Introduction

The dividend policy is an essential concern for today’s enterprises. Firms exercise dividends as a mechanism for pecuniary indications for the recluses concerning the strength and growth scenario of the organization. At the same time dividends engage in exercise with an imperative role on capital structure of a firm. As a result there is a profound relationship connecting the firm dividend and investment decisions. The theory of residual dividend illustrates that a firm will pay dividends only when the firm does not encompass any advantageous investment prospect in other words the firm don’t have a project with positive net present value, the firms emphasize on increased dividends. Dividend controversy comes into view when the question arises, do dividends boost up the value of a firm as a whole? The debate in relation to dividends starts from the technique the issue is outlined. For resolving the question do dividends append the value of a firm, it is required keep constant the inconsistent of the investment and debt policy. In this purpose dividend policy should be set aside from the capital borrow and budgeting assessments. It is argued that when the dividend policy deals with trade-off among retained earning reinvestment, financing the investments along with just now issued stocks and pay-out dividends, the Dividend Controversy would like to investigate its impact on the firm with a diverse vies of today’s corporate world. The game is thus a trade-off among retained earnings at the same time deal out cash or securities to the stakeholders. This term paper would draw attention the modern views of corporate dividend practice along with the strategy of dividend pay-out to verify the policies, imperial evidences as well as implication of the Dividend Controversy.

Theoretical Dilemma Dividend Controversy

Brealey A R. & Myers, S. (2004) and Block, B. S. & Hirt, G. A. (2005) mentioned that the theory of dividend controversy established with three views such as, rightists views leftists views and irrelevant views or middle of the Road views. The irrelevant views augmented by M-M explained that within the perfect markets reasoning the firms have nothing to duplicate the investors. Both the firm and investors can enjoy these opportunities.

Wood, F., Sangster, A. (1999) addressed that the Rightists views are also known as ‘Bird in the hand fallacy’ approach that argues that the pay out a quantity of cash today should reduce the risk of payoff ambiguity of the future. Thus the viewers emphasized on high dividend pay-out regularly to live on.

Walter, James E, (1963) argued that the Leftists views stands on tax squabbles. His views based on tax issues such as the tax on dividends which is the similar to the tax on profits and the tax on net capital gains. Holt, H. H., (2002) bring up that for companies with fluctuated earnings, the policy to pay a minimum dividend per share with a step up feature is desirable. Brealey, A R. & Myers, S. (2008) established that a constant dividend per share policy puts ordinary shareholders irrespective of the firm’s investment opportunities or the preference of shareholders This policy does not put any pressure on a company’s liquidity since dividends are distributed only when the company has profits. As the tax on dividends has to be paid right now, there is on chance to gaining capital for the future.

Miller and Modigliani (1961) augmented even the business goes through a stable market condition, the investment policy is not only the exclusive determinant of the value of a firm, meanwhile the pay-out policies are also relevant. M-M has raised the question as, are the companies with openhanded pay-out policies all the time sell at a higher premium above the firms which are miserable to payout constantly. The analysis of M-M has not resolved the question as the initial assumption of the theory has been formed on 100% free cash flow pay-out on regular basis. Thus rendering miserable pay-outs are infeasible and emphasize that giving out would be more comprehensive and optimal. It is known as the dividend irrelevance of his theory. The entrepreneur’s set of opportunity has synthetically inhibited to payout policies those entirely allocate the free cash flow in economically unintelligent sense. The payout policy precisely expresses the identical logic as investment policy does whilst the M-M’s supposition is agreed to allow retention.

In addition:

- The firms will construct huge pay-outs in present value provisos,

- The present value of allocations would be equal to the present value of the project cash streams only whilst pay-out policy has optimized

- The NPV regulation for investments is not enough to ensure value maximization; to a certain extent of corresponding rule for pay-out policy.

Dividend irrelevance: Miller-Modigliani (M-M) Theory

Besley, S. & Brigham, F. E.,(2007, p. 445) explained that according to the Miller-Modigliani (MM), under a perfect market situation, the dividend policy of a firm is irrelevant, as it does not affect the value of the firm. They are arguing that the value of the firm depends on the firm’s earnings that result from its investment policy. Thus, when investment decision of the firm is given, dividend decision- the split of earnings between dividends and retained earnings- is of no significance in determining the value of the firm.

Besley, S. & Brigham, F. E., (2007, p. 445) also addressed that a company operating in ideal capital market conditions may face one of the following three conditions regarding the aspect of payment of dividends:

- A company has adequate cash to give dividends,

- The organization does not have cash to provide dividends as a result it issue new shares to invest for dividends,

- A shareholder desires money but the company does not give dividends.

Bodie, Z. Kane, A. and Marcus A. J. (2005, p 447) confirmed that in the first situation, when the company pays dividends, the shareholders obtain cash in their own hands. However, in this context the company’s assets must be decreased (therefore, its cash balance also declines). Horne, C. V. James, and Wachowicz, M. John (2008) argued that the most significant issue is what shareholders acquire in the form of the cash dividends or what they lose after reducing the assets. In this way, one shareholder’s money is transferred from another shareholder. In this stage, the net loss and gain is equal which demonstrates that MM’s theory is true. The value of the company will remain unchanged while the transaction is fair under ideal capital market condition.

Bodie, Z. Kane, A. and Marcus A. J. (2005, p 447) mentioned that in the second situation, when the firm issues new shares to finance the payment of dividends, two transactions take place. First the existing shareholders get cash in the form of dividends, but they are suffering an equal amount of capital loss since the value of their claim on assets reduces. In consequence, the wealth of the shareholders of a company will remain unchanged. Second the new shareholders part with their cash to the company in exchange for new shares at a fair price per share. However, the fair price per share is equal to the share price before the payment of dividends minus dividend per share to the current shareholders.

The existing shareholders transfer a part of their claim (in the form of new shares) to the new shareholders in exchange for cash. Both transactions are fair, and thus, the value of the firm will remain unaltered after these transactions.

Brealey A R. and Myers, S. (2004 p. 435) clarified that in the third situation, the firm does not pay any dividend a shareholder can create a “home-made dividend” by selling a part of his/her shares at the market (fair) price in the capital market for obtaining cash. The shareholder will have less number of shares; he or she exchanged a part of his claim on the firm to a new shareholder for cash. In the case of the third scenario, the net outcome is the same as second scenario. If the transaction is a fair transaction in perfect market condition then no one can profit or loss. The net worth of the company will remain equal before or after these transactions.

Illustration of Dividend irrelevance: Miller-Modigliani (M-M) Theory

Rose, S.(1977, p 23) pointed out that the crux of the MM dividend hypothesis, as explained above, is that shareholders do not necessarily depend on dividends for obtaining cash. In the absence of taxes, flotation costs and difficulties in selling shares, they can get cash by devising “home-made dividend” without any dilution in their wealth. Therefore, firms paying high dividend (i.e. high pay-out firm) need not command higher prices for their shares. A formal explanation of the MM hypothesis is given step by step.

Brealey A. R. & Myers, S. (2007, p. 457) M-M’s hypothesis of irrelevance is based on the following assumptions:

- Perfect capital markets: The firm operates in perfect capital markets where investors behave rationally, information is freely available to all and transactions and flotation costs do not exist. Perfect capital markets imply that no investor is large enough to affect the market price of a share.

- No taxes: No tax has been existed in his theory and there exists no differences in the tax rates which appropriate to capital gains in addition to dividends. This means that investor’s value a rupee of dividend as much as a rupee of capital gains.

- Investment policy: According to his theory, the company has an inflexible investment policy.

