Executive Summary

‘Wokoodle’ will present a relaxing, neighborhood-centered eatery with an oriental tint where the bar will serve noodle and other rice items to customers. Wokoodle will render different service to the customers much different from other noodle bars existing currently in the vicinity. The objective of this paper is to develop a business plan for the successful creation of Wokoodle noodle bar. This business plan envisages to present complete a product description, mission, vision and objectives of the noodle bar.

While the business plan makes a macroeconomic analysis of the external environment of the noodle bar industry it presents a micro analysis of the internal environment of the business focusing on the financial, marketing and operational issues involved in the noodle bar business. As a part of the business plan the paper makes use of analytical tools of PEST analysis, Porter’s Five Forces Model and SWOT analysis. The plan further provides a strategic growth plan for a medium term of the future. Estimated with a conservative outlook, the overall investment in the project is estimated to be £ and the project is expected to ensure a return of

Introduction

With a great idea and a viable business plan it is possible to start a noodle bar with a reasonable sum of money as initial investment. The ideal scenario is to start the noodle bar business with enough capital to enable the owner to move aggressively and expand the business faster. A business plan for noodle bar should serve as a visualization of how exactly the business is going to work. The purpose of the business plan is to enable the reader to decide whether the noodle bar business is viable, whether the business can be improved and the scope for future expansion and growth. A well drafted business plan is a valuable tool for growing the business. This paper provides a detailed business plan for the creation of a noodle bar in the name and style of ‘Wokoodle’ to become operative in London.

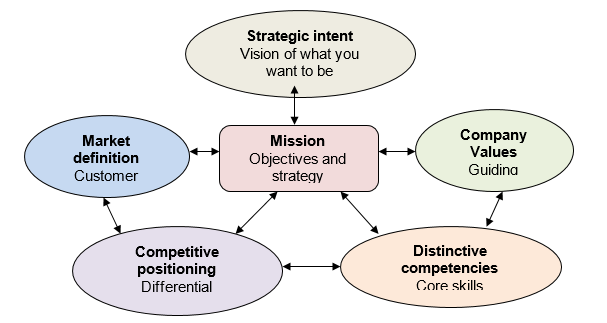

Mission

According to Hooley et al. (2008), a useful starting point in strategy formulation is to define its mission or purpose for organisation. “Formulating the mission into a brief and concise statement that can be communicated across the organisation can help engender a sense of common purpose and also provide guidelines for how decisions will be made and resource allocations prioritized in the future.” In other words, Mission tends to be about broad purposes. It often contains elements of long-term strategy as well as desired outcomes. In summary, it should reflect what the organisation wants to be.

Hooley et al. (2008) stated that five key elements to make up an effective statement of mission as follows:

- Strategic intent: it can be perceived as vision of where the organisation wants to be intent foreseeable future;

- Organisation values: it should be spelled out to see the ethical and moral tone to guide operations;

- Distinctive competencies: it should be articulated, clearly stating what differentiates the organisation from others of its kind what is the distinctive essence of the organisation;

- Market definition: in terms of major customer targets that the organisation seeks to serve and the functions or needs of those customers that will be served.

- Competitive positioning: the mission should spell out where the organisation is, or intends to be positioned in the marketplace. This is the result of bringing together market definition and distinctive skills and competencies

The five elements of Mission is shown in Figure 2

As mentioned above, the main business mission of Wokoodle is to become the preferred company for consumers when it comes to the act of purchasing noodles. Ultimately the realization of both the business mission and vision will contribute to the maximization of profit and satisfaction of customer. Moreover, compared to Hooley et al. (2008) five elements of mission, the accomplishment of the mission will be outlined as below.

- Strategic intent:the vision of Wokoodle is defined as the desired future state of the organisation as is stated as: to supply noodles of right price and quality for residents in London.

