Introduction

Macau was established by the Portuguese in 1557, and the Macau-Portuguese authorities first legalized gambling in 1847. The monopolies acquired exclusive rights to the industry in 1937. The Sociedade de Turismo e Diversoes de Macau (STDM) won a monopoly concession in 1962 and obtained dominance of the gaming industry in the Portuguese enclave for 40 years.

Ensuing Macau’s reversion to China in 1999, the government moved to end decades of monopoly controlled by STDM. Macau officially initiated bidding for the operation of casino games to companies who were financially capable of taking part in the tendering process. At last, the concession was given to three; one license was awarded to Sociedade de Jogos de Macau(SJM) for 18 years, which is a subsidiary of STDM, and the other two were awarded to Wynn Resorts and a joint venture between Hong Kong-based Galaxy Resorts and Venetian Macau for 20 years, a subsidiary of Las Vegas Sands. This decision profoundly changed the future of Macau.

The Chinese had internalized gaming, with some asserting that the desire to gamble and win is natural. However, the mainland government only legalized national lotteries and internet gambling when done at home. In addition, in Hong Kong, only lotteries and horse races organized by the Hong Kong Jockey Club, or betting at licensed mah jong centers and restaurants are authorized. For this reason, “Macau is the only place in China for legal participation in a variety of public gambling” (Macau Gaming Revenues Are out of Sight, 2006).

Due to the phenomenal economic growth in China, Macau has gone beyond Las Vegas and Atlantic City by gaming revenue in recent years, and became the world’s pre-eminent gaming destination (McCartney, 2008). However, Macau’s advantageous market position is confronted with challenges with Singapore legalizing casino gaming and opening bids to US companies to build casinos on Sentosa Island. Other competing gaming destinations such as the Penghu Island of Taiwan and Thailand threaten Macau’s gaming revenue growth stability.

Due to the possibility of similarity between what is offered by Makau, Singapore, Penghu and Thailand, there’s need for Makau’s differentiation from other casinos in the gaming industry to maintain as a destination with distinctiveness. “The MICE (meeting, incentives, conventions, exhibitions) tourism has been introduced at high-yield tourism destinations such as Las Vegas and has gradually become an important focus and direction of resources for the Macau government” (McCartney, 2008). We will examine “Macau’s strengths, weaknesses, opportunities, and threats (SWOT analysis) associated with the tourism development in this area” (McCartney, 2008). Since Singapore is the leading of MICE industry in the region, we need to take the advantages of Macau to reposition itself to develop the MICE industry, and propose suggestions on economic justification, tourism policy considerations, and development for Macau being a world-class gaming destination.

Literature Review #1

By mid 2008 Macau had surpassed the gaming revenues of Las Vegas and Atlantic City combined (Destination Macau, 2008). Taxation from gaming revenues reported almost 80% of its public revenue (Macao Statistics and Census Service, 2008b). “Among the challenges facing Makau is the changing of its tourism destination image perceptions from being not only a gaming destination but also an attractive convention and exhibition destination”(Destination Macau, 2008).

It is cited that meeting and conventions are some of the fastest growing segments within tourism (Weber & Ladkin, 2003). An attractive MICE location has become a major objective by an increasing number of destinations. Choice of destination is affected by internal factors such as image perceptions, motives and attitudes to external factors such as time availability and perceived costs (Baloglu & McCleary, 1999).

In 2007, The Venetian opened in the Cotai Strip inspired by The Venetian in Las Vegas, providing a momentum for those wishing to position Macau as an elite MICE destination (Nadkarni & Leong, 2007). The Venetian on the Cotai Strip has been developed with the convention model in mind, while other Macau casino operators at present have limited meeting facilities with a focus on gaming tourism (McCartney, 2008). Nadkarni and Leong (2007) mention that, given the gaming, entertainment, and leisure components coupled with the developing MICE facilities, this will create a competitive advantage for Macau over regional destinations, yielding higher-spending business tourist.