- No risks: Risk of uncertainty does not exist, that is, investors are able to forecast future prices and dividends with certainty, and one discount rate is appropriate for all securities and all time periods. Thus, r = k = k

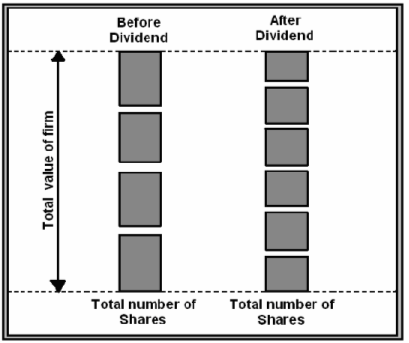

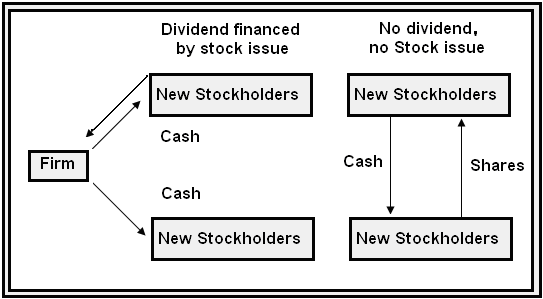

Here in Figure-1, the firm pay-out one third of its worth for dividend & raises fund by issuing new shares. The new stockholders worth is the same as to the dividend payout. Value of the company has remained unchanged.

In Figure-2, it has demonstrated two ways of lift up fund for the original shareholders. For both the cases the fund received would decline the old shareholders’ value. In stipulation of the firm’s pay-out of dividend, both the old and new share’s worth be less for the reason that more shares have to be issued aligned with the firms same assets. Proviso the old stockholders put up for sale a number of their share would be worth similar but the older stockholders posses smaller number of shares.

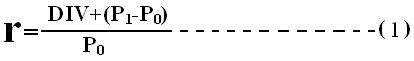

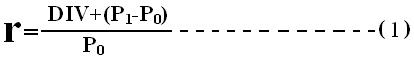

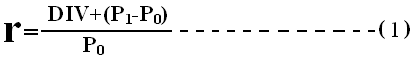

Ross A, Wererfield R, and Jaffe J. (2006, p.856) stated that under the MM assumption, r will be equal to the discount rate, k and identical for all share. As a result, the price of each share must adjust so that the rate of return, which is composed of the rate of dividends and capital gains, on every share will be equal to the discount rate and be identical for all shares. Thus the rate of return for a share hold for one year may be calculated as follows:

r= [Dividends + Capital gains or (loss)]/ share price

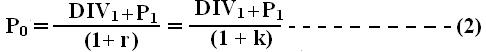

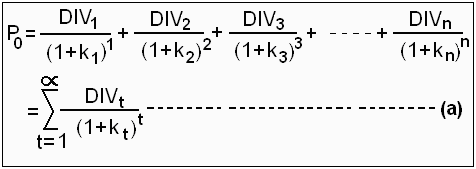

Brealey A. R. & Myers, S. (2008) added that where P0 is the market or purchase price per share at time 0, P1 is the market price per share at the time 1 and DIV1, is dividend per share at time 1. As hypothesis by MM, r should be equal for all shares. If it is not so, the low return yielding shares will be sold by investors will purchase the high return yielding shares. This process will tend to reduce the price of the low return shares and increase the prices of the high-return shares. This switching or arbitrage will continue until the differentials in rates of return are eliminated. The discount rate will also be equal for all firms under the MM assumptions since there are no risk differences.

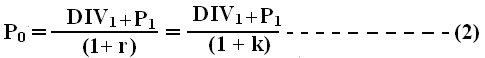

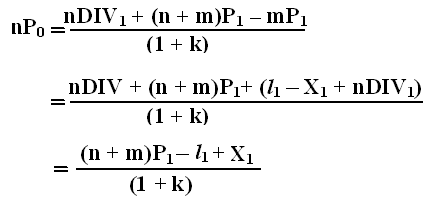

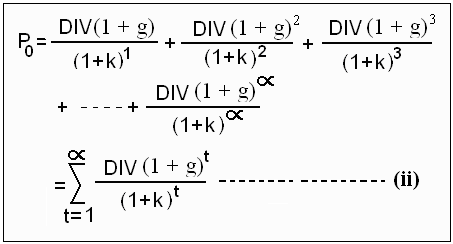

Jensen, M. C and Meckling, W. H. (1976, p. 43-49) given explanation that M-M’s fundamental principle of valuation described by equation (1), we can derive their valuation model as follows:

Since r=k in the assumed world of certainty and perfect markets. Multiples both sides of equation (2) by the number of shares outstanding n, it can be obtained the total value of the firm if no new financing exists.

![]()

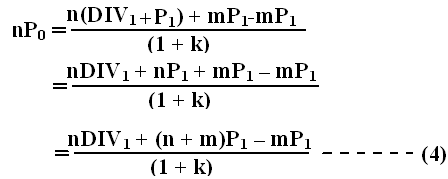

If the firm sells m number of new shares at time 1 at a price of P1, the value of the firm at time 0 will be:

Mao, James C. T. (1969, p. 482) added that M-M’s valuation equation (4) allows for the issue of new shares, unlike Walter’s and Gordon’s models. Consequently, a firm can pay dividends and raise funds to undertake the optimum investment policy. Thus, dividend and investment policies are not confounded in the MM model, like Walter’s and Gordon’s models. As such, MM’s model yields more general conclusions.

Brigham, E. F., and Houseton, J. F. (2004, p 355) exposed that the investment programs of a firm, in a given period of time, can be financed either by retained earnings or the issues of new shares or both. Thus, the amount of new shares issued will be:

![]()

Where l1 represents the total amount of investment during first period and X1 is the total net profit of the firm during the first period. By substituting equation (5) in to equation (4), MM showed that the value is unaffected by its dividend policy.

Kamlet, A. & Carreiro, R., Stocks (1997, p-112) addressed that a firm which pays dividends will have to raise funds externally to finance its investment plans. MM’s argument, that dividend policy does not affect the wealth of the shareholders, implies that when the firm pays dividends, its advantage is offset by external financing. This means that the terminal value of the share (say, price of the share at first period if the holding period is one year) declines when dividends are paid. Thus, the wealth of the shareholders dividends plus terminal price – remains uncharged, as a consequent of the present charge per share after the dividends. In this way, the shareholders are unresponsive among payment of dividends and the retention of income.

Relevance of Dividend Policy on Market imperfections

Chetty, Raj; & Saez, Emmanuel (2008) augmented that the MM hypothesis of dividend irrelevance is based on simplifying assumptions. After analyzing this hypothesis, it can be found rationally consistent and instinctively appealing conclusion. But the assumptions underlying MM’s hypothesis may not always be found in practice. For example, we may not find capital markets to be perfect in reality; there are issue costs; dividends may be taxed differently than capital gains; investors may encounter difficulties in selling their shares. Because of the unrealistic nature of the assumptions, MM’s hypothesis is alleged to lack of practical relevance.

This suggests that internal financing and external financing are not equivalent. Dividend policy of the firm may affect the perception of shareholders and, therefore, they may not remain in different between dividends and capital gains. The following are the circumstances where the MM assumption may go wrong track.