- Organisation values:customer-centric service and noodle will be stressed in marketing and operational management. Moreover, the professionalism, commitment and creativity of the staff working at Wokoodle will be a key element in the success of the company

- Distinctive competencies:differentiation through integrated services to consumers: by becoming a “one stop shop” for consumers, Wokoodle will offer its customers the opportunity to buy their taste by selecting materials. Quality: to meet customer expectations, the noodles sold at Wokoodle. Wokoodle will seek to maintain high quality standards in the materials used and throughout the production process. Innovative store layout: The store will replicate the atmosphere of a real oriental home. The aim of this is for customers to visualize a real oriental noodle bar. Attractive pricing structure: customers will choose materials whatever they want to put in the dish and that mean price depends on their selection without having to spend an unreasonable amount of money. However, overall price will be cheaper than competitors

- Market definition:Wokoodle will clearly focus on the needs of a well-defined market target, as reflected in its brand name and its business purpose: ‘noodle bar designed for the resident in London’. The staff of Wokoodle will take this into account and offer individual advice to customers taking into account their specific needs and preferences.

- Competitive positioning: To become a major supplier of fast-food noodle for residents and visitors in London within five years.

Goals

- To become a major supplier of fast-food noodle for residents and visitors in London within five years.

- To gain further market share within the local community.

- To become the regional market leader, gaining competitive advantage based on the experience, expertise and knowledge.

- To increase turnover and profitability.

- To provide an adequate income for venture members

Objectives

- To create a unique upscale, innovative environment that will differentiate Wokoodle from other local noodle bars

- To make Wokoodle a destination for noodle lovers with oriental taste and to provide a welcoming atmosphere to the customers

- To form an environment that will attract people with diverse backgrounds and interests to be united in the common feature of ‘taste’

- To consistently provide specialty noodle and rice items coupled with an excellent customer service

Financial Objectives

- To achieve a turnover of £ 255,600 in the first year

- To earn a Gross profit margin on 45%

- To earn a Net profit margin of 7%

- To not to make any drawings during the first year

- To enhance the income above £ 20,600

Literature Review

The objective of this chapter is to present an overview of the noodle market in London and macro and micro economic analysis of the noodle industry in the UK. For making the macro and micro analysis tools like PEST analysis, Porter’s Five Forces analysis and SWOT analysis have been used.

Noodle Industry in London – An Overview

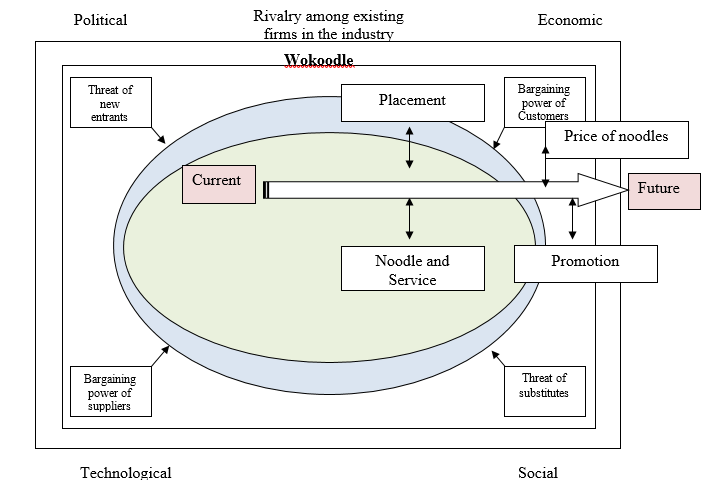

The Noodle industry in London can be analyzed through external analysis tools including PEST analysis for macro-environment and Porter’s five forces for micro-environment. The study of various factors having their influence on Wokoodle will facilitate the establishment of core strategies for the establishment of the noodle bar. Therefore, this section is crucial and can be summarized in the figure exhibited below.

PEST analysis

First of all, the external environment of Wokoodle is analyzed by six factors including Political/Legal, Socio cultural, Technological and Economic (PEST). The summary of the conceptual framework in the likelihood effects of PEST is presented in Figure 3

Political factors

UK is one of countries in the Europe Union (EU), North Atlantic Treaty Organisation (NATO), United Nations Security Council (UNSC) and G8. In other words, UK can maintain its food industry operating internationally and with utmost trading convenience. London especially is a centre of the UK. In this city, with policies changing from the positive to negative side for relevant business have been offering exciting opportunities or critical threats. Therefore, it becomes necessary to analyze the policies relating to food, trading and health industry. The relevant issues affecting the industry are summarized as below:

- The nutrition standards for schools

- From September 2007, the government declared The Department for Education and Skills’ (DFES) new minimum nutrition standards for schools and even, will invest £240m for high-quality and healthy ingredients until 2011. In other word, children‘s health will be more seriously dealt with (Times 2007).