As above mentioned, the success of the MICE industry is based on the internal and external factors. However, Macau has limited space and unsound infrastructure. The Tourism Area Life Cycle (Butler, 1980) is discussed, showing the possibility of destination stagnation and decline should the destination reach capacity limits. Nadkarni and Leong (2007) also warn of the lack of trained professionals in Macau for the MICE industry and that the educational system is not equipped to handle this sudden increase in the human resource needs in the hospitality industry.

The issue of casinos embracing convention tourism is a relatively new concept, with little research and analysis done on this unlikely marriage (Fenich and Hashimoto, 2004). We, however, notice that Las Vegas as a gaming destination succeeds in combining the CAT and the MICE industries. Therefore, the degree to which Macau’s model will follow the Las Vegas style would require closer examination and input (Glenn McCartney, 2008).

Literature Review #2

According to the Union of International Associations (UIA), “Singapore has been the top convention destination since Asia in 1996 and today ranks in the top ten in the world since 1982 and is one of the competitors for Macau’s MICE industry in Asia region”.

Crouch and Ritchie (1998) identified the following factors as key in the site selections process: accessibility, local support, extra-conference opportunities, accommodation facilities, and meeting facilities. An evaluation of Singapore’s MICE industry success, particularly the rapid modernization of its infrastructure, management, and economy after gaining independence from United Kingdom in 1963 and from Malaysia in 1965 shows a great achievement. However, it has some weaknesses as well, including limited entertainment and cultural attractions, competitors coming out in Asia, as well as a number of challenges, including its high costs and a dearth of scenic and cultural activities (Lew & Chang, 1999).

Singapore also lacks a sufficient number of internationally recognized events. Further analysis shows that “much of Singapore’s success has been based on regional meetings, rather than global events” (Lew & Chang, 1999). In addition, the biggest complaint is the lack of traditional ethnic cultural attractions, which seem to have been subsumed by the country’s push toward modernization (Lew, 1998).

In addition to Singapore, the Chinese influence has a big impact on the gaming in Macau. Recently, the Chinese government released restrictions about mainland people travel to Macau, bringing in more visitors to Macau. Compared to Las Vegas, Macau’s position is quite obvious. Following the Venetian Macau established in 2007 and the Cotai Strip alliance with some famous hotel chains, casino owner focus on MICE industry in order to advance visitors volume and advance the weekday hotel occupancy. Consider Hong Kong is well-known for a major entertainment, convention, shopping and recreation destination in Asia. There is a propose to construct a bridge between the two destinations, if the project carries out, travel time between Hong Kong and Macau “will be extremely reduced and competition for non-gaming tourism between the two cities may further intensify” (Gu, 2004). As a result, Macau needs to integrate with Hong Kong since it is around 40 miles away from Hong Kong, not be a rival with Hong Kong. A model of “Gaming in Macau and non-gaming in Hong Kong” will benefit both cities. (Gu, 2004).

“Since Singapore’s MICE industry has been the top convention destination in Asia and today ranks among the top ten in the world, Singapore’s success has been based on regional meetings, rather than global events” (Lew, 1999), Singapore’s government enthusiastically legalized gaming and open bidding for US casino companies to build Las Vegas style casino in order to accelerate visitors’ volume and to accelerate MICE industry globally. Macau needs to utilize its advantages and learn western casinos’ experiences in MICE industry to be a leader of MICE business in Asia. Only to consolidate VIP market and MICE industry can expand Macau’s revenue growth and stand stably on its position.

Literature Review #3

For a tourism destination, “the purpose of revenue management is to maximize the amount and minimize the risk of tourism revenue” (Gu, 2006). Macau needs to take its advantages to keeps the revenues growth via product differentiation when faced with many competitors coming out in Asia region. In addition, Macau should “distinguish itself from other competing destinations by differentiated gaming service products and enhancing its traditional VIP room operations is an effective way to achieve this goal” (Gu, 2006). “Macau can also preserve its risk-taker market and minimize the revenue risk posed by upcoming competition in the region” (Gu, 2006).

In recent years, Macau’s gaming revenues has steadily increased, largely due to the phenomenal economic growth in China, its main tourist-feeder market (Gu, 2004). The strong growth momentum of its gaming revenue demonstrates the profitable market position that Macau is enjoying in Asia (Gu, 2006). However, Singapore still remains Macau’s greatest competitor.