Uncertainty and Shareholders’ Preference for Dividends

Frankfurter M. George and Wood, G. Bob (2008) confirmed that many believe that dividends are relevant under conditions of uncertainty. It is suggested that dividends resolve uncertainty in the minds of investors and, therefore, they prefer dividends than capital gains. Gordon and his contemporary researchers have supported to the logic that dividends are appropriate under volatility within the bird-in-the-hand model. Gordon asserts that uncertainty increases with the length of time period. Investors are risk-averters and, therefore, prefer near dividends to future dividends. In consequence, future dividends are low-priced at a higher rate than current dividends. This means that the low-priced rate with insecurity. As a result, a firm paying dividends earlier will command a higher value than a firm which follows policy retention. This view implies that there exists a high payout clientele who value shares of dividend paying more than those which do not pay dividends. A growth firm lacking liquidity may borrow to pay dividend. This will adversely affect the firm’s financial flexibility. Financial flexibility includes the firm’s ability to access external funds at a later date. The firm may lose the flexibility and capacity of rising external funds to finance growth opportunities in the future.

Gordon, Myron. J., (1962, p. 19) mentioned that the uncertainty argument is not very convincing. MM argued that, even if the assumption of the perfect certainty is dropped from their hypothesis, dividend policy continues to be irrelevant. They contend that the market prices of two firms with identical investment and capital structure policies and risk, cannot be different because they follow different dividend policies. These firm’s will have the same cash follows from their investment despite the differences in dividend policies. The risk (uncertainty) of the firms’ shareholders is alike, given the similarities of their risk and investment and capital structure policies. The dividend policy possibly will not shift the amount of risk on the cash flows within the investments. It just come apart these cash flows in to dividend pay-out as well as retained earnings.

Holt, H. H., (2002) stated that the current receipt of money in the form of dividends is considered safer than the uncertain potential gain in the future. The reason for this safety is that it is cash in hand rather than that it is dividend income and not a capital gain. If the company does not distribute the dividends then the shareholders can transact some shares from their portion to acquire current money. The risk returns trade-off will make shareholders except lower returns from those firm’s that have payout ratios. A firm’s investment and capital structure policies, paying dividends and the future capital structure policies, paying dividends does not alter the firm’s value under the efficient market conditions. However, there many still exist a high-payout clientele, not because current dividends safer, but because some shareholders need a steady source of income, or because some will prefer to receive dividends as early as possible since some firms do not provide reliable information about their investments and earnings.

Jensen, M. C and Meckling, W. H. (1976, p. 47) added that yet another reason for shareholders preferring current dividends may be their desire to diversify their portfolios according to their risk preferences. Hence, they would similar to the organizations to distribute profits. They will be able to invest dividends received in other assets keeping in mind their need for diversification.

Under these circumstances, investors may discount the value of the firms that use internal financing.

Transaction Cost and the case against Dividend payments

According to Block, B. S. & Hirt, G. A. (2006, p-221), M-M argued that internal financing (retained earnings) and external financing (issues of shares) are equivalent. This implies that when firms pay dividends, they can finance their investment plans by issuing shares. Whether the firm retains earning or issues new shares, the wealth of shareholders would remain unaffected. This cannot be true since the issue of shares involves flotation or issue costs, including costs of preferring and issuing prospectus, underwriting fee, brokers’ commission etc. No flotation costs are involved if the earnings are retained. The presence of flotation or transaction cost makes the external financing costlier than the internal financing via retained earnings. Thus, if flotation costs are considered, the equivalence between retained of earnings would be favored over the payment of dividends, rather increasing it, unless earning declined, in spite of need for funds.

Wood, F., Sangster, A. (1999) explained that under the MM hypothesis, the wealth of the shareholder will be same whether the firm pays dividends or not. If a shareholder is not paid dividends and she desires to have current income, she can sell the shares held by her. When the shareholder sells her shares to satisfy her desire for current income, she will have to pay brokerage fee. This fee is more for small sales. Further, it is inconvenient to sell the shares, particularly for investors with small share holdings. Some emerging markets are not very liquid, and many shares are not frequently traded. Because of the transactions costs and inconvenience associated with sale of shares to realize capital gains, shareholders may prefer dividends to capital gains.

Information Asymmetry and Agency Costs: Case for Dividend Payments

Besley, S. & Brigham, F. E., (2007, p. 445) deal with that the managers in practice may not share complete information with shareholders. This gap between information available with managers and what is actually shared with shareholders is called information asymmetry. This is the cause of numerous agency problems, for instance the conflict between the managers and other shareholders. Sometimes managers of the company do not provide adequate information to the shareholders. They may act in their own self interest and take away the firm’s wealth in form of non pecuniary benefits. Shareholders incur agency costs to obtain full information about a company’s investment plan, future earnings, expected dividend payments etc. The shareholders and managers conflict can be reduced through monitoring which includes bonding contracts and limiting the power of managers vis-à-vis allocation of wealth and managerial compensation. However, monitoring involves costs that are referred to as agency costs. Payment of dividend allocates resources to shareholders, and thus, alleviates the need for monitoring and incurring agency costs.

Kamlet, A. & Carreiro, R., Stocks (1997, p-114) addressed that the high payout policy helps of the company helps to reduce the conflict arising out of information asymmetry. It is argued that companies which pay high dividends regularly may be raising capital more frequently from the primary markets. Therefore, the actors in the primary markets like the financial institutions and banks would be monitoring the performance of these companies. If the professionals in the banks and financial institutions continuously do such monitoring, shareholders need not incur monitoring (agency) costs.

Brigham, E. F., and Houseton, J. F. (2004, p 357) supported that dividend payout also allocates financial resources in favor of shareholders as against lenders. Lenders have prior claims over a company’s cash flows generated internally. The payment of dividend changes this priority in favor of shareholders as they receive cash flows before the loan principals of lenders are redeemed. Thus, we observe that from the point of view of the agency costs, the shareholders would generally prefer payments of dividend.

Tax Differential: Low-Payout and High -Payout Clientele

Ross A, Wererfield R, Jaffe J., (2006, p 850) argued that MM’s assumption on taxes does not stay alive as it’s too far from reality. Taxes should be imposed on investors both for their dividends and capital gain. But the applicable tax rates would be different on capital gains and dividends. The dividend proceeds are usually counted as the commonplace income, at the same time as capital gains are particularly taken into accounts for tax purposes. The capital gains tax rates are much lesser than the additional tax rate for ordinary income in the practices of most the countries. From the point of view taxpayer, a shareholder in elevated tax group should have a preference of capital gains more than present dividends for two motivations:

- The capital gains tax is a reduced amount than the tax imposed on dividends.

- The capital gains tax is billed only on the occasion of essentially sold.

Mao, James C. T. (1969, p. 486) supported that the effect of the favorable tax differential in case of capital gains will result in tax savings. As a consequence, the value of the share should be higher in the internal financing case than in the external financing one. Thus, the tax advantage of capital gains over dividends strongly favors a low-dividend payout policy. This implies that investors will pay more for low-dividend yield shares. Tax differential should attract tax clienteles. Investors in high-tax brackets should own high-payout shares, and low- tax brackets should own high payout shares. In realism, most of the investors possibly will have marginal income tax rate which is higher than the capital gains tax rate. Thus, dividends, on an average, are considered bad since they will result in higher taxes and reduction in the wealth of shareholders. Tax differential generally favor low -payout clientele.

Let reflect on an illustration. Two identical firms X and Y, have different dividend policy. Both of them encompassed an after tax profit, P of US$ 100 percent dividend. Y does not pay any dividends and shareholders gain capital gains from shares held at least for one year taxed at 20 per cent and marginal income tax rate is 40 per cent. Suppose X’s shareholders’ will receive dividends of US$ 100 and their after tax dividend income will be: 100 x (1- 0200 + US$ 80) Y’s shareholders are better off as they have tax advantage. Since the after tax equity income of Y’s shareholders is higher than X’s shareholders since both firms are identical in all other respects, Y’s equity price will be higher. To match capital gains of Re 1 of Y’s shareholders should receive dividend of US$ 1.33.

