Introduction

The government of Dubai has committed a lot of resources to a series of public projects that are meant to change the phase of this city. These megaprojects are meant to turn this city into the world’s leading tourist destination. These ambitious projects have received praises from various members of the society as they believe that such projects will be brought to completion successfully as per the plans. However, Tonnquist (2009, p. 67) warns that the project implementation process is always faced by a series of challenges that the project management team must be aware of, and determine how to deal with them adequately. Government officials responsible for such Projects, Programs, and Portfolio Management (PPPM) must be aware that they are dealing with projects that face risks, and that if these risks are not handled appropriately, a project may fail to achieve its objectives. According to Nagarajan (2005, p. 73), one of the main reasons that lead to ineffective project delivery is an inefficient analysis of risk factors that are involved in the project. This scholar says that government projects need a detailed analysis to understand some of the risk factors that they may face before the implementation stage.

According to Haynes (2002, p. 90), projects would always face financial risks during their implementation process. Understanding financial risk factors that a government project may face during its implementation process helps in creating an appropriate approach to dealing with them. Financial risk factors have major impacts on the success of projects, especially those that require a heavy financial investment. For instance, the Dubai Ruler, Sheikh Muhammad Bin Rashid unveiled Mohammed bin Rashid City, a megaproject that is estimated to cost hundreds of billions. As Kerzner (2013, p. 99) notes, one of the risk factors that such a project would face is an understatement of the real cost of such a project. During the implementation, the project management team realizes that the originally estimated cost falls way below the actual cost of the project. In such instances, the financiers would have the discretion of providing extra funding for the project to meet the cost or let such a project stall.

Some projects would have an increase in the cost of up to 40-60% of the originally estimated costs. That would lead to a lot of dissatisfaction from the financiers. In this case, the project is funded by public funds. The government may need to give a valid reason why such extra funding is necessary to get approval for the extra funding (Field & Keller 1998, p. 89). If this funding fails to materialize, such a project may risk stalling during the implementation stage. When such mega government projects stall, it would lead to massive loss of public funds that were invested in it and some extra funding that may be needed for its demolition. It is, therefore, important to ensure that such scenarios are avoided before they take place. This research focuses on analyzing the impact of financial risks on government projects in Dubai. The research will focus on the theoretical approach that scholars have given this field over the years, and how this can be used to create a positive impact on such projects in the future.

Research Questions

In empirical research, research questions play important value in guiding the researcher in the process of collecting research. In this study, the researcher is focused on developing a theoretical framework on this topic to support some of the policies meant to make government projects financially viable. The following are some of the questions that this research seeks to answer.

- What is the impact of financial risks on the governmental projects in Dubai?

- How can the government officials in the department of planning, public policy, and management predict these risks before they take place?

- What are some of the appropriate measures of dealing with these risks in case they take place during the project implementation process?

The above research questions will form the basis of this study as the researcher will collect information from the available literature that responds to them appropriately. The section below will take a critical approach in analyzing some of the relevant literature on risk management in government projects. This means that as the researcher will be identifying some of the approaches that have been proposed by other theorists that are applicable in the contemporary world of project management, other prominent approaches proposed by other scholars that are considered ineffective will also be identified.

Literature Review

Dubai is one of the fastest developing cities around the world. It is one of the seven emirates in the United Arab Emirates (Meredith & Mantel 2012, p. 97). It is also the most populous of the seven emirates and has experienced massive development in the recent past. Dubai is a semi-autonomous city with its government responsible for several administrative duties. According to Gido and Clements (2009, p. 58), Dubai is ranked the seventh most visited city in the world. The government of Dubai has been very active in developing this city as a leading business hub in this region. According to the research by Fight (2005, p. 89), Dubai is fast overtaking some of the developed nations as the leading business partner with the developing nations. Just like China, Dubai has been able to create a market for cheap products that are attractive to the markets of developing nations. However, Gatti (2013, p. 74) notes that the city has not only been attractive to the developing economies. It is considered one of the leading tourist destinations in the world. This makes it a strategic business hub with great potentials. The main reason why this city has achieved this success is mainly because of its infrastructural developments.