People tend to become more risk taking in the process of becoming wealthier, and nations with fast-growing economies are likely to be premium markets for casinos (Gu, 1996). China’s economy has been growing at an amazing speed in recent years, and the rising disposable income of the Chinese has nourished numerous new risk-taking gamblers for Macau casinos (Gu, 2006). In 2004, “Macau casino gaming revenue reached US$5bn, just US$0.3bn shy of the gaming revenue achieved by Las Vegas Strip casinos” (Macau gaming Control Bureau, 2005). “The strong growth momentum of its gaming revenue demonstrates the profitable market position that Macau is enjoying in Asia” (Gu, 2006).

However, Macau’s is faced with the most competitor, Singapore, which legalized gaming and opened bids on two casino resorts to be built in Singapore (Macau Daily, 2005). This article provides some strategic revenue management issues related to the long-term success of Macau as a gaming destination in Asia.

First of all, revenue risk is due to gaming proliferation (Gu, 2006), not only Singapore would be the competitor that Macau will encounter, but also some destinations are coming out in Asia such as the Penghu Island of Taiwan and Thailand, threatening Macau’s gaming revenue growth stability. Besides, Chakravorty (2005) points out that “future gaming supply in Macau may not be able to generate enough gaming revenue if the ongoing casino constructions in Macau are not matched by enough incremental visitor volume to accommodate in the future”. Gaming proliferation will eventually lead to market saturation and make it hard for Macau to increase its visitor volume needed for the increased gaming supply, thus endangering its thriving casino industry (Gu, 2006).

Second, revenue risk from product homogeneity (Gu, 2006). If all the destinations followed by Las Vegas style, each of them would be a threat to each other, and make the gaming competition in the region even worse. The Cotai Strip is regarded as Asia’s Las Vegas Strip, which included several worldwide hotel chains cooperate with Las Vegas Sands Corp. to build a tourist and convention/exhibition destination in Asia.

Third, lowering risk by maintaining destination distinctiveness (Gu, 2006). Macau can’t stop gaming proliferation in the region, but Macau can lower risk by product differentiation. Unlike Las Vegas focus on mass market, the Macau market is dominated by risk-taking gaming players, rather than tourists who just occasionally play in casinos. Gu (1996) identifies risk-taking players as the most valuable customers for casinos, because they contribute the most to a casino’s gaming revenue. Macau should distinguish itself by taking full advantage of its VIP market nature from other Asian destinations which plan to follow Las Vegas gaming style (Gu, 2006).

Literature Review #4

Previously, Macau’s casinos, though highly lucrative, were generally small, unimpressive and were hurt by violence and organized crimes in the past (Strow, 2002a). With some concessions given to western casinos operators, one to Stanley Ho’s SJM, the other two given to US gaming companies, Wynn Resorts, Inc and Las Vegas Sands Inc (Wong, 2002; Yu, 2004). The issuance of gaming licenses to US companies was widely acclaimed as a move on the part of the Macau SAR (the Special Administrative Region) Government to bring in competition and turn Macau into a Las Vegas style gambling destination. So far, no doubts have been raised on Macau following Las Vegas style.

Macau’s situation in the heart of the Pacific Rim location is an obvious advantage of Macau’s gaming industry. Macau’s unique Portuguese culture is another advantage; Macau can build Chinese – or Portuguese – theme casinos to distinguish itself culturally from Las Vegas and other gaming destinations, hence create its own unique model (Gu, 2004). Besides, Macau is the only legalized jurisdiction in China; the China Government does not have plans to legalize other jurisdictions of China any time soon. Therefore, Macau will face no competition from any part of the Chinese mainland in terms of casino gaming (Gu, 2004). However, due to a consequence of gaming monopoly of more than two decades, Macau’s management skills and customer services are not comparable to Las Vegas’ (Gu, 2004).

Moreover, limited space is a major problem for Macau’s gaming development; Macau has very limited available space to develop massive entertainment, convention, shopping and recreation services. Therefore, Las Vegas style is not suitable in it.

