Abstract

The purpose of this dissertation is to analyze the materialization and the progress of governing rules of financial reporting in Kuwait experience by observing the real scenario of Kuwaiti Stock Market to evaluate to what extent the existing rules of financial reporting are effectual to retain investors by increasing share prices and capable to respond to any market collapse. Moreover, the corporate fraud recent global financial crisis has escalated the awareness of regulators to take control over the financial accounting tools to rescue the Stock Market of Kuwait and the policy makers are anxious to bring back the investor’s confidence. This study has aimed to assist the academia, regulators, policy makers, and investors with enhanced understanding about the weakness of financial reporting practice and associated corporate frauds including its driving force such as non-holy alliance with the financial managers and non-executive directors of the listed companies. With the outcomes of this investigation, the listed companies will get a potential investment environment in the stock market of Kuwait and get a better level of inventor’s confidence, which will endow with the companies a practical advantage for the financial managers and policy makers.

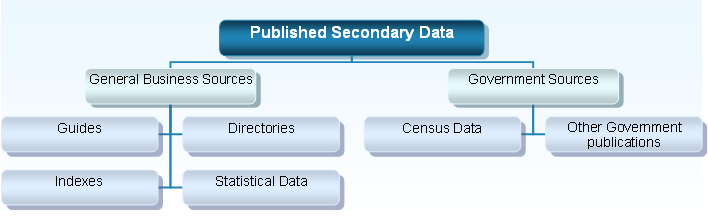

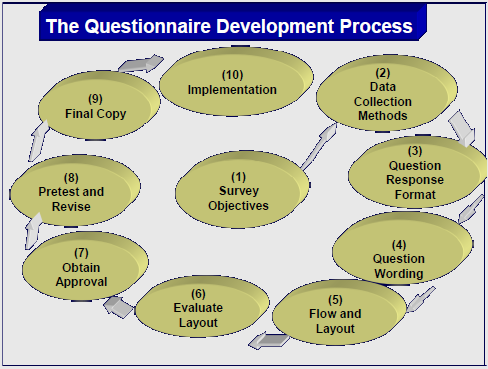

The paper has been grounded with the methodical framework of PEA along with primary and secondary research taking into account of tools of Marxist interpretations to the views of globalization. The literature research of the study floated to explore the research questions with the most legendary authors and theoreticians of financial accounting. The researcher has conducted a field survey with a predetermined questionnaire and analyzing the collected data the finding has deliberated. With a discussion from secondary sources regarding the topic area, the conclusion and recommendation have well designed to argue for the emergence and the development of the rules that govern financial reporting in Kuwait.

Problem Statement

Introduction

This dissertation critically illustrates the perceptions and attitudes of the rules that govern financial reporting in Kuwait and factors touching their motivation and exploration within the existing rules have been emerged and developed through direct influence and closeness with the International Accounting Standards. The prescriptions those issued by the IAS1from being seventies, the Kuwaiti legislation has integrated most of them, but there is no evidence to establish any sustainable standard of financial accounting to deliver appropriate financial reporting, The dissertation has been organized and contained the six major episodes designed below-

Problem Statement

This episode of the dissertation has well thought-out with a study in wide-ranging among the selected area of financial accounting, endow with the underlying problems of the rules that govern financial reporting in Kuwait. It also addresses the hypothetical principles of financial reporting connecting with stock market listing rules and agendas for the research; raises the research questions and affirms the limitations and scope of the study used within this present dissertation.

Literature Review

This part of the dissertation launches with a chronological indication to the existing rules that have been emerged and developed linking with the motivation of the interest groups; then, recites too more up-to-date literature integrating modern corporate governance measures and accounting standards with the aim to theoretically answering and arguing to the research questions. Moreover, the expression on accomplishment of conceptual framework of regularity authority in Kuwait has engaged to ensure suitable stock market situation and sustaining investor’s confidence while the influencing groups are continuously shaping of existing rules of financial reporting;