- The ban on smoking

- Smoking was banned in all enclosed spaces, with smoking in restaurants only permitted in designated bedrooms on Sunday 1st July 2007. In public places and workplaces, indoor smoking is no longer allowed. Managers of smoke-free premises are now held legally responsible for infringements of the ban within their premises, with failure to comply with the law being a criminal offence, with penalties and fines for infringements (Times 2007). Moreover, according to Federation of Licensed Victuallers Associations (FLVA), licensees have spent millions of pounds creating attractive outdoor areas since the indoor smoking ban was introduced.

- The national minimum wage

- The national minimum wage increased in October 2007 to £5.82 an hour for workers aged 22, £4.60 for 18 to 21 year-olds and £3.40 an hour for 16 to 17 year-olds. This aim is to provide employees with decent minimum standards and fairness in the workplace. Employer should pay the national minimum wage and are not being allowed to pay less to the workers (Times 2007).

- A new business tax

- According to British Retail Consortium (2007), New Business Tax (NBT) to give shire counties and the Greater London Authority (GLA) the power to fund local projects, saying that retailers is open to widespread abuse and will lead to retailers funding projects from which they receive minimal benefit. Moreover, The BRC indicated that retailers already contribute more than £4.5bn to the public purse each year through business rates alone and thinks it unreasonable to demand that they pay any more (KeyNote 2008).

Economic factors

The growth of retail market

According to National Statistics (2008), the sales volume for all retail sales in the 3 months from November 2007 to January 2008 rose by 0.6% compared with the previous 3 months and 0.5% growth over the 3 months to July 2007. Monthly growth in sales volume was 0.1% for predominantly food stores, while no increase was reported for predominantly non-food stores.

Growth of UK economy

Economic growth of UK is currently 3% and is forecast to be 3% throughout 2008, in the areas of specialty travelling and food processing (2007). In particular, the economy of London is very strong with Gross Value Added (GVA) per head being 53% above the national average. Even after allocating workers’ incomes to the region where they live, GVA per head is 36% above the UK average, still making London the highest region (National Statistics 2007).

Failure of catering business

UHY Hacker Young (2007) claimed that, restaurants and bars are three times more likely to go bankrupt than other UK businesses. A study of more than 150,000 business failures over the previous year (2006), found that around 15.5% of businesses in the UK hospitality and catering industry (restaurants, pubs and hotels) failed, compared with around 5.2% for the economy as a whole. It caused by result of inflation-exceeding increases in the minimum wage. Moreover, the other reasons were difficulties in raising additional financing, poor market research and financial planning, and the challenge of building a loyal client base that can protect against rapidly changing consumer tastes in bars and restaurants.

Changes to capital allowances

According to the Chancellor of the Exchequer (2007), changes to capital allowances could have serious implications for the UK industry. The plan involves the phasing out of the Industrial Buildings Allowance — a 4% tax relief claimable annually for 25 years — by 2011. This will see tax relief for capital allowances on building fixtures reduced from its current 40% to 25%, 20% and then 10% in 2008/ 2009, before being phased out altogether.

Global food prices

Global food prices rose steadily in 2007, and the upward trend is set to continue in 2008. Wheat and rice prices for delivery in March 2008 have jumped to an all-time record, soybean prices are at a 34-year high and corn prices are at an 11-year peak. Knock-on price rises are set to hit consumers in the coming months, raising inflationary pressure and constraining the ability of central banks to mitigate the slowdown in their economies.

The increase of euro zone food-price inflation to 4.3% in November 2007 was one of the main reasons for the jump in the zone’s annual inflation rate from 2.6% in October to 3.1% — the highest in 6 years. In the year to November 2007, the retail price index (RPI) for food in the UK increased by 5.3%, while for catering services, the increase was 3.5%. This suggests that caterers are absorbing some of the increasing costs themselves (KeyNote 2008)

Social factors

Growth of population

London has an extremely ethnically diverse population. Around 30 per cent of Londoners are from non-White groups and while London makes up just 15 per cent of the population of England, it contains 43 per cent of the nation’s non-White population (National Statistics 2007)

Growth of household income

The average weekly household income (including all sources of income) in London is £304 per person, over a fifth higher than the national average. However, the population is polarized and while a quarter of households are earning over £1,000 per week, 14 per cent have an income of less than £150 per week (National Statistics 2007)

Lifestyles

Since the changing busy lifestyles in large amount of British consumers, the adults working hours are longer compared with most other European countries, people have less time at lunchtime and after work to prepare or cook meals (KeyNote 2008). Times (2005) pointed out that the average workers in the EU worked a 40-hour week, while the average is 44 hours in the UK. Furthermore, the UK was also characterized by a high proportion of part-time jobs, with many of these jobs filled by women, and this tend kept on rising.