After dividend = after tax capital gain

(1-0.40) DIV = (1 – 0.20)

DIV = 0.80/0.60 = 1.33

If X’s shareholders get dividend of US$ 1.33 and Y’s shareholders get capital gains of US$ 1, both will have after tax income of US$ 0.80.

Brealey A. R. & Myers, S. (2008) stated that if a tax system favor capital gains to dividend income, there may still be several investors who are in lower tax brackets. These investors are willing to investing in shares which will have a preference dividend income quite than capital gains. Thus, there may exit high-payout clientele. Within the tax system those treats of dividends are more auspiciously than capital gains; shareholders in far above the ground tax brackets will also have a preference getting dividends quite than capital gains. Under this tax system, dividends will be considered good and it will generally attract high-payout clientele.

Neutrality of Dividend Policy: The Black-Scholes Hypothesis

Pandey, I. M. (2007) explained that shareholders always desire for regular dividend to satisfy their desire for current income. Dividend can facilitate this benefit including transaction cost. Consequently shareholders avoid to selling out shares and achieve the capability of signaling a firm’s prospects and risk tolerance with regard to their investment portfolios. The costs of dividends are much higher than tax on dividend. Black and Scholes argue that shareholders trade off the benefits of dividends against the tax loss. Based on the trade offs that shareholders make, they could be classified into three clienteles: i) a clientele that considers dividends are always good; ii) a clientele that considers dividends are always bad; iii) a clientele that is indifferent to dividends. Shareholders in high tax brackets may belong to high-payout clientele since in their case the tax disadvantage may outweigh the benefits of dividends. On the other hand, shareholders in low tax brackets may fit in to low payout clientele as they may suffer marginal tax disadvantage of dividends. Tax- exempt investors are indifferent between dividends and capital gains, as they pay no taxes on their income.

Pandey, I. M. (2007) also added that in a real world situation, all three clienteles exist as tax status and need for current incomes of investors differ. There are insists of the three varieties of clienteles. Black-Scholes argue that since the supply of dividends and demand for dividends match, there will be no gains if a firm changes its dividend policy; the investors have already made their choices or there already exist to another.

How the companies will find out whether change in dividend policy will have an effect on their share prices? This is an empirical question and a difficult question to answer, given the problems with statistical techniques. However, the Black-Scholes hypothesis shows that the tax disadvantage of dividends is not as great as made out by some academicians.

The Informational content of dividends

Solomon, E. (1963, p 142) acknowledged that for informational significances dividends are most relevant. A company can make statements about its expected earnings growth to inform shareholders in order to create a favorable impression on them. However, these statements would be paid better attention if they follow with a dividend action – a disbursement of cash. The cash payment for dividends conveys to shareholders that the company is profitable and financially strong. When a firm changes its dividend policy in a significant manner, investors assume that it is in response to an expected change in the firm’s profitability which will last long. An increase in payout ratios signals to shareholders a permanent or long term increases share prices and that managers use the dividend changes to convey information about the future earnings of their companies. They will also influence the performance of the investors about the risk of the company which follows a stable dividend policy. This sort of argument is also known as the dividend – signaling hypothesis. Solomon contends that dividends may offer tangible evidence of the firm’s ability to generate cash and as a result. The dividend policy of the enterprise possibly will have an effect on the share price.

Rose, S., (1977, pp 34) make it clear that the dividend signaling hypothesis implies that the most valuable dividend policy is the one that provides information that cannot be effectively communicated through any other means. The most dividend polices are very likely to be those that very closely reflect the firm’s long term performance. Let us reflect on a few examples. Pandey, I. M. (2007) supported that a company has been following a dividend policy of paying US$ 2 per share for quite sometime. Also assume that the company’s current earnings of, say, US$ 4 per share increases to, say, US$ 7 per share. If the company does not increase its dividend from US$ 2 per share, the message conveyed to the shareholders will be that the increase in earnings is only a temporary cyclical occurrence. As a result, the market price of the share possibly will not be exaggerated very extensively. On the other hand, if the dividends were raised from, say, US$ 2 per share to US$ 3 per share, the shareholder would imply that the management is expecting a long term increase in the earning levels. This thinking of the shareholders might have an impact on the market value of the share. The market value of the share is affected not because of the change in the dividends, but because of the information about change in the future expected earnings conveyed through the payment of the higher dividends. The dividends per share do not affect the share vale.

The reaction of market to the information conveyed by the dividend action depends upon the established policy of the company. If the long-established policy of the firm is to pay, for example 50% of earnings to shareholders and has increased dividends in the past only when earning increased to new levels on a permanent basis, an increase in dividends will communicate convincing information that the earning of the company have grown. As a consequence, the share’s the market price would be extensively influenced. On the further views if a company goes behind a dividend policy of shifting dividends with all recurring shifting in the earnings, the market price possibly will not be exaggerated or may perhaps be affected little because shareholders had the information.

Wood, F., Sangster, A. (1999) suggested that the payout ratios of the companies may depend on the fact whether they are mature or growth companies. Mature companies may characterize high payout ratios as they may have few profitable investment opportunities. Shareholders of such companies are more concerned with dividend income. Therefore, any change in the amount of dividend’s immediately reflected in the market price of the share. Growth companies, on the other hand, have a low payment ratio as they have enough internal investment opportunities to employ retained earnings. The shareholders of the companies with much growth are paying attention in capital gains than dividends. A steady increase in both earnings and dividends coupled with a continuing low payout ratio gives the message that the firm expects to keep growing. A greater increase in the dividends than the earnings may convey to the shareholders that profitable investment opportunities of the firm are diminishing. This understanding of shareholders may depress the market price of the share in spite of an increase in the dividends.

MM has been admitted the dividends informational content. They contented that the price of the share determined by the expected future earnings and the firm’s investment policy and not by the dividends. They argue that informational content of dividends indicates that they are merely a reflection of the firm’s investment policy and expected earnings and do not have any impact on the value in their own accord.

Dividend relevance: Walter model

Professor James E. Walter argues that the choice of dividend policies almost always affect the value of the firm. His model is one of the earlier theoretical works, shows the importance of the relationship between the firm’s rate of return, r, and its cost of capital, k, in determining the dividend policy that will maximize the wealth of the shareholders. Walter’s model is based on the following assumptions:

- Internal financing: The firm finances all investment through retained earnings; that is, debt or new equity is not issued.

- Constant return and cost of capital: The firm’s rate of return, r, and its cost of capital, k, are constant.

- 1000% payout or retention: All earnings are either distributed as dividends or reinvested internally immediately.

- Constant EPS and DIV: The commencement earnings and dividends not at all change. The values of the earnings per share, EPS, and the dividend per share, DIV, may be changed in the model to determine results, but any given values of EPS or DIV are assumed to remain constant forever in determining a given value.

- Infinite time: the enterprise has a exceptionally elongated or infinite life.

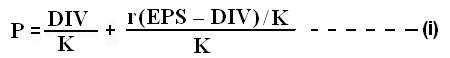

Walter’s formula to determine the market price per share is as follows:

Where,

- P = market price per share

- DIV = Dividend per share

- EPS = earnings per share

- R = Firm’s rate of return (average)

- K = Firm’s cost of capital or capitalization rate.