Research Methodology

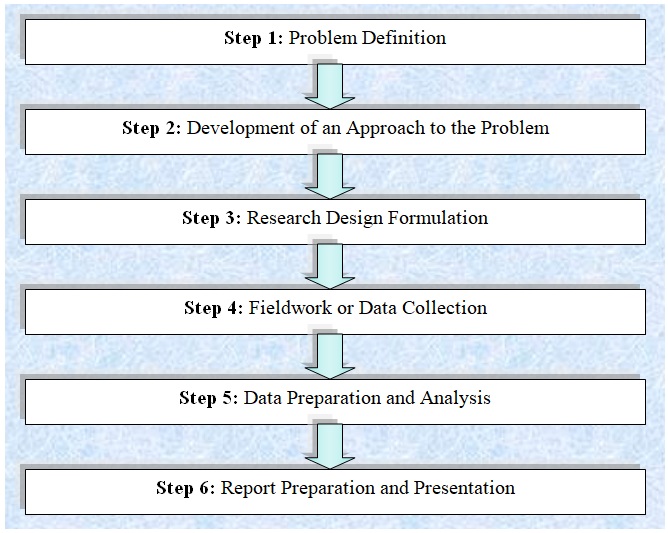

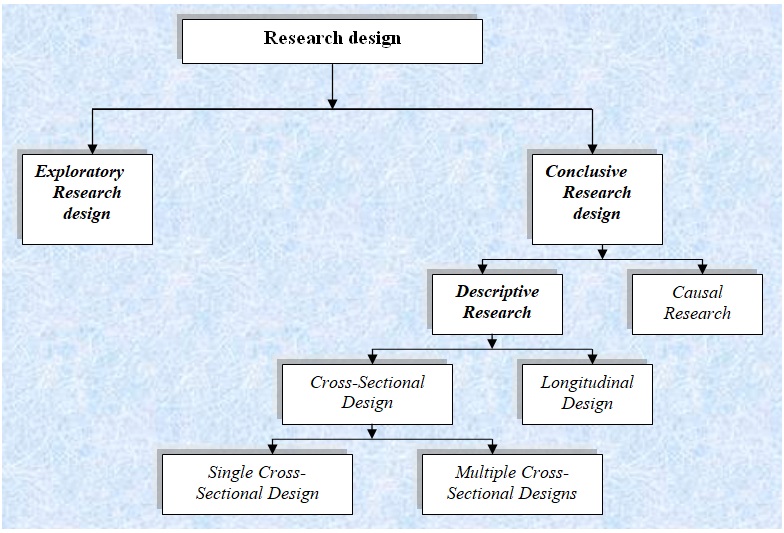

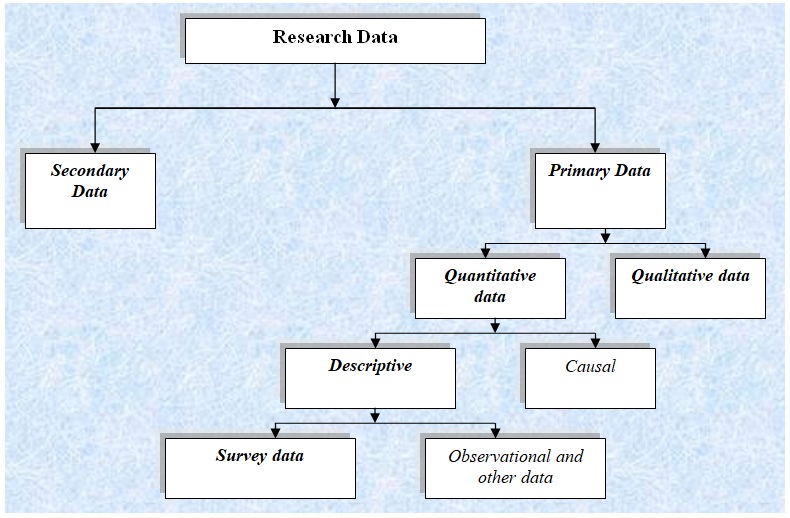

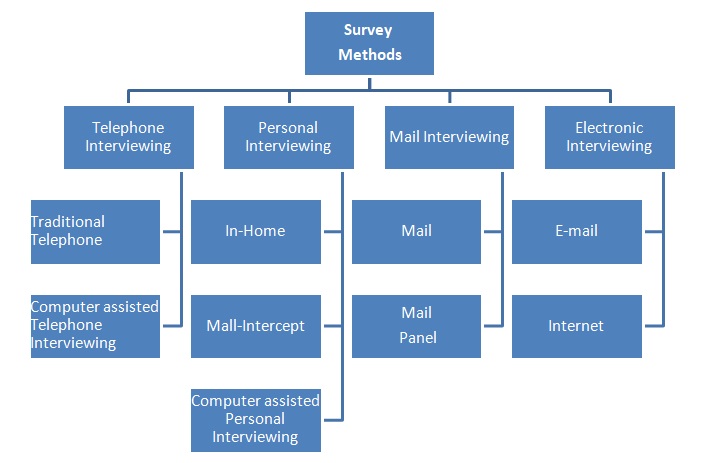

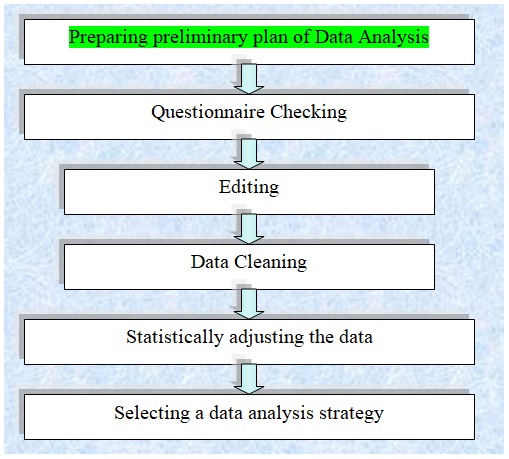

The prime objectives of this section is to demonstrating the process how the chosen research methodology will set out with the foremost goal of the present dissertational inquiry and how it will complete throughout this concurrent study pointed to the engaged processes. The author of this dissertation will conduct the research in accordance with six major steps for research approach definite to than the case study approach and should point out that the researcher had the opportunity to adopt case study approach guided that this approach may not be applicable. This episode of this dissertation furnishes the explanation and way out on how the research would be conducted, describes position and population selection, data assembly and treatment, develops a qualitative analysis of the data, gives an explanation of the process and states limitations of this study towards financial reporting in Kuwait;

Findings

This segment of the dissertation specifies the collected data, refine and denotes unexpected results by concreting on the findings as well as hypothetical uses for the information delivered from the rules that govern financial reporting in Kuwait and proposes idea generation for the research from secondary data. This section will then statistically analysis the collected data to generating the outcomes of the interview generated with the intention to present primary research;

Discussion

Moreover, this section also enlightens the results in reflecting the outcomes of the research and discuss on validation of findings that will ultimately argue to justify the findings from the real life perspective linking to practical evidence of influencing trend of the global capitalism in the existing rules;

Conclusions

This is the final episode of the dissertation summaries the process, advises sensible outcomes that construct the key recommendations; and promotes conclusions as well as implications of this study pointing to the further research as well.

Background of the problem

The Financial Times (2010) published a new of corporate scandal connecting the Kuwaiti financing company ‘Investment Dar’ the owner of automaker Aston Martin who unduly sued for financial stability law to initiate a dreadful practice of protecting the creditors. In respond to Investment Dar, the major creditors have driven for legal proceeding demanding US$ 3.50 billion recovery, but the complicacy rose while the Central Bank of Kuwait has approved the inconsistent annual financial reporting of the company for 2008 and 2009. The news that ultimately raise a question mart to the standards and practice of the rules that govern financial reporting in Kuwait

The Kuwait Times (2007) reported that the National Assembly Council of Kuwait urged its members to approve the financial statement law with the aim to introduce legislation for the declaration of the financial positions integrating international standards along with Islamic values to strengthening the transparency of financial reporting.

Al-Shammari (2005) has conducted an empirical investigation with the degree of fulfillment of the international accounting standards by the companies by the GCC2 member counties including Kuwait involving 1996 to 2002, and tried to identify how the companies act in accordance with those standards of financial reporting. Based on the financial reporting of hundred and thirty-seven listed companies in the GCC including Kuwait, he examined to what extent the companies were able to comply with the IAS3 and identified the noteworthy variation in the degree of compliance among the companies though the number of integration of financial reporting standards has increased significantly in this region.

Al-Shammari (2005) also identified that the level of non-compliance with the rules that govern financial reporting in Kuwait has moderately featured with limited supervision and enactment by the regulatory agencies of the state accountable to control financial reporting of the listed companies with imperfect strength of auditing through the external auditors. On the other hand, the role of the regulatory agencies, external auditors, and quite a lot of companies have demonstrated negative attitudes to complying with the code of conduct of the financial reporting as guided by IAS and delivered increasing variation depending on the size, leverage, and company’s identity whether local or international. The other attributes that influenced to the degree of noncompliance with the nature of industry, volume of profitability, nature of ownership and liquidity without giving any credit to the auditor whether it is local or multinational, but not addressed to the historical and critical study that view there are many factors keep vital role in reporting standards.

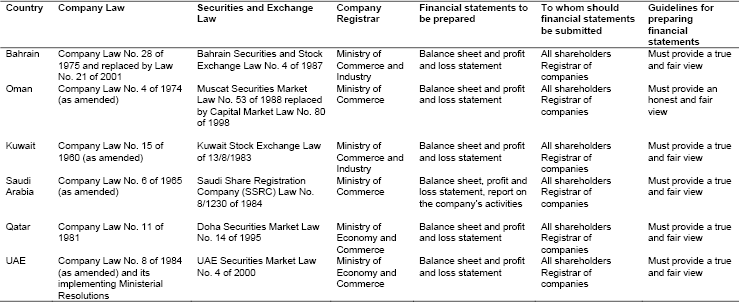

Al-Qahtani (2006) conducted another research with the financial reporting regulation in GCC with auditing requirements in accordance with the commercial law with the aim to formulate a wide-ranging background to the development of accounting standards in this region taking into account of consequence of the interest groups. Based on the legislation and secondary sources the research pointed out that the associated features of accounting as well as financial reporting in Kuwait has integrated within the auditing practice and performance by means of codes of the Company Act connecting with social and a political phenomenon. With such in a study, there is no evidence of investigating to the historical evidences incorporating with serious study that views there are many factors play role in reporting roles.

Haneh (2009) conducted a study in the area of voluntary exposes of the listed companies of Kuwait linking their uniqueness, economy, and political sustainability of thirty-eight listed firms of Kuwaiti Stock Exchange and argued that the size and age of firm, debt-ratio, and profitability, criteria of ownership are the major factors that influence the voluntary disclosure of the companies. This study also drooped out to examining the historical and critical school of thinking that pointed to the factors those play vital role in the financial reporting.

Within this above scenario, the governing rules of financial reporting system in Kuwait has been passing through an unstable situation facing different changes, and generating huge complicated situation regarding to financial managers, and the regulators while the management suffered from risk of volatility and the shareholder’s interests are not safeguarded. With this background problem, this researcher has decided to conduct a study with the emergence and the development of the rules that govern financial reporting in Kuwait and considered that such a research would determine the way out for the regulators of Kuwait to coming out from the existing dilemmas and the develop a suitable solution.

Rationale for the research

Many scholars tried to find out the solution of the question how financial reporting in a certain company’s accounting practice could influence the investors in the stock market to raise share prices of that company and how the corporate fraud occur breaking the stock market stability and investors confidence in the global financial market including Kuwait from last several era. Most of the remarkable contemporary researchers have concentrated on the accounting standards, corporate governance and regulatory reform in the stock market, but no overarching research agenda has yet been proposed on whether the manipulated financial reporting is a conscious drive of the global capitalism for deliberated cheating or not.

Gonedes and Schnellar (1984) pointed out that while the companies aggressively focus more on financial reporting manipulation with the tools of financial accounting then it is clear that they are trying to retain more investor’s confidence while the large firms would involve to utilizing such tools as a technique of retaining more enhanced share value and huge investors. Rath and Sun (2008) strongly argued that manipulation of financial reports painfully distresses the whole truthfulness of the financial statements as well as conspicuously influence the resource distribution in the economy while the modern academia, regulators, policy thinkers, and investors are enthusiastic to put a stopple to malpractice in the financial reporting.