The government of Dubai has initiated several projects meant to improve this city and make it more attractive to the outside world as a regional business hub. This city boasts of the world’s tallest building, the Burj Khalifa, a government project that was brought to completion in 2010 (Burtonshaw-Gunn 2009, p. 82). There are major other government projects that have helped make this city attractive not only to the players in the business fraternity but also to the tourists. The Government of Dubai has taken an active role in the development of transport and communication network in the city. The government has also been active in developing the hospitality industry, and other tourists attraction centers. The planned Mohammed bin Rashid City is one of such ambitious projects that will change the face of this city.

These ambitious projects face several risks that must be dealt with to make them successful. According to Boussabaine (2013, p. 45), megaprojects are always faced with several risks that need the implementing team to understand, to develop appropriate measures of dealing with them. It is necessary to understand the constraints involved when developing mega-government projects. As Kendrick (2009, p. 40) notes, one of the constraints that government projects face is the problem of finding technical personnel to deal with such projects in the local labor market. Time constrain has been another challenge, and it is common to find some projects being completed behind their schedule. According to Merna and Njiru (2002, p. 34), financial constraints are the biggest challenge that this project faces during the planning and implementation process.

Financial risks pose a serious threat to the success of any governmental project. According to the research by Esty (2004, p. 38), one of the leading reasons why some government projects fail is because there are cases where government officials fail to conduct a comprehensive analysis of the costs of such projects. This scholar says that the success factor of any project is always based on the ability of its financiers to avail the needed financial support within the required time. Government projects are always funded through public coffers. When developing its budget, it should always be clear on the amount of money that may be needed to complete such government projects. Understating this value may put the project management team in an awkward position, especially when the estimated amount of money cannot meet the real cost of implementation. It is the responsibility of the sponsor of such projects to ensure that all the assets needed for the project are delivered in time and the expected quantity. Both the liquid asset and other material assets must be availed as per the agreement. Esty (2004, p. 35) notes that the failure of some projects is always caused by the inability of the sponsor to avail the needed resources within the agreed time. Although the government of Dubai has always been prompt in meeting its obligations in most of the public projects it has been engaged in, it is important to realize that these resources should be made available at the right time to ensure that such projects achieve the intended success.

It is important to critically analyze the impacts of financial risks on governmental projects in Dubai. According to Brigham and Ehrhardt (2011, p. 39), projects have stalled because of financial risks that they are subjected to by either the sponsors or the team trusted with the implementation. Projects can face financial risks because of several reasons. When this happens, Tonnquist (2009, p. 118) says that such projects may face serious negative consequences. One such possible consequence is a delay in the completion of the project. Projects are always implemented to give specific returns after a given period. It is always in the plan that after a specific period, such a project should start giving back returns. The feasibility of a project is always done using such constraints to calculate the pay-back period. However, this becomes problematic when such projects are not completed within the expected time. The project would still be consuming resources at a time when it was expected to start giving out returns. This means that the sponsor would be forced to draw a supplementary budget to cater for the project costs that it had not planned previously.

The planned feasibility analysis of the project would also not hold because the benefits of the project would not be realized at the specified time. As Ehrhardt (2011, p. 39) puts it, the project would deliver a lesser percentage of output as compared to the estimated amount. Another serious impact of financial risks on government projects is a possible total failure of a project. According to Esty (2004, p. 34), government funding is always based on strict budgeting because of the series of approvals that are always needed. Before the government can release financial or any other asset to a given project, several people need to be convinced that the project is viable and able to deliver good results. When a government project faces a financial risk, it can be a major challenge to find the extra funding to make the project complete. The process of approving and releasing such extra funding can take such a long period that it may be difficult to achieve the initially intended result. According to Yescombe (2013, p. 36), this is so because the government has a large portfolio of projects. In its project portfolios, the government will assign each project a given amount of resources. Each project in the portfolio will also be assigned some degree of priority. This means that when one of the projects faces financial risks during its implementation, it may be difficult to have quick access to extra funding from the sponsor. There are cases where the sponsor may fail to give the expected extra funding to enable the project to be completed within the expected time. When this happens, the project will be stalled. Depending on the stage at which it gets stalled, the project can be a partial success or a total failure. Whether it is a partial success or a complete failure, the fact would be that the project would be unable to give out the expected returns. In such instances, the project would be considered a failure because the estimated output would not be met.