Walter, J. E. (1963, Vol. 18, Issue 2, pp. 280-91) also addressed that the equation (i) reveals that the market price per share is the sum of the present value of two sources of income: 1) the present value of the infinite stream of constant dividends, DIV/K and 2) the present value of the infinite stream of capital gains, [r (EPS – DIV)/ k]/k. When the firm retains a perpetual sum of (EPS – DIV) at r rate of return, its present value will be: r (EPS – DIV)/k. This quantity can be known as a capital gain which occurs when earnings are retained within the firm. If this retained earnings occur every year, the present value of an infinite number of the capital gains, r (EPS – DIV]/k, will be equal to: [r (EPS – DIV)/ k]/k. Thus, the value of a share is the present value of all dividends plus the present value of all capital gains as shown in equation (i) which can be rewritten as follows:

P = [DIV + (r/k) (EPS – DIV)]/ K

In Walter’s model, the dividend policy of the firm depends on the availability of investment opportunities and the relationship between the firm’s internal rate of return, r and its cost of capital, k. Thus:

- Retain all earning when r > k

- Distribute all earnings when r < k

- Dividend (or retention) policy has no effect when r = k

Thus, dividend policy in Walter’s model is a financing decision. When the dividend policy has been treated as a tool of financing decision, the pay-out of cash dividends are considered as passive residual.

Criticism of Walter’s Model

Pandey, I. M. (2007) criticized that Walter’s model is quite useful to show the effects of dividend policy on all equity firms under different assumptions about the rate of return. However, the simplified nature of the model can lead to conclusions that are not true in general, though true for the model. The following is a critical evaluation of some of the assumptions underlying the model.

No external financing

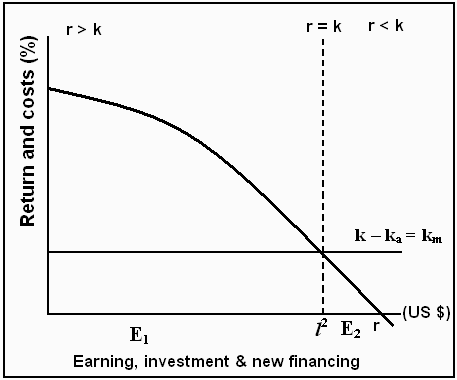

Walter, J. E. (1963, Vol. 18, Issue 2, pp. 280-91) argued that the model of share valuation mixes dividend policy with investment policy of the firm. The model assumes that retained earnings finance the investment opportunities of the firm and no external financing- debt or equity – is used for the purpose. When such a situation exists, either the firm’s investment or its dividend policy or both will be sub-optimum. In the following figure it has demonstrated graphically figure. The horizontal axis represents the amount of earnings, investment and new financing in US $. The vertical axis shows the rates of return and the cost of capital. It is assumed that the cost of capital, k1 remains constant regardless of the amount of new capital raised.

Wood, F. & Sangster, A. (1999) take in hand that the average cost of capital ka is equal to the marginal cost of the capital km. The rates of return on investment opportunities available to the firm are assumed to be decreasing. This implies that the most profitable investments will be made first and the poorer investments will be made at last. In figure 17.2 l* rupees of investment occurs where r = k. l* is the optimum investment regardless of whether the capital to finance this investment is raised by selling shares, debentures, retaining earnings or obtaining a loan. If the entrepreneur’s earning is E1, afterward (l* – E1) sum must be lift up to finance that investment. However, external financing is not included in Walter’s simplified model. Thus, for the Walter’s model would show that the owner’s wealth is maximized by retaining and investing firm’s total earnings of E1 and paying dividends. In a more comprehensive model allowing for outside financing, the firm should raise new funds to finance l* investments. The wealth of the owners will be maximized only when this optimum investment is made.

Constant return, r

Walter’s model is based on the assumption that r is constant. In reality r diminish with investment as more and more investment is made. This reflects the assumption that the most profitable investments are made first and then the poorer investments are made. The firm should stop at a point of investment occurs at l* where r = k, if the firm’s earnings are E2 it should pay dividends equal to (E2 – l*); on the other hand, Walter’s model indicates that, if the firms earnings are E2, they should be disturbed because r < k at E2. This is clearly a enormous policy and will fail to optimize the wealth if the owners.

Constant opportunity cost of capital, k

A firm’s cost of capital or discount rate, K does not remain constant, it changes directly with the firm’s risks. Thus, the present value of the firm’s income is moves inversely with the cost of capital. By presumptuous that the price cut rate k is a constant. Walter’s model abstracts from the effect of risk on the value of the firm.

Gordon’s Model

Gordon, M. J. (1962, p. 17-24) suggested that the above discussion of market imperfections indicates that the shareholders may not be indifferent as to how the earnings of the firms are divided between dividends and retained earnings. The tax differential effect and the presence of flotation costs favor the capital gains resulting from the retention of earnings, while the existence of the transaction costs, agency costs, information asymmetry and desire for the current income and diversification favor the payment of the dividends. The dividend policy would also be relevant for the reason that the informational contented of dividend.

According to attachments the chosen company’s current dividend policy follows Gordon’s Model developed by Myron Gordon. Gordon’s model is one of the very popular models explicitly relating the market value of the firm to dividend policy. To be successful the current dividend policy is based on the following assumptions:

- All-equity firm: The firm is an all-equity firm, and it has no debt.

- No external financing: There is no external financing is to be had. Consequently retained earnings would be used to finance any expansion. Thus, Gordon’s model confounds dividend and investment policies.

- Constant return: The entrepreneur’s interior rate of return, r is a constant. This ignores the diminishing marginal efficiency of investment as represented.

- Constant cost of capital: The appropriate discount rate, k, for the firm remains constant. Thus, Gordon’s model also ignores the effect of a change in the firm’s risk-class and its effect on, k.

- Perpetual earnings: The firm and its stream of earnings are perpetual.

- No taxes: the corporate taxes do not exist,

- Constant retention: The retention ratio, b, once decided upon, is constant. Consequently the growth rate, g = br, is a constant perpetually.

- Cost of capital greater than growth rate: The price cut rate is larger than the growth rate, k> br = g. in this stipulation it would be not satisfied and cannot acquire a having an important effect value for the share.

According to this model, share price, P0= D/ (k-G)

Where,

- P0 = Price of the share

- D = Dividend per share

- K = Company’s cost of debt

- G = Growth rate = (br)

Gordon. Myron. J., (1962, p. 69) addressed that the model, dividend policy is irrelevant where r=K, when all other assumptions are held valid. But when the simplifying assumptions are modified to confirm more closely to reality, Gordon concludes that dividend policy does affects the value of share when r = K. this view is based on the assumption that under conditions of uncertainty, investors tend to discount distant dividends (capital gains) at a higher rate than they discount near dividends. Investors, behaving rationally, are risk-averse and, therefore, have a preference for near dividends to future dividends.

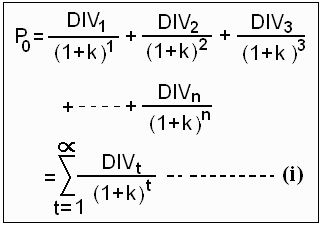

Value of share in future

When the discount rate is assumed to be increasing, the equation would be as follows:

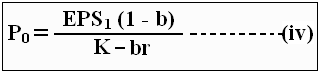

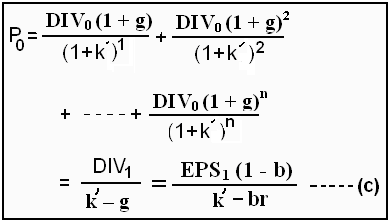

Block, B. S. & Hirt, G. A. (2006, p-221) added that the dividend per share is expected to grow when earnings are retained. The dividend per share is equal to the payment ratio, (1 – b) times earnings per share, EPS; that is, DIV = (1-b) EPS1 where b is the fraction of retained earnings. It has implicit that the retained earnings should be refinanced contained by the all equity This permits earnings to grow at g = br per period entrepreneurs at the entrepreneur’s internal rate of return, r. When we incorporate growth of earnings, in the dividend-capitalization model, the present value of a share is determined by the following formula:

When this equation is solved it becomes:

Substituting EPS1 (1 – b) for DIV1 and br for g, in former equation can be written as:

The last equation explicitly shows the relationship of expected earnings per share, EPS1, dividend policy as reflected by retention ratio, b, internal profitability, r, and the all-equity firms cost of capital, k, in the determination of the value of the share. This equation is particularly useful for studying the effects of dividend policy on the value of the share.