The rationale of this research is to analyze the rules that govern financial reporting in Kuwait experience by observing the real scenario of Kuwaiti Stock Market to evaluate to what extent the existing rules of financial reporting is effectual to retain investors and increase share prices, but to respond while the stock market collapse. In addition, the corporate fraud of Enron and WorldCom has escalated the awareness of regulators to take control over the financial accounting tools while the global financial crisis already socked the Stock Market of Kuwait and the policy makers are anxious to bring back the investor’s confidence. This dissertation has aimed to will assist the academia, regulators, policy makers, and investors with better understanding about the lacking of financial reporting practice and related corporate frauds including its driving force such as non-holy alliance with the financial managers and non-executive directors of the listed companies. Through this investigation and its outcomes, the listed companies will get a potential investment environment in the stock market of Kuwait and get a better level of inventor’s confidence, which will endow with the companies a practical advantage over the non-executive directors and managers who are involved with the manipulating financial reports.

Research Question and Objectives

There are so may research already conducted with the nature and shape of financial reporting standard and practice in Kuwait, but there is no research agenda has been raised with the historical complexities of financial reporting as well as the fundamental accounting standards and their practice. The legislation of Kuwait is eager to upraise the capabilities of the companies to be capable represent their business and financial status based on their current knowledge and prospects to the future with international standard. The objective of the governmental policy is to supporting the stakeholders while they want truthful reports of companies regarding the operating results and cash flows as well as financial statements to measure and reflect the economic and business reality through which the company is running and it assists the investors to formulating investment decisions.

While the financial reporting misrepresent the economic and business reality of a business, the capital flow would be misguided to the improper entry and such misallocation of resources would hamper the investment environment and the investors have to carry higher opportunity cost more than their return. Consequently, the optimistic business may suffer from lack of investment and will deprive from proper allocation while the customers, employees, and suppliers would make their strategic decision depending on the faulty financial reports. Such situation would give birth of new evidence like WorldCom and Enron, which is quite unacceptable to the stakeholders and to bypass similar risk, it is essential for the regulators to ensure appropriate financial reporting enclosure. Thus, it is most indispensable to investigate why the modern business communities and policy makers are very much concerned with the rules that govern financial reporting in Kuwait, why the accounting standards and disclosures are facing chronological development and quick shift, and what the regulators are trying to accomplish historically.

It is evidenced from the global scenario of the stock market and recent socks of global financial crisis that disclosure requirements around the world have emerged and developed because of social, economic, and political factors rather than the internal factors of the business. As an integral part of global economy, Kuwait cannot keep itself to apart from the impact of global financial crisis and its consequential collapse in the stock market while the rules that govern financial reporting is no different from other countries in that its disclosure requirements have emerged and developed connecting to the same factors. This study scrutinizes the understanding of the emergence and development of the rules that govern financial reporting in Kuwait by adopting the political economy of accountancy and globalization approach as the as the base of theoretical framework to deliver a sustainable financial report.

This dissertation aimed to investigate, does the historical perspectives of financial reporting with earning management is the watchful drive of global capitalism to immoral gambling with the investors in stock market? The more refined and highly structured aim of this dissertation has been designed to respond to the following six research questions; the answer to these questions would facilitate the legislators and regulating authority to organize the policy and towards a greater motivation for increased confidence of investors in the Kuwaiti Stock Exchange with its historical performance. Six research objectives are listed below:

- How existing rules have been emerged and developed?

- What are the interests that are served existing rules?

- Which groups or people have influenced the shaping of existing rules?

- How are conflicts resolved among these groups?

- What are their motivations?

- Is there a global capitalism influence in the existing rules?

Scopes of the study

The researcher of this dissertation has unlimited scopes to develop the topic area, for example –

- The author has the opportunity to observe to what extent existing listing rules of Kuwait complied the rules of International Accounting Standards (IASs);

- In addition, this paper has the chance to observe internal financial reporting system in Kuwait considering the Best Practice Report, Business Indicator Report, Financial Standards Report of Kuwait;

- This paper concentrates on the principles of corporate governance, International Standards on Auditing, objectives and principles of existing listing rules, performance in global best practice indices, taxation policy, and key standards to sound financial systems;

- However, this study has also scope to give the theoretical framework of financial reporting, the effectiveness of listing rules, the impact of these regulations on the stock market, and the influence to resolve conflicts among these companies;

- This paper has the opportunity to provide historic development of financial reporting in Kuwait, for instance, the position of Stock Market in 1970s, necessity of new regulation in the period of 1970-1978, the emergence of “Souk Al-Manakh”, the impact of Souk Al Manakh crisis on disclosure requirements and so on;

- The entire dissertation will assist to give a fruitful, realistic and applicable suggestions and recommendations to develop existing listing rules to reduce corporate fraud in Kuwait;

- As the total word limit was sufficient to consider most of the aspects to get appropriate outcomes from this study;

- In addition, the researcher will collect the primary data to discuss the significance of listing rules, current position of financial reporting in Kuwait Stock Market, and other relevant issues.

- 1.6 Limitations of the study: –

Besides the scopes to conduct research, the researcher has suffered numerous problems to research on financial reporting in Kuwait, for instance –

- The topic of this dissertation is mixed with legal aspects, for instance, it is essential to concentrate on government rules and regulation, and listing rules to discuss emergence and the development of the rules that govern financial reporting in Kuwait. As a result, it is complicated issue to deal with legal issues and listing because of limitation of data sources and lack of knowledge on specific area;

- In this case, accounts and financial managers of the large Kuwaiti companies are not interested to disclose the real situation of the development of existing listing rules, so some answers of survey report become confusing.

- In addition, most of the accounts and financial managers were either busy with their occupation or they were reluctant to give their opinion on the financial reporting in Kuwait; therefore, the low response rate from the respondents was another problem to complete the result section as some respondent completed their questionnaire after completing the whole dissertation;

- On the other hand, the researcher was not get enough time to carry out face-to-face interview to complete the dissertation;

- However, limited budget for conducting research was another major difficulty for the author to collect both secondary data and primary data from respondents. In recent times, there are many journal articles upon the development of the rules that govern financial reporting in Kuwait that apparently seem imperative to the author by considering summary of the articles, but the price of the entire articles were not affordable as there is no way to assess whether these resources are appropriate or not for the paper.

- Furthermore, numerous secondary sources were accessible in the internet, e-books and journals, but most of them were not directly relevant with the topic; for instance, there were many articles on financial reporting, but most of them were for the UK, USA or other countries.

Literature Review

Path of Emerging and Development of the Existing Rules

Theoretical Development of Financial Accounting

Sutton (2009) defined that the financial accounting is the progression of a technology to represent the recording financial transaction of a company and commencing the historical brass tacks, it has evaluated as a focal point to the expansion of insistent socialized capital in association the informational gaps among the holders of capital as well as concerned managers. Gray, Owen & Maunders (1988) pointed out that, with such essential categorization of financial accounting, the agency rapport did not raise any question until sixties, and the GPFR4 has been considered the target equity for both the investors as well as creditors.

Jennings and Happel (2003) added that the grown-up of stakeholder theory and the succeeding progression of critical accounting theory have thrown challenge to the assumptions of conventional GPFR while the mentioned theories quarreled to have a necessary extension of GPFR application and the post-Enron world disclosed to the world that stakeholder theory engaged just on the political views of issues.

The most notable points of stakeholder theory are that it has grounded along with a set of absolute morals those included honesty to handling with the shareholders and customers, the business concerns would be may be the idyllic corporate citizen in requisites of diversity along with benevolence jut like Enron. The practice of this theoretical framework evidenced that huge number of socially painstaking funds had invested in the fraudulent companies as if Enron and such channel did not become aware to the essential moral imperfection of the business operations those indicates very enlightening, but manipulated financial reporting through earnings management. In additional, the pragmatic researchers’ of post-Enron financial accounting demonstrated that the stakeholder theory was not at all superficial to that extends which company tired express to the public connecting their environmentalism and diversity and the implementation of such theatrical framework contributed collapse of a number companies and massive corporate fraud.

Here the Author has deliberated to present the theoretical development of financial accounting with the most prevalent option of the theoreticians in the accounting filled with concurrent understating into two subheads firstly ‘Conceptual Framework of Financial Accounting Environment’ and secondly, ‘The Advancement of Financial Reporting Standards’ described as follow-

The Advancement of Financial Reporting Standards

Glandon (2010) argued that the generally accepted accounting principles are the prime source to endow with the hypothetical agenda and it is the basement of theoretical establishment of financial accounting those are overriding the companies to some extent with very particular standards those are obligatory for the companies to maintain at the time of publishing financial statement. The chronological progression of financial accounting practice demonstrates that in 1933, the federal government in the United States of America introduced the regulator authority to administer and look after publicly traded companies in the capital market and formulated legislation for Securities Exchange Act- 1934 in the Congress. Under this legal framework, they initiated the SEC5that has authorized to administer the capital market for trading stocks to the public and setting financial standards for the listed companies. For long standing with both success and collapse, the SEC has enjoyed its authority over companies to sell their stock to the public and pass on the financial accounting standards setting course of action for the listed companies, even though in many times the issued standards faced tremendous challenges and evidenced may changes.