As a result, more people prefer to choose fast food for their meals, and that these outlets always position at convenient locations and serve within quick speed. In addition, the numbers of single-person households are still increasing in UK, which also has promoted fast food sales. Because adults living alone are unlikely to cook meals by self and young singles usually have active social lives with less possibility on cooking, more likelihood options are fast food.

Children’s overweight and trends

More and more children are likely to eat fast food, but their inactive lifestyles, such as spend too much time on computers and fewer walking chances, which lead to an increasing percentage of overweight and obesity in younger. According to the lobby group Consensus Action on Salt (CASH), many meals at UK fast-food restaurants contain ‘shockingly’ high levels of salt and many serve well over the maximum daily recommended limit of salt in just one meal.

For the high calorie, over fast and salt in fast food meals, there is a growing criticism of eating fast food and an encouragement for fast food outlets to supply more healthy items, that McDonald’s Corporation did very well by this view, it provided a series healthy fast food such as salads meal and fruit bag, and its ‘eat smart, go active’ strategy made young children more energetic opportunities while they enjoyed in eating time. Moreover, latest high-profile events have also pitted consumer confidence in the fast food sector. (KeyNote 2007)

Consumer Confidence

The Food Standard Agency’s (2007) English Regions Consumer Attitudes to Food Survey, published in February 2008, points to increased confidence among the public about the food they are consuming. Since the initial Survey was conducted in 2000, the number of people concerned about issues such as food poisoning, additives and general food safety has been steady.

Hygiene issue

A series of official hygiene examinations carried out in the first half of 2007 by environmental health officers into the cleanliness of hospital kitchens found that almost half were plagued by vermin, risked infections by storing food incorrectly, or employed staff with poor personal hygiene.

The investigations found that, of 377 NHS and private hospitals surveyed in England, 173 (45.9%) were found to have poor standards of cleanliness in their kitchens, or in canteens or cafés used by staff, patients and visitors. 11 of the 173 had experienced a vermin or pest problem, 57 employed catering staff who displayed inadequate personal hygiene and 18 were found to stock out-of-date food. 68 did not meet the legal minimum standard for food storage and 66 were storing food at the wrong temperature, which can stimulate the growth of bacteria (KeyNote 2008).

Technological factors

UK banking technology

The UK banking sector is introducing contactless payment cards that could help to speed up the purchase of food in retail outlets. Debit and credit cards started being updated with the new technology in September 2007 and will allow consumers to pay for transactions of £10 or less at participating retailers and vending machines by waving their card over a reader. The banking industry estimates that more than 5 million contactless cards will be issued by the end of 2008, and they will be accepted in at least 100,000 outlets.

Contactless payment systems appear to be well suited for use in outlets such as fast-food shops, coffee shops, newsagents, off-licenses, pubs, taxis, parking facilities and vending machines. The roll-out is being led by MasterCard and Visa. The Bank of Scotland, Barclaycard, Citi, Euroconex Technologies, Halifax, HSBC, Lloyds TSB and The Royal Bank of Scotland (RBS) all participated in the first phase of the roll-out (KeyNote 2008)

E-commerce

Within some catering markets, such as fast food and takeaways, the increased use of online purchasing is forecast to be one of the key drivers of growth over the next few years. It is predicted, for example, that the Internet, interactive television and text messaging will eventually overtake telephone ordering in the home-delivery food sector. Although technology is not a key subject for fast food market, it recently is improved widely as effective marketing channel. Consumers can get food and drink in advance from on-line service. They also can obtain more information on firms’ selling production and logistics systems from their official website links.

New management system

Accompanying the innovation of the information technology (IT), usage of enterprise resource planning to manage external and internal organisation including accounting, marketing, human resource management, and even supplier and customer relationship has considerably increased in the last five years (Datamonitor, 2006). With development of the systems, supplier chain management and customer relationship management are well-organised. Moreover, packing technology resulting in long storage has been developed

The PEST analysis has been summarized and shown in Table 1

Table 1: Summary of the PEST analysis.