The government of Dubai has organized massive projects, some of which have been identified in this research. As mentioned above, some of these projects run cost a hundred billion dollars. Such a level of investment is so massive that a failure cannot be an option. Esty (2004, p. 67) says that most government projects always demand heavy investment. This money comes from the tax earned from the people of Dubai. They expect to benefit from such projects once the government commits any funds to the project. Those who are involved in government projects must understand the high-risk factors involved in their project, especially the financial risks, to define the best approach that can be used to mitigate them. Researchers have given various approaches and theories on the impacts of financial risks on government projects, and how they can be mitigated. Some of these approaches that have been put forth have been successful. However, other approaches have either failed the test of applicability or remain in blueprints because they have not been considered appropriate enough to offer the desired solution.

Theoretical Framework

Government projects have a greater impact not only on the government as the sponsor but also on all other stakeholders within the society. This has made them be seen as major projects whose success has to be guaranteed. According to Nagarajan (2005, p. 18), scholars have made efforts to come up with appropriate models that are focused on managing risks within such projects. Financial risks in government projects have attracted the attention of many theorists, especially due to their massive impact. Some of these theories have been popularly used to manage financial risks in government projects because of their applicability. However, others have not been able to prove useful in managing risks in government projects or other major projects in the private sector.

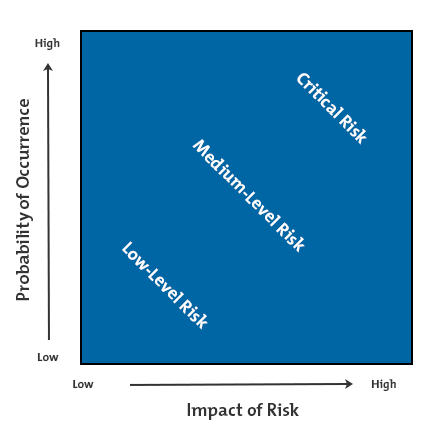

The probability theory is one of the theories that have been considered appropriate in understanding the possible financial risks, and the probable cause of actions that can be taken in mitigating them. Probability theory was developed by Galileo out of a simple dice game (Buljevich 1999, p. 47). He then developed a Mathematical model out of it as a way of explaining the probability of occurrence of given issues. In the contemporary world, probability theory has gained a lot of acceptance in various fields, including in the risk management of projects. As Ehrhardt (2011, p. 88) notes, it is important to realize that probability theory does not state the specific way in which a given risk would occur. However, it gives all the possible occurrences in a given project and the percentage likelihood that such a given incident would occur. The researcher supports the use of this mathematical approach in managing the impacts of financial risks on government projects in Dubai. As Nagarajan (2005, p. 99) states, this approach is always clear in stating all the possible occurrences. The project management team can determine the magnitude of each of the identified risks. If it is confirmed that the probability of a given risk occurring is high and that the consequences of their occurrence are massive, such projects can be forfeited or restricted to make them less risky. When it is confirmed that chances of such risks taking place are relatively low, then such a government project should be given priority. The essence of this theory would be to identify projects with higher risk potential so that they can be restricted to pose lesser levels of threats or be forfeited to avoid the risks. The figure below shows how risks would be assessed using this theory.

Risk Impact/Probability Chart

As shown in the above model, the risk would be categorized as low-level risks, medium-level risks, and critical risks. As Buljevich (1999, p. 48) notes, any project comes with some form of financial risk. It is, therefore, a fact that a firm cannot avoid risks in its operations. The most important thing is to identify the level of risk. This theoretical model helps in identifying these levels. For a project to be considered successful, it should have low-level financial risks. When the risks reach the medium level, the project management team should conduct a thorough reevaluation of the project to minimize the risks. When it is determined that that the project has critical financial risks, such a project should be restricted or forfeited to avoid the associated negative consequences.

Sensitivity analysis is another theoretical approach that has gained popularity in contemporary world management. Sensitivity analysis is not only used in risk management but also in other areas related to project management such as marketing. According to Schniederjans (2002, p. 57), sensitivity analysis has become an appropriate tool in managing financial risks in projects of varying magnitudes. This scholar says that sensitivity analysis is used in placing a value on the possible effect that can result from a change in one of the variables in a project. As Merna (2013, p. 27) notes, sensitivity analysis is always used alongside other risk management tools to determine the appropriateness of given actions. When managing risks using this approach, the project management team would analyze all the variables within the project. The variables will be analyzed to determine the possibility of their occurrence during the process of implementing the project.