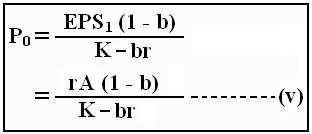

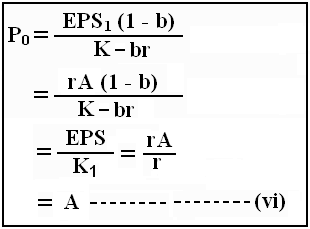

Now it needs to consider the case of a normal firm where the internal rate of return of the firm equals its cost of capital, i.e., r = k. under this situation, equation (iv) may be expressed as follows:

Since EPS = rA = assets per share

If r = k, then:

Equation (VI) shows that regardless of the firm’s earnings per share, EPS1 or risk (which determines K), the firm’s value is not affected by dividend policy and is equal to the book value of assets per share. That is, when r = k, dividend policy is irrelevant since b, completely cancels out of equation (vi). Interpreted in economic sense, this finding implies that, under the competitive conditions, the opportunity costs of the capital K, must be equal to the rate of return generally available to t he investors in comparable shares. This means that any funds distributed as dividends may be invested in the market at the rate equal to the firm’s internal rate of return. Consequently, shareholder can either lose or gain by any change in the company’s dividend policy, and the market value of the shares must remain unchanged.

Considering the case of the declining firm where r < k, equation (vi) indicates that, if the retention ratio, b, is zero or payout ratio, (1 – b), is 100 per cent the value of the share is equal to:

P0 = rA/ k (b = 0) – – – – – – (7)

If r < k then r/k < 1 and from equation (7) it follows that P0 is smaller than the firm’s investment per share continuously fall. These results may be interpreted as follows:

Jensen, M. C and Meckling, W. H. (1976, p. 45) argued that if the internal rate of return is smaller than k, which is equal to the rate available in the market, profit retention clearly becomes undesirable from the shareholders standpoint. Each additional rupee retained reduces the amount of funds that shareholders can invest at higher rate else where and thus further depresses the value of the company’s share. Under such conditions, the company should adopt a policy of contraction and disinvestment, which would allow the owner to transfer not only the net profit but also paid in capital (or a part of it) to some other, more remunerative enterprise.

Finally Wood, F. & Sangster, A. (1999) stated that it should discuss that the case of a growth firm where r > k, the value of the share will increase as the retention ratio, b, increases under the condition of r > k. however, it is not clear as to what the value of b should be to maximize the value of the share, P0. For example, if b = k/r, equation (iv) reveals that denominator, k – br = 0, thus making P0 indefinitely large, and if b =1, k – br becomes negative, thus making P0 negative. These absurd results are obtained because of the assumption that r and k are constant, which underlie the model. Thus, to get the meaningful value of the share, according to equation (iv) the value of b should be less than k/r.

Illustration and application of Gordon’s model

The implications of dividend policy, according to Gordon’s model, are shown respectively for the growth, the normal and declining firms. It is reveled that under Gordon’s model:

- That market value of the share, P0, increase with the retention ratio, for firms with growth opportunities, i.e., when r > k.

- That market value of the share, P0, increases with the payout ratio, (1 – b), for declining firms with growth with r < k.

- That market value of the share is not affected by dividend policy when r = k.

- Gordon’s model’s conclusions about dividend policy are similar to that of Walter’s model. This correspondence is due to the resemblances of assumptions that motivate each of the models. As a consequence Gordon’s model experiences from the like boundaries as the Walter model.

Dividends and uncertainty: The Bird-in-the hand Argument

Mao, James C. T. (1969, p. 487) mentioned that according to the Gordon’s model, dividend is irrelevant where r = k, when all other assumptions are held valid. But when the simplifying assumption are modified to conform more closely to reality, Gordon’s concludes that dividend policy does affect the value of the share even when r = k. This view is based on the assumption that under conditions of uncertainty, investors tend to discount distant dividends (capital gains). Then at an elevated rate they discount next to the dividends. Investors, behaving rationally, are risk average and therefore, have a preference for near dividends. The logic underlying the dividend effect on the share value can be described as the bird-in-the hand argument.

Myron Gordon has expressed the bird-in-the hand argument more convincingly and in formal terms. As per him explanation uncertainty enlarges with futuristic where future one look at the future with trend of the further uncertain dividends arises. Accordingly when dividend policy is considered in the context of uncertainty, the appreciate discount rate, k, cannot be assumed to be constant. In fact, it increases with uncertainty; investors prefer to avoid uncertainty and would be will to pay higher price for the share that pays the greater current dividend, all other things held constant. In other words, the appropriate discount rate would increase with the retention which is shown in figure-3. Thus, distant dividend would be discounted at a higher rate than near dividends. Symbolically, k1 > k t – 1 for t = 1, 2, 3… because of increasing uncertainty in the future. As the distant rate increase with the length of time, a low dividend payment in the beginning will tend to lower the value of share in future.

When the discount rate is assumed to be increasing equation (i) can be rewritten as follows:

Where P0 is the price of the share when the relation rate, b, is zero and kt > kt-1. If the firm assumed to retain fraction of earnings, dividend share will be equal to (1-b) EPS1 in the first year. Thus, the dividend per share is expected to grow at rate g = br, when retained earning are reinvested at r rate of return. The dividend in the second year will be DIV0 (1 + g) 2 = (1 – b) EPS1 (1 + br) 2, in the third year DIV0 (1 + g) 3 = (1 + b) EPS2 (1 + br) 3, and so on. Discounting this stream of dividends at corresponding discount rates of k1, K2…. We obtain the following equation:

Where, Pb is the share when the retention rate b is positive, i.e., b > 0. The value of Pb calculated in this way can be determined by discounting this dividend stream at the uniform rate, k’, which is the average of k r.

Pandey, I. M. (2007) explained that assuming that the firm’s rate of return equals the discount rate will Pb be higher or lower than P0? Gordon’s view is that the increase in earnings retention will result in a lower value of share. To emphasize, he reached this conclusion through assumptions regarding investors’ behavior: i) investors are risk averters and ii) they consider distant dividends as less certain than near dividends. On the basis of this assumption, Gordon’s concludes that the rate at which an investor discounts dividend stream increases with the futurity of this dividend stream. If investors discount distant dividend at a higher rate than dividends, increasing the retention ratio has the effect of raising the average discount rate, ![]() or equivalently lowering share prices.

or equivalently lowering share prices.

Thus, incorporating uncertainty into his model, Gordon concludes that dividend policy affects the value of share. His reformulation of the model justifies the behavior of investors who values a cash of dividend income more than a capital gain income. These investors prefer dividend above capital gains because dividends are easier to predict, are less uncertain and less risky, and are therefore, discounted with a lower discount arte. However, all do not agree with this view.

