or $ 705 per each individual To understand various statutory deductions available, tax credits and other special privileges available in the tax law, it needs a lot of expertise and an ordinary office going citizen or small business owner may not have the enough talent to understand this complex tax structures. Today, US Citizens are over-burdened with highest tax rates and major lion’s share of income is originating from the tax revenues.

Flat tax rate would replace the existing tax system with a single rate. For example , a federal tax collections are about 10% of U.S total personal income and thus a flat tax of 10% on the whole base of personal income would collect the exact revenue to the treasury.

One may recall the great fiscal lesson of the 1980 taught that when there is lower tax, it will always generate higher revenues. In 1980 after Regan’s tax cut measures, federal revenues soared from $ 530 billion to $ 1031 billion in 1990. Likewise, tax revenue increased at a 20% faster snip in the 1980s than in 1990s, which witnessed two world record tax increases. (Moore 1996).

Regan tax cuts had been criticized that the share of income earned by the wealthy 5% of the population increased from 17 % to 19% but they have disregarded the fact that segment’s share of the tax burden also augmented from 38% to 49% of cumulative federal income-tax collections. A reduction in marginal rates would stimulate economic development thereby increasing the size of the taxable assesses. Thus the whole society will be benefited from the increased economic activity.

The cost to individuals of compliance with the personal income tax is estimated to be $ 157 billion by the Tax Foundation and this will reduce to $ 10 billion if flat rate tax is introduced due to simplified procedures. There are approximately about 890 forms under current tax system and the flat rate tax system only needs two post-card size forms to be filled in and it will be more users friendly.

Even the Internal Revenue Service admits that the present system compel taxpayers to spare 6.6 billion hours each year in the preparation of tax returns. But in the case of flat rate tax system, the compliance system is so lucid and simple and it would reduce the compliance cost to 10 billion dollars. Flat rate will reduce compliance cost by eliminating the role of political lobbyist, lawyers and accountants.

Role of Audit Committees of the Board in fraud detection

Audit committee will deal with complaints regarding any objectionable auditing or accounting matters including:

- deliberate error or fraud in the preparation, assessment, appraisal or audit of any fiscal statement of the company;

- fraud or intentional error in the maintaining and recording of financial records of the company;

- shortages in or nonconformity with the company’s internal accounting controls;

- falsification or false statement to or by a senior executive or accountant regarding a subject contained in the financial records, audit reports or financial reports of the Company; or

- departure from full and fair reporting of the Company’s monetary condition.

About 72 % of the survey’s out of a sample of 330 respondents have responded that internal controls is of their paramount attention and focus of the member of the audit committee as disclosed by the survey conducted by Ernst & Young during first half of 2006. Compliance with regulations and laws and business risk management were their next aim and it constituted about 60% of the respondents. About 35% respondents responded that anti-fraud was the main focus of the audit committee. Further, Ernst & Young survey indicated that audit committee members have underwent a demanding workload with internal control issues. [Directors& Trustee Digest, August 2006].

A study conducted in the banking industry in USA by Fiesher, Dale L reveals that about 30% of the survey’s audit committee had reported violations.Audit committee with the all outside directors reported about 29% violations. As a rectification measure for violations, measures such as civil money penalties, a cease and desist order and termination of an executive. About 9% of banks with an audit committee have dismissed an executive for theft, fraud, misfeasance and misuse of funds.

For instance, the audit committee of Sapient Corporation, U.S.A had disclosed it had reached the conclusion to investigate into the Sapient’s chronological stock-based compensation practices.

The report of the sapient audit committee’s included the following major findings:

- The inquiry found no misbehavior by any member of its current management team.

- The investigation found out lack of checks and controls and documentation with Sapient’s stock-based reparation allotting method, as well as misdeeds relating to the pricing of some stock option allotments granted mainly during the phase from 1996 through 2001.