The focus, in this case, would be to identify what would happen and when to the entire project when a given variable is changed. For instance, one of the most important variables in a project is the cost of the associated materials needed to complete it or the cost of labor. As Merna (2013, p. 89) notes, it is a fact that such costs always fluctuate with the changing environmental factors. When implementing a government project, one fact that comes out is that they always take a longer period for them to be completed. Some of these projects take as long as seven or even ten years to be brought to completion. When estimating the costs of the projects, the values that are used are always based on the current market forces. It is always easy to ignore the fact that these variables can change significantly as time goes by. For this reason, sensitivity analysis comes up with an explanation of what may happen to the project when one of the variables is changed. As Tonnquist (2009, p. 121) notes, some variables may be changed in a manner that their consequences to the organization can be less destructive. For instance, the deadline that was given by the sponsor can be extended as a way of easing pressure on the implementing agency. This may not have serious negative consequences to the project’s success because the project members would still have the discretion of completing the project at the initially set deadline. However, some variables may have a magnified influence on the project if they are changed during the process of implementation. For instance, changing the cost of labor or materials used in the project may magnify the overall cost of the project. In such cases, the project would be subjected to financial risk that may have a series of consequences to the success of the project. Using sensitivity analysis, the project management team can determine the degree of effect that change of any variable may cause to the project. Although this approach of managing financial risks within a project has been considered appropriate, some critics have considered it as an inappropriate tool that is dependent on other management tools. Merna (2013, p. 46) says that sensitivity analysis can only be used on a single variable independently, and therefore, it cannot be used to understand the comprehensive change in various variables within a project.

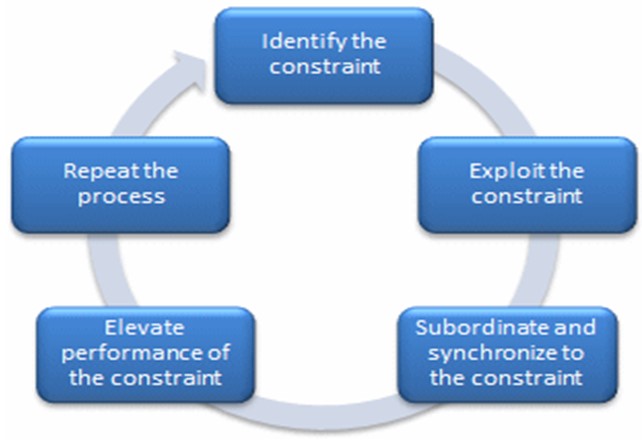

Another popular theory that has been used widely in managing the impact of financial risks in projects is the theory of constraints. This theory holds that the success of any organization or a given project is always inhibited by some constraints. As Yescombe (2013, p. 55) notes, “The Theory of Constraints is based on the premise that a chain will always be as strong as its weakest link.” This scholar further states that success can always be enhanced by addressing these bottlenecks. However minor bottlenecks within an organization will always have the effect of reducing the performance of the organization. In project management, numerous constraints may affect the normal operations of a firm. There are variants of financial constraints that a project may face. For instance, the constraint may be a limited amount of budget assigned to a given project, a delay in making the assigned funds being made available to the project, or the costs of labor or materials rising due to inflation. Irrespective of the nature of the constraints, this theory holds that such constraints must be identified and addressed as soon as possible to eliminate the bottlenecks they pose to the project (Fabozzi 2009, p. 89). This theory holds that when addressing constraints, it is necessary to start by addressing the biggest constraints before moving to others. This is because the biggest constrain is the weakest point of the project. By addressing that weakness, the project becomes more capable to handle various other environmental challenges to achieve the desired success. The theory also explains what should take place at every stage when addressing a single constrain that has been identified. The diagram below shows a framework of this model.