Target payout and dividend Smoothing

Lintner’s Model of corporate dividend behavior

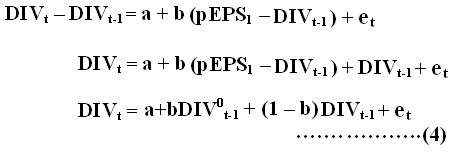

Pandey, I. M. (2007) explained that it has already been discussed the stability of dividends in terms of dividends per share (or dividend rate) and stable payout ratio. A stable payout ratio results in to fluctuating dividend per share pattern, which could be a cause of uncertainty for investors. In practice, firms express their dividend policy either in terms of dividend per shares or dividend rate. It raise the question whether this mean payout ration is not considered important by firms while determining their dividend policies. John Lintner in his study of the USA companies found that firms generally think in terms of proportion of earnings to be paid out. Investment requirements are not considered for modifying the pattern of dividends behavior. Thus, firms generally have target payout ratios in view while determining change in dividend per share or dividend rate.

A study shows that managers are strongly in favor of companies regularly paying policy should be changed only when it can be maintained in the future. Managers feel that a current dividend depends on current earnings, the future earnings potential as well as on dividends paid in the previous year. Dividends must be paid even when a company needs funds for undertaking profitable investment projects.

Pandey, I. M. (2007) also confirmed that in order to discuss Lintner’s model, it should assume that a firm has EPS1, as the expected earnings per share in year l, and p as the target payout ratio. If the firm strictly follows stable payout policy, the expected dividend per share, DIV1 will be:

![]()

And dividend change (as compared to the dividend per share for the previous year, DIV0) will be:

![]()

But in practice, firms do not change the dividend per share (or dividend rate) immediately with change in the earnings per share. Shareholders like a steady growing dividend per share. Thus, firms change their dividends slowly and gradually even when there are large increases in earnings. This implies that firms have standards regarding the speed with which they attempt to move towards the full adjustment of payout to earnings. Linter has, therefore, suggested the following formula to explain the change in dividends of firms in practice:

![]()

Where, b is the speed of adjustment. A conservative company will move slowly towards its target payout.

Pandey, I. M. (2007) also explained that the implications of equation (3) are (i) that firms establish their dividends in accordance with the level of current earnings, and (ii) that the changes in dividends over time do not correspond exactly with changes in earnings in the immediate time period. In another expression, the predictable dividend per share (DIV1) is dependable on the entrepreneur’s present earnings (EPS1) at the same time the dividend per share in the preceding year (DIV0); entrepreneur’s present earnings (EPS0) in the foregoing year’s and the dividend per share at the year before preceding (DIV1).

Linter’s model can be expressed in the form of the following regression equation:

Where, DIVt is the dividend per share in year t, b is the adjustment factor, DIVt = pEPSt is desired dividend per share, p is the target payout ratio; DIVt -1 is dividend per share in year t – 1 and e is the error term. It can be interpret the term (1 – b) as safety factor that the management observes by not increasing the dividend payment to the levels where it cannot be maintained. Together coefficients a and b can be used to test the hypothesis that management is more likely to increase dividend over time rather than cut them.

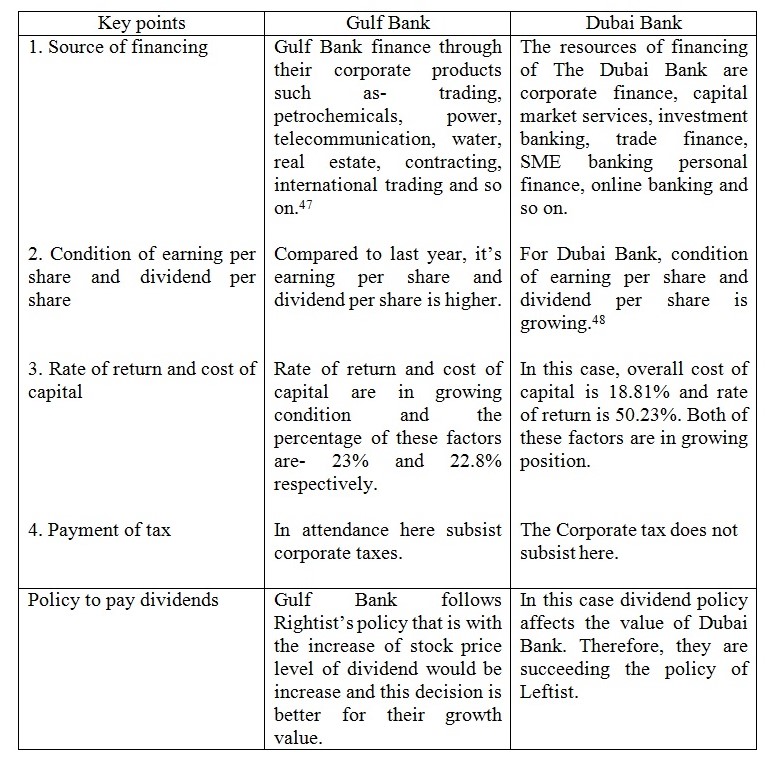

Empirical Evidence of The Gulf Bank and The Dubai Bank

Proof of Dividend Irrelevance Miller and Modigliani, (1961)

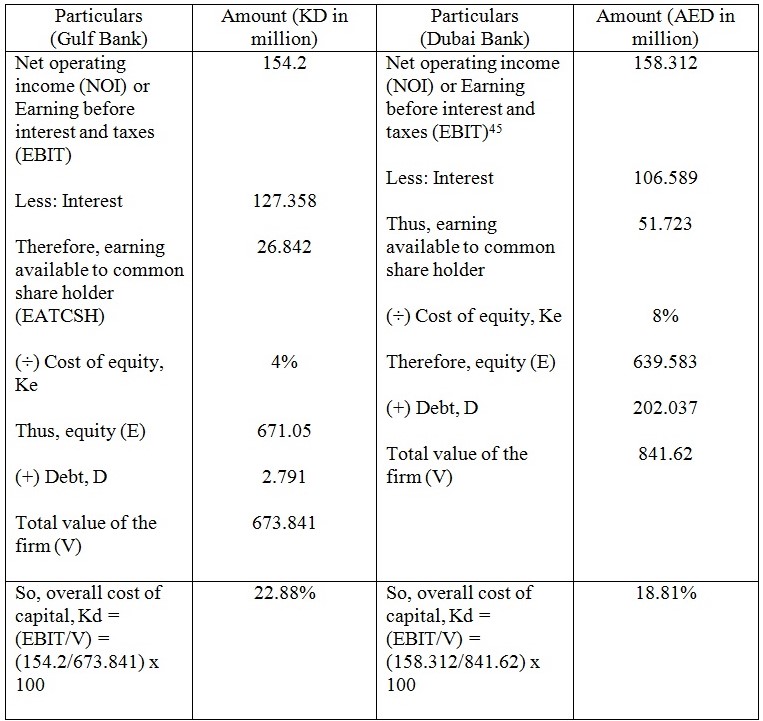

Value of the firm today

Calculation of value of the Gulf Bank and Dubai Bank’s at the beginning of 2007:

Therefore, at the beginning of 2007, value of the Gulf Bank and Dubai Bank are-673.841 (KD in million) and 841.62 (AED) in million) respectively.

Sources of fund

Identifying dividend policy

In the vicinity of financial management of Gulf Bank and Dubai Bank, payment of dividend is an imperative dimension. Both dividend policies are a process to come to a decision whilst the amount of retained earnings should be distributed among shareholders. The Retained has a enormous impact on the growth of Gulf Bank and Dubai Bank. In a further expression, commencing the view point of shareholder, they yearn for to enlarge their current return.