Las Vegas focus is on non-gaming segmentation because visitors are largely entertainment-seekers. In addition, Las Vegas market shows market saturation due to its intense competition among Strip casinos (Ader, Falcone & Steinberg, 1998), Las Vegas needs to focus on non-gaming attractions or service to compete for clients. Macau thus far has not experienced any market saturation thanks to the booming Chinese economy and a lack of competition (Gu, 2004).

Hong Kong, which is about 40 miles away from Macau, has positioned itself as a major entertainment, convention, shopping, and recreation destination in Asia and is likely to be rivaled by Macau.

This article uses SWOT analysis of Macau’s gaming industry, and “shows that copying the Las Vegas style is non-optimal for Macau because it will force Macau to compete with Las Vegas and other Las Vegas style Asian gaming destinations and fight with Hong Kong for non-gaming tourists in the future” (Gu, 2004).

Theory

It has been cited that within tourism, meetings and conventions are one of the fastest growing segments (Weber & Ladkin, 2003; Oppermann, 1996; Oppermann &Chon, 1997). The chief explanation is the economic benefits for the destination and community as well as improving image (Opperman, 1996). The primary assertion in order to constructing convention centers is the economic impact of delegates spending more, staying longer, and not simply spending on hotel and restaurants but on leisure activities such as retail, events, and visits to local attractions such as museums and theaters (Clark, 2004); non-economic factors such as social, environmental, cultural, and destination image impacts. Moreover, marketing, infrastructure, human resource management, and service quality issues are most important parts of MICE industry.

Major Macau casino revenue is from gaming revenue (about 97%), 72% revenue of gaming revenue is from VIP market and the remnant 28% is from mass market. Due to “Macao’s lure of being a high-yield tourism sector, it is a key aim of the Macau Government to develop Macau into a major leisure and entertainment center, widening and expanding its tourism market segment beyond gaming” (McCartney, 2008).

The special economic zone, Zhuhai, working in the exhibition trade and the large population size can be factors to assist MICE growth (McCartney, 2008). Besides, Hong Kong is well-known as a major entertainment, convention, shopping and recreation destination in Asia. A model of “Gaming in Macau and non-gaming in Hong Kong” will benefit both cities (Gu, 2004).

Except for enhancing Macau’s traditional VIP room operations, Macau is trying to emulate Las Vegas convention style and reposition itself on MICE industry. “Implementing such a revenue management strategy, Macau will be able to preserve its risk-taker market and minimize the revenue risk posed by upcoming competition in the region” (Gu, 2005).

Research Methodology

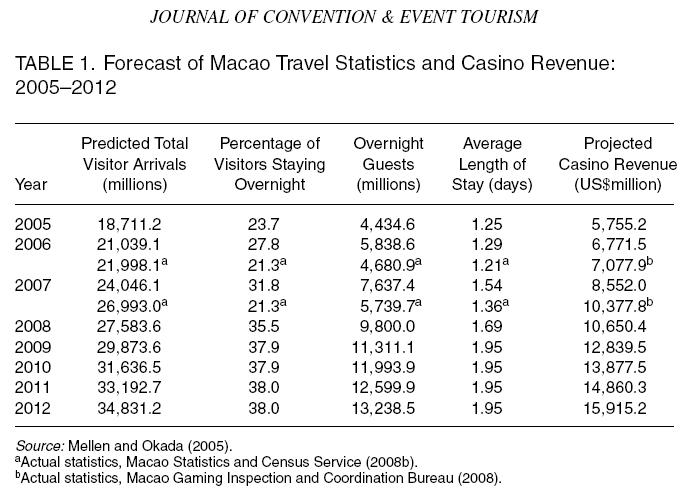

SWOT analysis will be used to build a new Macau’s model which is different from Las Vegas casinos and other gaming destinations in Asia. We will also use case studies to explore the background of Macau gaming industry and the government’s regulation and policies affecting Macau’s gaming operations. Combined quantitative and qualitative evaluation of Macau’s annual gaming revenue, VIP market and mass market revenue, existing visitors spending, and visitor arrivals will also be applied to show Macau’s revenue growth. The table below presents information on performance of Macau casinos (Report by: Gaming Inspection and Coordination Bureau).