- The investigation revealed that the Sapient’s former CFO, former CEO and former General Counsel involved, to varying degrees, in issuing these allotments.

- Whether the management has found out, and the audit committee concurs, that the company will require restating some of its past financial statements to account non-cash charges for compensation expenses pertaining to earlier period stock option allotment. [Business Wire, 2006].

Thus, Audit Committee plays a pivotal role in detecting and preventing frauds as evidenced by survey made by Ernst & Young and by Fiesher, Dale L. Hence IRS should closely scrutinize the audit committee’s report to assess whether the company is engaged in fraudulent activities or not.

Conclusions and Recommendations

I strongly recommend that Company should provide hotlines to employees as well as third parties to help whistle blowers to report any suspicious activity. Besides background checking on new employees, company should initiate steps like workshops on frauds, anonymous reporting process and surprise audits to reduce the fraud.

ACFE research conducted in 2006 reveals that about 75% of the fraud was uncovered by external audit, about 60% of the fraud was detected by internal audit and about 50% frauds were unearthed by hotlines and fraud workshops and surprise audits detected about 30% corporate frauds.

According to ACFE research, about 46% of business organizations emphasized on fraud awareness workshops and ethics training program. The main aim of such workshop is to make employees aware of how fraud being perpetrated and how to report such frauds when it is detected or suspected. The median loss suffered by business with fraud workshop was $ 100,000 where it was 100% more for the organization which does not organize such workshops.

I recommend that both external auditors and internal auditors should be independent and they should not be employed by the company for any other assignments other than audit.

A flat tax would result in increased employment, investment and saving. Flat rate tax would augment the national wealth as it would result in rise of income-producing assets and it would also increase the a One another study reveals that the flat rate tax would augment the size of the U.S economy by 10% and it would reduce interest rates by 25% and this will balance the loss on the home mortgage loan interest deduction.

Flat rate tax remove the marriage penalties as there is only one tax, the income of the spouse won’t push a couple into an elevated tax bracket. One another study reveals that the flat rate tax would augment the size of the U.S economy by 10% and it would reduce interest rates by 25% and this will balance the loss on the home mortgage loan interest deduction.

One of the studies has established that it cost to US government $ 1.40 for collection of 1$ under this existing tax system and flat rate would minimize compliance costs by 94%

Further it will eliminate the deductions, credits, loopholes, exemptions and political intimidation. Thus politician’s role will be minimized to zero as they would no longer shed favoritism, help friends and penalize foes and to deploy tax code to inflict their values on the U.S economy.

Erstwhile communist nations like Latvia, Lithuania, and Estonia have introduced the flat rate tax system along with free-market reforms to resurrect their economies. Russia also adopted a flat rate tax structure of 13% from 2001. This has resulted in a spurt in the Russian economy as revenues have risen due to cessation of tax evasion and avoidance. Serbia, Slovakia and recently Romania all joined the band wagon of flat rate tax system. It is expected that Bulgaria, Croatia and Hungary will shortly switch over to flat rate tax system.

We might have witnessed that some business sells at low margin hoping that increased sales will lead to greater profit. If we apply the same principle if the tax rate is higher as people will shift their work, investment choices, and savings in a style that will minimize the earnings from the government. Hence the flat rate tax can stimulate the people to engage in work so that they will have some handsome revenue and to pay minimum tax.

Among various current flat tax rate proposals, government should seriously consider to implement the flat rate tax system at the earliest with necessary adjustments with offer of safeguard to poor and business.

This research strongly recommends that requirement as per SOX for audit committees to introduce confidential whistle blowing mechanisms in companies without fail. According to this research, large quantum of fraud could be detected by a tip rather than through other sources like external audit, internal audit and internal controls.

I am of the opinion that IRS should be strengthened and should be toothed with more powers as it plays a key role in detecting the tax evasion and restitution of money to fraud victims.

List of References

A Flat Tax Will Spare Us the Costs of Paying More Lawyers and Accountants. (1996). The Washington Times, p. 2.