To bring the standards into very specific adoption of financial reporting issues this legislation facilitated to exercise FRR6 on the companies and in the corresponding years, CAP7 that is subordinate body of the AIA8 recognized the financial accounting standards for the listed companies, but there were no academic agenda to support the expansion of the standards. In 1957, the CAP introduced standards where flagged as ARB9 while the name of AIA transformed in to the AICPA10. Shortly thereafter and the level of CAP turned in to the APB11 and within the durations of its practice the APB contributed APBO12, analysis financial statement and kept its effort to ascertain the theoretical frameworks, but failed due to technical grounds.

The first self-regulating body for public accounting occupation ‘Financial Accounting Standards Board’13 has formulated in 1973 by restructuring APB which consist of seven permanent members from the myriad icons of the financial accounting world those represent the direct interest groups. At the very beginning, FASB analyzed all previously issued regulation, direction, and white papers of the previous bodies and identified the way of best practice by modifying the backdrops of the previous practice. FASB concentrated on the practical evidence of accounting practices and developed the theoretical framework of financial accounting, delivered concept papers as FASCs14, designed the statement standards as SFAs15 and remarkable research work on financial accounting.

Within the progression it has been identified that the formulation of accounting standards is the most familiar political module of transformation in the accounting standards those are capable of keeping momentous economic impact on companies as well as industries and entire industries while FASB has kept its keen eyes to cautiously measuring the associated risks to embracing new standards. Due to the presence of tremendous MNCs in the US marketplace and most of them were maintaining their home counties financial accounting, but eager to enlist the US Stock exchanges, with due process FASB made it compulsory to comply with host country’s financial accounting as a primary condition to be enlisted at any stock exchange. This type of embargo to right of entry to the capital market raised the reality to harmonizing the financial accounting standards globally that drove to formulating the International Accounting Standards Committee. IASB16 started its journey with the global reorganization as an organization to settle on the global financial accounting by keeping joint effort with the national standardization authority and it has already issued almost forty-one harmonized standards for global practice and looks forward to having more integrity.

Conceptual Framework of Financial Accounting Environment

Glandon (2010) pointed out that the financial reporting is an imitative by the business concerns to focuses on the concurrent status of that business in context to the previous period to review by the external users such as primarily investors, regulators, and creditors of the company, financial mediators, and other stakeholders. As the financial reporting is the course of action to delivering significant financial information to the above-mentioned third parties, the economic environment of the business including the existing capital markets are the most vital factor where all the vital investors and creditors come in a common platform who needs accurate of the companies to make their investment decisions. Thus, the success and smooth convey of the stock exchange is deeply concerned with highest level of the truthfulness of the financial reporting of the companies.

The Capital market has clarified into two episodes, while the primary capital market concerned to deal with publicly regulated companies to issuing stocks and bonds, the secondary market functions to trading with the issued securities those are distributed among the investors, and to exchange them with existing stock market regulation. While the securities of a company put on the market primary market that company will get no revenues while that issue goes for trading in the secondary market, but the player of secondary market trade with them from a cash flow respective and the transaction continues in the stock market based on a number of anticipated future returns. The most familiar market motivation generated from two perspectives such as periodic payment of dividends by the issuer company and the increase of prices of the share from the concluding sale of the issue. In this context, above two variables are measured by investors with the predictable rate of returns along with the allied risks concerned with the stock issuer company for which the financial reporting is essential to deliver necessary information to the investors for their safe decision-making.

Depending on the information of the financial reporting the investors and creditors can measure the associated risk of future cash flows with an issue and identify the return on their investment within the period while financial reporting also facilitated a major opportunity to providing trustworthy information to which issues are safe for steady earning. In the financial reporting, the investors also get understanding on the cash basis accounting that display the cash basis results of the company’s operations, which is termed as net operating cash flows and it is essential to measure future trend.

Moreover, a financial reporting also gives enough ideas on the short-range operating cash flows, but does not show the sign of the viewpoint concerned with the future cash flows of a listed company. The financial reporting also contended with the accumulation of accounting results of the operation of a company and the accretion accounting has termed as net income, it replicate the revenues that the company earned. The expenses those the company incurred for the duration of the accounting period of the presented results would deliver in either net income or net losses and it is an enhanced reflection of the impending future cash flows of the company (Glandon 2010).

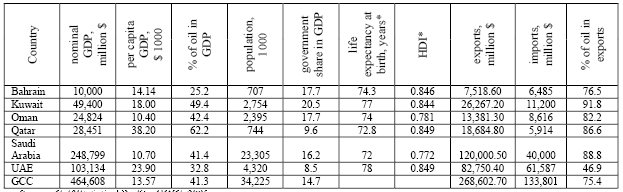

Economic Condition of Kuwait

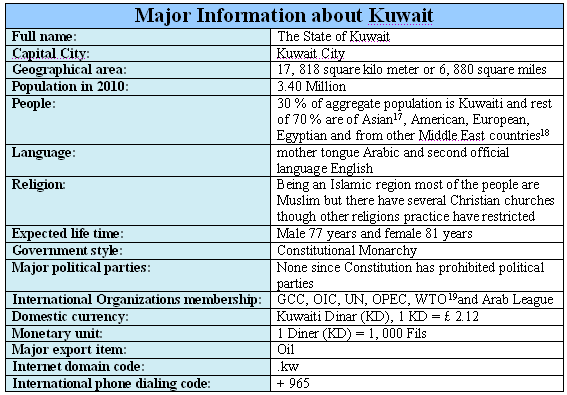

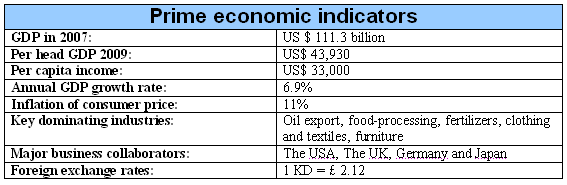

Indexmundi (2010) suggested that Kuwait has a geologically small, affluent, and comparatively open economy with crude-oil reserves of about 102b barrels, which is approximately nine percent of world reserves; its fuel accounts for almost half of GDP, 95 percent of export-revenues, and 95 percent of government-income; in fact, Kuwait aims to augment oil-production to 4m barrels everyday by 2020. Kuwait sustained in the recession on the strength of budget surpluses engendered by high oil prices, relocating its tenth successive budget surplus in 2008, before falling into discrepancy territory in 2009; moreover, the government in 2009 approved an economic-development-plan to expend $140b to diversify economy away from oil, draw more investment, and enhance private sector partaking in the economy. However, the following table shows some other information regarding Kuwait –

BBC News reported that, Kuwait is one of the emergent as well as oil rich states of GCC region surrounded by other influential Middle East nations like Saudi Arabia, Iraq, and Iran. Since 1930, Kuwait has renowned for its oil stocks and their petroleum industry have developed after independency during 1961. Economic profile of the state has mostly dominated through oil exporting and in addition, 90 % of their export revenues have generated through oil industry where Kuwait has 8/9 % of aggregate world oil reserves. During 2003, invasion of Iraq was greatly affected Kuwaiti economy. Stock market performance over global economic crisis has been satisfactory, additionally, Kuwait is a well promoter for the foreign investors, and hence, Kuwaiti government has succeeded in shifting 95 % state sector workers to the private organization. Here are the major economic facts of Kuwait.

Historical development of Financial Reporting in Kuwait

Country profile of Kuwait is informed that before independent, public companies was started their journey in Kuwait at beginning of 1950. At that time, there was only one bank “the British Bank for the Middle East”, which possessed by the foreign investors and additionally, strongly hold monopoly business of all banking task (Mouhammed, 2010). In order to establish accountability and transparency of financial operations as well as reporting of all business industries, last week of 1952, Kuwaiti National Bank the first public bank in Kuwait established with support of capital KD 19, 465, 875. Most efficient features of the bank where it offered open subscription for public.