The articles show Macau’s authorization of concessions to some US gaming companies, and how the casino owners brought the Las Vegas style casinos into Macau. In recent years, China’s economy has grown faster with the Chinese government recently releasing restrictions about mainland people travelling to Macau thus bringing in more visitors to Macau. It is observed that Macau needs to integrate with Hong Kong since they are only 40 miles apart. A model of “Gaming in Macau and non-gaming in Hong Kong” will benefit both cities. (Gu, 2004).

“Singapore’s MICE industry has been the top convention destination in Asia and today ranks among the top ten in the world” (Gu, 2004). However, Singapore’s success has been based on regional meetings, rather than global events (Lew, 1999), Singapore’s government enthusiastically legalized gaming and open bidding for US casino companies to build Las Vegas style casino in order to accelerate visitors’ volume and to accelerate MICE industry globally. Macau needs to utilize its advantages and learn western casinos’ experiences in MICE industry to be a leader of MICE business in Asia by consolidating VIP market and MICE industry to expand its revenue growth and stand stably on its position.

Operational Definition

Meeting – “general term indicating the coming together of a number of people in one place, to confer or carry out a particular activity” (Free online Dictionary, 2010)

Incentive – “meeting event as part of a program which is offered to its participants to reward a previous performance” (Free online Dictionary, 2010)

Conference – participatory meeting designed for discussion, fact-finding, problem solving and consultation.

Exhibition – Events at which products and services are displayed.

(ICCA – International Congress & Convention Association)

Mass Market – In casino industry, mass market means slot machine and table games segmentation rather than high-roller (VIP) segmentation. (BusinessDictionary.com)

VIP Market (high-roller) – Gambler gambles rashly or for high stakes or called risk-taking player. (The Free Online dictionary, 2010)

Owned events (MICE industry) – events that are internationally recognized to exist each year

Independent Variable

Location – Macau is situated in the heart of the Pacific Rim and it only 40 miles away from Hong Kong

Government’s regulation and policy – Macau is the only Chinese jurisdiction which legalized gaming and speaking the same language.

Macau’s operations – Macau can’t develop non-gaming segmentation due to its limited space. However, Hong Kong has been regard as entertainment destination. VIP market – Macau’s casinos revenue of about 97% comes from gaming segmentation, 72% of gaming revenue from VIP market, 28% of gaming revenues from mass market wit VIP market clients being Asians.

Dependent Variable

Competitors – Many Las Vegas operators look forward to establishing Las Vegas style destination in Asia such as Singapore, Penghu Island of Taiwan, and Thailand.

MICE market in Singapore – “Singapore’s MICE industry has been the top convention destination in Asia and today ranks among the top ten in the world” (Lew, 1999).

Professional Implications

On the basis of these articles, and SWOT analysis of Macau’s gaming industry, Macau needs to differentiate itself from Las Vegas and other destinations which follow Las Vegas style. The best suggestion is to stabilize Macau high-profitability VIP market and reposition itself into convention tourism. The economy of China has growing up recently, according to Friedman and Savage’s (1948) theory on choice involving risk, people tend to become risk-taking when they are becoming wealthier. Mainland people are likely to be premium players of Macau’s VIP market.

By product differentiation, Macau can keep its revenues growth and avoid cut-throat competition. Although Singapore has been the leading MICE industry in Asia since 1983, lots of complaints come out since Singapore lacks cultural heritage and attractions. Macau used to be a clave of the Portuguese; it has a unique culture than other gaming destinations. In competing with Singapore, Macau needs to alliance with The Best Cities Global Alliance (McCartney, 2008). Macau’s location is an obvious advantage for tourism destination and MICE industry since it is close to the special economic zone, Zhahai, as well as Hong Kong.

Macau can create its own model by product differentiation, and along with other advantages such as location, China prosperous economy, the integrated Cotai Strip, and Portuguese culture.