Alterman, E. (1996). Deflating the Flat Tax. The Nation, 262, 5+.

Badawi, Ibrahim M. 2005. Global Corporate Accounting Frauds and Action for Reforms. Review of Business 26, no. 2: 8+.

Boran, Christopher. “Money Laundering.” American Criminal Law Review 40.2 (2003): 847+.

Botkin , Daniel B. (2006). Energy Forever: A Solution to Our Energy Problem. Web.

Cochran, Amanda A. 2001. Evidence Handed to the IRS Criminal Division on a “Civil” Platter: Constitutional Infringements on Taxpayers. Journal of Criminal Law and Criminology 91, no. 3: 699+.

Du Pont, P. (1995). Flat Tax, Other Reforms Are Pro-Family, Pro-Middle Class. Insight on the News, 11, 36.

Gips, Michael A. “Tips for Tightening Fraud Controls: Leading-Edge Companies Are Expanding Their Codes of Conduct and Asking Audit Committees to Focus on Fraud.” Security Management, 2006, 18+.

Gray, Kenneth R., and George W. Clark Jr. 2004. Addressing Corporate Scandals through Business Education. World and I.

Grosse, Robert E. Drugs and Money: Laundering Latin America’s Cocaine Dollars. Westport, CT: Praeger, 2001.

Hall, R. E. (1996). Fairness and Efficiency in the Flat Tax. Washington, DC: American Enterprise Institute.

Internal Revenue Service. 2007. In The Columbia Encyclopedia 6th ed., edited by Lagasse, Paul. New York: Columbia University Press.

IRS Reform a Victory for Taxpayers. 1998. Journal of Accountancy 186, no. 4: 16+.

Jacinto, Jarret, and James Fitzmaurice. 2008. Tax Violations. American Criminal Law Review 45, no. 2: 995+.

Kohn, Stephen M. 2001. Concepts and Procedures in Whistleblower Law. Westport, CT: Quorum Books.

Kohn, Stephen M., Michael D. Kohn, and David K. Colapinto. 2004. Whistleblower Law: A Guide to Legal Protections for Corporate Employees. Westport, CT: Praeger.

Koniak, Susan P. 2003. Corporate Fraud: See, Lawyers. Harvard Journal of Law & Public Policy 26, no. 1: 195+.

Nicolaisen, Donald T. (2005). ‘A conversation with the chief accountant of the SEC: in Public interest.’ Leader’s Edge.

Paredes, Troy A. 2004. A Systems Approach to Corporate Governance Reform: Why Importing U.S. Corporate Law Isn’t the Answer. William and Mary Law Review 45, no. 3: 1055+.

Romano, Roberta. 2005. The Sarbanes-Oxley Act and the Making of Quack Corporate Governance. Yale Law Journal 114, no. 7: 1521+.

Schwenninger, S. R. (1996). How to Save the World: The Case for a Global Flat Tax. The Nation, 262, 16+.

Shield, Cosmo. 2005. Whistle-Blowing: The Price of Botheration. New Statesman, 22.

Stephen Moore, “Flat and Simple, stupid – Flat Tax – National Review –1996.

Telberg, Rick. (2004) ‘A Joint Effort to fight Corporate Fraud: CPA Stand as a Solid Line of Defense in Thwarting…’ Journal of Accountancy.

Vermeer, Thomas E., K. Raghunandan, and Dana A. Forgione. “The Composition of Nonprofit Audit Committees.” Accounting Horizons 20, no. 1 (2006): 75+.

Warren, A. C. (1997). Three Versions of Tax Reform. William and Mary Law Review, 39(1), 157-175.

Weisbach, D. A. (2000). Ironing out the Flat Tax. Stanford Law Review, 52(3), 599-664.

acfe. (2004). ‘Fraud Statistics reinforce need for SOX requirements ; preventive measures.’ Leader’s Edge.