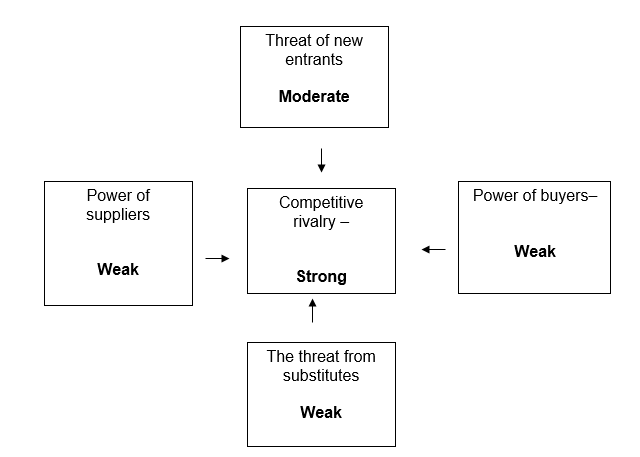

Porter’s five forces analysis

In the Porter’s 5 Forces, there are major elements: supplier, buyer, competitors, new entrants and substitutes. It will help Wokoodle to contrast a competitive environment by this analysis. Hence, Wokoodle should recognize the forces that decide the conclusive profit potential. Figure 6 below will discuss these 5 major elements in details for the London market.

Rivalry among competitors

- Number of competitors and diversity of competitors: according to the British Restaurant Association (Key Note 2007), there are over 10,300 oriental restaurants in the UK and London would be served by around over 200 oriental restaurants selling noodle. Moreover, the London noodle Industry is characterized by a large number of small or medium size including over 50 noodle bars. The main 6 noodle bars in the sector have 25% of the market share. These 6 bars have a certain degree of market power in terms of presence (KeyNote 2008 and FAME 2007).

- Market growth: on the noodle retail side, the outlook is a bit brighter. According to KeyNote (2008), the market remaining ethic and healthy has been emphasized in the past 5 years. Moreover, due to the good current economic climate, the forecasted market growth for 2008 is 6. Therefore it seems that noodle industry is at mature stages of the product life cycle (KeyNote 2008).

- Sustainable competitive advantage and product differentiation: Wagamama, Neds, Miso, and New Culture Revolution are the major noodle retailers in the London, together accounting for approximately 25% of noodle industry value. They also operate several formats, such as large, out-of-town restaurant and smaller, High Street bar, which compete more directly with smaller local noodle bar. In fact, food specialization by range has already taken place and most restaurants are now seeking new ways to reduce their costs in order to remain competitive. Compared to this, Wokoodle’s food differentiation is low. Therefore, it seems that competition for sales tends to be more intense.

- Fixed cost allocation per value added: most fast food outlets are labor intensive and have high fixed costs in rents, rates, and labor costs capital investment. On account of losses occurred early in UK’s economic downturn, there high fixed costs were difficult to cut back and losses lasted for a long time. Moreover, this weaken fast food market (Piao 2007)

- Economies of scale: the chains of major noodle competitors have massive buyer power over their suppliers and the ability to fund lengthy campaigns to gain planning permission for new branches. These economies of scale allow them to strengthen themselves in the market. Moreover, the profitability of the major suppliers means that they can compete fiercely on price without imperiling their own margins in a mature industry in which aggregate revenue growth is unspectacular.

Table 2 Factors influencing degree of rivalry in the London noodle market.

Threat of entry

As mentioned earlier, Oriental restaurants selling noodle are sprouting everywhere, with new concepts, sleeker designs and offering more than typical restaurant. Moreover, Asian food ingredients are easily available nowadays and with the growing population of immigrants the industry is becoming attractive for new entrants. Consequently, noodle business in London was concluded that it will be still an attractive market to enter and the growth prospects are still reasonably good.

- Costs of entry: entry to the UK fast food market does not require large capital outlay; setting up a single, independent fast food outlet is within the means of many individuals in the UK. Larger companies can reduce the cost of expanding into the UK by running some or all of their outlets as franchises.