From the Annual Report- 2007 of Gulf Bank and Dubai bank demonstrates that both the dividend policy pay-out ratio and retention ratio of Gulf Bank and Dubai Bank contain the key perception to decide whilst to pay or not. The Payout ratio submits the percentage of earnings to facilitate the payout as dividend. On the other hand, retention ratio is compute-100 percent minus payout ratio. There are a number of ways to find out a firm’s policy to pay dividends-according to Walter’s model, Gordon’s model or as M-M’s model. In case of Gulf Bank and Dubai Bank following are the assumptions to identify their policy to pay dividend:

Decision to pay dividend

Applying Miller and Modigliani (MM) theory, beneath a perfect market state of affairs, the dividend policy of Gulf Bank is irrelevant for the reason that the value of a firm does not affect as a result of it. The investment policy makes out the Gulf Bank’s way of earnings on which value of Gulf Bank is depended. Therefore, the value of Gulf Bank is build by the Gulf Bank’s investment decision not by dividend decision that is a ratio connecting dividends and retained earnings. FROM Annual Report- 2007, Gulf Bank (2007) it can be said that beneath a perfect capital market situation, Gulf Bank’s decision to pay-out depends on following conditions:

- If the Gulf Bank has enough cash or money to pay dividends.

- Issuing new shares would also be as a source to pay-out dividends whilst it has scarcity of sufficient money

- Through issuing new shares as a source to financing new projects

- According to the claim of shareholder sometimes Gulf Bank and Dubai Bank pays dividends.

- To payout dividends, the Gulf Bank is dependant on the worth of the stock. When the stock price increases they increase their dividend payments.

In case of Dubai Bank, they do not wish to increase their dividend payments.

Dividend payout ratio

Calculation for dividend payout ratio:

Based on above theoretical discussion as an example following calculation is given for verifying MM’s model on dividend controversy.

Calculation for Gulf Bank at the end of 2007

On the basis of theoretical discussion and aforementioned calculation of Gulf Bank refers that at the end of the year when dividends are paid, the terminal value of the shares have no collision on wealth of the shareholders. Thus the significance of Gulf Bank proves the irrelevance of MM’s argument for dividend policy.

Calculation for Dubai Bank at the end of 2007

Dubai Bank’s tolerable on M-M’s valuation allows for the issue of new shares, unlike others Walter’s and Gordon’s models. Consequently, Dubai Bank can pay dividends and raise funds to carry out the optimum investment policy. Thus, dividend and investment policies are not confounded in the MM model, in the vein of Walter’s and Gordon’s models. At the same time as such, MM’s model yields further general conclusions.

On the starting point of speculative debate of MM’s model on the dividend controversy, in case of the Dubai Bank, evidenced that dividend policy is irrelevance. This implies that at the end of the year whilst dividends are paid, the terminal value of the share has no shocks on worth of the shareholders. Thus, the case of Dubai Bank implies irrelevance of MM’s argument for the dividend policy.

Conclusion

The mystery of dividend controversy has drawn the attention of modern economists of twenty first century. From now to five decades back, it has been turned as a topic of most demanding theoretical modeling and pragmatic examination. The incompatible theoretical modeling spells out the existing strategy to explicate the dividend controversy. The intention of this term paper is to scrutinize the scholastic efforts of the model dividend controversy. Predicting the efforts of dividend pay-out on share price or on the value of a firm is the theoretical background of corporate dividend policy as well as dividend controversy. All over the last century three schools of deliberation has been augmented for dividend controversy. The foremost fragment envisages dividends as an attractive and optimistic persuade on stock price. The next adherents supported that the stock prices are depressingly interrelated with dividend pay-out altitudes. The third segment sustained with the views of dividend policy that is incoherent in valuation of stock price. The pragmatic models of dividend controversy have lately improved the separation into a poles apart tagging within the nature of the market structure.

References

Besley, S. & Brigham, F. E., Essentials of Managerial Finance, 13th ed., Thomson South Western, Singapore, ISBN: 0-324-22502-, 2007, pp. 112-224.

Block, B. S. & Hirt, G. A. (2005), Foundations of Financial Management, 11th edition, McGraw Hill Irwin, Boston. ISBN: 1428811109.

Bodie, Z. Kane, A. and Marcus A. J., Investments, 5th Edition, Tata McGraw-hill publishing company limited, New Delhi; ISBN: 0-07-048662-X, 2005, pp. 427-454.

Brigham, E. & F., & Houston, J., Fundamentals of financial management, 4th edition, ISBN 0 13-040671-6, 2004, pp. 117-124.

Brealey A Richard & Myers, Stewart, Fundamentals of Corporate Finance, New York: McGraw Hill., ISBN: 0073012386, 2007, pp. 433-467, 465-85.

Brealey A Richard & Myers, Stewart, Principles of Corporate Finance, New York: McGraw Hill. 6th editions, ISBN: 0072957239, 2006, pp. 207-254.

Brealey, A. Richard & Myers, Stewart, Financing and risk management, New York: McGraw-Hill. 4th editions, ISBN: 9780071383783. Web.

Brigham, E. F., and Houseton, J. F. (2004), Fundamentals of Financial Management, 10th Edition, Thomson south-western, Singapore, ISBN: 0-324-17829-8.

Chetty, Raj; & Saez, Emmanuel , Dividend Taxes And Corporate Behavior: Evidence From The 2003 Dividend Tax Cut, The Quarterly Journal of Economics, Vol. CXX, 2005, Issue 3. 2008. Web.

Dubai Bank (2007), Annual Report. Web.

Frankfurter M. George and Wood, G. Bob (2008), Dividend Policy Theories And Their Empirical Tests. Web.

Gordon. Myron. J., The investment: Financing and Valuing of Corporation, Richard D. Irwin, 1962, pp. 17-24.

Gulf Bank (2007), Annual Report. Web.

Horne, C. V. James, and Wachowicz, M. John, Fundamentals of Financial Management, 12th edition, 2008. Web.

Holt, H. H., (2002), Entrepreneurship New Venture Creation, 6th Edition, Prentice- Hall of India Private Limited, New Delhi, ISBN: 81-203-1281-3.

Jensen, M. C and Meckling, W. H., Theory of the firm: Managerial behaviour, Agency Costs and ownership Structure, Journal of Financial Economics, 1976, pp. 43-49.

Kamlet, A. & Carreiro, R., Stocks – Dividends, The Investment FAQ, Christopher Lott, 1997.

Keele University, The Dividend Controversy, Chapter-16, 2008. Web.

Mao, James C. T., Quantitative Analysis of Financial Decision, Prentice Hall, ISBN: 9780023758201, 1969, p. 482.

Pandey, I. M. (2007), Financial Management, 9th Edition, Vikas publishing house Ltd: New Delhi, ISBN: 81-259-1658-X, pp-328-377.

Ross A, Wererfield R, Jaffe J., Corporate finance, 8th edition, ISBN: 0073105902, McGraw-Hill, pp.853-857, 2006.

Rose, S., The Determinant of Financial Structure: the Incentive – Signaling Approach, Bell Journal of economics, 1977, pp 19-39.

Solomon, Ezra, The Theory of Financial Management, Colombia University Press, 1963, p 142-147.

Walter, James E, “Dividend Policy: Its Influence on the Value of the enterprise”, The American Finance Association, Journal of Finance, 1963, Volume – 18, Issue: 2, pp. 280- 91

Wood, F., Sangster, A. (1999), Business Accounting 1, 8th Edition, Pitman Publishing, China, ISBN: 0273638394.