Five Steps in Eliminating Constraints

As shown in the above diagram, when using this approach, the first step would be to identify the main constrain that could be inhibiting success in the project. As Buljevich (1999, p. 83) notes, this can be done in a brainstorming session among the project team members. At every step, the focus would be to identify a single constraint that has the greatest negative impact. When the constraint is identified, the project management team would exploit it. The team would try to get the best out of the constraint. The team would then subordinate all other processes to ensure that this constraint is aligned to the current system in the organization to improve the performance of the constraint. The fourth stage is the elevation of the performance. of the constraint. This would involve making any necessary changes that would help in increasing the capacity of the constraint. The last stage is to assess the success achieved, and if the constraint is not addressed as was expected, the team would need to go back to step one and start all over again. If the process is successful, the team would identify the next most pressing constraint and address it using the same approach (Pinto & Venkataraman, 2013, p. 90). Although it is not the most appropriate strategy to use, the Theory of Constraints can be used to address some of the financial constraints within a project before they cause serious consequences to an organization. This theory will help in the early detection of the constraints, and this would help in finding the right answers before they affect a project negatively.

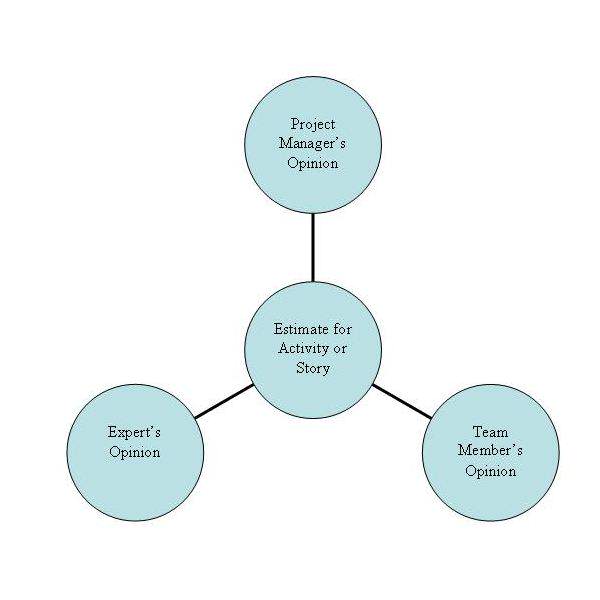

Delphi Method is another process that has widely been used to manage risks in a project. According to Smith (2006, p. 67), some of the financial risks that are always experienced in government projects are caused by a lack of consensus from relevant stakeholders on the appropriate strategy that should be taken when handling various issues. Different people have different skills and approaches they can use to determine some of the financial consequences when a given path is taken by the organization. It is important to note that dealing with these problems may require the collective work of all the individuals within an organization. This is so because some of the easily ignored groups have always proven to have superior ideas when dealing with various issues within an organization. This approach holds that different groups of people should be allowed to work independently to arrive at a given desirable answer. As shown in the framework below, this approach has three categories of people who will be expected to work independently when seeking solutions to financial risk factors within a project. The three groups as identified in the framework include the project manager, the project team members, and the experts. Each team would converge their ideas, and until all the three parties have a converging solution, any project implementation process may be halted.

Some scholars have, however, criticized this approach of managing the financial risks within a project to minimize their impact. According to Yescombe (2013, p. 112), this approach assumes that the three groups have an equal capacity of coming up with the right solution, and therefore, gives them equal weight. However, this is not always the case. Experts are always better placed to find a solution to financial risks within a project. For them to be referred to as experts, means that they have years of experience in handling related issues. They should always be allowed to guide the thinking of the project manager and project team members instead of letting each unit work independently. Some scholars have also argued that it is not a time-conscious approach in managing project risks. However, the researcher believes that when handling mega government projects, it may be necessary to use this strategy. This is so because it allows all the stakeholders responsible for the project to appreciate that effort of everyone is needed. It also helps them realize that they are responsible for all the activities that take place within the organization.