After successful continuation of the first Kuwaiti public bank, during first week October 1954, National Kuwaiti Cinema Company formed with KD 1, 630, 263 capitals and followed by the second bank, in mid September 1957, Kuwaiti Oil Tankers appearance with KD 25, 936, 605 capitals where 53 % share owned by the government. Major difference among these three banks was the first had succeeded to fulfill public demands, but rest two were not efficient in stock trading as well as not made significant scope of public participation. In order to recover the difficulties Kuwait formed their first commercial Companies Act No.15 during 1960 and considering public commercial companies following are the key statutes of financial markets as well as for authentic financial reporting. Point should to note that Kuwaiti commercial Companies Act is not only for applying on newly establish companies, but also a commercial standards for the existing companies’ business operation. Moreover, the Act has significantly influenced by the major Arab States17 Company Laws as well as British Company Act (Beblawi, 1984).

Obligatory features of all public companies should to make sure of that newly establish companies must be Kuwaiti, its shareholders must be citizen of Kuwait, and location of head office should to be inside the country.

Annual report of financial operations or profit and loss account of a company should to be inconsistent with the company’s regulation as well as free of fake data.

It is obligatory for all of the companies to submit their financial statements annually towards CCD18 at MCI19 and additionally, submitted financial report should to audit by a registered accountant. During annual meeting of a company, an accountant appointed for auditing.

An auditor is responsible for the entire audit tasks of forming the annual report whether ascertain information and data should correct of the financial report of the company and since consideration by the Company Act; an auditor is termed as an agent of the shareholders. In reference of this statue, shareholders have also right to call the auditors for any type of query as well as clarification.

First balance sheet of a company should to brief last 12 months in form of correct and true financial records.

Alternatively, Kuwaiti commercial Companies Act has kept guidelines for the public companies how to formation and administration, process to wining up as well as final liquidation modes.

The decade of 1960 – 70 is a significant period for Kuwait to establishing shareholding companies as well as formation and impact of financial reporting regulations. Firstly, in between 1960 – 62, large number of shareholding companies was established and proportionately public share issuing was increased significantly. Secondly, from 1963 – 70, was reversed period for the commercial companies due to dramatically reduction of establishing new shareholding companies and amendment of Company financial reporting regulations. At early stage of independence, Kuwaiti economy more focused on shareholding companies as an effective economic segment.

The period 1960-1962

Thirteen new companies were established in consistence with the promulgation of Commercial Companies Act No. 15 of Kuwait during 1960 with aggregate capital of KD 35.80 million. According to the Act No. 15, Kuwaiti government had substantial equity to participating in the investment and occupation of this opportunity made scope to participate by capital of KD 15.40m or 43 % of the companies’ overall investment or by seven of total company number. In 1961, another significant Company Act No. 2 amended in 1982 namely No 68 required financial reporting of a company in terms of Journal featuring three facts such as all financial entries, inventory books along with the mail register.

Another requirement of the journal is authenticated throughout Ministry of Justice where inventory books and mail registers are not for practical use. On the other hand, companies enforced to execute internal reporting as well as financial statements prepare in terms of a general ledger book. A significant point should to quote that at beginning of independency, Kuwait had no legal framework for operating stock market activities though newly formed companies were enthusiastic to execute their job at highest level of professionalism. During that period, stock-holding companies traded either directly by the traders or the stockowners or by the unofficial brokers20. Early independent period of Kuwait, an observer of several substantial tasks by a group of entrepreneurs that harshly threatened stock market prospect of Kuwait as well as its economic development and effects of these soared share prices such level that absolutely isolated from a company’s regulation as well as performances (Khouja, 1979).

The period 1963-1970

Shareholding companies in Kuwait grow and expand slowly compare to the prior time. During this time, only eight shareholding companies formed and established, but none of then could not continued their business operation after 1969 – 70. On the other hand, government announced that they participated by investing 60 % of overall authorized capital in terms of KD 26.30 million of aggregate capital KD 43.75 million. Six of the eight companies was then formed as the industrial entity with aid of government participation by 98.72 % and rest of survived through privatization namely Al Ahli Bank of Kuwait. In Kuwait, there were 23 shareholding companies during end of 1968 where overall, nominal capital was KD 100 million and government private participation was respectively 43 % and 57 %. At the end of Kuwaiti financial history, overall analysis is quoted that since 1963, primary and secondary market’s downward trends was started in term of stock prices dropped. Hence, the investigation to identify misinterpretation of the trading companies as well as common public investors financial reporting got demand for accountability and transparency of the listed companies inconsistent with the accounting standards (Shuaib, 1995).

The period 1977-1982 and Journey to “Souk Al-Manakh”

From 1977 – 1982, KSE was started to trade of diversified products like financial instruments, real estate, and poultry firms. Trade of these products and services in KSE were then termed as the “Souk- Al-Manakh”. Trade of the stocks of these items commonly brought on credit and in addition frequently sold with premium value before rise of stock price. During transaction of that time, buyers had required to pay postdated checks. Consequence of the facts, first half of 1982, the Souk-Al-Manakh traded stocks of over $ 6.0 billion those had book value of only $ 200.0 million. In this way, mid 1982, aggregate postdated checks of buyers floated over market that crossed around $ 96.0 million, and additionally, stock values of the “Souk Al-Manakh” doubled every hour. During August 1982, the “Souk Al-Manakh” market stocks crashed and thus government felt emergence to intervening. Facts of speculation of the “Souk Al-Manakh” make lost of small investors who had less than $ 5.0 million. During leaving of the point it has point that establishment of the “Souk Al-Manakh” assembled through GCC member countries after scandal of the share market crash, government has imposed obligatory regulation to submit yearly three times financial report and no broker would have allowed prior government approval. (Preston)

Emergence of Shareholding Companies in Kuwaiti Economy

Inspiration of historical flow of Kuwaiti financial reporting regulation as well as listing rules of the stock market from 1952 – 60 informed and illustrated significance of shareholding companies in Kuwaiti economy and performance of corporate equity issues of these companies. Financial analysts figured that major issue of large number of Shareholding Company reflected healthy liquidity of an individual’s assets. On the other hand, oil revenues elevated swiftly, government initiatives wall also boomed to develop country roads & housing, effective public services as well as other infrastructural advancement. Alternatively, government was also paid efficient attention on generous compensation towards the people whose property had great potentiality to flourish new planning and development schemes. Management committee of any company voluntarily generated financial reports since 1950 as well as prior to establishment of government regulation for obligatory forming of financial reporting and the accounting statements.

For instance, the National Bank of Kuwait first Shareholding Company in Kuwait stated in their articles of incorporation that their financial statements would have been audited annually at the end of every fiscal year. Since early period of 1960 shareholding companies in Kuwait increased too swiftly and additionally, in order to fulfill economic demand of the state a group of investor were preparing to launch new more commercial companies and hence trade & industrial department of government intervened to regulating financial reporting of new born companies for an authentic and transparent security trading. In discussing emergence of share-holding companies in the economy of Kuwait had patronized through two major dynamics and felt urgent necessity of commercial Company Act No. 15 developed in 1960. First motivation of the government to encourage investors for their significant contribution on state’s economy and secondly, enthusiasm of the investors to establish new more shareholding companies and flow of this motivation noticed that government’s initiative for economic development had more focused on domestic investment rather than foreign investment.

Significance of Political Economy Financial Reporting

Bryer (2008) mentioned that though the new-fangled explanation of neoclassic economists has concentrated to concluding to the limitation of the Marxist view to resolving the renovation crisis of capitalism and tried to demonstrate that the labor theory of value was unintelligible, but the impact of most recent global financial crisis generated the reality of backing to the Marxist views. The global financial crisis and its consequential recession has proved the failure of Keynesian economy and urged to aligning with the Marxist views while careful explanation of Marx has contributed to demonstrate that the major socially essential labor time generates monetary value to commodities and in this regards the neoclassic views were incoherent and controversial to undermine Marxist ideology.

Modern academia argues whether there are renovations crisis into capitalism or not, the transformation of the society has necessarily aligned with labor time that included with the prices of manufacturing to deliver broad-spectrum rate of profit for the capitalists while Marx has resolved carefully the accounting transformation and clarified the core competences of accounting system. Marx elaborately defined that the capitalist accounting has engaged to resolve the turnaround dilemmas of economists to explaining how capitalists are converting the broad-spectrum rate of profit including the costs of production hooked on collectively essential labor time. The capitalist accounting also engaged in due course to effectively calculating and maintaining the accounts and measuring capital in the scale of the monetary value of publicly essential labor time for the capitalists and it is equal for the sampler groups.