Although Singapore has been the leading MICE industry in Asia since 1983, lots of complaints coming out due to Singapore lacks culture heritage and attractions. Macau used to be a clave of the Portuguese; it has a unique culture than other gaming destinations. Compete with Singapore, Macau needs to alliance with The Best Cities Global Alliance, which is the “world’s first and only convention bureau alliance with eight partners in five continents” (Best Cities Global Alliance, 2008), creates a development plan and image of the city incorporating rich cultural history, having a specific promotional program, service quality training for those in tourism, and modernizing or introducing infrastructure and transportation facilities to effectively support this development (Glenn, 2008).

Macau’s location is an obvious advantage for tourism destination and MICE industry. Macau is closed to the special economic zone, Zhahai, and closed to Hong Kong, well-known as a major entertainment in Asia and it is just 40 miles away from Macau. Due to limited space in Macau, Macau doesn’t have space to develop non-gaming segmentation. A model of gaming in Macau and non-gaming in Hong Kong will not pit Macau be a rival to Hong Kong. In addition, as mentioned before, there are some important factors to be a MICE destination, marketing, infrastructure, human resource management, and service quality issues. To strengthen infrastructure among these prosper cities will benefit Macau’s MICE industry.

Macau creates its own model by product differentiation, and along with Macau’s advantages such as location, China prosper economy, the integrated Cotai Strip, Portuguese culture. A unique Macau model will make Macau a unique gaming destination that will thrive for a long time.

Limitation

McCartney (2008) discusses social carrying capacity thresholds for Macau and the need to limit social, environment, and economic impacts on the local community. The infrastructure development is a quite significant component of MICE industry, the possibility of destination stagnation and decline should the destination reach capacity limits (Butler, 1980). There are problems such as insufficient parking space, traffic jam, and overcrowding at the tourism attraction points.

Moreover, with The Cotai Strip opening, an integrated resort combined with convention and exhibition-based destination, the educational system is not equipped to handle this sudden increase in the human resource needs in the hospitality industry as a whole. Due to MICE market requiring higher levels of service, Macau’s hospitality industry faces issues of declining standards due to a lack of qualified personnel and internationally certified training programs.

Government policy and regulation are also other issues that Macau will encounter. Although the government does not have any plan to legalize casinos in other places soon, the high-profit gaming revenue results in high taxation revenue.

MICE market and the CAT (casino tourism) have been successfully demonstrated in Las Vegas. However, it is still a new concept to bring into Macau because of different cultures and environment. Macau lacks an empirical research conducted on the performance of convention over time, and can only learn from US companies’ experiences and adjust it to its market.

Future Research

The most significant exogenous forces that will influence the country’s future MICE activities is the increasing globalization of travel and tourism, accompanied by a trend towards increasing numbers of international meetings, conventions, exhibitions and incentive trips. Due to the booming China economy, tourism and travel will continue to increase globally and especially within the Asia-Pacific region. Social infrastructure development and transportation between cities such as Hong Kong and the specific economic zone, Zhuhai, and Macau are quite important to assist MICE industry in Macau. Moreover, in order to be a world-class destination in Macau, it needs to bring in qualified personnel and internationally certified training programs to international level.

Due to limited space in Macau, proper use of the land without threatening the quality of life of Macau residents is very important. The government regulation and policy are also significant for the stabilization of her gaming revenue and MICE market in mainland China. Because MICE industry is a new entry to Macau, it still lacks empirical research conducted on the performance convention centers. Macau requires constant monitoring to allow for any corrective measures to achieve an optimum mix of travelers to keep its revenue growth in a long term.

References

Ader, J., Falcone, M. and Steinberg, A. (1998). Global Gaming Almanac. New York: Bear Stearns & Co.

Baloglu, S., & McCleary, K. W. (1999). A model of destination image formation. Annals of Tourism Research, 26, 868–897.

Butler, R. W. (1980). The concept of a tourist area cycle of evolution. The Canadian Geographer, 24(1), 5–12.

Chakravorty, J. (2005) ‘Las Vegas Sands shareshit new low on Asia fears’, Reuters News, Web.

Chang, T.C., Low, L. and Raguraman, K. 1998. Singapore: Total Business Environment for Business Travellers, unpublished Interim Report of Tourism Unlimited Project, Singapore: NUS and STB.