Conceptual Framework

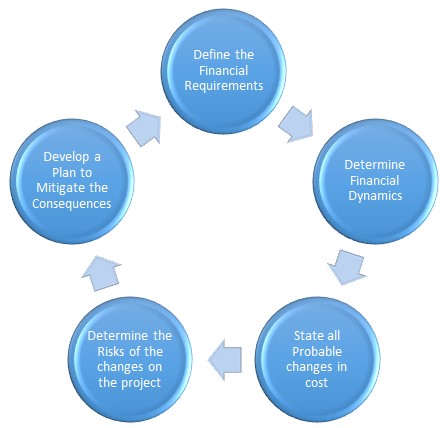

Dubai’s government has committed a lot of resources to various projects that are meant to improve the face of this city. According to Delmon and Delmon (2009, p. 73), the government of Dubai has succeeded in initiating several prosperous projects in the past. However, Ahmed (1999, p. 56) attributes the past success to the fact that the government was willing and able to give more funding even when the initial budget was surpassed. Burj Khalifa was one such project that this scholar mentioned as one that went beyond the initial budget, but the government was willing to increase the funding. However, the current economic condition may not permit this government to do this, especially given the magnitude of these projects. This, therefore, requires a high degree of financial discipline on the side of the participating members of these government projects. It is important to understand how to mitigate the impact of financial risks on government projects that are yet to be implemented. This conceptual framework tries to identify how financial risks on government projects can be managed to eliminate their negative consequences. The framework below shows some of the steps that can be taken by the implementation team to identify and eliminate financial risks that may arise in these government projects.

The conceptualized framework above shows some of the specific activities that the project management team would need to perform to eliminate financial risk factors on a government project. It is necessary to note that this is a proactive plan that is defined before the onset of the project. All the activities identified in this framework take place before the project is launched. The first step would be to define all the financial needs of the project. The donor would be informed of the estimated costs of the project. The project management team will then work with experts to determine some of the expected dynamism in the market. This would involve determining possible economic changes that may take place such as inflation. The team will then specify some of the possible effects of economic changes on the cost of the project. The team would then determine how these changed costs pose direct or indirect risks to the project. The team would then define a plan that could be used to manage these risks. This way, it would be easy to reduce the negative impact of financial risks on a government project in Dubai.

Research Methodology

The methodology section will focus on aspects of research development. It is the overview of chapter three of this research where the methodology is discussed in detail. It describes methods of collecting data, their analysis, and the presentation. Every research applies a given research approach to achieve its specific objectives depending on the set goals. Powell (2010, p. 56) notes that in research, design deals with aims, purposes, uses, intentions, and plans within the practical constraints of time, money, location, and the staff. In this research study, respondents will be adequately briefed in advance. The sampled group will be amicably informed, to make them prepared for this study. The briefing is always important because it enhances the reliability of a study. It is ethical to notify the sampled population before one can research on them (Taylor 2005, p. 78). The results would be made available to the researchers as a way of ensuring that the study is moral. The researcher will observe research ethics by avoiding any form of bias when collecting data.

This research will use quantitative research methods when conducting the study and in data collection. Quantitative research is appropriate because it seeks to summarize data mathematically. According to Proulx (2011, p. 27), Quantitative methods are a systematic investigation of a given social phenomenon or phenomena through mathematical, statistical, or computational techniques. A quantitative research study utilizes figures to reach certain conclusions. In this respect, the research will assume a survey form, whereby the researcher will identify specific individuals, and send them questionnaires. The sampled population will be selected through stratified sampling as a way of eliminating biases. The researcher will then make necessary follow-ups by calling respondents on phone (Wamia 2005, p. 80). This study shall provide an opportunity to understand some of the financial risks that a project may face, and determine the magnitude of their impact. It would also offer the best approach that can be taken by the concerned parties to mitigate the risks to ensure that government projects meet their intended goals (Vogt 2007, p. 91).

In every research, it is always important to ensure that there is reliability in the tools used to gather research. It refers to the ability of research instruments used to produce results that are in agreement with theoretical and conceptual values. In this study, this was achieved through increasing the verifiability of perspective and using statistical tools to verify reliability. Schniederjans (2002, p. 45) notes that the validity of a study is determined by what a research study claims it measures and the availability of logical errors in the conclusion drawn from the study. This scholar further explains that internal validity is the extent to which it is possible to come up with an independent reference from the finding of a study, especially if the independent variable influences the dependent variable (Rodgers & Maryanne 2003, p. 98). On the other hand, external validity is the general application of the research findings of a study to other settings. The next chapter will deal with the methodology used in this research in detail.