Marx (1894) analyzed that the history of capitalism and determined the term “transformation crisis of capitalism” through taking into account of involved sole capitalists to acquiring control over the valorization procedure to practice ‘cost-price’, which the modern accountants or financial managers identify as the target cost of business entry. This study has identified that contribution of Marxist thinking has enriched theory of Political Economy of Accounting in the ‘Das Capital’ Vol. III and to start on hypothesis that the price of any product would be equal to the monetary value of the essential labor time in social context to manufacturing that product.

This paper also analyses the neoclassic economist’s progress and their accounting limitations integrating with the challenges arguing that the accountants and financial managers have no scope to adopt the theory of surplus value to provide explanation for the prices and profits for any product that owned by a capitalist company.

This researcher has engaged to keep effort to elaborate the understanding of Marx’s accounting way out for the makeover of prices into values as well as wrap up that capitalist accountants shored up his arguments and bring into practice rather than verifying through the neoclassic economists. It has also explained and indicated that the total figure of the entire profits of an individual company is obviously the part of the total surplus value of that society where the business is conducting (Marx 1894). This researcher has observed that the theory of accounting by Karl Marx has occupied to resolve the actually irredeemable difficulties of allocating the combined costs together with fixed capital and other operational factors. From the above discussion of Marxist-economy, it is clear that capital generates an incorporated accounting theory on how the capitalists jointly control over any company to manufacture, socialize, and at the same time distribute surplus value among the stakeholders by exploiting of labor while each capitalist search out a proportionate return on their involved capital. Thus, the political economy of accounting is a critical accounting practice that Marx demonstrated to the world for realistic analysis, for any further crisis Marx seriously argued to resolve with analysis of dialectical materialism.

Interests Served Existing Rules in Kuwait

Content and Outcomes of the Existing Rules in Kuwait

Existing listing rules in Kuwait usually segmented their stock market into two major categories regular and parallel. In the area of official market, during 2008 KSE Committee statue Decision No. 2 in order to concern rules, terms and conditions for the listing shareholding companies. Before illustration of the voluntary and obligatory listing rules, it should to quote that during mid–August of 1983, an Amiri Decree issued to organize Kuwait Stock Exchange, and alternatively, in the same time, MCI issued listing rules for KSE in accordance with the Decision No. 35. In 2004, for the first time, KSE Committee segmented stock market into two profiles official and parallel and hence, concerned listing rules under Decision No. 3. KSE committee specialized through two prime terms and the market committee in their Meeting No. 9 at early November of 2008 approved conditions of 2005 in accordance with the Decision No. 7 and during 2007, listing rules and regulation for the official market amended concerning the Decision No. 1 and all of the approvals. Following are the two major results come out from the meeting (KSE, 2008).

- Obligatory application form for all listing shareholding company: approved laws by the market committee enforced an application form for all the listing shareholding companies available in the KSE therefore market committee would revise their database as well as make problem free future decision-making.

- Obligatory task of market director: listing rules should to enforceable at the first day of issuing any shareholding company and the market director is assigning to enlist them in the published official gazette as well as have authoritative power to cancel all listing regulations that have span to make collide with the existing rules.

Interests Served in the Regular Market

Following are the brief account of existing listing rules of Kuwait Stock Exchange of the regular market.

- Listing of share: existing rules have requested the shareholding companies to enlist their number of shares in account of the official market that should satisfy obligatory terms and conditions;

- Share capital and shareholders equity: listing companies issued share capital to inform of fully paid as well as should not less than KD 10 million or in case of foreign currency share capital to equivalent of the required amount. Alternatively, equity rights of the shareholder should to be equivalent of 115 % of the WACC21 of the fully paid capital during previous two fiscal years individually. All of these financial reporting should approved by the listing companies annual general meeting as well as annual audited need to execute the financial auditor before listing request towards the market committee;

- Law of share trading: both of the listing rules and commercial Companies Law of Kuwait collectively considered tradable regulations where total number of share to trade should to fulfill obligatory requirements of the market committee.

- Company profit sharing: It is mandatory for listing request, that the companies should evidenced to achieving at least 7.50 % of the WACC in relation to the entire paid up capital during the end of previous fiscal period separately;

- Capital structure of a closed company: listing request or application by a closed company should to have an account higher than 50 % capital incensement within an individual fiscal year and in addition, one year period should to bypass after last date of serving notice for capital enhancement;

- Legal structure of a closed company: if a closed company transformed their legal structure as a shareholding company from the limited liability company, it should have left behind three consecutive years after noticing legal transformation as well as commercial registry;

- Capital distribution to the shareholders: on behalf of schedule guide authority, it has obligatory for all of the listing companies to distribute their 30 % capital among the shareholders, and they should guide through two trading segment inconsistent with the company book value during recent fiscal year.

- Account of annual general meeting: it has obligatory for the listed companies to brief their approved annual general meeting in order to listing their shares in KSE;

- Availability of reliable and correct information: requested companies for listing should to ensure KSE that all of the information provided by them is authentic and correct and additionally, inconsistent with the obligatory listing rules. Available of shareholders’ registry: another obligatory rule of KSE is that listing companies should to provide authentic shareholders’ registry as instructed by the KSE;

- Listing terms for non-Kuwaiti company: non-Kuwaiti companies should to enlist in their own country stock market;

- Paid up capital reserve: requesting companies of the KSE should to have reserved of 25 % of their total paid up capital for two years at enlisting date by the KSE and it has obligatory for the board of directors to specifically know about the shareholders account by whom reserve capital owed;

- Registration fee: according to the listing regulation of KSE, registration fee for a company is KD 10, 000 and additionally, required subscription fee is 0.05 % of company’s total paid up capital and optimal limit of subscription fee is KD 50,000.

- Market approval notification: four consecutive months after enlisting in the KSE as well as after notification of market approval listed companies should to consider as void inform of incompliance within this timeframe;

- Authority to rejecting listing of any shareholding company: though proper fulfillment of all obligatory and voluntary regulations as described by the KSE, but the market committee has the authoritative power either to authorize or reject a requesting company from listing by considering their illustrated financial accounts, their significance contribution to national economy as well as their market sustainability potentiality. For this reason, requesting companies permitted to submit specialized areas of their company along with the financial account to reduce scope of rejection by the market committee.

Interests Served in the Parallel Market

In 2007, KSE market committee established and approved Decision No. 2 for forming listing regulation of the parallel market as well as in similar time of issuing Amiri Decree of regular market. Moreover, Decision No. 4 of the KSE in 2000 had significant role to establishing parallel market in KSE. On the other hand, in 2004, Decision No-4 of the KSE adopted some emergent listing rules for both regular and parallel market and conversely, in 2005, KSE Decision No. 7 adopted two emergent regulation of listing rules, which approved in mid – December of 2006. Here are the obligatory listing rules for parallel market.

- Capital structure: either in term of Kuwaiti Dinar (KD) or equivalent foreign currency capital value of listing parallel market share should to minimum KD 3.0 million and conversely, shareholders equity share should not amount less than paid up capital of any company in accordance with their latest audited annual financial reporting before requesting for listing in KSE;

- Profit margin: during requesting for listing, company should to have an achievement of healthy profit margin for the previous two years and in addition, aggregate profit in that period should not less than 5.0 % from their paid up capital or aggregate capital value.

- Number of shareholder: should to have at least fifty shareholders;

- Rules for tradable share: during trading, companies should earnestly follow the rules of bylaws as directed by the Kuwaiti Companies Act during inception of trade as well as approved listing request and here number of share and the traded period should be inconsistent with prior Companies Act;

- Application rules for a closed company: a closed company that achieved doubled (50 %) profit compare to their capital value in their previous one-year working period before application for commercial registration has an opportunity to request listing. Conversely, it can point up for a closed company that it should have one-year operational experience with achievement of 50 % its total capital value before listing request through changing their judicial status or form.

- Registration of a non-Kuwaiti company: Before requesting to listing in KSE, a non-Kuwaiti company should to have a void registration in its own country stock market;

- Duties of board members: board members of any listing company are responsible and accountable to implementing all of regulations required by KSE and additionally, it has obligatory for the board management of listing company should to confirm that all of the submitted data and information is most authentic as well as correct.