Chang, T.C. 1998. Regionalism and Tourism: Exploring Integral Links in Singapore. Asia Pacific Viewpoint 39(1):73-94.

Crouch, G.I. and Ritchie, J.R.B. 1998. Convention Site Selection Research: A Review, Conceptual Model, and Propositional Framework. Journal of Convention and Exhibition Management 1(1):49-69.

Echtner, M. C., & Ritchie, J. R. B. (1991). The meaning and measurement of destination image. Journal of Tourism Studies, 2(2), 2–12.

Fenich, G. G., & Hashimoto, K. (2004). Casinos and conventions: Strange bedfellows. Journal of Convention and Event Tourism, 6(1/2), 63–79.

Friedman, M. and Savage, L. (1948). The utility analysis of choice involving risk, Journal of Political Economies. 56(4), pp. 279–304.

Gu, Z. (1996) ‘Utility analysis of gaming motivation’, The Gaming Industry: Introduction and Perspectives, Chapter 11, Faculty of International Gaming Institute, College of Hotel Administration, University of Nevada, Las Vegas/John Wiley, New York, 235–250.

Gu, Z. (2002). Performance gap between US and European casino operations: A comparative study, Gaming Research & Review Journal, 6(2), pp. 53–62

Gu, Z. (2004) ‘Macau gaming: copying the Las Vegas style or creating a Macau model’? Asia Pacific Journal of Tourism Research, 9, 1, 89–96.

Gu, Z. (2006). Product differentiation: Key to Macau’s gaming revenue growth. Journal of Revenue and Pricing Management, 4(4), 382-388

Lew, A.A. 1998. Tourism and Quality of Life in Cities: Friend or Foe? Proceedings of the First International Conference on Quality of Life in Cities–Issues and Perspectives, 4-6 March 1998, Singapore, pp. 431-39.

Lew, Alan A. and Chang, T. C.(1999)’Where the World Meets’,Journal of Convention & Exhibition Management,1:4,17 — 36

Macau Gaming Control Bureau (2005) ‘2004 Macau casino operation results’, Web.

Macau Gaming Revenues Are Out of Sight (2006). Asia Case Research Centre, The University of Hong Kong.

Macao Statistics & Census Service. (2008b). 2007 Macao in figures. Web.

Macau Business. (2007). Macau milestone. pp. 36–37.

Macau Business. (2008a). Gotcha! Web.

McCartney, Glenn(2008)’The CAT (Casino Tourism) and the MICE (Meetings, Incentives, Conventions, Exhibitions):Key Development Considerations for the Convention and Exhibition Industry in Macao’,Journal of Convention & EventTourism,9:4,293 — 308.

Nadkarni, S., & Leong, A. M. W. (2007). Macao’s MICE dreams: Opportunities and challenges. International Journal of Event Management Research, 3(2), 47–57.

Nevada Gaming Control Board (2002). Nevada Gaming Abstract. Las Vegas.

Opperman, M. (1996). Convention destination images: Analysis of association meeting planners’ perceptions. Tourism Management, 17(3), 175–182.

Opperman, M., & Chon, K.-S. (1997). Convention participation decision-making process. Annals of Tourism Research, 24(1), 178–191.

Pride W. and Ferrell, O. (2000) Marketing Concepts and Strategies Houghton Mifflin, New York.

Smith, R. (2005) ‘Inside gaming: analyst wonder if Singapore plans sensible’, Gaming News, Web.

Strow, D. (2002a, February 8). Wynn, Adelson win licenses for Macau casinos, Las Vegas Sun.

The Free online Dictionary (2010). Definitions Toolbar. Web.

Tan, A. 1997. Singapore’s Expensive to Live In, Dine Out. The Business Times (Singapore).

Tseng, K. (2005) ‘Macau gaming prospers as usual’, Macau Daily. Web.

Weber, K., & Ladkin, A. (2003). The convention industry in Australia and the United Kingdom: Key issues and competitive forces. Journal of Travel Research, 42, 125–132.

Wong, M. (2002, June 26). Adelson plans version of Venetian for China, Las Vegas Sun.

Yu, V. (2002, June 24). Wynn signs deal to build hotelcasino in Macau, Las Vegas Sun.