Conclusion

The success of government projects always depends on the successful planning, management, and adequate forecasting of all project deliverables. It is important to identify various constraints that may have a direct impact on the success of a project and define the best approach that can be used to deal with them. This research has demonstrated that the impact of financial risks on the government projects in Dubai can be very devastating, especially when measures are not taken to control them in time. Projects may face financial risks because of several reasons. One of the main reasons that may cause financial risks within a project is the changing economic environment within a country. Issues such as inflation always have the effect of increasing the cost of undertaking a given project. Such inflation increases the price of both labor and materials needed for normal operations. Another possible cause of financial risks in government projects can be the source of funding. The main source of funding in government projects comes from public coffers. The government may fail to avail the needed liquid and material assets to the project team members in good time. This would delay such projects, making it difficult to achieve the originally planned objectives at the right time.

When these financial risks are not mitigated in good time, there can be a series of consequences that may be faced in the project. As demonstrated in the above discussion, some projects have completely stalled in the past due to financial risks they faced during their implementation. The discussion above also shows that some projects may also be completed, but not as per the specification. When a government project is approved, there is always a specific expectation that it is expected to meet upon its completion. The government authorities approving would base their judgments on the proposed benefits of the project. However, when the outcome fails to meet the initially stated standards, then it becomes impossible to meet the stated objectives. This would mean that such a project’s rate of return will be below the expected levels. For this reason, it is very important for the project manager and project members involved in government projects to understand these financial risks early enough, define the best strategy for tackling them, and implement that strategy in the best way possible. This would help in reducing the negative impacts such financial risks may have on a project.

List of References

Ahmed, P 1999, Project finance in developing countries, The World Bank, Washington.

Boussabaine, H 2013, Risk pricing strategies for public-private partnership projects, Cengage, New York.

Brigham, E & Ehrhardt, M 2011, Financial management: Theory and practice, South-Western Cengage Learning, Mason.

Buljevich, E 1999, Project financing and the international financial markets, Klwuer Academic, Boston.

Burtonshaw-Gunn, S 2009, Risk and financial management in construction, Gower, Farnham.

Delmon, J & Delmon, B 2009, Private sector investment in infrastructure: Project finance, PPP projects and risks, Kluwer Law International, Alphen Aan Den Rijn.

Esty, B 2004, Modern project finance: A casebook, Wiley, Hoboken.

Fabozzi, J 2009, Finance: Financial Markets, Business Finance, and Asset Management, John Wiley & Sons, New Jersey.

Field, M & Keller, L 1998, Project management, International Thomson Business Press, London.

Fight, A 2005, Introduction to Project Finance, Elsevier, Burlington.

Gatti, S 2013, Project finance in theory and practice: Designing, structuring, and financing private and public projects, Academic Press, New York.

Gido, J & Clements, J 2009, Successful project management, South-Western Cengage Learning, Mason.

Haynes, M 2002, Project management: Practical tools for success, Crisp Learning, Menlo Park.

Kendrick, T 2009, Identifying and managing project risk: Essential tools for failure-proofing your project, AMACON, New York.

Kerzner, H 2013, Project management: A systems approach to planning, scheduling, and controlling, John Wiley & Sons, Hoboken.

Meredith, J & Mantel, S 2012, Project management: A managerial approach, Wiley, Hoboken.

Merna, T & Njiru, C 2002, Financing infrastructure projects, Thomas Telford, London.

Merna, T 2013, Corporate risk management, Wiley, Hoboken.

Nagarajan, K 2005, Project management, New Age International, New Delhi.

Pinto, J & Venkataraman, R 2013, Cost and value management in projects, Wiley, Hoboken.

Powell, G 2010, Understanding Quantitative Research Methods, SAGE, London.

Proulx, T 2011, Modal Analysis Topics, Volume 3: Proceedings of the 29th IMac, a Conference, Springer New York.

Rodgers, S & Maryanne, H 2003, Gender and E-commerce: An exploratory study, Cengage, New York.

Schniederjans, M 2002, E-Commerce operations management, World Scientific, Danvers.

Smith, N 2006, Managing Risk in Construction Projects, Blackwell Publishers, Oxford.

Taylor, G 2005, Integrating qualitative and quantitative methods in research, University Press of America, Lanham.

Tonnquist, B 2009, Project management: A complete guide, Academica, Aarhus.

Vogt, P 2007, Quantitative Research Methods for Professionals Author, Pearson, New York.

Wamia, G 2005, Quantitative methods in research, University Press of America, Lanham.

Yescombe, E 2013, Principles of Project Finance, Elsevier Science, Burlington.