- Correlation among KSE clearing chamber: listing company should to update their registration processes required by the KSE clearing chamber and in addition adhering towards the entire instructions issued by the KSE market;

- Approval of annual general meeting of the listing company: in case of annual general meeting, KSE makes obligatory to attaining an approval of listing company’s annual general meeting for trading their shares in market;

- Strategic share capital for a closed company: In accordance with the KSE listing rules, strategically a closed company should to ensure that at least 5.0% and an optimal rate of 25.0 % company capital owed by all shareholders. On the other hand, when the strategic shareholders have occupied less than 25% of aggregate average capital of any company and this attribute has potentiality to recover the deficiency of company capital by contribution of other shareholders by 5.0 % from any company’s aggregate capital. Moreover, a shareholding company should not have authority to act with 50 % of total aggregate shares for two consecutive years after enlisting in order to balancing. Here, it should to note that strategic shareholders have scope to sell all of their shares to a new shareholder, but they should to abide with the timeframe regulated by the KSE from the moment of approval of listing request;

- Registration and membership fee: it has obligatory for all of the listing companies to pay KD 3,000 as registration fee along with 0.05 % of total paid up capital as membership fee annually. Point should to acknowledge significantly by all of the companies that both of registration fee and membership fee must not bypass the amount of KD 25, 000 for parallel market trade.

- Deadline to conform: within 90 days after approval of listing request in the KSE, a shareholding company is oblige to perform all of the obligatory and voluntary regulations as directed by the KSE and the KSE has authoritative right to cancel membership entity of any company for not to adhering terms and condition within mentioned timeframe;

- Refusal of listing request: KSE market committee has authoritative power to refuse the shareholding companies’ listing request prior affirming any reasonable reason;

- Cancel decisions by the KSE: finally, the KSE has right to perform concealing all of the aforesaid regulation for shareholding companies from the time of issuing listing request which will be considered a matter of conflict.

Significance of Financial Reporting

For last two decades, demand for application of international accounting standards as well as financial reporting accelerated too swiftly therefore currently, significance of financial reporting globally and also in Kuwait increased speedily. By following the IFRS, significance of financial reporting has now formed as most acceptable accounting model in Kuwait. Alternatively, recent business companies in Kuwait formed as multinational company in order to widen their global accessibility and in addition, request for listing in foreign country’s stock exchange. Consequently, demands for financial reporting inconsistent with the international reporting standards make stronger than before. In describing significance of financial reporting in Kuwait, it should note that goal of financial reporting in the light of IFRS occupied through comparability, reliability, as well as transparency. In this way, financial reporting has developed keen prospect of cross-broader trading as well as capital rising. Moreover, complex procedures of financial reporting would easy during formation through the framework of international standards, have significant influence on identifying positive and negative areas of a company, and hence decision-making. Involved parties who have get enjoyed significant areas of financial reporting primarily classified into three groups. Here are the significant areas of these groups to define significance of financial reporting in Kuwait (Deloitte & Touche, 2003).

- Key benefit of a business organization: dramatically reduce cost of production and in addition, make easy to access into foreign market by utilizing only one financial report. On the hand, authentic presentation of financial report has benefited by acquiring subsidiaries in international market.

- Key motivations for investors: reasonably easier to take investment decisions since financial reporting provide a significant guideline to motivate to widen broader investment areas in both domestic and international market.

- Aid to the national policy makers and regulators: national policy makers have enjoyed a vast and reliable information stocks therefore it has rather easy for them in participating in disclosure based market system.

Global Capitalism Influence in the Existing Rules

To deliberate to what extent the global capitalism influenced on the existing rules of Kuwait, this researcher aimed to based on the methodological ground of Marxist political economy to discovering the fusion of Kuwaiti by analyzing its reality socio economic political elements and by building a conceptual framework that will indicate the common features of global capitalism influenced in Kuwait. With this view, the essential element of the economic reality that affects other elements of the society and the people’s regular life by amalgamation with the global capitalism and how the Kuwaiti legislators uphold the interest of global capitalism rather than national intersect would be reconsidered with the authenticity for the mentioned purpose of testing and prediction. In this context, the methodology stuck on the wide-ranging scholarly knowledge on the dialectic materialism and critique of political economy of Karl Marx. The essential motivation of this section to explain the deep amalgamation of Kuwait with the global capitalism considering with the cerebral relevance of political economy that Marxist analysis presented with the inspiration of economic surplus of Kuwait along with its significance for economic growth and chronological progression with the core of monopolistic capitalism.

Influence of Global Capitalism in Terms of Globalization

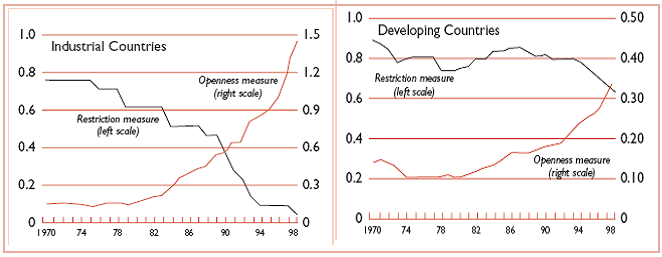

Deardorff and Stern (2000) pointed out that the WTO22 is the body that has take the liability to engender the globalization through out the world and defined as immediately ‘the greater economic integration of the world economy than ever’ by opening national economy for the essay access of foreign direct investment. WTO has driven to implement the agenda of GAAT23 by which the developed economy would be gainer and the developing countries would face tremendous challenges.

Anderson (2001) argued that to implementing globalization drive WTO has to revolve and shifting the policy options to mounting and alternating economy and trade strategies with convinced categories of government interference in markets, particularly those are incongruity to escalating the globalization. Moreover WTO has been continuing the pressure on the government of less developed countries to amend the local legislation that can ensure the global capitalists to have easy access in the local market while the business entries of the lees developed countries has no capability to compete with the developed nations. Moreover, globalization has criminalized the trade union, enhanced child labor, created unemployment, and environmental hazard and generated more threats for economic and political.

Oguz (2005) explored that theoretical framework of globalization in the name of internationalization of capitalism has developed by the Marxist interpretation of imperialism which has flourished in the post world war II era while it has shaped as a neoclassic economics and academism theories in seventies. The raise of transnational corporations, free flow of capital in the form of FDI24, increasing stock market, transferring technology, and escalating innovation reshaped the media coverage but presented the dangerous outcome for the national economy but favorable environment for the global capitalism where IMF and World Bank are the major institution to look after the interest of global capitalism.

Liodakis (2003) explained the globalization as global capitalism with the predication of Marxist viewpoint and analyzed the current development of capitalism with a theoretical and historical evaluation of imperialism while the current progression and the expanding globalization of capitalists show the way to a dialectical restraint of imperialism. Analyzing the most up to date of economic conditions along with the existing arguments regarding globalization of capital, it has predicted that the new stage in the expansion of capitalism is at this time rising, which is the highest level of capitalism and its shape and character attempts to confirm the Marxist though by Lenin. The structural individuality of this framework ensures Lenin’s definition of for imperialism and the essential trends of the new phase of capitalism would endeavor to weigh against this hypothetical outset with that of the realm of previous sufficient framework to understanding the existing reorganization of capitalism.

Influence of Americanization in Terms of Globalization

Elwell (2009) pointed out that the historical and contemporary US foreign policy of the starting from post World War II era mainly aligned with its politically influencing the world, military aggression, and dominance of economic power. America along with its European allies leads such anachronistic role all over the world and continues imperialist suppression in the banner of the scattering freedom, upraising democracy, reducing nuclear weapons and fighting against terrorism around the world, to protecting US citizens and their allied. Such unchallenging US races continuing mass destruction, and robbing the natural resources including, foster asserts, mineral resources oil and gas of different countries while the ultimate goal of these actions are to preserve the interest of US capitalists to collecting raw materials, conquering markets, and exploiting labor in different countries.

Capitalism in the colonial ear was eager to conquering different countries to expand market for their commodities, in imperialism the highest stage of capitalism, lend capital to the governments of the developing countries and exploit them by taking highest profit from interest, influencing their policy and freedom. The global leader of imperialists the America is the most hegemonic power at this moment in the core of the global capitalist system, and its lead military aggression against any government who care national interest rather than serving US interest and do not bother to use nuclear weapon on the civilians. The US imperialistic drives become more arrogant in the post cold war era and it is the most notorious inhabitant of British imperialism who speaks out regarding democracy and human rights but all the time violates human right and democracy globally.