This point will be explained in greater detail when the financial resources are analyzed but, at this stage, it can be said that the capital requirements to set up Wokoodle will be moderate. They bear the costs of equipping outlets at sites owned or leased by the franchisor, and pay a fee for the franchise itself, as well as rents and service charges. (The franchisee enjoys something of the advantages of running his or her own business, while benefiting from the franchisor’s brand strength, expertise, and scale economies.)

- Existing or new distribution channels: The structure of noodle retailing sector is divided as follows (Datamornitor, 2008):

- Oriental restaurant: 30%

- Noodle bar: 20%

- Small and large supermarket 25%

- Competitive retaliation: as the concentration of power from the players in this industry is low due to its high fragmentation level, the retaliation power of its players will also be low. Retaliation by existing players, such as the launch of a price war, is a possibility, especially where a new entrant moves into a more concentrated segment. The brand strength of the major chains is considerable, which may negate much of the effect of low switching costs. Finally, revenue growth rates have been respectable rather than dramatic in recent years, making the market less attractive. Overall, there is a strong likelihood of new entrants.

- Differentiation: the Wokoodle’s noodles are not different and there is hardly any brand recognition or loyalty from consumers.

Moreover, negligible switching costs for consumers mean that they are free to transfer their custom to a new player. However, market entrants face several other barriers.

Table 3. Factors influencing the likelihood of new entrants in the London noodle market.

Threat of substitution

Healthier options such as oriental cuisines including noodle are increasingly being offered as an alternative to the traditional Asian restaurant food. Noodle is increasingly being served in the local restaurant and in this context restaurants have been moving more into high level restaurants with emphasis into better quality food offerings. There is also an abundance of noodle takeaways that are convenient, cheaper and good quality.

Substitutes for noodle fast food include other forms of profit foodservice, and also food retail (ready meals or ingredients for home cooking). Noodle fast food tends to be cheaper than other forms of foodservice. Substitutes therefore do not clearly challenge fast food on price, and they lack the benefit of convenience that defines fast food. Moreover, it is worth to highlight that a switch in consumer expenditure patterns from noodle to other foods can negatively affect the demand for Wokoodle. Some example of factors that can cause a change in expenditure patterns by consumers.

However, many forms of fast food have attracted criticism for being unhealthy, while oriental noodles are perceived as healthy food. Also, the substitutes generally offer a much broader range of products. Overall, substitutes present a moderate threat.

Table 4. Factors influencing the threat of substitutes in the London noodle market.

Bargaining power of buyers

Consumers can do research on the noodle bar’s options over the internet by looking through the menus, comparing price offerings and most importantly read customer feedback prior to deciding where to have noodle.

The noodle fast food market will be analyzed taking independent and chain restaurant companies as players and consumers as buyers.

Buyer power is weakened by the fact that, while not everyone enjoys noodles, it is nonetheless highly popular with large numbers of individual UK consumers.

Players differentiate their offering through the range of foods on offer.

Furthermore, the major chains in particular invest heavily in brand-building, through advertizing, the uniform visual style of their outlets, and so on.

This strengthens customer loyalty, and weakens buyer power.

Factors strengthening buyer power include the negligible cost of switching from one fast food company to another, and a fair degree of price sensitivity. Overall, buyer power is assessed as moderate.

Table 5. Divers of buyer power in the London noodle market.

Bargaining power of suppliers

Wokoodle will have a bargaining power with its suppliers. With centralized purchasing process, Wokoodle will be also optimizing its resources. Therefore, key inputs for food retailers include commodity foods. While the ultimate suppliers of rice, wheat, livestock, etc are numerous, often relatively small, farmers and growers, many food retailers do not buy directly from these sources. Buying commodity foods from direct farmers boosts supplier power from the point of view of noodle fast food bars. However, some vertical integration occurs, as does sourcing direct from the grower.

The imbalance of power between the major retailers and the producers and wholesalers upstream is well known. Suppliers are more numerous, and smaller, than the supermarket chains. Although it is important for retailers to maintain reliable supply chains, and to source good quality food at prices which will maintain their margins, the very high concentration of buyer power in the hands of the largest companies means that if one supplier does not fulfill their requirements, it is easy to find another to take its place. Therefore, there is a strong incentive for a supplier to meet even the most exigent requirements for quality and price, because losing the custom of a supermarket could threaten its survival. Supplier power in this industry is weak.

Table 6. Divers of Supplier power in the London noodle market.