Elwell (2009) also added that the US imperialism has shaped had its objectives within very particular bubble of influence all the states of Gulf Council of Cooperation including the Middle East region, Pakistan, ,Afghanistan and ad central Asia to robbing there oil and gas resources and started very antagonistic policy to enlarge its economic and political influence by military aggressions. Another remarkable strategy of US imperialism is to generate unrest among the countries in this region and create rivalry with the intention to sell war weapons to those neighbors. The US has huge stock lots of war weapons stating from World War II to Soviet fall, later on cold war the US imperialists influence the counties to increase their military budget and to purchase those scraps as war weapons. If any national government protest and does not agree to do so, they will create different violence in that country and lead military aggression in the name of rescuing democracy. For instance, Saddam Hussein was a very good friend to the US imperialists until he looked for national interest and protested US exploitation, but did not bothered to use nuclear weapons among the civilian, children and women, to lead such notorious attacks there was no cry for democracy or human rights. The most recent WikiLicks proclaimed that US had influenced Saddam Hussein through Saudi Arabia to attack Kuwait and all this games were to exploit oil resources and selling weapons.

As an integral part of global economy and a major player of GCC Kuwait is not out of US influence and the rules that govern financial reporting in Kuwait has been influencing nakedly by the US government and nongovernmental organization, development agencies like WTO, IMF, World Banks while all of them are eager to exploit oil resources of the country. All these US allies are not always influencing Kuwaiti government to capture its oil economy but always suggest to developing non-oil economy keeping less importance on its strong petrochemical economy. The role of government is very suspicious and looks like a teddy bear to obey US direction rather than national and regional interest. The monarchy of Kuwait also

US UK Straggle to Influencing Kuwait

Venn (2000) pointed out that the United Sates of America and United Kingdom the most anarchy of global capitalism has long been engaged to establishing their imperialist control over Kuwait to ensure the interest by influencing the local constitutional monarchy of the country. UK established British naval base in the Persian Gulf at the beginning of last century to protect British interests in this region and about eighty years afterward in 1980 by means of Carter Doctrine, USA droved to take control over the Persian Gulf to robbing oil resource of Kuwait. German imperialists planned to establish Baghdad Railroad while Soviet Union also engaged to set up naval base in this region but British imperialists protected its supremacy by a treaty with the local rulers. The US drive towards this region abolished the British supremacy of power and American oil companies turned into most significant source of economic movement as well as government revenue of Kuwait by seriously influencing the constitutional monarchy of Kuwait including elites and business communities. At the time of inter-war era, the US oil companies became capable to gain extensive share in the oil reserves of the greater Arabian Peninsula including Kuwait and stated to creating unrest and violence to hamper the local system.

In this modern era the Arabian Peninsula including Kuwait has turned the supremacy of US imperialists with a greater political influence and policymaking initiatives, a week democratic environment, limited freedom of speech, simultaneous continuation of family monarchy and parliament has facilitated the US oil companies to prolong their dominance in Kuwait. The US imperialists have acquired almost fifty percent of the Kuwaiti oil allowance to the US multinational of the world’s oil refineries in Kuwait without any renounce for political stability, democratic practice, multi party politics and military resistance for the country and enjoying a heavenly place for ‘Opportunity devoid of responsibility’ in Kuwait.

US Middle East Policy & Kuwait

Noël (2008) argued that the US energy security policy along with its military aggressions are directly connected to its Persian Gulf policy in accordance with Carter Doctrine which has been implementing by deploying US Central Command in this region as a strategic security plan for Middle East. Pointing to the Soviet military presence in Afghanistan, US imperialism ailed with the Middle East countries and argued for protecting them from possible soviet aggression but after Soviet back, from Afghanistan US military do not left this area. Moreover destroying the Afghanistan, it has droved to destabilize in Middle East Considering to the threat evolved within the neighbor countries and strategic context of Gulf region, Iraqi attack in Kuwait, the monarchies of Kuwait became more intimate with the US policy while US intervention increased in this county without any development of democratic institution. Development of education, human rights also not yet improved enough, and the constitutional monarchy suffers from internal and external threat; there is lack of initiatives to protect the world oil resources from US oil companies. Under such political instability, it is quite natural for Kuwait to be influenced by the global capitalism to introducing any legislation for the nation and the rules that govern financial reporting are not out of this consideration. The most alarming issue is that a large number of the US companies as well as oil driven multinationals are working in the Kuwait market but not a single US companies are not listed in the Kuwaiti Stock Exchange.

Global Capitalism in Terms of Globalization

Deardorff and Stern (2000) pointed out that the WTO25 is the body that has take the liability to engender the globalization through out the world and defined as immediately ‘the greater economic integration of the world economy than ever’ by opening national economy for the essay access of foreign direct investment. WTO has driven to implement the agenda of GAAT26 by which the developed economy would be gainer and the developing countries would face tremendous challenges.

Anderson (2001) argued that to implementing globalization drive WTO has to revolve and shifting the policy options to mounting and alternating economy and trade strategies with convinced categories of government interference in markets, particularly those are incongruity to escalating the globalization. Moreover WTO has been continuing the pressure on the government of less developed countries to amend the local legislation that can ensure the global capitalists to have easy access in the local market while the business entries of the lees developed countries has no capability to compete with the developed nations. Moreover, globalization has criminalized the trade union, enhanced child labor, created unemployment, and environmental hazard and generated more threats for economic and political.

Oguz (2005) explored that theoretical framework of globalization in the name of internationalization of capitalism has developed by the Marxist interpretation of imperialism which has flourished in the post world war II era while it has shaped as a neoclassic economics and academism theories in seventies. The raise of transnational corporations, free flow of capital in the form of FDI27, increasing stock market, transferring technology, and escalating innovation reshaped the media coverage but presented the dangerous outcome for the national economy but favorable environment for the global capitalism where IMF and World Bank are the major institution to look after the interest of global capitalism.

Liodakis (2003) explained the globalization as global capitalism with the predication of Marxist viewpoint and analyzed the current development of capitalism with a theoretical and historical evaluation of imperialism while the current progression and the expanding globalization of capitalists show the way to a dialectical restraint of imperialism. Analyzing the most up to date of economic conditions along with the existing arguments regarding globalization of capital, it has predicted that the new stage in the expansion of capitalism is at this time rising, which is the highest level of capitalism and its shape and character attempts to confirm the Marxist though by Lenin. The structural individuality of this framework ensures Lenin’s definition of for imperialism and the essential trends of the new phase of capitalism would endeavor to weigh against this hypothetical outset with that of the realm of previous sufficient framework to understanding the existing reorganization of capitalism.

The US – Kuwait Strategic Integrity in Post Saddam Era

Terrill (2007) added that in 2003, the Iraqi revolt in Kuwait was a most significant aspect into the Kuwait US strategic integrity in post Saddam era where the parties keep hold of a hazard for further prolonging where Kuwait was more eagerness for the expulsion Saddam. At this stage, most of the Kuwaitis consider and blame America for the conspiracy that laid the gulf war and assess it as a mismanaged event due to US strategic plan, though it is not any governmental analysis but most popular public perception. Most of the Kuwaitis consider that the government leadership is particularly reluctant to it’s criticize due to US policy influence and gratuitous creator of tensions and conflict, while they obliged to speak out against the consequences of the Abu Ghraib scandal and consider as an aggression against Muslim.

The Kuwaiti government is interested to have a regional dialogue among the gulf countries including Syria and Iraq to generate a sustainable peace process in the Middle East but the US government tries to motivate Kuwaiti Emirs that while US armed force back from Iraq, it will again attack Kuwait. For the interest of to keep Kuwait safety, USA not yet withdrawal its military force from Iraq. At the same time Kuwait is also suffering from seriously dilemmas with Iraqi refugee crisis those Kuwait allowed in the direction of USA, they are creating different social crisis and there is another risk to drive some an unrestrained civil war while US army leave Iraq. Under such political crisis it is difficult for Kuwaiti government to argue with USA regarding the policy issues, due to lack of higher education and research on social economic aspects, it is also difficult for Kuwait to encounter US prescriptions of interference in the internal policy maters.

Alternative to the Existing Rules